Femoral Stems Market Size 2024-2028

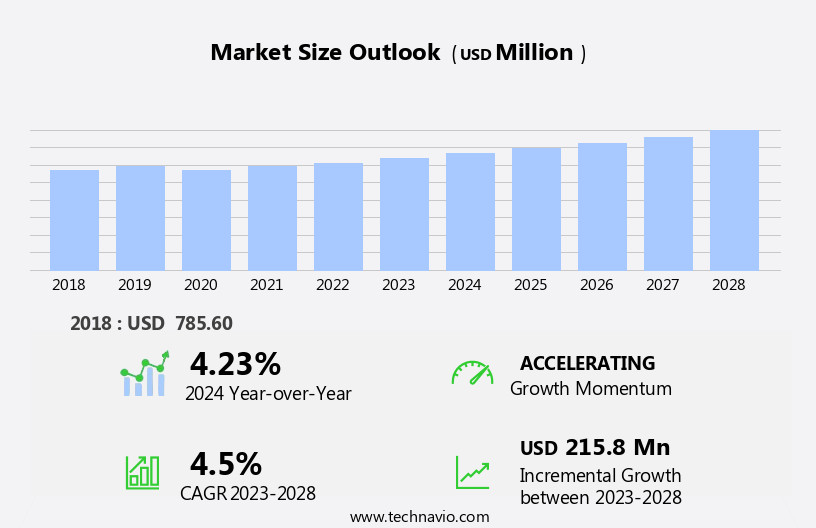

The femoral stems market size is forecast to increase by USD 215.8 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing prevalence of orthopedic conditions such as osteoarthritis (OA), osteoporosis, and rheumatoid arthritis (RA). These conditions often necessitate hip replacement surgeries, driving demand for femoral stems. Moreover, the trend towards robotic hip replacement surgeries is gaining traction, offering advantages like enhanced precision and reduced complications. However, the market faces challenges, including the high cost of hip replacement surgeries and declining reimbursements, which may limit accessibility and affordability for patients.

- Companies in this market must navigate these challenges while capitalizing on the growing patient population and advancements in surgical technology to maintain a competitive edge.

What will be the Size of the Femoral Stems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the ongoing quest for improved implant performance and patient outcomes. Hydroxyapatite coating, a popular implant surface coating, enhances osseointegration and promotes a stronger stem-bone interface. Femoral head replacement and stem length options cater to individual patient needs, while cobalt-chromium femoral stems offer durability and resistance to wear. Osteolysis prevention strategies, such as porous coating technology and implant longevity studies, are crucial in mitigating implant failure. The intramedullary design of femoral stems allows for better stress distribution and reduces the stress shielding effect. Preoperative planning software and surgical insertion techniques ensure precise implant positioning and alignment.

Stem neck designs and component materials continue to evolve, with a focus on biocompatibility and durability. Implant failure analysis and implant surface coatings provide valuable insights into the causes of implant failure and potential solutions. Femoral stem dimensions and taper geometry are critical factors in achieving optimal implant performance. The femoral stem market is characterized by continuous innovation and a dynamic market landscape. The integration of these technologies and strategies contributes to the ongoing evolution of the market and the development of more effective and efficient implant solutions.

How is this Femoral Stems Industry segmented?

The femoral stems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Cementless femoral stems

- Cemented femoral stems

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The cementless femoral stems segment is estimated to witness significant growth during the forecast period.

Cementless femoral stems, a common choice in total hip replacement (THR) surgeries, feature hydroxyapatite coatings or rough surfaces that facilitate new bone growth, creating a permanent bond between the implant and bone. Porous coating technology and implant surface coatings are essential in cementless fixation. The market offers two main stem variants: conventional stems, typically 150mm long, and short stems, under 120mm. Young patients often prefer cementless stems due to their long-term success and clinical efficacy. Post-operative rehabilitation protocols are crucial for optimal implant integration. Implant longevity studies and implant failure analysis are ongoing to ensure the highest quality and durability.

Stem neck designs and materials, such as cobalt-chromium, are essential considerations. Stress shielding effects are managed through stem taper geometry and surgical techniques. Preoperative planning software and alignment techniques aid in precise implantation. The femoral stem intramedullary design and stem dimensions are essential factors in achieving successful outcomes. In THR, osteolysis prevention strategies are vital to minimize implant complications. Surgeons employ various surgical insertion techniques to minimize complications and optimize patient outcomes. The stem-bone interface is a critical area of focus in ensuring implant success. Implant surface coatings and stem length options are essential factors in the ongoing advancements in the femoral stem market.

The Cementless femoral stems segment was valued at USD 619.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

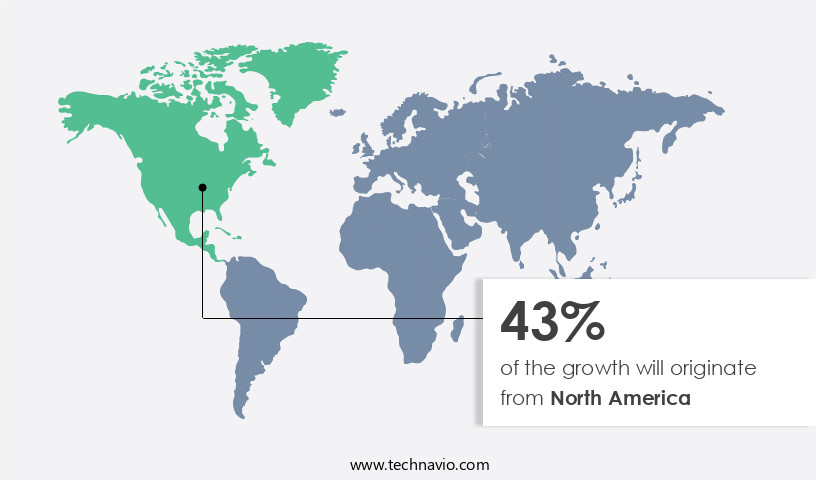

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American market, the United States and Canada are the primary contributors to the revenue growth of the femoral stems industry. The market's expansion is driven by several factors, including the rising adoption of advanced femoral stems, enhanced healthcare infrastructure, and the increasing prevalence of orthopedic disorders and associated risk factors. For example, in the US, the number of primary and revision total hip replacements (THR) is projected to reach approximately 1.45 million and 147,000, respectively, by 2035. Advanced femoral stems, such as those with hydroxyapatite coatings, are gaining popularity due to their potential to enhance implant integration and reduce the risk of osteolysis.

Cobalt-chromium femoral stems, with their strength and durability, continue to dominate the market. Porous coating technology and implant surface coatings are other trends that are gaining traction, as they improve the stem-bone interface and contribute to implant longevity. Post-operative rehabilitation protocols play a crucial role in ensuring successful implant integration and reducing the risk of implant failure. Preoperative planning software, surgical insertion techniques, and stem alignment techniques are essential components of these protocols. Stem length options and taper geometry are crucial considerations for surgeons when selecting the appropriate stem for a patient. Stem neck designs and component materials are also essential factors that influence the performance and longevity of the implant.

The stress shielding effect of femoral stems is a critical concern, as prolonged exposure to reduced bone loading can lead to bone loss and implant failure. To mitigate this risk, osteolysis prevention strategies, such as the use of porous coating technology and implant surface coatings, are being adopted. Implant failure analysis is an ongoing process to identify the root causes of implant failure and improve the design and manufacturing processes to minimize the risk of future failures. In summary, the market in North America is experiencing significant growth due to the increasing demand for advanced femoral stems, improved healthcare infrastructure, and the rising prevalence of orthopedic disorders.

The market is characterized by the adoption of innovative technologies, such as hydroxyapatite coatings and porous coating technology, and a focus on enhancing implant longevity and reducing the risk of implant failure.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Femoral Stems Industry?

- The rising prevalence of conditions such as osteoarthritis (OA), osteoporosis, and rheumatoid arthritis (RA) serves as the primary market driver, necessitating significant growth in the healthcare industry.

- The global prevalence of orthopedic conditions, including osteoarthritis (OA) and osteoporosis, is on the rise, posing a significant challenge to the healthcare industry. According to recent research, the global prevalence of OA is projected to increase from 265.09 million in 2011 to 375.55 million by 2025. In the US alone, over 30 million adults were diagnosed with OA as of 2017. Osteoporosis, another prevalent orthopedic condition, affected an average of 9-11 million Americans in 2015, with an additional 43-45 million having low bone density. Osteoporosis is a leading cause of morbidity and mortality in the elderly, contributing to hip fractures, wrist fractures, and vertebral fractures worldwide.

- To address these challenges, advancements in femoral stem technology have been made, focusing on preoperative planning software, surgical insertion techniques, and stem alignment techniques. Femoral stem dimensions and taper geometry have also been optimized to improve implant stability and patient outcomes. These technological advancements aim to provide a more immersive, harmonious, and emphasized surgical experience for patients, ultimately reducing the risk of complications and enhancing overall patient satisfaction.

What are the market trends shaping the Femoral Stems Industry?

- The focus on robotic hip replacement surgeries is gaining momentum in the medical industry. This advanced surgical approach is becoming increasingly popular due to its precision and potential for improved patient outcomes.

- Hip replacement surgeries have seen a significant shift towards the use of robotic platforms due to their precision and minimally invasive nature. These systems enable clinicians to customize procedures based on a patient's unique anatomy, ensuring optimal implant fit. The benefits of robotic-assisted surgeries include smaller incisions, reduced blood loss, and minimal damage to surrounding tissues. Moreover, the implants used in these procedures are known for their durability and long-lasting performance. Companies are investing heavily in research and development to create advanced surgical robots for hip replacement procedures.

- One such focus area is the correct positioning of components during surgery. The use of hydroxyapatite coating on femoral stems is a notable strategy for osteolysis prevention. Cobalt-chromium femoral stems are popular choices due to their strength and biocompatibility. By prioritizing innovation and patient-centric solutions, the market for femoral stems continues to evolve, offering potential for significant growth.

What challenges does the Femoral Stems Industry face during its growth?

- The escalating costs of hip replacement surgeries and decreasing reimbursements pose a significant challenge to the growth of the industry.

- The femoral stem market is driven by the increasing number of hip replacement surgeries due to the aging population and rising prevalence of hip diseases. However, the high cost of these surgeries is a significant barrier to their widespread adoption, with prices ranging from USD 15,000 to USD 35,000 on average. The cost can vary depending on factors such as implant type, surgical complexity, surgeon expertise, hospital fees, diagnostic tests, insurance coverage, and medications. Moreover, a substantial number of patients require revision surgeries due to complications like infection, wear, and acetabular component failure, leading to additional financial burden. Advancements in technology, such as porous coating technology and implant surface coatings, are aimed at improving the stem-bone interface and enhancing the longevity of the implants.

- These innovations can potentially reduce the need for revision surgeries and lower long-term healthcare costs. Post-operative rehabilitation protocols play a crucial role in ensuring the successful integration of the implant and promoting quicker recovery. By focusing on these areas, stakeholders in the femoral stem market can create value and address the affordability concerns of patients and healthcare providers.

Exclusive Customer Landscape

The femoral stems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the femoral stems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, femoral stems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AK Medical Holding Ltd. - The company specializes in providing advanced femoral stems, including the MR modular type, designed to facilitate bone splitting during implantation, enhancing surgical efficiency and patient outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AK Medical Holding Ltd.

- Altimed JSC

- Amplitude Inc.

- B.Braun SE

- BEZNOSKA Sro

- Biotechni SAS

- Corentec Co. Ltd.

- EVOLUTIS SAS

- Exactech Inc.

- GROUP FH ORTHO

- Gruppo Bioimpianti Srl

- IMECO SA

- ImplanTec GmbH

- Johnson and Johnson Services Inc.

- Lepine Group

- Limacorporate SpA

- Medacta International SA

- Meril Life Sciences Pvt. Ltd.

- PETER BREHM GmbH

- Smith and Nephew plc

- Stryker Corp.

- X.NOV

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Femoral Stems Market

- In January 2024, Stryker Corporation announced the FDA approval of its Acculink Tritanium Total Hip System, which includes the Acculink Tritanium Femoral Stem. This approval marked a significant expansion to Stryker's orthopedic product offerings (Stryker Corporation Press Release).

- In March 2024, Smith & Nephew entered into a strategic partnership with Medtronic to co-develop and commercialize novel, advanced total hip arthroplasty systems. This collaboration aimed to combine Smith & Nephew's hip stem technology with Medtronic's robotic-assisted surgical systems (Smith & Nephew Press Release).

- In May 2024, Zimmer Biomet Holdings, Inc. completed the acquisition of Medacta International's Orthopedic Reconstruction and Spine business. This acquisition granted Zimmer Biomet access to Medacta's innovative femoral stem designs and expanded its global footprint in the orthopedic market (Zimmer Biomet Holdings, Inc. Press Release).

- In April 2025, DePuy Synthes, a Johnson & Johnson company, received CE Mark approval for its TRUMATCH Precision Femoral Stems. These stems utilize 3D-printed technology, allowing for customized implants tailored to individual patients (DePuy Synthes Press Release).

Research Analyst Overview

- The femoral stem market is experiencing significant advancements in response to evolving patient needs and clinical requirements. Aseptic loosening risk, a persistent challenge in total hip arthroplasty, is being addressed through the development of implants with improved implant stability and stem-bone integration. Post-surgical mobility is a key concern, leading to the refinement of surgical technique and the optimization of stem design parameters, such as stem stiffness and orientation precision. Radiographic assessment techniques and wear debris analysis are essential for evaluating implant performance and identifying potential issues. Clinical outcome measures and implant stability metrics are also crucial in determining the long-term success of femoral stems.

- Material fatigue analysis and biomechanical testing methods are being employed to enhance the durability and reliability of these devices. Patient selection criteria and periprosthetic bone loss are critical factors influencing the market. Surgical instrumentation and stem modularity are essential for ensuring precise implant placement and facilitating surgical approach techniques. Complications management, including the treatment of osteolysis and metal ion release, is a priority for manufacturers and healthcare providers. Continuous research and innovation in stem design features, such as bone ingrowth stimulation and stem stability assessment, are driving the market forward. The focus on improving surgical technique and enhancing implant stability is expected to remain a significant trend in the femoral stem market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Femoral Stems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 215.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, France, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Femoral Stems Market Research and Growth Report?

- CAGR of the Femoral Stems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the femoral stems market growth of industry companies

We can help! Our analysts can customize this femoral stems market research report to meet your requirements.