Fire-Resistant Glass Market Size 2024-2028

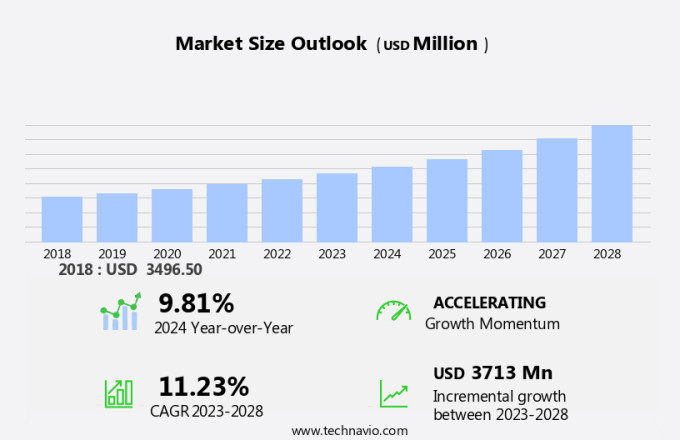

The fire-resistant glass market size is forecast to increase by USD 3.71 billion at a CAGR of 11.23% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand in building and construction applications, particularly in the development of commercial infrastructure and the creation of smart cities. This trend is driven by the need for enhanced safety measures in response to the rising number of fire accidents. In addition, the market is witnessing increased interest in marine applications due to the stringent safety regulations in this sector. The automotive aftermarket is another potential application area for fire-resistant glass. Moreover, profit-margin segments are seeking fire-resistant glass solutions as they offer superior protection against the effects of fire, including oxygen depletion, combustion, heat, and reactant gases. Pyroguard, a leading player in the market, is capitalizing on this trend by providing innovative and high-performance fire-resistant glass solutions. However, the market faces challenges such as high competition among companies, which is leading to price wars and thinning profit margins. Raw material prices and logistics costs can significantly impact the market's growth.

What will be the Size of the Market During the Forecast Period?

Fire-resistant glass is a specialized type of glass designed to provide protection against fire, smoke, and heat transfer. This glass is engineered with fire resistive interlayers and multiple glass layers to ensure safety during fire-related incidents. The market is witnessing significant growth due to the increasing number of fire-related accidents and the subsequent emphasis on safety measures in various sectors. Fire-resistant glass plays a crucial role in preventing the spread of fire and smoke in residential and commercial building projects. In the United States, government spending on infrastructure development and safety improvements continues to drive demand for fire-resistant glass.

Additionally, the automotive industry is increasingly adopting fire-resistant glass for vehicular safety, particularly in high-risk applications. The production of fire-resistant glass involves the use of raw materials such as silicon and boron oxide. The production technologies employed in the manufacturing process include tempering and the creation of gel-filled interlayers. Unemployment rates and economic conditions can also influence the demand for fire-resistant glass, as they impact the construction industry's overall health. The market can be segmented into the ceramic segment, tempered glass, and gel-filled segment based on the type of glass.

Furthermore, the building & construction application dominates the market due to the extensive use of fire-resistant glass in residential and commercial buildings. Furthermore, marine applications are a growing segment due to the increasing demand for fire-resistant glass in the maritime industry. With the growing concern for passenger safety, automobile manufacturers are increasingly incorporating fire-resistant glass in their vehicles. Additionally, military spending on defense and security projects is expected to boost the demand for fire-resistant glass in the military sector. In conclusion, the market is poised for growth due to the increasing focus on safety and the growing demand for fire-resistant glass in various industries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Application

