Glass Market Size 2024-2028

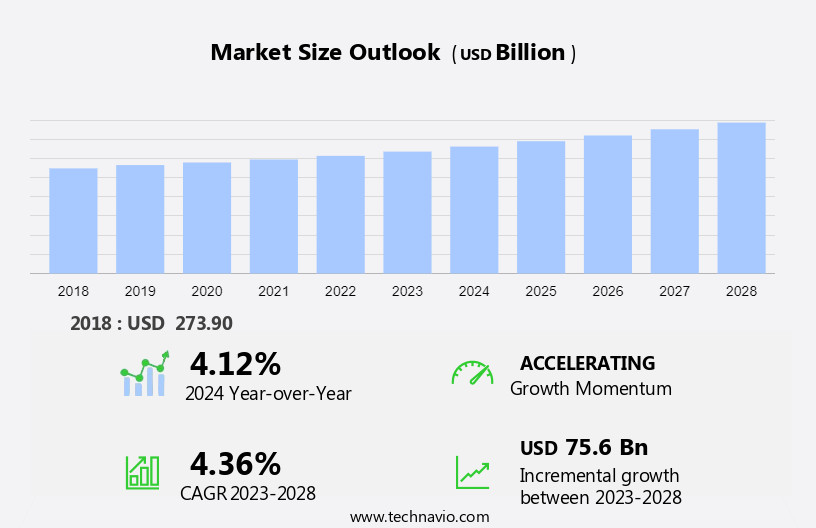

The glass market size is forecast to increase by USD 75.6 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key factors. One of the primary drivers is the increasing consumption of beverages, leading to a rise in demand for glass bottles. Another growth factor is the increasing use of flat glass in photovoltaic modules and e-glass due to the rising need for clean energy. This trend is expected to continue as the world transitions to renewable energy sources. However, the market faces challenges from alternatives such as plastic bottles and other packaging materials. These alternatives offer cost advantages and are gaining popularity, particularly In the beverage industry. Despite this, the market is expected to maintain its position due to its superior properties, including reusability, recyclability, and impermeability to light and gases. Overall, the market is poised for steady growth In the coming years, driven by increasing demand for glass in various end-use industries.

What will be the Size of the Glass Market During the Forecast Period?

- The market is witnessing significant growth, driven by the increasing demand for energy-efficient solutions In the construction and automotive sectors. Smart Glass, a key segment of this market, is gaining popularity due to its functional improvement and aesthetic appeal. This advanced glass technology is integrated with IoT and AI for enhanced safety features and minimalist architecture. In the construction sector, smart glass offers heat insulation, soundproofing, solar protection, and self-cleaning properties, making it an ideal choice for modern buildings. In the automotive sector, smart glass is used in connected vehicles for solar industry applications, providing comfort and convenience to passengers.

- Moreover, the automotive production sector is witnessing a rise in demand for electrochromic materials for energy-efficient solutions. The solar industry is also a significant consumer of flat glass for heat insulation and solar protection. However, the use of non-biodegradable materials in glass production raises concerns about resource depletion and environmental protection. To mitigate these concerns, companies are focusing on developing sustainable glass solutions. The market is further expanding into consumer electronics, such as smartphones and electronic displays, offering functional improvements and sleek designs. The market is expected to continue its growth trajectory, driven by innovation and consumer demand.

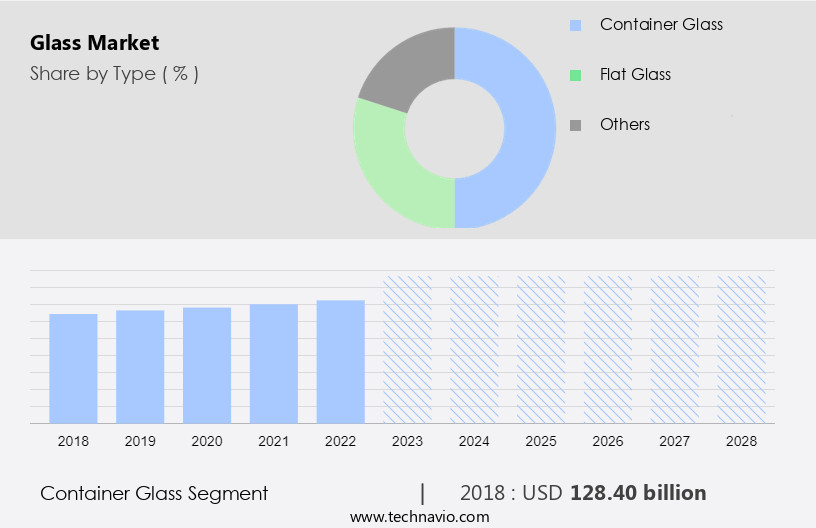

How is this Glass Industry segmented and which is the largest segment?

