Flip Flops Market Size 2025-2029

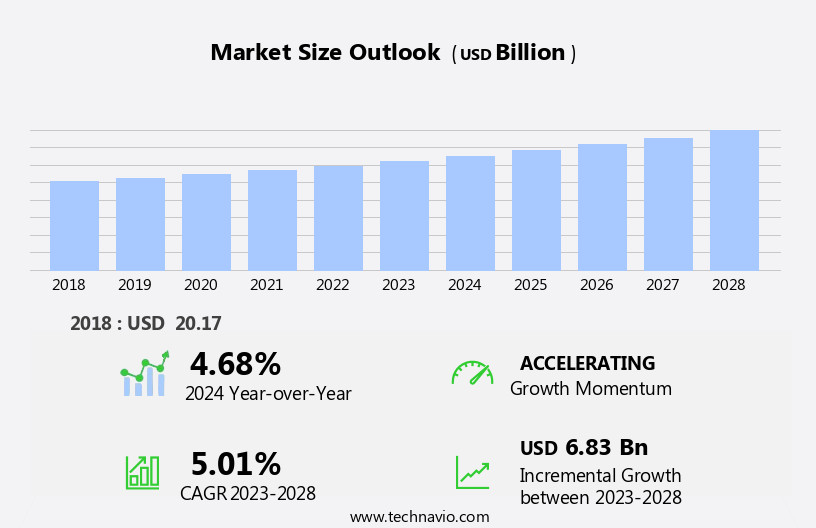

The flip flops market size is forecast to increase by USD 7.37 billion at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the rising production of rubber and the declining trend in leather production. This shift in raw materials is a response to increasing consumer preferences for eco-friendly and affordable footwear options. Additionally, an uptick in advertising services and marketing campaigns is fueling market growth, as companies seek to capitalize on this trend and expand their customer base. However, the market faces challenges, including the volatile prices of raw materials, which can impact production costs and profitability.

- Producers must navigate these price fluctuations and find ways to maintain consistency in their supply chains to remain competitive. To capitalize on opportunities and mitigate challenges, companies should focus on innovation, sustainability, and cost management strategies. By staying attuned to consumer preferences and market trends, they can effectively respond to shifting market dynamics and position themselves for long-term success. The integration of 3D-printed footwear in footwear production offers customization opportunities, while footwear cushioning and ergonomics analysis ensure superior comfort.

What will be the Size of the Flip Flops Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The flip flop market exhibits diverse trends, with style variations appealing to an expansive target demographic. Material sourcing plays a pivotal role in the industry, with manufacturers prioritizing eco-friendly options and innovative upper material compositions. Footbed material options, midsole foam density, and strap width choices cater to consumer preferences for comfort features. Design aesthetics encompass pattern design options and color variations, while performance metrics, such as sole thickness variations and outsole rubber compound, influence functionality. Manufacturing processes and supply chain management ensure timely delivery and maintain quality control. Price points and size range availability are crucial factors in distribution channels, with retailers focusing on both value and inclusivity.

Comfort features, such as strap adjustment mechanisms and lining fabric types, contribute to consumer satisfaction. Durability testing and durability ratings are essential performance metrics for flip flops, reflecting their long-term value. Heel height variations and toe shape designs cater to diverse consumer preferences, with the market continuing to evolve and adapt to emerging trends. E-commerce platforms like Online Retailing, Credit card, Online banking, and Mobile wallets, smartphone have made purchasing footwear more accessible.

How is this Flip Flops Industry segmented?

The flip flops industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Men/boys

- Women/girls

- Children

- Price Range

- Economy

- Mid-range

- Premium

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

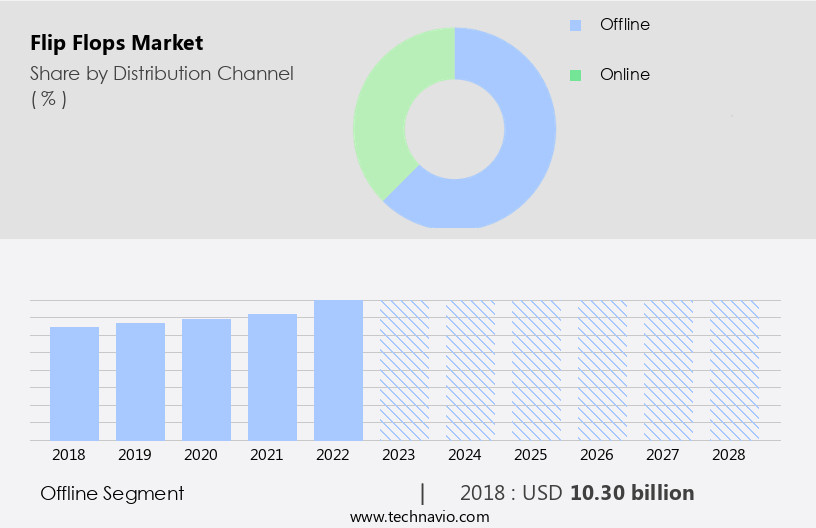

The Offline segment is estimated to witness significant growth during the forecast period. In the market, consumers prioritize offline purchasing channels due to the importance they place on tactile evaluation and durability. Buyers often prefer to examine flip flops in person before making a purchase, making brick-and-mortar stores the preferred choice. An increasing trend in the market is the provision of value-added services by retailers. These services include 3D foot scans for customized sizing and foot spat relief for muscle comfort. Flip flops with woven fabric uppers, slip-resistant outsoles, colorfast dyes, recycled material content, embossed design details, quick-drying fabric linings, adjustable buckle straps, and rubber outsole durability are popular among consumers. Retailers are focusing on offering these features to attract and retain customers.

As far as the global flip flops market is concerned, buyers across the globe have shown more interest in offline channels as compared to online channels because most of the users/buyers look for value and durability factors. They want to feel flip flops sandals before buying, and for the same, buying through online channels is not possible. So nowadays, users/buyers of flip flops usually opt for offline channels to buy flip flops to check different types of sandal designs, which will give comfort to buyers while buying flip flop sandals. Another emerging factor is the value-added services offered by the retailers, such as 3D foot scan checks for customized foot checks so that there should not be any size issues and foot spat relief for aching muscles.

Most offline stores provide patient salesmen who can spend maximum time with buyers to get their favorite flip flops in terms of look, comfort, and fitment. The retention rate for offline channels for the global flip flops market has increased and become strong as the buyers trust the brands because of the money and time they have consumed to buy flip flop sandals, which has given value and advice while buying, which is not possible through online channels. Such factors are anticipated to drive the growth of the offline segment, which, in turn, will propel the growth of the market during the forecast period. One major factor is the increasing popularity of digital payment systems, which facilitate seamless transactions and enhance customer convenience.

The Offline segment was valued at USD 10.68 billion in 2019 and showed a gradual increase during the forecast period.

The flip flops market is witnessing steady growth driven by consumer demand for customizable, durable, and stylish footwear. A key feature enhancing comfort and fit is the strap adjustment mechanism, allowing users to modify tightness effortlessly. Product performance depends heavily on upper material composition and lining fabric type, chosen for durability, water resistance, and comfort. Modern designs offer diverse toe shape design and strap width options, catering to varied aesthetic and functional preferences. Factors like weight per size are carefully considered to ensure lightweight wear without compromising support. The manufacturing process highlights sustainable materials and precision construction. Additionally, packaging considerations and attractive retail display strategies play a vital role in influencing consumer purchase decisions within this highly competitive market.

Regional Analysis

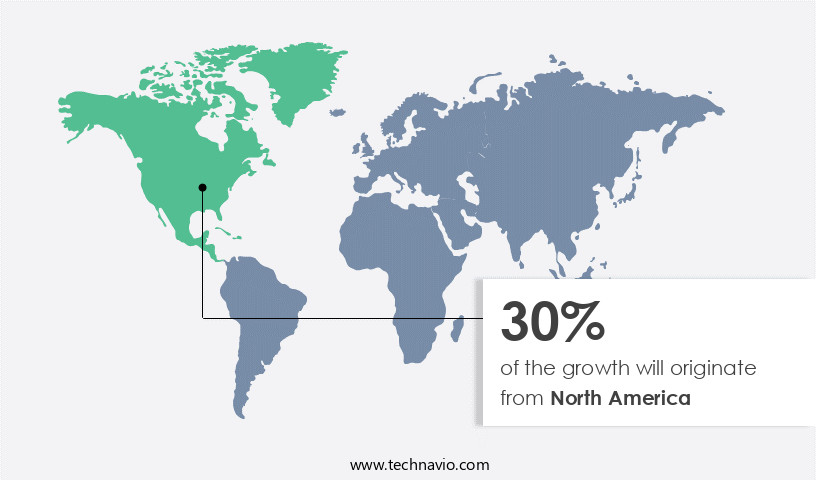

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to several factors. The introduction of new products, such as those with woven fabric uppers, slip-resistant outsoles, and quick-drying fabric linings, continues to attract consumers. Additionally, the increasing use of online platforms for fashion shopping and the growing trend towards eco-friendly materials, including recycled content and colorfast dyes, are driving market expansion. Moreover, the demand for customized flip flops, featuring embossed design details, adjustable strap lengths, and ergonomic footbeds, is on the rise. Furthermore, the adoption of advanced technologies, such as impact absorption system, arch support technology, and antimicrobial treatment, adds value to the market.

The use of synthetic leather uppers, durable stitching techniques, and rubber outsoles ensures product durability. The market is also witnessing a trend towards UV resistant materials, water-resistant coatings, and ventilation system design for enhanced comfort and functionality. The market in North America is expected to grow further with the increasing popularity of lightweight, flexible sole constructions, toe protection features, and adjustable buckle straps. The market is also witnessing the launch of celebrity-endorsed products and designer collections, which are priced higher due to their unique features and brand value.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Flip Flops market drivers leading to the rise in the adoption of Industry?

- The significant increase in rubber production and subsequent decrease in leather production serves as the primary market trend. Flip flops, specifically those made of rubber, have gained significant traction in the footwear market due to their ease of use and versatility. The easy-on, easy-off design and sole traction pattern make them a popular choice for various occasions. Rubber flip flops are known for their durability, thanks to advanced stitching techniques and synthetic leather uppers. The patterned outsole and printed sole design add to their aesthetic appeal.

- Women are particularly drawn to this trend, with a growing preference for rubber flip flops and slips over men. The demographic shift towards younger populations, with an average age range of 18 to 40 years, is fueling the growth of the rubber flip flops sector. This age group is more likely to be fashion-conscious and willing to experiment with various footwear options. The rubber market is poised for continued growth, offering opportunities for businesses to cater to the evolving consumer preferences.

What are the Flip Flops market trends shaping the Industry?

- The trend in marketing is characterized by an escalating number of advertising and marketing campaigns. This upward trajectory reflects the industry's ongoing evolution and adaptation to consumer preferences. Flip flops have experienced significant growth in sales over the past few years due to effective marketing and advertising strategies. Companies in this market invest in various advertising platforms to increase brand awareness and sales. Online retailing has emerged as a major distribution channel, driven by the increasing reliance on the internet.

- Eva foam construction and toe protection features further add to the comfort and durability of flip flops. Companies in the market focus on providing adjustable strap lengths to cater to diverse consumer preferences. These design elements contribute to the overall appeal and functionality of flip flops, making them a preferred choice for consumers seeking comfort and style. Ergonomic footbed designs, mold resistant materials, water-resistant coatings, printed graphic designs, ventilation systems, and impact absorption systems are essential features that enhance consumer experience.

How does Flip Flops market face challenges during its growth?

- The volatility in the prices of raw materials poses a significant challenge and impedes the growth of the industry. The market faces challenges due to the volatility in the prices of raw materials, which are essential for manufacturing these footwear items. Materials such as leather, polyester, nylon, rubber, cotton fiber, coconut fiber, and foam are commonly used. Fluctuations in the prices of these materials can negatively impact the profitability of manufacturers. Additionally, the entry of numerous local players in recent years has intensified market competition, putting pressure on established companies' profit margins.

- Moreover, rubber flip flops are stain resistant and offer a flexible sole construction, making them ideal for both indoor and outdoor use. The increasing trend of sustainable living and fashion has led to a shift from traditional leather flip flops to rubber ones. This situation poses a significant challenge to the expansion of the market. Additionally, celebrity endorsements are a popular marketing tactic used by flip flop manufacturers to promote their products. The design of flip flops is also a key factor in their popularity.

Exclusive Customer Landscape

The flip flops market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flip flops market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flip flops market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - The company specializes in providing a range of flip flops, including the Adilette aqua slides, Adilette shower slides, and Adilette TND slides.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Alpargatas SA

- BasicNet Spa

- Birkenstock digital GmbH

- Boardriders

- Clarks Reliance Footwear Pvt. Ltd.

- Crocs Inc.

- Deckers Outdoor Corp.

- Duke Fashions India Ltd.

- FatFace Ltd.

- Flop Happy LLC

- Nike Inc.

- OluKai LLC

- Oofos Inc.

- Skechers USA Inc.

- Solethreads

- SUPERDRY PLC

- The Gap Inc.

- Tory Burch LLC

- VALENTINO Spa

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Flip Flops Market

- In January 2024, Reef, a leading flip flop brand, announced the launch of their new eco-friendly line, "Reef Eco," made from recycled materials. This initiative marked a significant shift in the flip flop industry towards sustainable production methods (Reef Press Release, 2024).

- In March 2024, OluKai, another major player, formed a strategic partnership with REI Co-op, a prominent outdoor retailer, to expand its market reach and distribution channels. This collaboration aimed to increase OluKai's presence in the US market (OluKai Press Release, 2024).

- In May 2024, Crocs, a well-known footwear company, acquired Jibbitz, a manufacturer of customizable charms for Crocs shoes, including flip flops. This acquisition allowed Crocs to enhance its product offerings and cater to the growing demand for personalized footwear (Crocs Press Release, 2024).

- In February 2025, the European Union passed a new regulation mandating the use of recycled or biodegradable materials in all flip flops sold within the EU market, starting from 2027. This policy change signaled a major regulatory push towards sustainable production methods in the flip flop industry (European Commission Press Release, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market activities unfolding across various sectors. Ergonomic footbed designs, mold resistant materials, water-resistant coatings, and printed graphic designs are seamlessly integrated into these versatile footwear options. Ventilation systems and impact absorption systems are thoughtfully engineered to enhance comfort and functionality. Eva foam construction and toe protection features ensure durability and support, while adjustable strap lengths cater to individual preferences. Quick-drying fabric linings and easy-on easy-off designs add to the convenience. The market's ongoing evolution also includes the use of recycled materials, colorfast dyes, and UV resistant materials.

Flexible sole constructions with durable stitching techniques and rubber outsole durability offer superior traction and stability. Embossed design details and patterned outsoles add aesthetic appeal, while adjustable buckle straps and machine washable material ensure ease of care. Arch support technology and antimicrobial treatment are increasingly popular features, addressing the needs of diverse consumer segments. The market's continuous dynamism is reflected in its ability to cater to evolving consumer preferences and trends. The flip flops market is evolving with innovative designs focused on comfort, durability, and style. Modern products feature polyurethane midsole cushioning and ergonomic footbed design for superior support, while impact absorption system and heel cup stabilization enhance foot alignment.

Premium flip flops use quick-drying fabric lining, water-resistant coating, and UV resistant material for lasting outdoor wear. Stylish options incorporate printed graphic design, embossed design detail, and reinforced stitching. Adjustable fits are ensured with adjustable strap design, adjustable buckle strap, and adjustable strap length. Functional details like slip-resistant outsole, toe post design, and lightweight construction boost performance. Materials such as stain resistant material, mold resistant material, synthetic leather upper, and woven fabric upper meet both fashion and practical demands. The rise in international sporting events in the region, such as the Asian Games, ICC Cricket World Cup, and ACC Asian Cup, has heightened consumer awareness of the benefits of sports and fitness activities.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Flip Flops Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 7.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, Canada, China, Germany, India, Brazil, France, UK, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flip Flops Market Research and Growth Report?

- CAGR of the Flip Flops industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flip flops market growth of industry companies

We can help! Our analysts can customize this flip flops market research report to meet your requirements.