Healthcare Facilities Management Market Size 2024-2028

The healthcare facilities management market size is forecast to increase by USD 92.9 billion at a CAGR of 9.7% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics. These technologies enable smart building technology, enhancing operational efficiency and patient care. Cloud-based solutions are gaining popularity due to their flexibility and scalability. Strategic alliances and new product launches are driving market competition. However, the market remains fragmented, with numerous players vying for market share. The integration of these technologies in healthcare facilities management is transforming the industry, offering improved patient outcomes and operational cost savings.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the planning, designing, constructing, and maintaining of physical infrastructure to deliver efficient and effective healthcare services. This market plays a crucial role in ensuring the health and well-being of patients, particularly those in the geriatric population and those suffering from non-communicable and chronic diseases. One of the primary objectives of healthcare facilities management is to improve patient safety. Advanced technologies, such as AI and IoT, are increasingly being integrated into healthcare facilities to achieve this goal. Big data analytics derived from these technologies enable healthcare providers to monitor patient volume, energy usage, and digital platforms to optimize patient scheduling and electronic health records management.

- Moreover, healthcare facilities management is essential for energy management. With the competitive nature of the healthcare industry, on-site and off-site facility management companies are leveraging smart building technology to reduce energy usage and costs. This not only benefits the healthcare providers but also contributes to the overall sustainability efforts. Patient safety and health and well-being are the top priorities in the healthcare sector. Healthcare services must adhere to stringent regulations, including patent scrutiny, to ensure the highest standards of care. Healthcare facility construction is a significant investment, and ROI is a critical consideration. Effective healthcare facilities management can help maximize this investment by ensuring that the infrastructure is utilized optimally.

How is this market segmented and which is the largest segment?

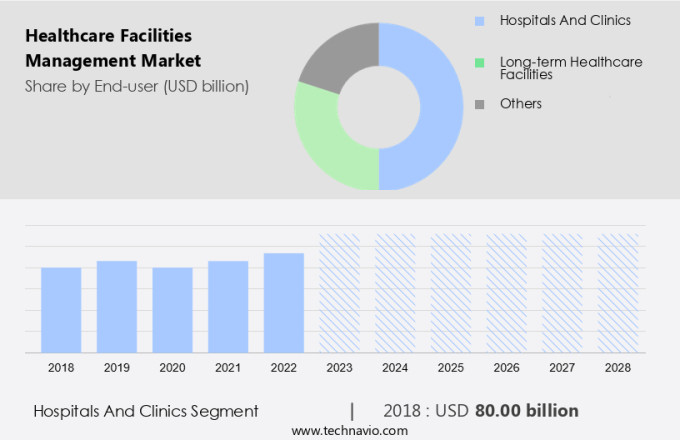

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and clinics

- Long-term healthcare facilities

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

- The hospitals and clinics segment is estimated to witness significant growth during the forecast period.

In the realm of healthcare, managing facilities in hospitals and clinics is a critical aspect of delivering optimal patient care. This involves overseeing the coordination of facilities, assets, and personnel to ensure a safe, efficient, and high-quality care environment. Advanced technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT), are increasingly being integrated into healthcare facilities management to enhance operations. Big data analytics and smart building technology enable real-time monitoring and optimization of energy usage, HVAC systems, and other essential services. Compliance, security, and emergency planning are also integral components of healthcare facilities management, ensuring the well-being of both patients and staff.

Moreover, with the dynamic nature of healthcare, from brief outpatient visits to lengthy inpatient procedures, agility and careful planning are essential. By leveraging the latest technologies, healthcare facilities management can adapt to the unique demands of the healthcare setting and prioritize patient care.

Get a glance at the market report of share of various segments Request Free Sample

The hospitals and clinics segment was valued at USD 80.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is poised for steady expansion over the coming years, with a significant portion of this growth occurring in the United States. Several factors are driving the market's expansion in North America. First, there is an increasing adoption of healthcare facilities management services by various industries. Second, there is a trend towards advanced and outsourced healthcare facilities management services, which is replacing traditional management methods. Third, the expansion of end-user industries is contributing to market growth. Additionally, government initiatives aimed at implementing healthcare facilities management services are gaining traction. Furthermore, the burgeoning startup culture in North America, particularly in the US, is expected to generate more end-users and heighten the demand for healthcare facilities management services.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Healthcare Facilities Management Market?