The glass industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Container glass

- Flat glass

- Others

- Application

- Packaging

- Construction

- Automotive

- Electrical and electronics

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

The container glass segment is estimated to witness significant growth during the forecast period.The market encompasses various types of glass, including smart glass, which offers energy-efficient solutions for both the construction and automotive sectors. In the construction industry, smart glass, featuring electrochromic materials, provides functional improvement with minimalist architecture, offering aesthetic appeal and interactive displays. These glass solutions cater to environmental factors such as heat insulation, soundproofing, and solar protection. In the automotive sector, smart glass integrates with IoT technology, advanced safety features, and connected vehicles, enabling automatic tinting, heads-up displays (HUD), and electrochromic technology in connected and autonomous vehicles. The solar industry also benefits from smart glass applications in solar power generation and production of flat glass for solar panels.

In the consumer electronics sector, smartphone production and consumer electronics incorporate self-cleaning glass and electronic displays. The future of glass technology lies In the integration of artificial intelligence (AI) and spectacles demand, further expanding its applications across various industries.

Get a glance at the market report of share of various segments Request Free Sample

The container glass segment was valued at USD 128.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

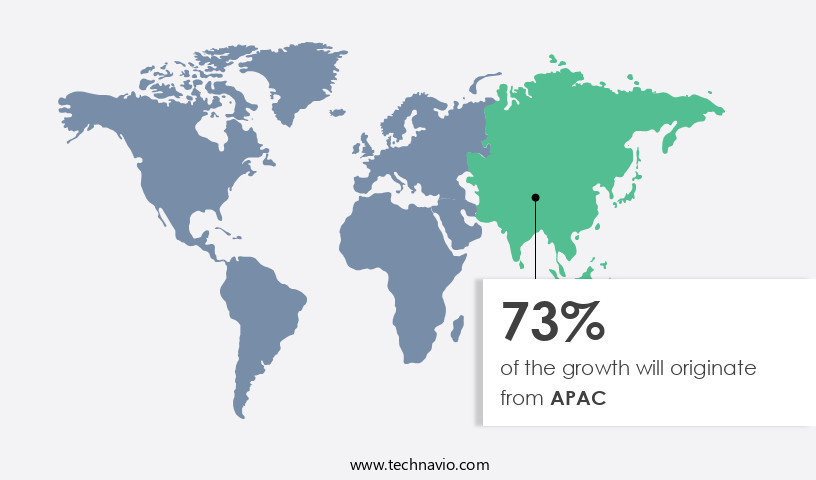

APAC is estimated to contribute 73% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market encompasses various applications, including container glass for food and beverage packaging, fiber glass for transportation and construction, and specialty glass for electrical and electronics, telecommunication, and energy efficiency. Despite its recyclability, the use of non-biodegradable materials in glass production contributes to environmental concerns and resource depletion. To mitigate these issues, the industry focuses on energy-saving strategies, such as reducing energy consumption in manufacturing processes and increasing the use of renewable energy sources. In packaging applications, glass containers offer advantages like preserving the quality and freshness of packaged foods, but their heavy weight and fragility necessitate careful handling and transportation.

The electrical and electronics sector utilizes glass in energy-efficient components, such as solar panels and LED lighting, while fiber glass is employed in lightweight and durable automotive parts and insulation materials. Overall, the market continues to evolve, balancing environmental protection with technological innovation and resource efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Glass Industry?

- Increasing consumption of beverages is the key driver of the market. The market is experiencing significant growth due to the increasing adoption of advanced glass technologies in various sectors. In the construction industry, the use of smart glass for energy-efficient solutions is becoming increasingly popular. Smart Glass, with its electrochromic materials, offers functional improvement and aesthetic appeal, making it an ideal choice for minimalist architecture. In the automotive sector, the integration of IoT, advanced safety features, connected vehicles, and autonomous vehicles is driving the demand for active smart glass with automatic tinting, Heads-Up Display (HUD), and electrochromic technology. In the solar industry, the demand for flat glass in solar power applications is increasing due to its heat insulation, soundproofing, and solar protection properties.

- The renewable energy sector's expansion and the growing solar capacity are also contributing to the market's growth. In the consumer electronics sector, including smartphone production and consumer electronics, the demand for electronic displays is increasing, leading to the development of thinner, lighter, and more energy-efficient glass. The use of artificial intelligence (AI) in glass production is also gaining momentum, enabling the creation of self-cleaning glass and customized glass solutions for various applications. The infrastructure sector's growth and the increasing construction output are also fueling the demand for glass in residential and commercial construction.

What are the market trends shaping the Glass Industry?

