Fired Heaters Market Size 2025-2029

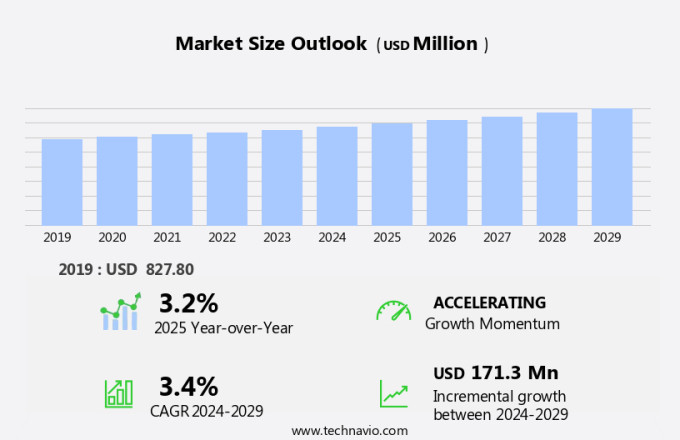

The fired heaters market size is forecast to increase by USD 171.3 million at a CAGR of 3.4% between 2024 and 2029.

- The market is witnessing significant growth due to several key factors. The expansion of oil and gas refineries worldwide is driving market demand, as these industries rely heavily on fired heaters for their processes. Additionally, the increasing preference for electric-fired heaters over traditional fossil fuel-based alternatives is another trend gaining traction. Market trends include the integration of advanced technologies, such as the Internet of Things (IoT), emission control systems, and automation technologies to optimize performance, reduce CO2 emissions, and ensure regulatory compliance. However, the market is also faced with challenges such as volatile manufacturing costs, which can impact the profitability of market participants. Producers must stay agile and adapt to these market dynamics to remain competitive. Overall, the market is expected to experience steady growth In the coming years, driven by these trends and challenges.

What will be the Size of the Fired Heaters Market During the Forecast Period?

- The market encompasses various types of heaters, including direct and indirect fired heaters, used extensively In the oil and gas industry for steam generation, process heat, and heat treatment applications. Fired heaters come in different designs, such as vertical cylindrical and horizontal cylindrical, catering to diverse industrial requirements. Digitalization and connectivity solutions are transforming the market, enabling predictive maintenance and real-time monitoring for improved efficiency and reliability.

- Moreover, the chemicals sector also relies on fired heaters for various applications, including the production of petrochemicals and refining processes. Fired air heaters, heat generation equipment, and furnaces are integral components of gas plants, refineries, and other industrial facilities. As environmental regulations evolve, the market is expected to adopt more advanced emission control technologies to minimize environmental impact.

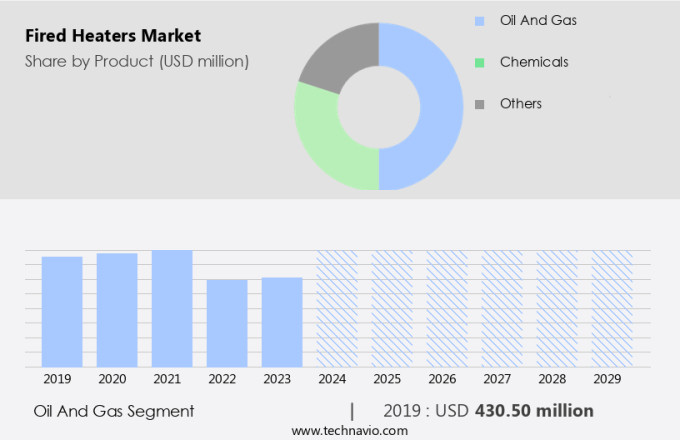

How is this Fired Heaters Industry segmented and which is the largest segment?

The fired heaters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Oil and gas

- Chemicals

- Others

- Type

- Direct fired heater

- Indirect fired heater

- Geography

- APAC

- China

- India

- Japan

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- South America

- Brazil

- APAC

By Product Insights

- The oil and gas segment is estimated to witness significant growth during the forecast period.

Fired heaters play a crucial role In the oil and gas industry, particularly in refineries, where they are utilized for heating various fluids and feedstocks. The design of these heaters varies based on the application, with vertical cylindrical and box-type furnaces being common choices. Fired heaters are offered for both offshore and onshore installations. In the production of petrochemicals, processes such as cracking are employed to split large hydrocarbon molecules into smaller ones. Fluid catalytic cracking is used for petroleum fractions, while steam cracking is utilized for natural gas liquids. These processes often involve extreme temperatures and pressures. Fired heaters are integral to these applications, with indirect fired heaters and direct fired heaters being popular options.

Get a glance at the Fired Heaters Industry report of share of various segments Request Free Sample

The oil and gas segment was valued at USD 430.50 million in 2019 and showed a gradual increase during the forecast period.

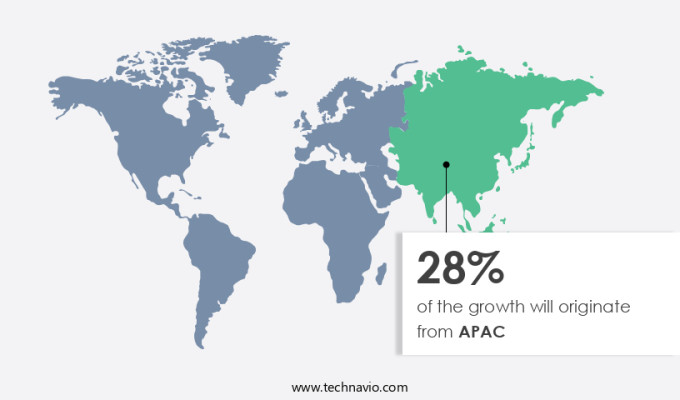

Regional Analysis

- APAC is estimated to contribute 28% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing growth due to expanding capacity in sectors like oil and gas, chemicals, and food and beverage industries, particularly In the Asia-Pacific region. Urbanization and rising disposable incomes in countries such as China, Japan, India, Indonesia, Malaysia, and Bangladesh are driving this demand. In the Asia-Pacific region, the food and beverage industry is thriving due to changing urban lifestyles and increasing disposable income, leading to an increase in demand for processed and convenience foods. Additionally, developing countries are focusing on enhancing their manufacturing sectors, including food production and chemicals, which will boost the demand for heat generation equipment in industrial processes.

Market Dynamics

Our fired heaters market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Fired Heaters Industry?

Rise in global oil and gas refinery capacity is the key driver of the market.

- The global chemical processing industry relies heavily on fired heaters, particularly In the oil and gas sector, for steam generation and process heat applications. In refineries and gas plants, fired heaters are integral to converting crude oil into valuable products, such as olefins, ammonia, and fertilizers. The expansion of refinery capacity, driven by increasing demand for oil and gas, significantly influences the market for fired heaters. Fired heaters come in various designs, including direct fired and indirect fired, vertical cylindrical, and horizontal cylindrical. Advanced control systems, automation technologies, and emission control technologies are essential components of modern fired heaters to ensure optimal performance and adherence to environmental regulations.

- In addition, digitalization and connectivity solutions, such as the Internet of Things (IoT), enable predictive maintenance, reducing downtime and enhancing overall efficiency. The chemical industry, including petrochemicals and synthetics, is another significant end-user of fired heaters. Manufacturing industries, power generation, and processing industries also rely on fired heaters for their operations. Urbanization and rapid industrialization contribute to increased demand for energy and process heat, further driving the market for fired heaters. Despite the benefits, concerns over CO2 emissions and air pollution from fired heaters persist. Stringent environmental regulations necessitate the adoption of cleaner technologies, such as natural gas-fired heaters and alternative energy sources, to mitigate environmental impacts.

What are the market trends shaping the Fired Heaters Industry?

Increasing popularity of electric-fired heaters is the upcoming market trend.

- The market encompasses direct fired heaters and indirect fired heaters used extensively In the oil & gas sector for steam generation, process heat, and furnace applications in refineries, gas plants, petrochemicals, and chemicals and synthetics industries. Fired Heaters convert fuel into heat, primarily using oil and gas. However, the increasing focus on reducing CO2 emissions and adhering to Environmental Regulations necessitates the implementation of advanced control systems, automation technologies, and emission control technologies. The Internet of Things (IoT), digitalization, connectivity solutions, predictive maintenance, and other technological advancements are transforming the market. The global energy market's decreasing average unit price and the availability of reliable electricity in most developed and rapidly industrializing countries are driving the demand for fired heaters.

- Moreover, industries such as manufacturing, power generation, processing, construction, hotel, and tourism are significant consumers of process heat. Fossil fuels, despite contributing to air pollution and health problems, remain the primary energy source for fired heaters. Sigma Thermal Inc. Provides innovative electric heating solutions, including immersion and circulation electric heaters, for various applications. These heaters, ranging from 2 watts to 60 watts per square inch, offer energy efficiency and cost savings. The market's growth is influenced by factors such as rapid industrialization, urbanization, and investment in new projects.

What challenges does the Fired Heaters Industry face during its growth?

Volatility in manufacturing costs is a key challenge affecting the industry growth.

- Fired heaters are essential heat generation equipment used extensively in various industries, including oil and gas, chemicals, and synthetics, refineries, gas plants, petrochemicals, fertilizer plants, manufacturing, power generation, and processing industries. Direct fired heaters and indirect fired heaters are the two primary types, with vertical cylindrical and horizontal cylindrical designs being common. The market dynamics for fired heaters are influenced by several factors. Price fluctuations of raw materials, such as stainless steel, iron ore, aluminum, bronze, and other metal alloys, significantly impact the production costs of fired heaters. This volatility can lead to demand-supply disparities and affect the profitability of manufacturers.

- Furthermore, the high initial investment required to manufacture fired heaters due to the use of expensive components increases the cost of ownership and reduces profit margins. Oil prices also play a crucial role In the market dynamics of fired heaters. An increase in oil prices can drive up the cost of equipment and operating expenses for end-users. Additionally, steel, a major raw material in fired heater manufacturing, is subject to price fluctuations, which can impact the overall cost structure of the industry. Advanced control systems, automation technologies, and emission control technologies are critical trends In the market. Digitalization, connectivity solutions, predictive maintenance, and environmental regulations are also driving the market's growth.

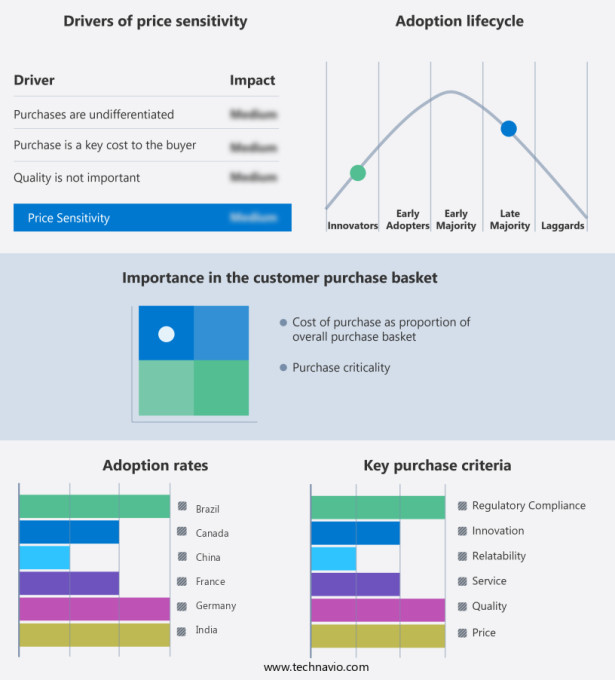

Exclusive Customer Landscape

The fired heaters market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fired heaters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fired heaters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Air Industrie Thermique - The company offers fired heaters such as cabin fired heaters, vertical cylindrical fired heaters.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Boustead Singapore Ltd.

- ComEnCo Inc.

- Esteem Projects Pvt. Ltd.

- Exotherm Corp.

- G.C. Broach Co.

- Hastings HVAC Inc.

- Kilburn Engineering Ltd.

- Linde Plc

- Optimized Process Furnaces

- Petrosadid Group

- Pirobloc S.A

- SCANDIUZZI STEEL CONSTRUCTIONS

- Sigma Thermal Inc.

- Stelter and Brinck Ltd.

- TechEngineering S.r.l.

- Thermax Ltd.

- Tulsa Heaters Midstream

- UnitBirwelco Ltd.

- Westinghouse Air Brake Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fired heaters play a pivotal role in various industries, including oil and gas, chemicals, and power generation. These heaters are essential for converting raw materials into valuable products and generating steam for power generation. The market for fired heaters is driven by several factors, including the increasing demand for energy and the need for efficient and environmentally friendly processes. Direct fired heaters and indirect fired heaters are two primary types of fired heaters. Direct fired heaters transfer heat directly to the process fluid, while indirect fired heaters use a heat transfer medium, such as water or steam, to heat the process fluid.

Moreover, both types of heaters have distinct advantages and applications. The oil and gas industry is a significant consumer of fired heaters. In refineries and gas plants, fired heaters are used for various applications, including crude distillation, fluid catalytic cracking, and reforming. In the petrochemicals industry, fired heaters are used for the production of olefins, ammonia, and other chemicals. The chemicals and synthetics industry also relies heavily on fired heaters for the production of various chemicals and synthetics. Fired heaters are used In the production of fertilizers, polymers, and other specialty chemicals. The manufacturing sector, including the production of steel, cement, and glass, also utilizes fired heaters for various processes.

In addition, the power generation industry is another significant consumer of fired heaters. Fired heaters are used for steam generation in power plants, providing the heat energy required to drive turbines and generate electricity. The market for fired heaters is influenced by several trends. Rapid industrialization and urbanization have led to an increase in demand for energy and the need for efficient and environmentally friendly processes. Digitalization and connectivity solutions are transforming the industry, enabling advanced control systems and predictive maintenance. Emission control technologies and environmental regulations are also driving the market for fired heaters. As concerns over CO2 emissions and air pollution grow, there is a growing demand for more efficient and cleaner fired heaters.

Furthermore, the adoption of IoT technologies and automation solutions is helping to improve the efficiency and reduce the environmental impact of fired heaters. Investment in new technologies and innovations is also driving the market for fired heaters. Advanced control systems and automation technologies are helping to improve the performance and efficiency of fired heaters, while emission control technologies are helping to reduce their environmental impact. The market for fired heaters is expected to grow significantly In the coming years, driven by the increasing demand for energy and the need for efficient and environmentally friendly processes. The market is also being driven by the adoption of digitalization and automation technologies and the growing demand for more efficient and cleaner fired heaters. Therefore, the market for fired heaters is a dynamic and growing industry, driven by the increasing demand for energy and the need for efficient and environmentally friendly processes. The market is being transformed by digitalization and automation technologies, and there is a growing demand for more efficient and cleaner fired heaters. The future of the industry looks bright, with significant opportunities for innovation and growth.

|

Fired Heaters Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 171.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, India, Germany, Japan, Canada, UK, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fired Heaters Market Research and Growth Report?

- CAGR of the Fired Heaters industry during the forecast period

- Detailed information on factors that will drive the Fired Heaters growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fired heaters market growth of industry companies

We can help! Our analysts can customize this fired heaters market research report to meet your requirements.