Rheumatoid Arthritis Diagnostic Devices Market Size 2024-2028

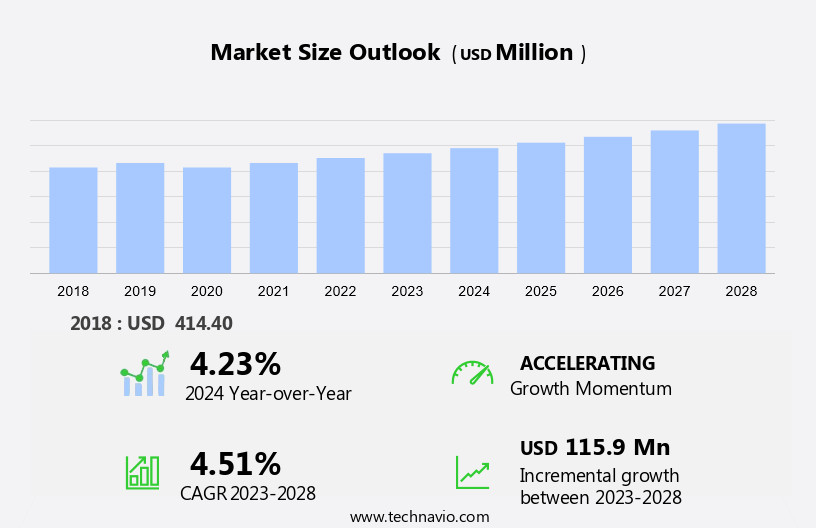

The rheumatoid arthritis diagnostic devices market size is forecast to increase by USD 115.9 million at a CAGR of 4.51% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The increasing number of RA cases worldwide, driven by an aging population and the rising prevalence of obesity and smoking, is a major growth factor. Additionally, the growing number of business strategies, such as collaborations, acquisitions, and product launches, is fueling market expansion, particularly as healthcare services adopt advanced technologies to improve data storage, management, and accessibility. However, high costs associated with RA diagnosis, including expensive imaging techniques and laboratory tests, pose a significant challenge to market growth. Despite this, advancements in technology, such as point-of-care diagnostics and telemedicine, offer opportunities for cost-effective and convenient solutions. Overall, the RA diagnostic devices market is expected to continue growing, driven by the increasing burden of RA and advancements in diagnostic technology.

What will be the Size of the Rheumatoid Arthritis Diagnostic Devices Market During the Forecast Period?

- Rheumatoid Arthritis (RA) is a chronic autoimmune disease characterized by inflammation of the joints and connective tissue. The diagnostic process for RA involves various procedures to identify the presence of the disease in patients. These procedures include serology tests such as Rheumatoid Factor (RF) and Antinuclear Antibody (ANA), as well as assessing inflammation markers like Erythrocyte Sedimentation Rate (ESR) and Uric Acid. The diagnostic devices market for Rheumatoid Arthritis is driven by the increasing number of patients, with annual incidence rates estimated to be around 40-70 per 100,000 individuals. The geriatric population is particularly vulnerable, given that RA is more common in older adults.

- The market is segmented into diagnostic laboratories, private laboratories, public laboratories, and ambulatory surgical centers. The growing awareness of RA and its early diagnosis are expected to fuel market growth. However, the variants of COVID-19 and health reimbursement policies may impact the market. The diagnostic devices used in RA testing include RF, ANA, ESR, and Uric Acid tests. These tests help in identifying the presence of inflammation and autoantibodies, which are indicative of RA. The market is expected to grow steadily due to the increasing demand for accurate and early diagnosis of RA.

How is this Rheumatoid Arthritis Diagnostic Devices Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Analyzers

- Consumables

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Asia

- Japan

- Rest of World (ROW)

- North America

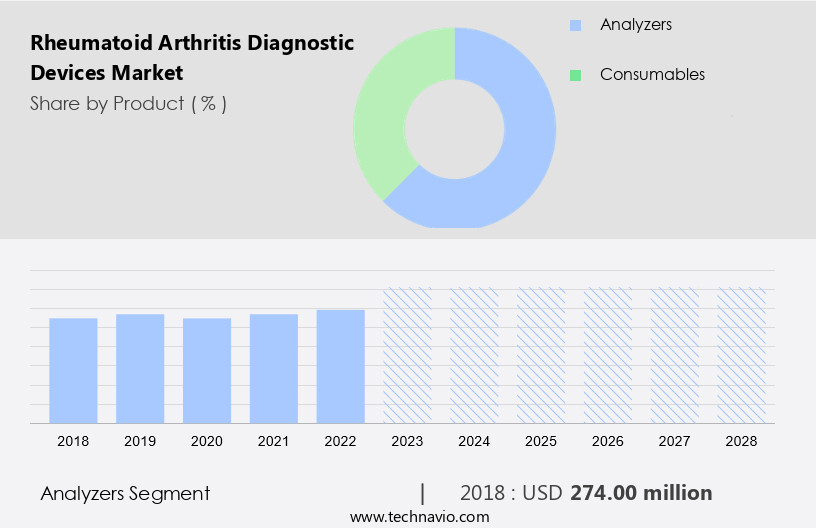

By Product Insights

- The analyzers segment is estimated to witness significant growth during the forecast period. Rheumatoid arthritis (RA) is a chronic autoimmune disease characterized by inflammation of the joints and connective tissue, leading to swelling, pain, and damage to cartilage, bone, muscles, and fibrous tissue. Diagnostic procedures for RA involve identifying specific biomarkers through serology tests, such as the rheumatoid factor (RF) and antinuclear antibody (ANA), as well as muscle enzyme tests, creatinine test, and salicylate level count. The human immune system's response to RA can be influenced by factors like smoking and obesity. Rheumatoid arthritis diagnostic devices, including analyzers, play a crucial role in detecting RA in patients. These analyzers perform serum and plasma tests to identify specific proteins, such as CCP antibodies and RF.

- Advanced automated analyzers are being developed to enhance productivity and reduce turnaround time. For instance, Abbott Laboratories' ARCHITECT c4000 is a notable analyzer used for RA diagnosis. The annual incidence rates of RA are increasing, particularly in the geriatric population. Diagnostic laboratories, including private and public laboratories and ambulatory surgical centers, use these analyzers to provide accurate test results for RA. These tests are essential for proper diagnosis and treatment of RA, which can help manage inflammation, joint damage, and pain in the hands, wrists, and feet. The COVID-19 variants have impacted healthcare systems, leading to increased awareness of the importance of early and accurate diagnosis of chronic diseases like RA.

Get a glance at the market report of share of various segments Request Free Sample

The Analyzers segment was valued at USD 274.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

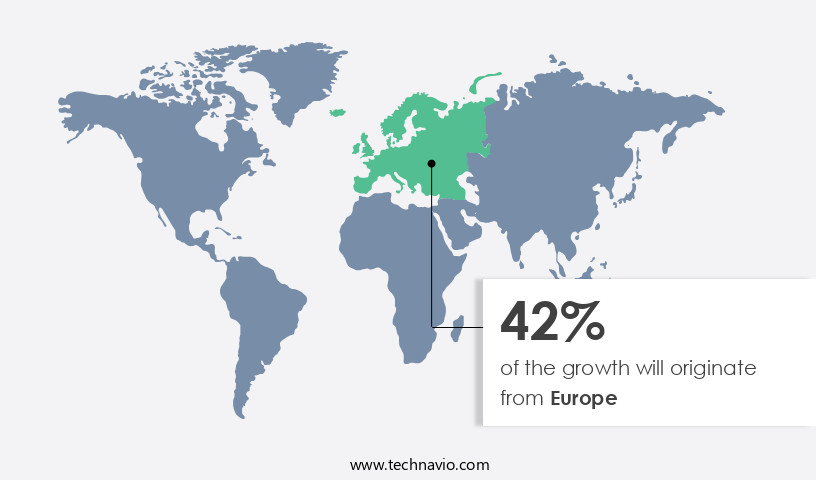

- Europe is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Rheumatoid Arthritis (RA) is a chronic autoimmune disease characterized by inflammation of the joints and other connective tissues. Diagnostic procedures play a crucial role in identifying RA in patients. The human immune system produces Rheumatoid Factor (RF) and Antinuclear Antibody (ANA) in response to the disease. Variants of COVID-19 have not significantly impacted diagnostic procedures, but health reimbursement and awareness campaigns are essential to encourage early detection.

For more insights on the market size of various regions, Request Free Sample

RA affects joints, bones, cartilage, muscles, and fibrous tissue, causing swelling, pain, and inflammation. Symptoms often appear in the hands, wrists, and feet. Diagnostic tests include Serology Test for RF and ANA, Erythrocyte Sedimentation Rate (ESR), Creatinine test, Muscle enzyme tests, and Uric Acid count. Laboratories, including private and public, and ambulatory surgical centers perform these tests. The geriatric population, with annual incidence rates of 1-3%, is a significant demographic for RA diagnosis. Smoking and obesity are known risk factors. Salicylate level counts are also essential to monitor RA progression. RA is an inflammatory condition, and diagnosing it early is vital for effective treatment. Inflammation can damage joints and other tissues, leading to long-term complications. Therefore, accurate and timely diagnosis is crucial.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rheumatoid Arthritis Diagnostic Devices Industry?

- Increasing number of rheumatoid arthritis cases is the key driver of the market. The prevalence of autoimmune disorders, including rheumatoid arthritis (RA), has been on the rise globally. This condition, characterized by inflammation and joint damage, affects both men and women, although it is more common among older adults. According to the Centers for Disease Control and Prevention (CDC), the prevalence of arthritis, which includes RA, is 7.1% among adults aged 18-44 years and 49.6% among those aged 65 and above in the US. The aging population is more susceptible to RA due to physiological and immune system changes. Early diagnosis is crucial for effective management of RA and mitigating its impact on patient outcomes, including activity limitations and physical disabilities.

- Diagnostic devices play a pivotal role in the testing industry by facilitating accurate and timely identification of RA. Serological tests are commonly used for RA diagnosis, and advancements in diagnostic technology continue to improve diagnostic accuracy and efficiency.

What are the market trends shaping the Rheumatoid Arthritis Diagnostic Devices Industry?

- Growing number of business strategies is the upcoming market trend. Companies in the market are implementing strategic business moves, such as distribution partnerships, to broaden their sales and solidify their market presence. The rising demand for these diagnostic tools is motivating key players to expand their geographical reach, which can foster market expansion. Such business strategies enable medical equipment manufacturers to explore new opportunities without significant financial strain. These collaborations for product development and commercialization offer numerous advantages, including cost savings, expanded product lines, and extensive geographical coverage.

- These factors collectively contribute to the growth of the global healthcare equipment market, including the market. Early and accurate diagnosis of rheumatoid arthritis is crucial for optimal patient outcomes, as untreated or misdiagnosed cases can lead to physical disabilities and activity limitations for both women and men. Serological tests, such as rheumatoid factor and anti-citrullinated protein antibody tests, play a significant role in the diagnostic process. The testing industry continues to innovate and improve these diagnostic tools to ensure timely and accurate diagnoses for the undiagnosed population.

What challenges does the Rheumatoid Arthritis Diagnostic Devices Industry face during its growth?

- High costs associated with rheumatoid arthritis diagnosis is a key challenge affecting the industry growth. The prevalence of rheumatoid arthritis (RA) among women and men continues to rise, leading to an increased demand for diagnostic devices to aid in early identification and improved patient outcomes. However, the high cost of these devices poses a challenge to their widespread adoption. For instance, rheumatoid arthritis diagnostic analyzers can cost between USD 8,000 and USD 15,000, depending on their technology and applications.

- These devices play a crucial role in identifying the disease by detecting specific biomarkers. Serological tests, such as rheumatoid factor assays, are commonly used for RA diagnosis. These assays measure the presence of rheumatoid factor in the serum and plasma through in-vitro quantitative measurement. The early and accurate diagnosis of RA is essential to mitigate the impact of physical disabilities and activity limitations associated with the disease.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Antibodies Inc.

- Augurex Life Sciences Corp.

- Aviva Systems Biology Corp.

- Bio Rad Laboratories Inc.

- Danaher Corp.

- DNAlytics SA

- EUROBIO SCIENTIFIC

- F. Hoffmann La Roche Ltd.

- Myriad Genetics Inc.

- QIAGEN NV

- Quest Diagnostics Inc.

- Siemens AG

- Svar Life Science AB

- Thermo Fisher Scientific Inc.

- Werfenlife SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Rheumatoid Arthritis (RA) is a chronic autoimmune disease characterized by inflammation of the joints and other areas of the body. The diagnostic procedures for RA involve identifying various markers in the human immune system, such as Rheumatoid Factor (RF), Antinuclear Antibody (ANA), Erythrocyte Sedimentation Rate (ESR), and C-reactive protein (CRP). These tests help in detecting inflammation and damage to cartilage, bone, and other tissues. Patients with RA often experience swelling, pain, and stiffness in their joints, particularly in the hands, wrists, and feet. The diagnostic process is crucial as early detection and treatment can help manage the symptoms and prevent further damage.

Moreover, the variants of COVID-19 have not significantly affected the diagnostic procedures for RA, as most of these tests can be performed in diagnostic laboratories, including private and public laboratories, and ambulatory surgical centers. However, the annual incidence rates of RA have been increasing due to factors such as smoking and obesity, making early and accurate diagnosis more important than ever. RA diagnostic procedures involve various tests, including Salicylate level count, muscle enzyme tests, creatinine test, and serology tests. These tests help in identifying the presence of antigens and antibodies in the body, which are indicative of RA. As the geriatric population continues to grow, the demand for RA diagnostic devices is expected to increase. Furthermore, these devices include automated analyzers, immunoassay analyzers, and point-of-care testing devices, which help in providing accurate and timely results.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.51% |

|

Market growth 2024-2028 |

USD 115.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, France, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rheumatoid Arthritis Diagnostic Devices Market Research and Growth Report?

- CAGR of the Rheumatoid Arthritis Diagnostic Devices industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rheumatoid arthritis diagnostic devices market growth of industry companies

We can help! Our analysts can customize this rheumatoid arthritis diagnostic devices market research report to meet your requirements.