- An increasing use of flat glass in photovoltaic modules and e-glass due to rising need for clean energy is the upcoming market trend. The demand for glass, particularly smart glass, is experiencing significant growth due to its energy-efficient solutions in various industries. In the construction sector, e-glass, a type of glass coated with a low emissivity layer, is gaining popularity for its ability to allow natural light while ensuring high energy efficiency. This results in reduced reliance on indoor temperature control devices, leading to cost savings and environmental benefits. The automotive sector is another major consumer of smart glass, with applications including automatic tinting, heads-up displays (HUD), and electrochromic technology for connected and autonomous vehicles. The integration of IoT and advanced safety features in automotive production further enhances the demand for smart glass.

- In the solar industry, glass plays a crucial role in solar power applications, with flat glass used for solar panels and heat insulation, soundproofing, and solar protection in building architecture. The residential construction and infrastructure sectors also benefit from the functional improvement and aesthetic appeal of smart glass. The renewable energy sector's growth, driven by the reduction in solar panel prices and government incentives, is further increasing the demand for glass In the solar industry. Additionally, the consumer electronics industry, including smartphone production and artificial intelligence (AI) devices, utilizes electronic displays made from glass.

What challenges does the Glass Industry face during its growth?

- Increasing threat from alternatives is a key challenge affecting the industry growth. The market for smart glass is experiencing significant growth due to its energy-efficient solutions in various sectors, including construction and automotive. In the construction industry, smart glass offers functional improvement and aesthetic appeal, making it an attractive option for minimalist architecture and sustainable building designs. Energy savings and environmental factors are crucial considerations in modern construction, and smart glass provides excellent heat insulation, soundproofing, and solar protection. In the automotive sector, smart glass is increasingly integrated into connected and autonomous vehicles for advanced safety features such as automatic tinting, Heads-Up Displays (HUD), and interactive displays. Electrochromic materials, a key component of smart glass, enable these features while reducing energy consumption and improving overall vehicle production efficiency.

- The solar industry also benefits from smart glass technology, with applications ranging from solar power generation to solar capacity expansion. In the renewable energy sector, smart glass can be used as electronic displays for monitoring solar panel performance and optimizing energy production. In the automotive market, smart glass can be found In the production of connected and autonomous vehicles, enhancing the user experience and contributing to the growth of the automotive market. Moreover, smart glass is not limited to large-scale applications. It is also used in consumer electronics, such as smartphones and spectacles, to improve functionality and user experience.

- The integration of artificial intelligence (AI) and other advanced technologies further expands the potential applications and market opportunities for smart glass.

Exclusive Customer Landscape

The glass market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the glass market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, glass market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- Asahi India Glass Ltd.

- Cardinal Glass Industries Inc.

- Central Glass Co. Ltd.

- China Glass Holdings Ltd.

- Compagnie de Saint Gobain

- DBs Glass and Glazing

- Dillmeier Glass Co.

- Euroglas GmbH

- Fuyao Glass Industry Group Co. Ltd.

- Kibing Group

- Koch Industries Inc.

- Nippon Sheet Glass Co. Ltd.

- SCHOTT AG

- SHEBEI HUAJINDE GLASS CO. LTD.

- Taiwan Glass Ind. Corp.

- Toyo Seikan Group Holdings Ltd.

- TURKIYE SISE VE CAM FABRIKALARI A.S.

- Vitro SAB De CV

- Xinyi Glass Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for energy-efficient solutions In the construction and automotive sectors. Smart Glass, a technologically advanced glass type, is gaining popularity for its functional improvement and aesthetic appeal. In the construction sector, it is used for heat insulation, soundproofing, solar protection, and self-cleaning properties. Minimalist architecture and connected buildings are also driving the demand for interactive displays and IoT integration in glass. In the automotive sector, Smart Glass is used in advanced safety features such as automatic tinting, Heads-Up Display (HUD), and solar protection.

The integration of Electrochromic technology in Active Smart Glass enables vehicles to adapt to environmental factors, enhancing their energy efficiency. The automotive production sector is expected to witness a rise in demand for Solar Industry applications, including Solar power applications in vehicles and Solar capacity expansion in Smartphone production and Consumer electronics. The Infrastructure sector and Renewable energy industry are also key contributors to the market's growth. The use of Flat glass in building architecture, Residential construction, and Construction output is increasing due to its energy efficiency and Environmental factors considerations. The Solar industry's expansion is also driving the demand for Electronic displays and Artificial intelligence (AI) integration in glass. The demand for Spectacles with advanced features is also expected to propel the market forward.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 75.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.12 |

|

Key countries |

China, US, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Glass Market Research and Growth Report?

- CAGR of the Glass industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the glass market growth of industry companies

We can help! Our analysts can customize this glass market research report to meet your requirements.