Increasing demand for cloud-based healthcare facility management solutions is the key driver of the market.

- In the dynamic healthcare industry, the necessity for advanced technology in facilities management has resulted in a notable expansion of cloud computing solutions. These cloud-based offerings facilitate the integration of various healthcare facilities management services, providing a dependable platform for hosting healthcare software.

- Moreover, by utilizing cloud technology, organizations can enhance security and collaboration among their teams and affiliates in diverse locations, thereby reducing operational expenses. Cloud-hosted healthcare facility management solutions ensure the secure storage of essential data and offer several benefits, including heightened security, scalability, and expedited disaster recovery.

What are the market trends shaping the Healthcare Facilities Management Market?

Rising strategic alliances and product launch is the upcoming trend in the market.

- The market is experiencing notable advancements as a result of strategic collaborations and new product introductions. With the rising complexity of healthcare operations and the growing demand for enhanced patient care, these partnerships are becoming increasingly important for driving innovation, increasing efficiency, and ensuring regulatory compliance. By joining forces, healthcare providers, technology firms, and service companies can combine resources and expertise, leading to the development of customized solutions designed to address specific challenges within healthcare facilities. For example, alliances between pharmaceutical companies and healthcare technology providers have yielded integrated care models that merge medication management with sophisticated diagnostic tools, thereby improving patient well-being while streamlining operations.

- In addition, these collaborations play a crucial role in addressing the needs of the aging population and managing non-communicable and chronic diseases, which are major contributors to the growing demand for effective healthcare facility management solutions.

What challenges does Healthcare Facilities Management Market face during the growth?

Fragmented nature of market is a key challenge affecting the market growth.

- The market encompasses both acute and non-acute settings, including hospitals and post-acute care facilities, such as nursing homes and rehabilitation centers. This market is characterized by a high degree of competition among various facility management services providers. The market is segmented into organized and unorganized sectors. Organized sector players are large entities that adhere to regulations and possess the necessary permits.

- Moreover, in contrast, the unorganized sector comprises smaller entities that do not have government registration. Healthcare HVAC systems and other facility management services are essential for maintaining a clean and healthy environment in these settings. companies in this market compete based on pricing, service quality, and brand recognition. The market's competitiveness is heightened by the presence of numerous players, necessitating continuous upgrades to cleaning services to keep up with technological advancements.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABM Industries Inc.

- Aramark

- Arpal Gulf LLC

- CBRE Group Inc.

- Compass Group Plc

- Dussmann Group

- Ecolab Inc.

- International Business Machines Corp.

- ISS AS

- Johnson Controls International Plc.

- Jones Lang LaSalle Inc.

- Medxcel Facilities Management LLC

- Mitie Group Plc

- OCS Group International Ltd.

- Rekeep SpA

- SAP SE

- Serco Group Plc

- Sodexo SA

- UEM Group Berhad

- Vanguard Resources Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Healthcare facility management encompasses the physical infrastructure and digital platforms that ensure the delivery of high-quality, cost-effective healthcare services. With an aging population and a rise in non-communicable and chronic diseases, there is a growing demand for advanced technologies and AI-driven solutions to improve health and well-being. This includes smart building technology for energy usage optimization, digital platforms for patient scheduling and electronic health records, and remote patient monitoring for real-time data management. Patient safety is a top priority, with IoT sensors and big data analytics playing a crucial role in monitoring and responding to patient needs. Healthcare facilities are increasingly investing in AI and robotics for surgeries and other procedures, as well as energy management systems to reduce costs and improve sustainability.

Moreover, the competitive nature of the healthcare industry necessitates on-site and off-site facility management services, including construction, hard services, and energy services. In acute settings, patient volume and energy management are key challenges, while post-acute and non-acute settings require a focus on patient care and cost-effective solutions. Healthcare HVAC systems and facility management services are essential for maintaining a healthy and comfortable environment, with a focus on energy efficiency and regulatory compliance. Patient safety, digitalization, and cost savings are the driving forces behind the ongoing investment in healthcare facility management.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.7% |

|

Market growth 2024-2028 |

USD 92.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.7 |

|

Key countries |

US, Germany, UK, China, Canada, Japan, France, India, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch