Facial Implants Market Size 2024-2028

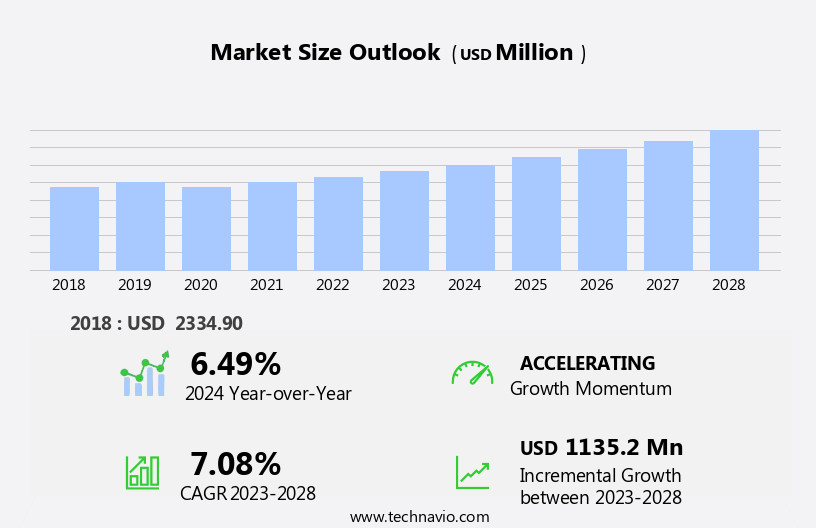

The facial implants market size is forecast to increase by USD 1.14 billion at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for cosmetic treatments. The global cosmetic ry market is projected to reach a value of [XX] billion by [YY], with facial implants being a key component of this industry. A notable trend contributing to market expansion is the rise in cosmetic ry tourism, as patients travel to countries with lower costs and advanced medical facilities to undergo procedures. However, disregard for pre-operative considerations, such as proper patient selection and thorough consultations, poses a challenge to market growth.

- As such, companies operating in this space must prioritize patient safety and education to capitalize on market opportunities and navigate challenges effectively. By focusing on innovation, quality, and customer service, players can differentiate themselves and meet the evolving needs of consumers seeking facial implant solutions.

What will be the Size of the Facial Implants Market during the forecast period?

- The market encompasses a range of maxillofacial and aesthetic plastic ry procedures, including jawline enhancement, chin augmentation, and eyelid ries. This market is driven by the growing preference for physical appearance enhancement and the increasing popularity of minimally invasive procedures utilizing polymeric materials and biologicals in the segment. The global market for facial implants is expected to grow significantly due to the rising number of plastic ries and joint reconstruction procedures. Social media platforms have also played a pivotal role in increasing the demand for aesthetic procedures, such as chin augmentation and cheek implants. The market comprises various segments, including the jawline, mandibular, and cranial segments, as well as the eyelid, injectables, and polymer segments.

- Key trends include the use of advanced materials like hyaluronic acid and the increasing number of license agreements and collaborations among market players. Applications of facial implants extend beyond aesthetics, with thoracic and sports medicine applications also contributing to the market's growth.

How is this Facial Implants Industry segmented?

The facial implants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Clinics

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

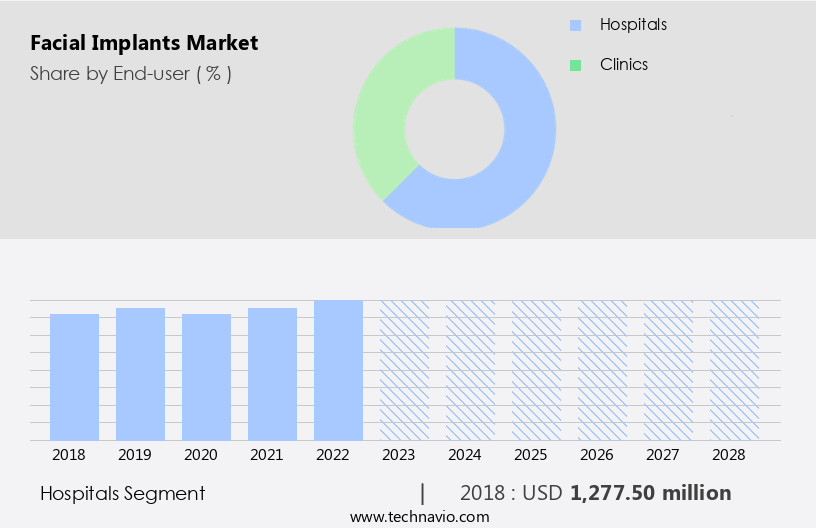

The hospitals segment is estimated to witness significant growth during the forecast period.

The market has experienced steady growth in recent years, driven by the increasing demand for elective procedures and the expansion of aesthetic care services in hospitals. Hospitals, including multi-specialty hospitals and hospital groups, play a significant role in the market's growth. These institutions offer a wide range of inpatient and outpatient services and generate substantial revenues. By engaging closely with suppliers, reimbursement authorities, and government organizations, they can easily procure facial implants and facilitate their adoption. Additionally, the rise in non-essential ries, such as rhinoplasty, jawline enhancement, chin augmentation procedures, and eyelid ry (blepharoplasty), contributes to the market's growth. Innovative implant materials, like Bactiguard and polymers, and surgical techniques, such as computer-aided design and virtual surgical planning, further fuel the market's expansion.

The market encompasses various product segments, including anatomical facial implants, round facial implants, oval facial implants, and 3D printing implants, as well as material segments, such as metal, ceramic, and polymers. The market caters to both male and female patients seeking self-enhancement and reconstruction due to accidents, trauma cases, soft tissue damage, facial fractures, and physical appearance concerns. The market is also influenced by the growing use of injectables, such as hyaluronic acid, and the increasing popularity of minimally invasive procedures. However, supply chain disruptions, manufacturing delays, and transportation restrictions can impact the market's growth. Overall, the market is expected to continue growing, driven by the patient-centric approach of hospitals and the increasing focus on aesthetic procedures.

Get a glance at the market report of share of various segments Request Free Sample

The Hospitals segment was valued at USD 1.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

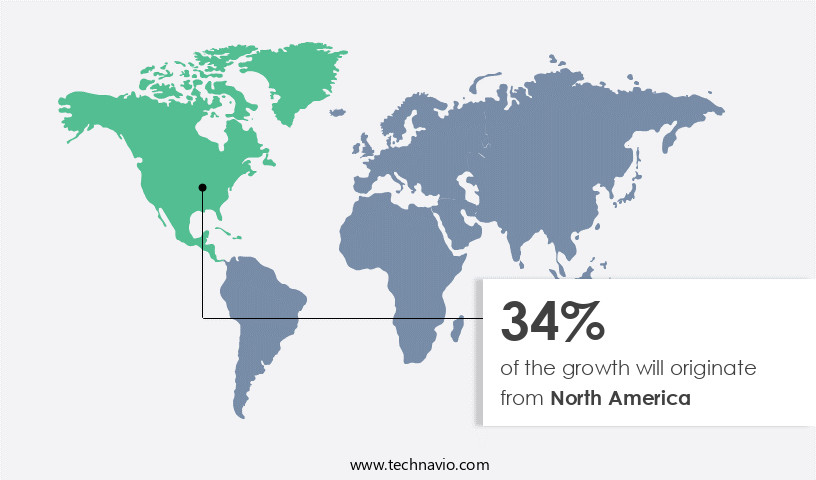

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for facial implants is projected to expand due to the significant number of road accidents in the region, leading to an increase in the usage of implants for facial injury treatments. In 2013, the US reported 1,591,000 road accident-related injuries, while Canada recorded 124,794 such injuries in the same year. These injuries often result in facial deformities, necessitating the use of chin or nasal implants for restoration. Furthermore, the growing consciousness towards physical appearance and the rise in disposable income have led to a in demand for cosmetic procedures, such as facelifts and rhinoplasty, which utilize facial implants.

These factors contribute to the market's growth in value and volume. Clinics and hospitals offer various cosmetic ries, including jawline enhancement, chin augmentation procedures, and eyelid ry (blepharoplasty), using anatomical facial implants made of polymers, ceramics, or metals. The market segments include shape segments (round or oval implants), product segments (implants, injectables, and implant materials), and material segments (polymer, ceramic, and metal). Virtual surgical planning, computer-aided design, and imaging technologies are used in innovative implant materials and surgical techniques. The market is patient-centric, with companies focusing on supply chain efficiency, manufacturing delays, and transportation restrictions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Facial Implants Industry?

- Growing demand for cosmetic treatments is the key driver of the market.

- The market is driven by the increasing preference for enhancing personal appearance, which is a growing trend worldwide. This trend is gaining acceptance in various domains, including the workplace and social gatherings, leading individuals to seek aesthetic solutions to boost self-confidence and self-esteem. Facial implants are a popular choice for individuals seeking to augment the skeletal features of their faces, such as the jawline.

- For men, a well-defined jawline signifies a masculine appearance, while for women, an angular jawline is preferred. These features are influenced by both genetics and physical development. The adoption of facial implants is a testament to the growing importance placed on physical attractiveness and the desire to enhance one's appearance.

What are the market trends shaping the Facial Implants Industry?

- Growth in cosmetic ry tourism is the upcoming market trend.

- Cosmetic ry tourism, facilitated by government initiatives, has significantly expanded the healthcare sector on a global scale. A key component of this trend is the rising demand for cosmetic surgical procedures, including facelifts and rhinoplasty, which necessitate the use of facial implants. The allure of cost savings, superior quality, and shorter recovery times have driven individuals to seek treatments abroad. For instance, the cost of a facelift in the US is approximately three times higher than in countries like India.

- Similarly, a rhinoplasty in India costs under USD2,500, compared to over USD6,000 in the US. These factors have become crucial considerations in the decision-making process for patients seeking cosmetic procedures.

What challenges does the Facial Implants Industry face during its growth?

- Disregard for pre-operative considerations is a key challenge affecting the industry growth.

- Facial implants have gained popularity as a cosmetic enhancement solution, yet misconceptions persist among potential patients regarding the procedure's benefits and outcomes. Patients often rely on internet sources for information, which may not be accurate. The desire to emulate specific celebrity features drives many to pursue facial implants, leading some to request multiple ries. However, achieving a perfect match to a celebrity's facial attributes is challenging for ons, and the process can be costly and potentially uncomfortable for the patient.

- Despite these considerations, facial implants remain an option for individuals seeking to enhance their facial features. It is essential for patients to consult with qualified professionals for accurate information and realistic expectations.

Exclusive Customer Landscape

The facial implants market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the facial implants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, facial implants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acumed LLC - The company specializes in advanced craniomaxillofacial solutions, featuring the ICON Facial Plating System, CFX Craniomaxillofacial Fixation System, and orthognathic systems. These innovative implant offerings cater to various facial reconstruction needs, enhancing patient outcomes through improved stability and precision in surgical procedures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acumed LLC

- EPPLEY PLASTIC RY

- Gebruder Martin GmbH and Co. KG

- Groupe SEBBIN SAS

- Guangzhou Wanhe Plastic Materials Co. Ltd.

- Hanson Medical Inc

- Implantech Associates Inc.

- Johnson and Johnson Services Inc.

- MATERIALISE NV

- Matrix Surgical USA

- Medartis Holding AG

- Poriferous

- Silimed Industria de Implantes Ltd.

- Stryker Corp.

- Surgiform Technologies Ltd.

- Tampa Surgical Arts.

- Xiloc Medical B.V.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Facial implants have gained significant traction in the global medical devices market due to the increasing demand for cosmetic and reconstructive ries. This segment caters to various facial features, including the jawline, chin, and nose, among others. The market dynamics are driven by several factors, including the growing emphasis on physical appearance and self-enhancement. The market encompasses a wide range of product segments and material segments. Anatomical facial implants, made of polymers, ceramic, or metal, are commonly used for cosmetic ries to enhance facial features. These implants are designed to provide a natural look and feel, making them a popular choice among patients.

The market for facial implants is diverse, with various applications in elective procedures, sports medicine, and trauma cases. In the cosmetic ry sector, round and oval facial implants are popular choices for enhancing the shape of the cheeks and chin. These procedures are often performed in specialized cosmetic ry centers using advanced surgical techniques and imaging technologies. The supply chain for facial implants is intricate, involving various stakeholders, from raw material suppliers to manufacturers and distributors. Manufacturing delays and supply chain disruptions can impact the availability of these implants, leading to potential challenges for healthcare providers and patients.

The market for facial implants is not limited to cosmetic procedures. These implants also find extensive applications in reconstructive ries for facial fractures and joint reconstruction. Innovative implant materials and advanced surgical techniques have led to improved patient outcomes and reduced recovery times. The use of facial implants is not limited to a specific demographic. Both males and females seek these procedures for various reasons, including self-confidence and social media pressures. The market for injectables, such as hyaluronic acid and botulinum toxin, is also growing rapidly, providing an alternative to surgical procedures. The market is subject to various regulatory requirements and licensing agreements.

Zimmer Biomet and other key players in the market invest in research and development to introduce innovative implant materials and technologies, ensuring a patient-centric approach to healthcare. The market for facial implants is not immune to external factors, such as economic conditions and transportation restrictions. The impact of lockdowns and other restrictions on non-essential ries has led to a decrease in demand for these procedures in some regions. However, the long-term growth prospects for the market remain positive, driven by the increasing acceptance of cosmetic and reconstructive ries as essential healthcare services. In , the market is a dynamic and evolving sector in the medical devices industry.

The market caters to various applications, from cosmetic procedures to reconstructive ries, and is subject to various market dynamics, including regulatory requirements, technological advancements, and economic conditions. The market is expected to continue growing, driven by the increasing demand for facial implants and the ongoing innovation in implant materials and surgical techniques.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 1135.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Facial Implants Market Research and Growth Report?

- CAGR of the Facial Implants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the facial implants market growth of industry companies

We can help! Our analysts can customize this facial implants market research report to meet your requirements.