Fire Protection Coatings Market Size 2024-2028

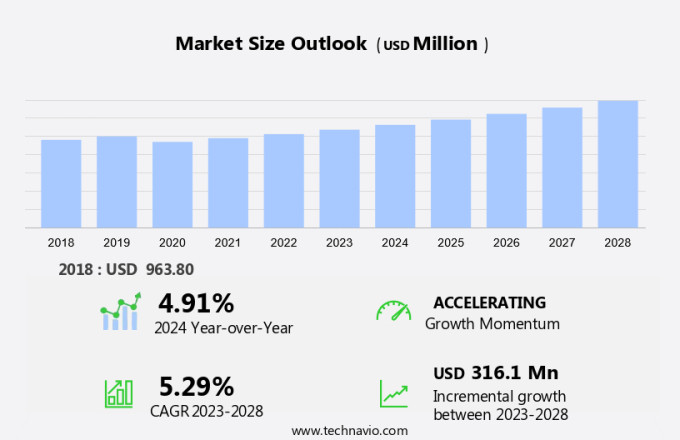

The fire protection coatings market size is forecast to increase by USD 316.1 million at a CAGR of 5.29% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for fire safety in various sectors. Architects, builders, homeowners, and facility managers are prioritizing fire safety in new construction projects and existing buildings. In addition, the oil and gas industry, including refineries, gas processing plants, and offshore drilling platforms, requires concentrated fire protection solutions to ensure safety and comply with regulations. The market is driven by the rise in the development of commercial infrastructure and rapid advances in coating technology. Compliance with codes and standards is also a major factor fueling market growth. These trends are expected to continue, making the market an attractive investment opportunity.

What will be the Size of the Market During the Forecast Period?

Fire protection coatings play a crucial role in safeguarding various structures from the destructive effects of flames. These coatings are applied to surfaces of buildings, aerospace, electrical, electronics, marine, and other industries to provide an additional layer of protection against fire. This market is driven by the stringent regulatory mandates, building codes, and fire safety regulations. Secondary research and primary research were conducted to gather data for this analysis. The data collected included market size, growth rate, and trends in the market. Intumescent coatings and cementitious coatings are the two primary types of fire protection coatings. Intumescent coatings expand when exposed to heat, forming a char layer that insulates the underlying material. Cementitious coatings, on the other hand, form a thick layer when exposed to heat, preventing the spread of fire. Fire protection coatings are used on various surfaces, including steel, concrete, and wood. The coatings are formulated to provide technical performance, durability, and adhesion. Ablative coatings, another type of fire protection coating, are used in high-temperature applications. These coatings vaporize when exposed to heat, reducing the amount of heat transferred to the underlying material. Regulatory standards and technical performance are critical factors in the market.

Further, regulatory mandates and building codes require the use of fire protection coatings in various industries. The technical performance of fire protection coatings is crucial as they must provide adequate protection against flames while maintaining the structural integrity of the material. The construction sectors, including buildings, aerospace, electrical, electronics, marine, and others, are significant consumers of fire protection coatings. The demand for fire protection coatings is expected to grow due to the increasing focus on fire safety and the stringent regulatory environment. Fire protection coatings provide several benefits, including heat resistance, durability, and adhesion. These coatings help prevent the spread of fire, reducing the risk of damage to structures and potential harm to people. Additionally, fire protection coatings can help extend the life of structures by protecting them from the destructive effects of flames. In conclusion, the market is an essential component of the construction industry. These coatings provide critical protection against flames, ensuring the safety of structures and people.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Waterborne

- Solvent-borne

- Powdered coatings

- UV-cured

- Application

- Commercial

- Industrial

- Residential

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Product Type Insights

The waterborne segment is estimated to witness significant growth during the forecast period. Fire protection coatings play a crucial role in safeguarding structures and their contents from the destructive effects of flames. Intumescent coatings and cementitious coatings are two common types of fire protection coatings. Intumescent coatings, which form an insulating char layer when exposed to heat, include offerings like Sherwin-Williams' FIRETEX FX6000. Cementitious coatings, on the other hand, expand and harden when in contact with fire, creating a protective layer. Fireproofing sprays are another option, providing a quick and effective solution for fire protection. Waterborne coatings, which use water as a solvent, are gaining popularity due to their eco-friendly nature and suitability for sensitive environments such as hospitals, schools, and residential buildings.

Get a glance at the market share of various segments Request Free Sample

The waterborne segment accounted for USD 369.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the fire coatings market holds a significant position globally, with the United States and Canada being the primary contributors to its revenue. The market's expansion in this region is primarily driven by the heightened emphasis on fire safety regulations in commercial and residential buildings. Enterprises in North America prioritize safeguarding their infrastructure and minimizing the human toll in fire incidents. The region's strong construction sector, which includes industries such as oil and gas, manufacturing, mining, and building, is technologically advanced due to early technology adoption. This maturity in the construction sector fuels the demand for fire coatings in various applications, including pipelines, storage tanks, and transportation activities. The North American market for fire coatings is expected to grow steadily due to the increasing number of small, medium, and large enterprises.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rise in development of commercial infrastructure is notably driving market growth. Fire protection coatings play a crucial role in safeguarding various structures and contents from the damaging effects of flames. These coatings are applied to surfaces of buildings, construction materials such as steel, concrete, and wood, as well as oil and gas installations, pipelines, storage tanks, aerospace, electrical, electronics, marine, and other infrastructure.

Moreover, intumescent coatings and cementitious coatings are commonly used types, with the former expanding and forming a char layer when exposed to heat, and the latter releasing water and heat-insulating gases. Fireproofing sprays offer quick application and are effective for small areas. Regulatory mandates, building codes, and fire safety regulations require the use of fire protection coatings to ensure safety in various sectors. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Rapid advances in coating technology is the key trend in the market. Fire protection coatings play a crucial role in safeguarding various structures and contents from the destructive effects of flames. These coatings are extensively used in diverse sectors such as Oil & Gas, Construction, Aerospace, Electrical, Electronics, Marine, and others. Intumescent coatings and cementitious coatings are popular types of fire protection coatings, offering excellent insulation and fire resistance to steel, concrete, wood, and other construction materials.

Moreover, fire protection coatings find extensive applications in buildings and construction, ensuring compliance with regulatory mandates, building codes, and fire safety regulations. In the Oil & Gas industry, these coatings are used to protect pipelines, storage tanks, and exploration and extraction equipment from fire hazards. Similarly, in the Aerospace sector, fireproofing sprays are employed to enhance the safety of aircraft structures. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

Compliance with codes and standards is the major challenge that affects the growth of the market. Fire protection coatings play a crucial role in safeguarding various structures and contents from the damaging effects of flames. These coatings are applied to oil and gas installations, buildings under construction, aerospace components, electrical and electronic equipment, marine vessels, and other structures to enhance their fire resistance.

Moreover, intumescent coatings and cementitious coatings are commonly used fire protection coatings. Intumescent coatings form a char layer when exposed to fire, insulating the underlying surface and preventing the spread of flames. Cementitious coatings, on the other hand, expand and harden when exposed to heat, providing a protective layer that shields the structure. Fireproofing sprays are another type of fire protection coating, often used on steel, concrete, and wood surfaces. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akzo Nobel NV: The company offers Fire Protection Coatings such as Chartek 1709, which is widely used coating for onshore fire protection.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axalta Coating Systems Ltd.

- BASF SE

- Clariant AG

- Etex NV

- Hempel AS

- InproCoat

- Jotun

- Lanexis Enterprises (P) Ltd.

- Nippon Paint Holdings Co. Ltd.

- Nullifire

- PPG Industries Inc.

- Protexion

- RPM International Inc.

- Rust Oleum Corp.

- SealXpert

- The Sherwin Williams Co.

- Sika AG

- Teknos Group Oy

- Tremco CPG Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fire protection coatings play a crucial role in safeguarding structures against the destructive effects of flames, particularly in industries such as oil and gas, construction, aerospace, electrical, electronics, marine, and infrastructure. Intumescent and cementitious coatings are two common types of fire protection coatings that form insulating layers when exposed to heat, thereby preventing the spread of fire and protecting the underlying surfaces. These coatings are essential for steel, concrete, and wood structures in various sectors, including buildings, construction materials, pipelines, storage tanks, drilling equipment, and offshore drilling platforms. Regulatory mandates, building codes, and fire safety regulations drive the demand for fire protection coatings.

Further, technical performance, durability, adhesion, and heat resistance are key considerations for materials science in formulating these coatings. Energy demands from exploration, extraction, and transportation activities further increase the need for fire protection coatings in infrastructure. Consumer preferences for safety standards and fire prevention initiatives also contribute to the market growth. Strategic partnerships between manufacturers and industry players in areas such as corrosion protection and micron-thick dry film thickness ensure the continued development of advanced fire protection coatings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.29% |

|

Market growth 2024-2028 |

USD 316.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.91 |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, China, Germany, Canada, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Akzo Nobel NV, Axalta Coating Systems Ltd., BASF SE, Clariant AG, Etex NV, Hempel AS, InproCoat, Jotun, Lanexis Enterprises (P) Ltd., Nippon Paint Holdings Co. Ltd., Nullifire, PPG Industries Inc., Protexion, RPM International Inc., Rust Oleum Corp., SealXpert, The Sherwin Williams Co., Sika AG, Teknos Group Oy, and Tremco CPG Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch