Fertility Testing Devices Market Size 2024-2028

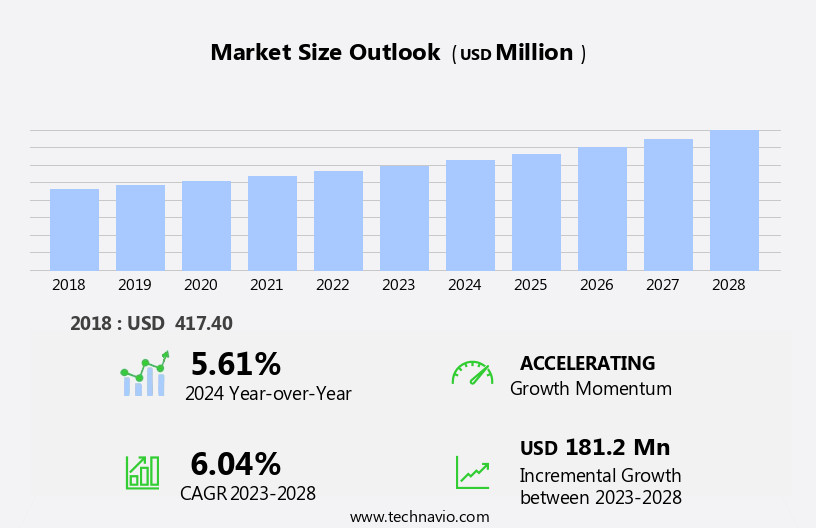

The fertility testing devices market size is forecast to increase by USD 181.2 million, at a CAGR of 6.04% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The rising median age of first-time pregnancies in women is a major factor fueling market expansion. As women delay starting families, the demand for fertility testing devices to assess reproductive health and potential issues increases. Another driver is the easy accessibility of these devices through e-commerce sites, making them more convenient for consumers. However, this market also faces challenges. Stringent regulatory bodies impose strict guidelines on the production and distribution of fertility testing devices, which can hinder market growth. Companies must navigate these regulations to ensure their products meet safety and efficacy standards while also remaining competitive.

- To capitalize on market opportunities and effectively navigate challenges, businesses should focus on innovation, regulatory compliance, and consumer education. By addressing these factors, they can differentiate themselves in the market and meet the growing demand for accurate and accessible fertility testing solutions.

What will be the Size of the Fertility Testing Devices Market during the forecast period?

- The market encompasses a range of technologies designed to aid infertility treatment, including ovulation detection, sperm quality analysis, and fertility optimization tools. Male and female infertility issues drive the demand for these devices, with solutions addressing unexplained infertility, hormone therapy, and fertility medication also gaining traction. Fertility tracking software, pregnancy planning tools, and fertility support groups offer emotional and informational assistance to those undergoing infertility treatment. Cost remains a significant factor in the market, with fertility insurance coverage varying widely. As a result, affordable fertility testing kits, such as ovulation prediction and conception probability devices, are increasingly popular.

- Advanced reproductive technologies like embryo freezing, egg freezing, intrauterine insemination (IUI), and in-vitro fertilization (IVF) rely on these devices for success. Donor eggs and sperm, as well as fertility preservation methods like sperm freezing, are also facilitated by these technologies. Fertility testing devices continue to evolve, with innovations in fertility medication, hormone therapy, and fertility counseling contributing to improved fertility outcomes. The market is expected to grow as advancements in technology and increasing awareness of infertility issues lead to greater adoption of these solutions.

How is this Fertility Testing Devices Industry segmented?

The fertility testing devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Ovulation predictor kits

- Fertility monitors

- Male fertility testing devices

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The ovulation predictor kits segment is estimated to witness significant growth during the forecast period.

Fertility testing devices have gained significant attention in the US market, driven by various factors including lifestyle choices, advancements in technology, and increasing awareness of fertility health. Fertility clinics and reproductive endocrinologists offer a range of services, from carrier screening and genetic testing to in-vitro fertilization (IVF) and embryo biopsy. Fertility awareness methods, such as the symptom-thermal method (STM) and cervical mucus method, have been used for decades to track ovulation and improve chances of conception. Fertility tracking apps and wearable technology have emerged as popular tools for cycle tracking, hormone monitoring, and predictive analytics. Sperm analysis kits and semen analysis enable men to assess their fertility at home.

Patient empowerment is a key trend, with digital health initiatives offering remote monitoring, virtual consultations, and personalized fertility plans. Early pregnancy detection is crucial for addressing potential complications, and pregnancy tests, including home ovulation tests and digital fertility monitors, have become more accurate and accessible. Fertility coaching and stress management programs help couples navigate the emotional and physical challenges of fertility treatments. Precision medicine and personalized medicine approaches are increasingly being used to optimize fertility treatments based on individual genetic profiles and lifestyle factors. Consumers are also turning to online resources and data analytics for education and support. Machine learning and artificial intelligence (AI) are being integrated into fertility monitoring devices and mobile apps to improve accuracy and provide real-time insights.

Fertility specialists and genetic counselors offer expert advice on fertility issues, including chromosomal abnormalities, sperm morphology, and DNA fragmentation. Weight management, smoking cessation, and alcohol consumption are lifestyle factors that can impact fertility and are being addressed through integrated health programs. In conclusion, the market is witnessing significant growth, driven by advancements in technology, increasing awareness, and a growing demand for personalized and convenient solutions. The integration of data analytics, AI, and precision medicine is transforming the landscape, empowering patients to take control of their fertility journey.

The Ovulation predictor kits segment was valued at USD 176.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, North America held the largest revenue share in 2023, primarily driven by the US. Factors such as the rising prevalence of Polycystic Ovary Syndrome (PCOS), the increasing age of first-time pregnancies, and the declining fertility rate in the region are significant contributors. According to the Organization for Economic Co-operation and Development (OECD), the average age of first-time pregnancies in the US is 30 years and above. Technological advances and the increasing preference for point-of-care (POC) testing devices further fuel market growth in the US. The presence of numerous fertility testing device companies in the US also reinforces market expansion.

Fertility awareness methods, including menstrual cycle tracking, ovulation predictor kits, and symptom-thermal method (STM), have gained popularity among consumers, leading to the development of various fertility tracking apps and wearable technology. These tools enable remote monitoring, data analytics, and machine learning algorithms to predict ovulation and enhance the chances of conception. Moreover, fertility clinics offer carrier screening, ovarian reserve testing, hormone monitoring, and in-vitro fertilization (IVF) to address various infertility issues. Fertility coaching, stress management, and personalized fertility plans are essential components of digital health services that empower patients to take charge of their reproductive health.

Obstetricians and gynecologists, reproductive endocrinologists, genetic counselors, and fertility specialists provide expert advice and guidance to couples experiencing infertility. Sperm analysis kits, semen analysis, and genetic testing are crucial diagnostic tools used to assess fertility issues in men. Early pregnancy detection, embryo biopsy, and chromosomal abnormalities testing are critical aspects of precision medicine, ensuring the health and well-being of both the mother and the baby. Consumer education on lifestyle factors, such as smoking cessation, alcohol consumption, and weight management, plays a significant role in improving overall fertility. Personalized medicine, including personalized fertility plans, hormone monitoring, and ovulation predictor kits, caters to individual needs and optimizes the chances of a successful pregnancy.

Artificial intelligence (AI) and predictive analytics enable fertility monitoring devices to analyze data and provide insights into fertility patterns, enhancing the chances of conception. Virtual consultations and online resources offer flexibility and convenience for patients seeking expert advice and support. Overall, the market is evolving to meet the diverse needs of consumers, with a focus on patient empowerment, innovation, and personalized care.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Fertility Testing Devices market drivers leading to the rise in the adoption of Industry?

- The increasing median age of first-time pregnancies among women serves as a significant market driver.

- The market has witnessed significant growth in recent years, driven by the increasing prevalence of delayed childbearing due to various factors such as polycystic ovary syndrome (PCOS), ruptured uterus, amniotic fluid embolism, and personal reasons. This trend is particularly noticeable in developed economies where the average age of first-time mothers is on the rise. According to the Organisation for Economic Co-operation and Development (OECD), the average age of women giving birth for the first time in countries like Ireland, Italy, South Korea, Spain, and Switzerland was 30-34 years in 2020. In contrast, the mean age in Mexico was 20-24 years.

- This shift in demographics has led to a growing demand for precision medicine solutions in the market. Digital health technologies, such as virtual consultations, ovulation predictor kits, and fertility awareness education, are increasingly being adopted to help women optimize their reproductive health. Consumer education and awareness programs on lifestyle factors like smoking cessation, alcohol consumption, weight management, and hormone monitoring are also gaining popularity. Reproductive endocrinologists and healthcare providers are emphasizing personalized medicine approaches to improve the chances of conception. Overall, the market is expected to continue its growth trajectory, driven by these trends and the increasing focus on improving reproductive health outcomes.

What are the Fertility Testing Devices market trends shaping the Industry?

- The increasing accessibility of fertility testing devices is becoming a notable trend in the market, with many e-commerce sites offering a wide range of options for customers. This convenience enables individuals to explore their fertility options more easily and efficiently.

- The digitalization of healthcare and increasing awareness of stress management for improved fertility have fueled the demand for fertility testing devices. According to recent research, the global population with Internet access reached 4.66 billion in 2020, creating a significant market opportunity for online sales of fertility testing devices. companies are meeting this demand by offering various products, such as digital fertility monitors, semen analysis kits, and genetic testing services, through e-commerce sites. These devices help users track their menstrual cycles, monitor follicle-stimulating hormone (FSH) and luteinizing hormone (LH) levels, and even provide genetic counseling services. Machine learning algorithms are being integrated into these devices to offer personalized fertility plans based on individual health data.

- Pregnancy tests and DNA fragmentation analysis are also available online, enabling users to monitor their fertility from the comfort of their homes. Manufacturers are leveraging digital channels to promote their products, reaching a wider audience through email campaigns, blogs, and social media. Overall, the market for fertility testing devices is experiencing steady growth as more individuals seek convenient, accurate, and personalized solutions to manage their reproductive health.

How does Fertility Testing Devices market faces challenges face during its growth?

- The strict regulatory bodies pose a significant challenge to the expansion of the industry.

- Fertility testing devices play a crucial role in assisting women in understanding their reproductive health. These devices encompass various methods, including fertility awareness methods, fertility tracking apps, sperm analysis kits, and cervical mucus tests, among others. Lifestyle factors significantly impact fertility, and these devices offer valuable insights into menstrual cycle tracking and early pregnancy detection. Moreover, fertility coaching and carrier screening are essential services that can be facilitated through advanced fertility testing devices. Despite their benefits, fertility testing devices come with challenges. Precision and accuracy errors, device malfunctions, and improper usage can lead to misdiagnosis and inappropriate treatment.

- To mitigate these risks, regulatory bodies, such as the US Food and Drug Administration (FDA) and the European Union (EU) authorities, oversee the manufacturing and marketing of these devices. Wearable technology and ovarian reserve testing are emerging trends in the fertility testing market, offering immersive and harmonious patient experiences. Embryo biopsy and other advanced fertility treatments are facilitated by these devices, empowering patients to take charge of their reproductive health. In conclusion, while fertility testing devices offer significant benefits, it is essential to ensure their precision, accuracy, and safety to avoid misdiagnosis and improper treatment. Regulatory bodies play a vital role in maintaining the quality and reliability of these devices.

Exclusive Customer Landscape

The fertility testing devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fertility testing devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fertility testing devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in advanced fertility and pregnancy diagnostic solutions, providing accurate and reliable results with tests such as ARCHITECT i1000SR, c4000, and c8000. Leveraging innovative technology, these assays deliver high-sensitivity analyses, enabling healthcare professionals to make informed decisions and improve patient care. By prioritizing precision and efficiency, the company's offerings elevate the diagnostic process, ensuring optimal outcomes for patients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AdvaCare Pharma

- Alfa Scientific Designs Inc

- Ava AG

- Babystart Ltd.

- bioZhena Corp.

- Church and Dwight Co. Inc.

- Geratherm Medical AG

- Get Stix Inc.

- Medical Electronic Systems LLC

- Piramal Enterprises Ltd.

- PREGMATE

- Prestige Consumer Healthcare Inc.

- Quanovate Tech Inc.

- Quidelortho Corp.

- Samplytics Technologies Pvt Ltd.

- Tempdrop Ltd.

- The Procter and Gamble Co.

- UEBE Medical GmbH

- Valley Electronics AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fertility Testing Devices Market

- In February 2023, Merck KGaA, a leading life science and healthcare company, announced the launch of their new fertility testing device, the elecsys FSH and LH Assay. This advanced test can accurately measure follicle-stimulating hormone (FSH) and luteinizing hormone (LH) levels, providing essential information for infertility diagnosis and treatment (Merck KGaA, 2023).

- In May 2024, Illumina, a global leader in genomic sequencing and array-based solutions, entered into a strategic collaboration with FertilityFocus, a digital health company specializing in fertility tracking. The partnership aims to integrate Illumina's genomic data with FertilityFocus's fertility tracking platform, allowing for more personalized and effective fertility treatments (Illumina, 2024).

- In October 2024, Roche Diagnostics, a pioneer in in vitro diagnostics, received FDA approval for its new home fertility testing device, the Roche Fertility Home Test. This over-the-counter test allows women to test their ovulation at home, providing results within minutes for more convenient and accessible fertility testing (Roche Diagnostics, 2024).

- In January 2025, Hologic, a medical technology company, completed the acquisition of Genesys Laboratories, a leading provider of genetic and genomic testing services. The acquisition is expected to expand Hologic's offerings in the fertility testing market, providing a more comprehensive suite of services for fertility clinics and patients (Hologic, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and growing demand for personalized reproductive health solutions. Fertility clinics and healthcare providers increasingly integrate lifestyle factors into their offerings, providing fertility awareness methods and coaching to help patients optimize their chances of conceiving. Fertility tracking apps and wearable technology enable remote monitoring and predictive analytics, allowing for early pregnancy detection and continuous cycle tracking. Genetic counselors and precision medicine approaches are gaining traction, with genetic testing and chromosomal abnormalities screening becoming essential components of fertility plans. Patient empowerment is at the forefront of these developments, with consumer education and online resources playing a crucial role in spreading awareness and promoting informed decision-making.

Fertility specialists and reproductive endocrinologists leverage hormone monitoring, ovulation predictor kits, and ovulation predictor tests to optimize treatment plans. Digital health innovations, such as virtual consultations and machine learning algorithms, facilitate more efficient and accessible care. Semen analysis, sperm morphology, and sperm count testing remain vital components of fertility assessments, with advancements in AI and data analytics enhancing the accuracy and interpretation of results. Smoking cessation, alcohol consumption, stress management, weight management, and other lifestyle factors continue to be addressed as integral aspects of fertility care. In-vitro fertilization (IVF) and embryo biopsy technologies have revolutionized fertility treatments, enabling more successful outcomes and reducing the need for multiple treatments.

The ongoing integration of technology and personalized medicine is expected to further transform the market, offering innovative solutions tailored to individual needs and preferences.

Dive into Technavio’s strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fertility Testing Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.04% |

|

Market growth 2024-2028 |

USD 181.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.61 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fertility Testing Devices Market Research and Growth Report?

- CAGR of the Fertility Testing Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fertility testing devices market growth of industry companies

We can help! Our analysts can customize this fertility testing devices market research report to meet your requirements.