Europe Feed Phytogenics Market Size 2025-2029

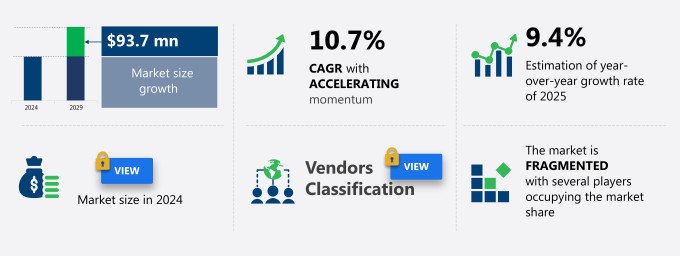

The Europe feed phytogenics market size is forecast to increase by USD 93.7 million, at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. Encapsulation technology is a major driver in the market, enabling the production of stable and effective feed phytogenic additives. The increasing demand for natural feed additives, particularly in the pet food industry, is shaping market expansion. However, the availability of substitutes, such as synthetic feed additives and antibiotics, poses a challenge to market growth. Producers must focus on offering superior efficacy and cost-effectiveness to remain competitive in the market. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights for stakeholders.

What will be the Size of the Market During the Forecast Period?

- The market, a significant segment of which is dedicated to phytogenic feed, continues to gain momentum in the poultry industry. Phytogenic feed additives, derived from plants, play a crucial role in enhancing feed quality, promoting animal health, and ensuring sustainable production. Phytogenic feed additives have gained popularity due to the increasing demand for antibiotic-free poultry farming. These additives offer an effective alternative to antibiotics for disease prevention and growth promotion in broiler chickens. They improve digestive health, reduce disease incidence, and boost overall animal welfare. Feed safety and quality are essential aspects of modern poultry production. Phytogenic feed additives contribute to these aspects by improving feed efficiency, enhancing nutrient utilization, and reducing the risk of contamination. Herbs and spices, a common source of phytogenic additives, provide essential nutrients and contribute to clean label poultry, appealing to consumers' growing preference for natural and organic products.

- Feed sustainability is another critical factor driving the adoption of phytogenic feed additives. These additives promote sustainable livestock production by reducing the reliance on synthetic growth promoters and antibiotics. Moreover, they contribute to the circular economy by utilizing plant by-products and waste streams. Feed innovation and research are at the forefront of the poultry feed industry. Phytogenic feed additives are a significant area of focus due to their potential to enhance animal health, improve feed efficiency, and reduce production costs. Feed manufacturing companies are investing in research and development to create more effective and sustainable phytogenic feed additives. Organic poultry production is a growing trend, and organic feed is a crucial component of this production method. Phytogenic feed additives are an ideal solution for organic poultry farmers, as they are derived from natural sources and do not contain synthetic additives or antibiotics.

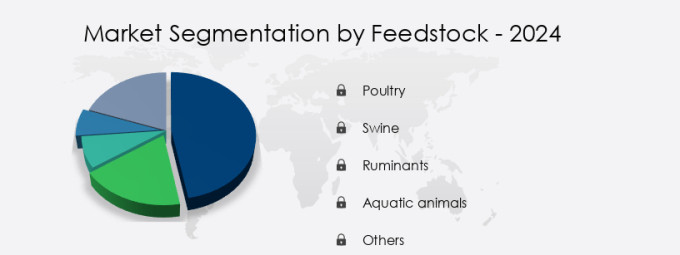

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Feedstock

- Poultry

- Swine

- Ruminants

- Aquatic animals

- Others

- Application

- Essential oils

- Herbs and spices

- Oleoresins

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By Feedstock Insights

- The poultry segment is estimated to witness significant growth during the forecast period.

The poultry industry is witnessing an uptick in production to meet the growing consumer demand for poultry meat. Phytogenic feed additives, derived from plants and consisting of herbs, spices, fruits, and other plant parts, are gaining popularity in this sector due to their potential benefits. These additives are known to enhance gastrointestinal function and overall health of poultry, leading to improved reproductive parameters and growth promoters. However, the effectiveness of phytogenic feed additives in poultry production is a subject of ongoing research and debate. Published studies present conflicting findings, making it essential for poultry producers to evaluate the costs and benefits of incorporating these additives into their feed regimens.

Despite the inconsistent evidence, many producers believe that phytogenics contribute to increased protein intake and improved feed conversion ratio. The use of phytogenics as alternatives to antibiotics is also gaining traction due to consumer preference for antibiotic-free poultry products. Dietary variety in poultry feed is another area where phytogenics offer potential advantages. By providing a diverse range of bioactive compounds, these additives can help ensure optimal nutrient absorption and promote a healthy gut microbiome. Overall, phytogenic feed additives represent an intriguing and complex area of research and application in the US poultry industry.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of the market?

Encapsulated technology is the key driver of the market.

- Phytogenic feed additives, derived from herbs, spices, and essential oils, play a crucial role in enhancing livestock health and productivity. These natural additives offer benefits such as improved gut health, disease resistance, and enhanced feed conversion ratios. However, incorporating phytogenics into animal feed can be challenging due to their sensitivity to environmental conditions. Essential oils, a common phytogenic source, can lose efficacy due to high temperatures, dust, and oxidation. To address these challenges, modern technologies like encapsulation are being adopted. Encapsulation is a process that protects phytogenic components by enclosing them in tiny capsules. This technology preserves the active components from environmental changes, ensuring their efficacy and stability in feed.

- Encapsulation offers several advantages, including increased palatability, ration stability, improved digestion, and enhanced animal performance. The phytogenic industry is witnessing significant growth due to the increasing demand for natural solutions to replace antibiotic growth promoters. The ban on antibiotics in animal feed and the rising concerns over antibiotic resistance have fueled the market's expansion. Furthermore, the growing trend towards organic meat production and sustainable farming practices is driving the adoption of phytogenic feed additives. Despite these opportunities, the phytogenic industry faces regulatory hurdles, particularly in terms of securing regulatory approvals for the use of phytogenic feed additives in animal feed.

- Additionally, the costs of phytogenic feed additives can be higher than synthetic additives, making it essential to optimize their use for maximum benefit. Phytogenic feed additives offer several advantages, including improved feed efficiency, growth performance, and herd health. They also contribute to sustainable farming practices by reducing the reliance on synthetic additives and antibiotics. As the demand for natural, clean-label solutions continues to grow, the phytogenic feed additives market is poised for significant expansion. Phytogenic feed additives offer several advantages to poultry and swine producers. They improve gut health, enhance feed conversion ratios, and boost growth performance. Furthermore, they contribute to sustainable farming practices by reducing the reliance on synthetic additives and antibiotics.

What are the market trends shaping the Europe Feed Phytogenics Market?

Increasing demand for natural feed additives for pets is the upcoming trend in the market.

- The market is witnessing significant growth due to the expanding population and increasing demand for high-quality, natural additives in animal feed. This trend is particularly noticeable in the poultry and swine industries, where phytogenics are used to enhance feed conversion ratios, improve growth performance, and promote gut health. These natural solutions offer an alternative to antibiotic growth promoters, which have faced regulatory hurdles and concerns over antibiotic resistance. Phytogenic feed additives consist of various herbs, essential oils, spices, and bioactive compounds derived from plants and microorganisms.

- These additives are gaining popularity due to their ability to improve animal health and productivity, while also addressing concerns over synthetic additives and antibiotic use. In addition, the rising demand for organic meat and sustainable farming practices is driving the adoption of phytogenics in animal feed. The market is also being driven by the need to address challenges such as heat stress, disease incidence, and mortality rates in livestock production. Phytogenic feed additives offer several benefits, including improved gut health, enhanced digestion, and better reproductive parameters.

What challenges does the market face during the growth?

Availability of substitutes is a key challenge affecting the market growth.

- Feed phytogenics, derived from herbs, essential oils, spices, and other natural additives, are gaining popularity in the animal feed industry as farmers and livestock breeders seek to enhance feed quality and promote sustainable farming practices. Phytogenic feed additives, including direct-fed microbials (DFM) and prebiotics, have been shown to improve animal health, growth performance, and feed conversion ratios. DFM, which provides beneficial microorganisms to animals, positively impacts milk yield, growth, digestion, and overall health. Commonly used DFM include Lactobacillus, Bifidobacterium, Bacillus, Streptococcus, and Enterococcus. Prebiotics, on the other hand, boost animal performance by increasing daily weight gain and improving gut health.

- Cereals, poultry diets, and swine feed are the primary applications for phytogenic additives. With the increasing ban on antibiotic growth promoters, phytogenics offer natural solutions to maintain herd health and reduce mortality rates. The phytogenic industry is expected to experience significant growth due to the demand for organic meat, clean-label feed, and sustainable farming practices. However, regulatory approvals and hurdles pose challenges to the industry's expansion. Phytogenics offer a plant-based alternative to synthetic additives, making them an attractive option for farmers seeking to reduce their reliance on antibiotics and improve animal welfare. Additionally, phytogenics have been shown to improve feed efficiency, disease incidence, and reproductive parameters, making them an essential component of intensive production systems.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasts, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adisseo France SAS - The company offers feed phytogenic products such as Krave AP additives.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A and A Pharmachem Inc.

- Archer Daniels Midland Co.

- Bluestar Adisseo Co.

- Cargill Inc.

- Delacon Biotechnik GmbH

- DOSTOFARM GmbH

- DuPont de Nemours Inc.

- Growell India

- Himalaya Global Holdings Ltd.

- Igusol SA

- Kemin Industries Inc.

- Koninklijke DSM NV

- Natural Remedies Pvt. Ltd.

- NOR-FEED

- Phytobiotics Futterzusatzstoffe GmbH

- Phytosynthese

- Silvateam Spa

- Synthite Industries Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to population expansion and the increasing demand for meat production. This trend has led to an increased focus on improving feed efficiency, animal health, and sustainable farming practices. One of the emerging areas of interest in the industry is the use of phytogenic feed additives. Phytogenic feed additives, derived from herbs, spices, essential oils, and cereals, have gained popularity as natural alternatives to synthetic additives and antibiotic growth promoters. These additives are known to enhance gut health, improve digestion, and boost immunity in livestock. The poultry industry, in particular, has seen a rise in the adoption of phytogenic feed additives. Poultry diets have traditionally relied on antibiotics to promote growth and improve feed conversion ratios. However, with the increasing concerns over antibiotic resistance and regulatory approvals, farmers are turning to natural solutions. Phytogenic feed additives have been shown to improve feed conversion ratios, reproductive parameters, and growth performance in broiler chickens. They contain bioactive compounds that promote gut health, enhance the gut microbiome, and reduce disease incidence. Moreover, they offer a clean-label solution, which is increasingly preferred by consumers seeking organic and natural meat products.

Also, the market is expanding to cater to other livestock, such as swine. Phytogenic feed additives have been shown to improve mortality rates, heat stress tolerance, and overall herd health in swine production systems. Despite the benefits, the adoption of phytogenic feed additives is not without challenges. The cost of these additives can be higher than synthetic alternatives. However, the long-term benefits, such as improved feed efficiency, reduced mortality rates, and improved animal health, make them a worthwhile investment for farmers. Moreover, the use of phytogenic feed additives is subject to regulatory approvals. Regulatory bodies are increasingly focusing on the safety and efficacy of these additives, which can add to the cost and complexity of their adoption. In conclusion, the use of phytogenic feed additives is an emerging trend in the feed mill industry. These additives offer natural solutions to improve animal health, feed efficiency, and sustainability in intensive production systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market Growth 2025-2029 |

USD 93.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.