- Building and construction

- Marine

- Others

- Product

- Ceramic fire-resistant glass

- Laminated fire-resistant glass

- Wired fire-resistant glass

- Tempered fire-resistant glass

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

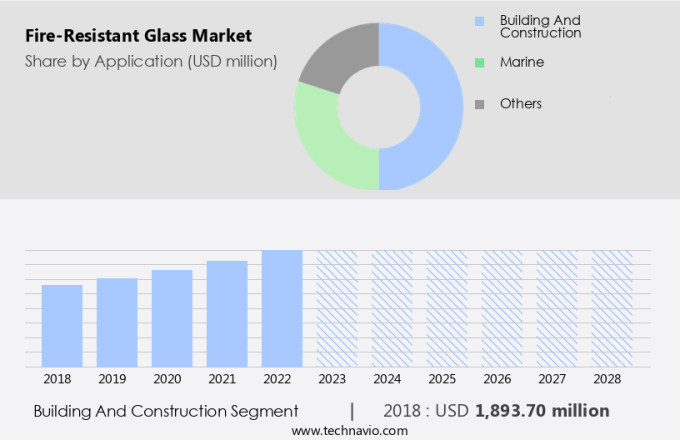

The building and construction segment is estimated to witness significant growth during the forecast period. Fire-resistant glass plays a crucial role in safeguarding structures against controlled fires, forest fires, short circuits, and explosions. This type of glass, which includes laminated glass and soda-lime glass, is integral to fire safety measures such as smoke alarms and fire safety drills. The global market for fire-resistant glass is poised for significant expansion due to the increasing importance of fire prevention. According to market research, the building and construction industry accounted for the largest share of The market in 2022. Glass's versatile properties make it a preferred material in construction, leading to its extensive use in this sector.

Furthermore, the market for fire-resistant glass in new buildings is projected to grow steadily during the forecast period, driven by ongoing industrialization and rising construction activities in countries like China, Thailand, Malaysia, and Indonesia. Furthermore, the US and the Middle East markets for fire-resistant glass in new buildings are also experiencing steady growth. Fire safety is a top priority for architects, builders, and property owners, and the use of fire-resistant glass is an essential component of fire prevention strategies. As such, the demand for this type of glass is expected to remain strong in the coming years.

Get a glance at the market share of various segments Request Free Sample

The building and construction segment accounted for USD 1.89 billion in 2017 and showed a gradual increase during the forecast period.

Regional Insights

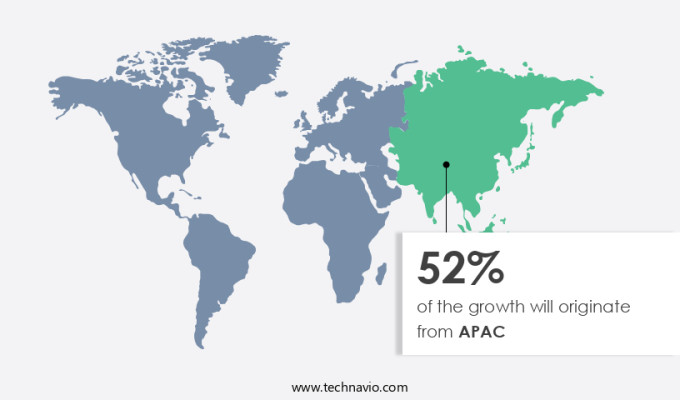

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) was the largest segment in 2023 and is anticipated to lead the market during the forecast period. APAC's dominance is due to the region's rapid economic growth and increasing construction activities in countries like China and India. Strict regulatory mandates and heightened awareness of fire safety compliance in industries are also significant factors driving market growth in Japan and Australia. The expansion of the real estate sector in APAC is a major contributor to the demand for fire safety systems, including fire-resistant glass. In recent years, there has been a rise in residential and commercial building projects in the region, necessitating the use of fire-resistant glass to meet safety regulations and ensure the protection of lives and property from fire, smoke, and heat transfer.

Furthermore, government spending on infrastructure development and safety initiatives in APAC is another factor fueling the growth of the market. The increasing number of fire-related accidents in the region has led to a heightened focus on fire safety measures, making fire-resistant glass a crucial component of modern building designs. In conclusion, the market in APAC is poised for significant growth due to the region's economic development, construction activities, regulatory mandates, and increasing awareness of fire safety. Fire-resistant glass plays a vital role in safeguarding lives and property from the damaging effects of fire, smoke, and heat transfer.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rise in development of commercial infrastructure is the key driver of the market. The urban population in emerging economies, including India and China, has experienced significant growth over the past decade. This expansion has led to an increase in infrastructure development, particularly in the construction sector, with a focus on residential buildings, roads, malls, and commercial properties. Urban areas are expanding both in terms of geographical size and height, necessitating the use of advanced materials and technologies in construction. In response, fire-resistant glass manufacturers are introducing innovative offerings to meet the specific demands of the industry.

Moreover, regulations mandate the installation of fire safety systems in public places such as airports, restaurants, and educational institutions. The production of fire-resistant glass involves the use of raw materials like silicon and boron oxide, which are processed using advanced technologies. National governments and industry development initiatives are driving the growth of this market, making it an essential component in the construction industry.

Market Trends

Increasing investments in smart cities is the upcoming trend in the market. In the realm of modern infrastructure development, the integration of fire-resistant glass has become increasingly significant in various applications, particularly in building and construction and marine industries. This innovative glass technology offers protection against fire, heat, light, and reactant gases, ensuring safety and security in critical situations. Pyroguard, a leading fire-resistant glass manufacturer, underscores the importance of fire safety in buildings and marine applications. Fire accidents can lead to devastating consequences, including loss of life and property damage. The profit-margin segments of the construction and marine industries recognize the value of fire-resistant glass in mitigating risks and enhancing safety.

Furthermore, oxygen and combustion are essential elements in the propagation of fire, and fire-resistant glass acts as a barrier, preventing the spread of fire and smoke. As smart cities continue to evolve, the collaboration between emergency service providers and fire-resistant glass manufacturers becomes crucial in ensuring the efficient operation of community services. In conclusion, the adoption of fire-resistant glass is a proactive measure toward safeguarding lives and assets in the building and construction and marine industries.

Market Challenge

High competition among vendors is a key challenge affecting the market growth. The market experiences significant revenue generation, yet encounters various challenges. One major issue is the market's high saturation, particularly in the construction glass industry. Urban areas, with their dense populations and high growth construction sectors, account for a substantial portion of this industry. Skyscrapers and other tall buildings, common in urban settings due to space constraints, are prime targets for builders and land developers, offering substantial revenue potential.

However, fire incidents in these structures can result in devastating losses, including deaths, injuries, and extensive property damage. Fire-resistant glass plays a crucial role in mitigating these risks. Despite its importance, raw material prices and logistical challenges can impact the market's growth. Additionally, sectors like the automotive aftermarket and military spending contribute to the market's expansion.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Technical Glass Products Inc. - The company offers fire-resistant glass such as FireLite, FireLite Plus, FireLite Plus WS, FireLite Plus NT, FireLite Plus IGU, and Fireglass 20.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- Asahi India Glass Ltd.

- Compagnie de Saint Gobain

- Crane Holdings Co.

- FG Glass Industries Pvt. Ltd.

- Fuso Glass India Pvt. Ltd.

- Metek Co. Ltd.

- Nippon Sheet Glass Co. Ltd.

- OKeeffes Inc.

- Pacific Fire Controls Pvt. Ltd.

- Press Glass Holding SA

- Pyroguard UK Ltd.

- Ravensby Glass Co. Ltd.

- SCHOTT AG

- Shenzhen Sun Global Glass Co. Ltd.

- Siddhi Engineering Co.

- Technical Glass Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fire-resistant glass plays a crucial role in safeguarding lives and properties against fire-related accidents. This specialized glass type is designed to withstand flames, smoke, and heat transfer. It achieves this through various layers and fire resistive interlayers. The market is driven by the increasing number of fire incidents, resulting in deaths, injuries, and significant loss. National governments and urban housing projects, high-rise buildings, and commercial building projects are major consumers of fire-resistant glass. The production of fire-resistant glass involves raw materials like silicon and boron oxide, which are subject to price fluctuations. Production technologies continue to evolve, with industry development fueled by government spending on fire safety and military applications.

Furthermore, the automotive industry also utilizes fire-resistant glass in vehicle safety and the automotive aftermarket. Fire-resistant glass is essential in various applications, including controlled fires in research laboratories, forest fires, short circuits, explosions, and smoke alarms. Fire safety drills and prevention measures further highlights the importance of this glass type. The market is diverse, with profit-margin segments including laminated glass, tempered glass, and high-performance glazing. Brands like Pyroguard and Pyran/Pyranova dominate the market, offering fire safety solutions for various applications, including building & construction, marine applications, and timber partitions. Fire safety knowledge is essential in mitigating the impact of fire incidents.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.23% |

|

Market growth 2024-2028 |

USD 3.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.81 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 52% |

|

Key countries |

China, US, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGC Inc., Asahi India Glass Ltd., Compagnie de Saint Gobain, Crane Holdings Co., FG Glass Industries Pvt. Ltd., Fuso Glass India Pvt. Ltd., Metek Co. Ltd., Nippon Sheet Glass Co. Ltd., OKeeffes Inc., Pacific Fire Controls Pvt. Ltd., Press Glass Holding SA, Pyroguard UK Ltd., Ravensby Glass Co. Ltd., SCHOTT AG, Shenzhen Sun Global Glass Co. Ltd., Siddhi Engineering Co., and Technical Glass Products Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch