Spain Food Flavor and Enhancer Market Size 2024-2028

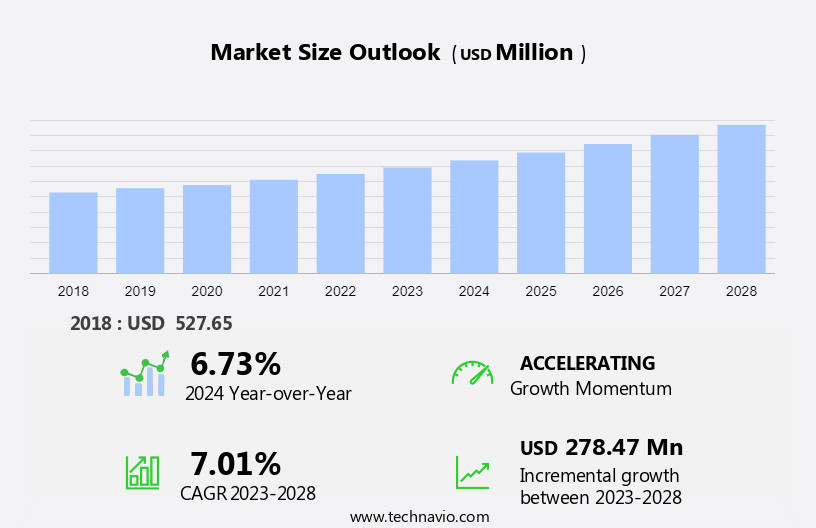

The Spain food flavor and enhancer market size is forecast to increase by USD 278.47 million at a CAGR of 7.01% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for food flavors in processed foods. Technological advances In the food flavor industry are also driving market growth, as companies invest in research and development to create innovative and natural flavor solutions. Key components include monosodium glutamate (MSG), sodium chloride, taste modulators such as nucleotides and amides, sweetness potentiators, and bitter taste receptors blockers like gymnemic acid and alapyridaine. However, the market faces challenges from the threat of counterfeit food flavor and enhancer products, which can negatively impact consumer trust and brand reputation. To mitigate this risk, market players are focusing on implementing strong supply chain management systems and adopting traceability technologies. Overall, the market is expected to grow steadily In the coming years, driven by consumer preferences for convenient and tasty food products.

What will be the size of the Spain Food Flavor and Enhancer Market during the forecast period?

- The Spanish food flavor and enhancer market encompasses a range of ingredients that enhance the sensory experience of food, primarily focusing on taste and smell. The market is driven by consumer preferences for enhanced palatability and taste perception, as well as the growing trend towards reducing sodium intake. Other factors influencing the market growth include the Maillard reaction, which contributes to the development of complex flavors during cooking, and the use of odorants and salivary components to stimulate appetite and improve taste quality.

- Sweeteners, both natural and artificial, are also a significant segment of the market, with ongoing research and development efforts focused on taste modification, taste suppression, and taste enhancement technologies. Overall, the Spanish food flavor and enhancer market is expected to continue growing, driven by consumer demand for improved taste experiences and ongoing innovation in taste perception science.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Natural flavors

- Artificial flavors

- Application

- Bakery and confectionery

- Food and nutrition

- Beverages

- Dairy and frozen desserts

- Others

- Distribution Channel

- Offline

- Online

- Geography

- Spain

By Product Insights

- The natural flavors segment is estimated to witness significant growth during the forecast period.

Natural flavors derived from organic sources are gaining popularity In the food industry due to increasing health consciousness among consumers. These flavors, which do not contain artificial substances or chemical preservatives, help maintain the authentic taste and aroma of food. The demand for natural flavors is particularly high in Europe, North America, and South America, with countries such as Germany, France, the US, Canada, and Brazil leading the trend. Natural flavors are derived from various sources, including herbs, spices, fruits, vegetables, dairy products, edible yeast, meat, and eggs. The growing awareness of the potential health risks associated with artificial flavors has led to an increase in demand for natural and organic alternatives.

Get a glance at the market share of various segments Request Free Sample

The natural flavors segment was valued at USD 396.21 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Spain Food Flavor and Enhancer Market?

Increasing demand for food flavors in processed foods is the key driver of the market.

- Processed foods, a significant portion of the global food industry, are manufactured using various chemical and mechanical processes for preservation and enhancement. These foods, which include a range of natural and artificial flavors, have gained popularity due to their appealing taste, appearance, and texture, attracting a substantial consumer base. The Spanish food flavor and enhancer market is anticipated to expand during the forecast period, driven by the increasing demand for processed foods. The growing working population in Spain is a primary factor fueling this demand. Taste, a critical sensory experience, is crucial in food consumption. Chemosensory perception, including taste and smell, plays a significant role in determining food palatability.

- Taste receptors located on the tongue identify five basic tastes: sweet, sour, salty, bitter, and umami. Taste modulators, such as monosodium glutamate (MSG) and sodium chloride, enhance these tastes, while sweetness potentiators and bitter blockers, like gymnemic acid and alapyridaine, modify taste perception. In the culinary world, taste enhancement is a crucial aspect of innovation, and food flavor and enhancer market growth is influenced by the development of new taste modulators and aroma enhancers. Natural ingredients, such as fresh herbs and spices, are increasingly being used to create balanced diets and enhance taste quality. Sensory evaluation is a critical component of the food industry, ensuring consistency and standardization in taste profiles.

What are the market trends shaping the Spain Food Flavor and Enhancer Market?

Technological advances in food flavor industry is the upcoming trend In the market.

