Automotive Aftermarket E-Retailing Market Size 2024-2028

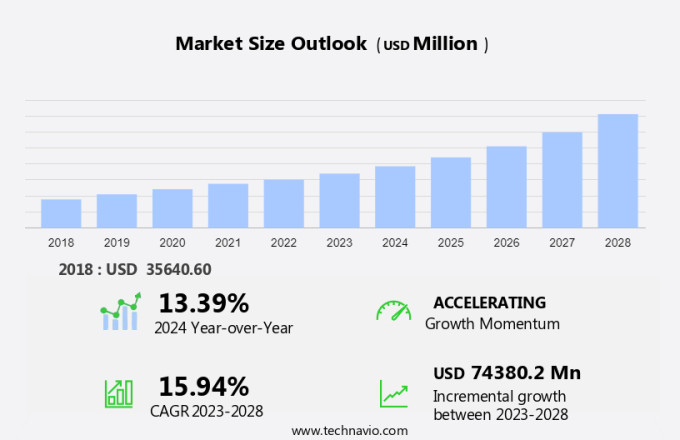

The automotive aftermarket e-retailing market size is forecast to increase by USD 74.38 billion at a CAGR of 15.94% between 2023 and 2028.

- The automotive aftermarket e-retailing industry is experiencing significant growth, driven by several key trends. One major factor is the increasing lifespan of vehicles, leading to a corresponding increase in demand for replacement parts. Another trend is the growing popularity of e-retailing In the automotive aftermarket, as consumers seek the convenience and accessibility of online shopping. However, this trend also presents challenges for e-retailers, such as high price sensitivity among consumers, resulting in margin pressure. The market In the US is experiencing significant growth, driven by the increasing popularity of internet retail and the expansion of e-commerce platforms In the automobile industry. To remain competitive, e-retailers must effectively manage their pricing strategies and offer value-added services to attract and retain customers. Additionally, they must navigate the complexities of logistics and supply chain management to ensure timely delivery of parts. Overall, the market is poised for continued growth, with opportunities for innovation and differentiation among competitors.

What will be the Size of the Automotive Aftermarket E-Retailing Market During the Forecast Period?

- Consumers are increasingly turning to online platforms to purchase vehicle parts, accessories, and services for maintenance and repairs. The age of vehicles on the road continues to rise, leading to an increased demand for aftermarket parts and accessories. Key product categories include interior accessories, infotainment-multimedia systems, powertrain components, tires and wheels, electrical products, and engine components. Logistics firms play a crucial role in ensuring the timely delivery of these items, with mobile commerce and internet penetration driving sales growth.

- Additionally, customer service and personalizing and designing interiors and exteriors are key differentiators for automotive aftermarket e-retailers. Delivery speed and transport solutions are also important considerations for consumers, particularly for urgent repairs or replacement of tires and wheels. Overall, the market is expected to continue growing, driven by the convenience and accessibility of online shopping for automotive needs.

How is this Automotive Aftermarket E-Retailing Industry segmented and which is the largest segment?

The automotive aftermarket e-retailing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Wheels and tires

- Brakes and brake pads

- Others

- Customer Type

- DIY customers

- Professional customers

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

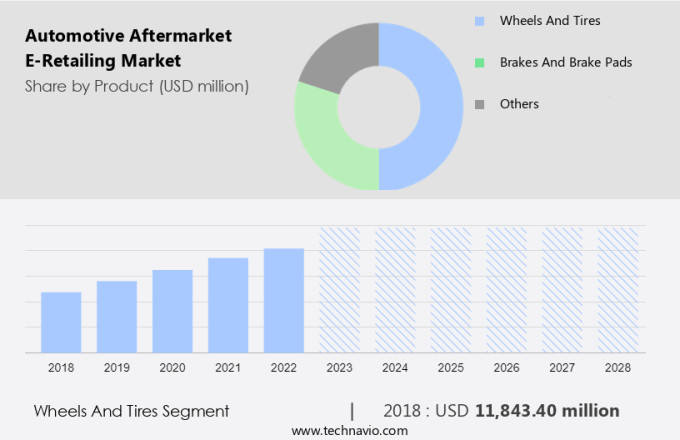

- The wheels and tires segment is estimated to witness significant growth during the forecast period.

The global aftermarket for automotive components, including tires, wheels, powertrain, interior accessories, infotainment-multimedia, and aftermarket accessories, is experiencing significant growth due to various factors. In mature automobile markets like the US, Japan, and Western Europe, the increasing aging vehicle population is driving demand for replacement parts, particularly tires, due to wear and tear and road conditions. In emerging markets, such as India, the susceptibility of vehicles to breakdowns caused by poor road conditions further boosts demand. The advent of e-retailing platforms has made purchasing aftermarket components more convenient, leading to a steady increase in demand. Companies specializing in logistics and distribution play a crucial role in ensuring timely delivery of these components to customers.

Get a glance at the Automotive Aftermarket E-Retailing Industry report of share of various segments Request Free Sample

The wheels and tires segment was valued at USD 11.84 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

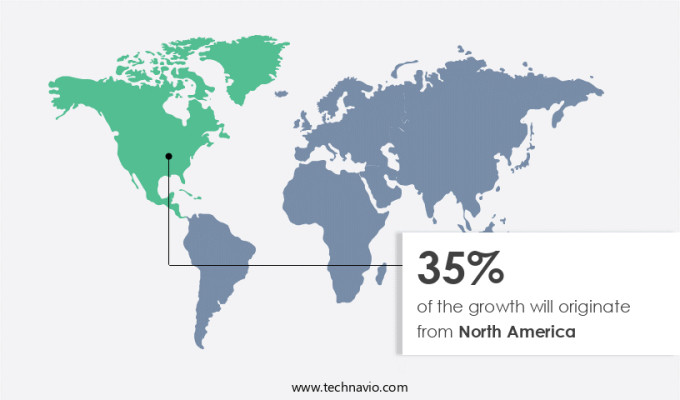

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American region dominates The market due to its status as the largest automotive market in terms of revenue. With a strong presence in both the passenger car and commercial vehicle segments, North America hosts a significant number of DIY customers who opt for repairing their vehicles in home garages. The shift towards e-retailing for the purchase of vehicle parts and accessories is becoming increasingly prevalent in this region. Aftermarket e-retailing offers convenience, competitive pricing, and a wide range of offerings, making it an attractive option for consumers. The region's focus on new technology development and new vehicle adoption further bolsters the growth of the market.

Market Dynamics

Our automotive aftermarket e-retailing market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Aftermarket E-Retailing Industry?

Increasing vehicle lifespan leading to vehicle parts growth is the key driver of the market.

- The automotive aftermarket In the US is experiencing significant growth due to several key factors. One of the primary drivers is the increasing age of vehicles in use. According to recent statistics, the average age of passenger cars and light trucks In the US surpassed 11 years in 2023. This trend is also prevalent in Canada, where the vehicle population is larger due to longer vehicle lifespans. As a result, there is a growing demand for automotive aftermarket parts, including vehicle components for maintenance and repairs. The shift towards e-commerce and online platforms has significantly impacted the automotive aftermarket industry.

- Additionally, customers increasingly prefer the convenience of shopping for aftermarket parts online, with options for personalized choices, product innovation, and competitive pricing. Online marketplaces provide easy access to reviews and returns and exchanges, enhancing customer trust. The digital makeover of the automotive aftermarket has led to the adoption of digital marketing strategies, including social media marketing. This trend is expected to continue as internet penetration increases, and smartphone usage becomes more prevalent. The aftermarket industry now offers a wide range of products, from engine components and filters to brakes, spark plugs, and interior accessories such as seat covers and floor mats.

- In summary, logistics firms have also entered the scene, providing efficient delivery services, including mobile commerce, to meet the growing demand for automotive aftermarket parts. The industry now caters to various vehicle types, including passenger cars, off-road vehicles, and commercial vehicles, offering specialized parts and tools for DIY enthusiasts and professional mechanics alike. The automotive aftermarket industry is not limited to just parts but also includes performance components, electrical items, and tires and wheels. The market is continuously evolving, with innovations in technology and customer service, making it an exciting space to watch.

What are the market trends shaping the Automotive Aftermarket E-Retailing Industry?

Aftermarket e-retailing gaining popularity in automotive aftermarket is the upcoming market trend.

- The automotive aftermarket sector is experiencing a significant digital makeover, with e-commerce platforms becoming an integral part of its revenue growth. Online retailing of automobile parts and accessories is gaining popularity among customers due to the convenience and wide range of offerings. The product portfolio In the market includes various components such as engine parts, filters, brakes, spark plugs, and interior accessories, among others. The shift towards online platforms is evident In the increasing sales of aftermarket parts through e-commerce sites. In recent years, this trend has surpassed traditional brick-and-mortar sales due to the digitalization of the industry. The DIY culture and the need for personalization choices have further fueled the demand for aftermarket components on online marketplaces.

- Additionally, logistics firms and mobile commerce have also played a crucial role In the growth of the market. With the rise of Internet penetration and smartphone usage, customers can now easily access product information, compare prices, read reviews, and make returns and exchanges from the comfort of their homes. Moreover, the market is witnessing product innovation, with the introduction of performance components, specialized parts, and electrical items. The sales of tires and wheels, powertrain, and infotainment-multimedia systems have also seen significant growth. Customer trust is a critical factor In the success of automotive aftermarket e-retailing. Companies are investing in digital marketing and customer service to build trust and loyalty.

- In summary, the delivery speed and transport options offered by e-commerce platforms have also contributed to the growth of the market. In conclusion, the market is witnessing a paradigm shift towards online platforms. The convenience, wide range of offerings, and digital marketing efforts have made e-commerce sites a preferred choice for customers looking for automotive parts and accessories. The trend is expected to continue as the industry embraces digitalization and the demand for personalization and performance components grows.

What challenges does the Automotive Aftermarket E-Retailing Industry face during its growth?

High price sensitivity leading to margin pressure on e-retailers is a key challenge affecting the industry growth.

- The market In the US is witnessing significant growth due to the increasing age of vehicles and the rising cost of maintenance and repairs. With the average age of vehicles on the road continuing to increase, there is a heightened demand for aftermarket components, including performance parts, specialized parts, and accessories. However, price sensitivity remains a major challenge in this market. The complexity of modern vehicles and the rising labor rates have led to an increase In the cost of repairs, making it essential for customers to carefully consider the cost-benefit before making a purchase. Moreover, the shift towards digital platforms for purchasing vehicle parts and accessories is accelerating.

- Additionally, online marketplaces, including e-commerce sites and mobile commerce apps, offer customers the convenience of shopping from the comfort of their homes, access to a wide range of products, and the ability to compare prices and read reviews before making a purchase. Logistics firms are also playing a crucial role in ensuring timely delivery of products. The automotive aftermarket industry is witnessing significant product innovation, with a focus on performance components, personalization choices, and digital makeovers. Customers are increasingly looking for interior accessories, infotainment-multimedia systems, electrical products, and tires and wheels to enhance the functionality and aesthetics of their vehicles.

- In summary, the rise of the DIY culture and the availability of diagnostic tools, wrenches, jacks, and other tools online have further fueled the growth of the market. Customer trust is a critical factor in this market, and online platforms are investing in digital marketing, customer service, and returns and exchanges to build customer loyalty. The use of smartphones and the increasing internet penetration have made it easier for customers to research and purchase automotive parts and accessories online. The market is expected to continue its growth trajectory, driven by the increasing popularity of e-commerce and the changing needs and preferences of customers.

Exclusive Customer Landscape

The automotive aftermarket e-retailing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive aftermarket e-retailing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive aftermarket e-retailing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 1A Auto Inc.

- Advance Auto Parts Inc.

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- AutoZone Inc.

- Buy Auto Parts

- CarParts.com Inc.

- Cummins Inc.

- Delticom AG

- DENSO Corp.

- eBay Inc.

- Genuine Parts Co.

- HELLA GmbH and Co. KGaA

- Icahn Automotive Group LLC

- LKQ Corp.

- PARTS iD Inc.

- Robert Bosch GmbH

- RockAuto LLC

- The Reinalt Thomas Corp.

- Walmart Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive aftermarket sector has undergone a significant digital makeover in recent years, transforming the way vehicle owners procure parts and accessories for their vehicles. The shift towards e-retailing in this industry has been driven by several factors, including the growing trend of DIY culture, increasing internet penetration, and the convenience and accessibility offered by online platforms. The aftermarket parts and accessories market encompasses a wide range of products, from engine components and brakes to filters, spark plugs, and interior accessories. These items are essential for maintaining and repairing vehicles, and their availability online has made it easier for customers to find what they need, no matter where they are located.

Additionally, the age of vehicles on the road continues to increase, leading to a higher demand for replacement parts and accessories. This trend is particularly evident In the passenger car segment, where the average vehicle age is over 11 years. Off-road vehicles also require specialized parts and accessories to withstand the rigors of off-road use. The digital marketing strategies employed by e-retailers In the automotive aftermarket sector have been instrumental in attracting and retaining customers. These strategies include personalizing and designing websites to cater to specific customer needs, offering competitive prices, and providing detailed product information and customer reviews.

In summary, product innovation is another key driver of growth In the market. Performance components and personalization choices have become increasingly popular, with customers looking to enhance the look and functionality of their vehicles. Electrical items, security systems, and infotainment-multimedia systems are also popular categories, reflecting the growing importance of technology In the automotive industry. Logistics firms have played a crucial role In the success of automotive aftermarket e-retailing. Mobile commerce and delivery speed have become essential factors in customer satisfaction, with many e-retailers offering same-day or next-day delivery for in-stock items. The aftermarket components market is highly competitive, with a large number of players vying for market share. E-retailers must focus on customer trust and excellent customer service to differentiate themselves from their competitors. Returns and exchanges are an inevitable part of the e-commerce business model, and handling them efficiently and effectively is essential for maintaining customer satisfaction. In conclusion, the market is a dynamic and growing sector that is transforming the way vehicle owners procure parts and accessories for their vehicles. The trend toward digital marketing and e-commerce is set to continue, with customers increasingly turning to online platforms for convenience, accessibility, and personalization choices. E-retailers must focus on innovation, customer service, and logistics to stay competitive in this market.

|

Automotive Aftermarket E-Retailing Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.94% |

|

Market growth 2024-2028 |

USD 74.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.39 |

|

Key countries |

US, Germany, France, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Aftermarket E-Retailing Market Research and Growth Report?

- CAGR of the Automotive Aftermarket E-Retailing industry during the forecast period

- Detailed information on factors that will drive the Automotive Aftermarket E-Retailing growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive aftermarket e-retailing market growth of industry companies

We can help! Our analysts can customize this automotive aftermarket e-retailing market research report to meet your requirements.