- The Spanish food flavor and enhancer market is witnessing significant advancements as companies invest in research and development (R&D) to produce natural and synthetic flavors with enhanced stability. This focus on innovation and technological progress is driving the demand for food flavors in Spain, thereby propelling market growth. In the culinary world, manufacturers are employing techniques for flavor recovery in liquid food processing to elevate taste profiles. Chemosensory components, including taste receptors, taste modulators, and odorants, play a crucial role in taste perception and palatability. Sodium chloride, monosodium glutamate, nucleotides, sweeteners, and bitter taste receptors are integral to taste modification, suppression, and blocking.

- Sweetness potentiators, such as gymnemic acid and alapyridaine, and bitter blockers, like certain spices, are essential taste enhancers and modifiers. Aroma enhancers and salt and umami enhancers further contribute to the sensory experience of food. In the pursuit of culinary creativity and a balanced diet, natural ingredients like fresh herbs and spices continue to be popular In the food industry. The market is poised for growth, as consumers seek to enhance their taste experience while maintaining moderation and adhering to health considerations. Sensory evaluation is a critical aspect of the food industry, ensuring consistency and standardization in processed foods and culinary artistry.

What challenges does Spain Food Flavor and Enhancer Market face during the growth?

Threat of counterfeit food flavor and enhancer products is a key challenge affecting the market growth.

- The chemosensory experience of food, including taste and smell, plays a significant role in food palatability and consumer satisfaction. Food flavor and enhancer market dynamics are influenced by various factors, including taste receptors, taste modulators, and sensory evaluation. Monosodium glutamate (MSG), sodium chloride, nucleotides, sweeteners, and umami enhancers are common taste modifiers used In the culinary world. Taste perception is further influenced by odorants, salivary components, and taste suppression or modification through taste blocking agents like gymnemic acid and alapyridaine. Counterfeit food flavor products, a growing concern In the market, pose health risks and negatively impact the reputation and sales of genuine companies.

- These products, often manufactured using low-cost, non-standard materials, can adversely affect consumers' health and mislead them into believing they are consuming authentic items. Enhancement of taste quality through natural ingredients, such as fresh herbs and spices, and balanced diet considerations are essential for maintaining culinary creativity and gastronomic experiences. In the processed foods industry, consistency and standardization are crucial for delivering desirable taste profiles. Aroma enhancers and sugar substitutes are also vital components In the flavor enhancement process. Overall, the food industry must prioritize authenticity, health effects, and moderation In the use of flavor enhancers and additives to ensure a positive sensory experience for consumers.

Exclusive Spain Food Flavor and Enhancer Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Bell Flavors and Fragrances GmbH

- Cargill Inc.

- DALLANT SA

- Firmenich SA

- Flavorchem Corp

- Givaudan SA

- Huabao International Holdings Ltd.

- International Flavors and Fragrances Inc

- Kerry Group Plc

- Koninklijke DSM NV

- Lucta SA

- MANUFACTURAS TABERNER SA

- McCormick and Co. Inc.

- Robertet SA

- Solvay SA

- Symrise AG

- T. Hasegawa Co. Ltd.

- Takasago International Corp.

- TER Chemicals GmbH and Co. KG

- V. Mane Fils

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The chemosensory experience of food plays a pivotal role in our perception of palatability and nourishment. Taste receptors, located on the tongue and other areas In the mouth, are responsible for identifying the five basic tastes: sweet, sour, salty, bitter, and umami. These tastes, along with odorants and salivary components, contribute to the overall taste quality and sensory evaluation of food. In the culinary world, the quest for enhancing and modifying taste profiles has led to the development of various flavor enhancers. Monosodium glutamate (MSG), a savory taste enhancer, has gained widespread popularity due to its ability to enhance umami flavors.

In addition, sodium chloride, or common table salt, is another widely used taste enhancer, known for its role in enhancing savory and sweet flavors. Taste modulators, such as nucleotides and sweetness potentiators, are used to intensify specific tastes. For instance, nucleotides can enhance the savory umami taste, while sweetness potentiators can increase the perceived sweetness of sugar. Bitter taste receptors, which are responsible for identifying bitter tastes, can be blocked using bitter blockers like gymnemic acid and alapyridaine. The use of taste suppressants and taste blocking agents is another area of interest In the food industry. These agents can help mask unwanted tastes or suppress the bitterness of certain ingredients, leading to a more balanced and enjoyable taste experience.

Moreover, aroma enhancers are another crucial component of the flavor enhancement market. Odorants derived from natural or synthetic sources can significantly impact the perceived taste and overall sensory experience of food. The use of natural ingredients, such as fresh herbs and spices, continues to be a popular trend In the culinary world. These ingredients not only add flavor but also offer various health benefits. However, the demand for processed foods and the need for standardization and consistency have led to the increased use of synthetic flavor enhancers and taste modifiers. The health effects of flavor enhancers and taste modifiers are a subject of ongoing research and debate.

Furthermore, while some argue that their use can lead to health issues, others believe that their benefits outweigh the risks. Moderation and the use of natural ingredients are key considerations In the culinary innovation process. The taste enhancement market is a dynamic and evolving industry, driven by consumer preferences, culinary creativity, and technological advancements. The quest for new and innovative flavor enhancers and taste modifiers continues to be a priority for researchers and food manufacturers alike. The role of taste perception and the sensory experience In culinary artistry is a fascinating area of exploration, offering endless possibilities for innovation and discovery.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.01% |

|

Market growth 2024-2028 |

USD 278.47 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.73 |

|

Competitive landscape |

Leading Companies, Market Report, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Spain

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch