Yeast Market Size 2024-2028

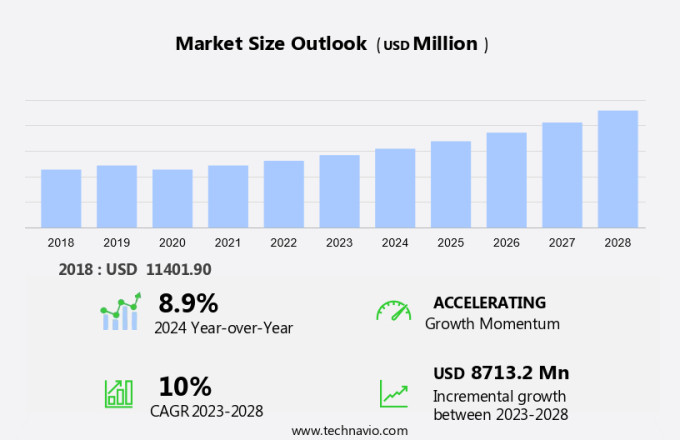

The yeast market size is forecast to increase by USD 8.71 billion, at a CAGR of 10% between 2023 and 2028.

- The market is driven by the increasing product launches of food and beverages utilizing diverse yeast varieties. This trend is fueled by consumers' growing preference for innovative and health-conscious food options. Furthermore, the demand for organic yeast offerings is on the rise, as consumers seek out more natural and sustainable alternatives. However, the market faces challenges due to the volatility in raw material prices for yeast products.

- This fluctuation can significantly impact the profitability of yeast manufacturers and distributors, necessitating effective supply chain management strategies. Companies seeking to capitalize on market opportunities should focus on innovation, sustainability, and cost management to navigate these challenges and meet the evolving demands of consumers.

What will be the Size of the Yeast Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in fermentation technology, nutrition, and applications across various sectors. Yeast fermentation plays a crucial role in the production of food, beverages, and industrial products. The ongoing research in this area focuses on optimizing the process for improved product yield and quality. Yeast nutrition is another key area of interest, with researchers exploring the role of beta-glucans, mannoproteins, and other nutrients in enhancing yeast growth and performance. The morphology of yeast cells is also under scrutiny, with potential applications in bioreactor design and flocculation. Autolyzed yeast and inactive dry yeast are gaining popularity due to their extended shelf life and ease of use.

However, the stress response of yeast during cultivation and downstream processing remains a challenge, necessitating ongoing research in this area. Yeast cultivation techniques are continually being refined to improve product consistency and reduce production costs. The genetics of yeast, including genetics, transcriptomics, proteomics, and metabolomics, are being explored to gain a better understanding of yeast behavior and optimize fermentation conditions. Furthermore, yeast is finding applications in feed and industrial sectors, expanding the market's scope beyond traditional food and beverage industries. The continuous dynamism of the market underscores the importance of staying abreast of the latest research and developments in this area.

How is this Yeast Industry segmented?

The yeast industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverage

- Others

- Type

- Baker's Yeast (Active Dry Yeast, Instant Yeast, Fresh Yeast)

- Brewer's Yeast

- Wine Yeast

- Feed Yeast

- Bioethanol Yeast

- Other Yeast Types

- Strain

- Saccharomyces Cerevisiae

- Saccharomyces Boulardii

- Other Strains

- Form

- Dry

- Liquid

- Cream

- End-User

- Commercial

- Household

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

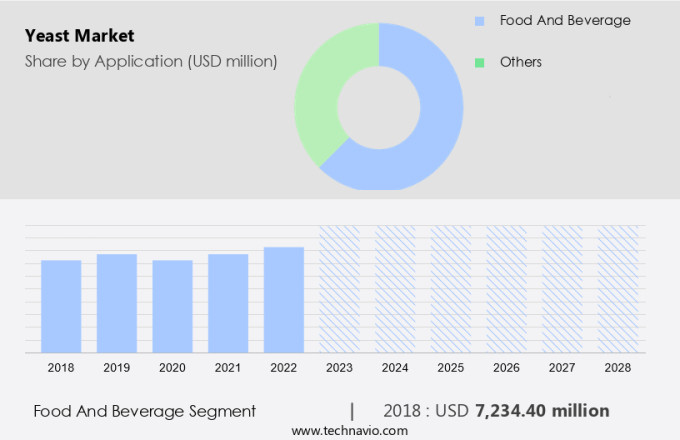

The food and beverage segment is estimated to witness significant growth during the forecast period.

The market in the food and beverage industry is experiencing significant growth, driven by the increasing demand for specialized yeast to enhance product quality. Yeast plays a crucial role in the fermentation process, preserving the aroma, flavor, and texture of various food and beverage products. In baking, baker's yeast is commonly used for bread production, while brewer's yeast is essential for beer fermentation. Wine yeast is another type used for winemaking. Manufacturers employ yeast in the production of soup mixes, such as Nestle's OPTIFAST 800 SOUP MIX, which utilizes yeast extract and torula yeast. Yeast morphology, strain selection, and cultivation significantly impact product yield and quality.

Advanced technologies like bioreactor design, yeast genetics, and metabolomics enable manufacturers to optimize fermentation and improve product consistency. Active dry yeast and inactive dry yeast are popular forms used for their extended shelf life and ease of use. Yeast mannoproteins, beta-glucans, and cell wall components are valuable byproducts with potential applications in food, feed, and biotechnology industries. Yeast stress response mechanisms and nutritional requirements are essential considerations for optimal yeast cultivation and productivity. Downstream processing, including autolyzed yeast and yeast extract production, is a growing area of focus for manufacturers to maximize product value. Fermentation optimization and quality control are essential aspects of the yeast production process to ensure consistent product quality and meet evolving consumer demands.

The Food and beverage segment was valued at USD 7.23 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

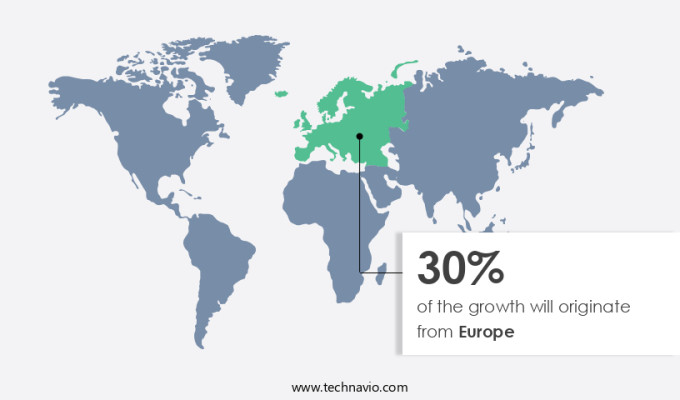

Europe is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing significant growth due to the increasing demand for yeast in the food and beverage industry. Baker's yeast remains a staple ingredient in the region's bakery sector, with traditional bakeries and established chains continuing to use it for manufacturing their products. The European Association for Specialty Yeast Products (EURASYP) is playing a crucial role in promoting the use of yeast and its derivatives, particularly due to their clean label status. Yeast's role extends beyond bakery applications, as it is also used in various food and beverage categories, including wine, beer, and feed. In wine production, specific yeast strains are used for fermentation to enhance the desired flavor profiles.

In the beverage industry, brewer's yeast is employed for brewing beer, while wine yeast is used for winemaking. Advancements in yeast research, such as yeast genomics, metabolomics, and proteomics, have led to a better understanding of yeast's behavior during fermentation and its role in various applications. This knowledge has facilitated the optimization of fermentation processes, ensuring improved product yield and quality. Flocculation, autolyzed yeast, and inactive dry yeast are other yeast forms that find applications in various industries. Flocculation aids in the separation of yeast cells during fermentation, while autolyzed yeast is used as a flavor enhancer and source of nutrients.

Inactive dry yeast is widely used in the food industry due to its long shelf life and ease of use. Yeast stress response and cultivation techniques have also gained importance in the industry, as they help improve yeast viability and productivity. Downstream processing techniques, such as centrifugation and filtration, are employed to extract yeast components, like mannoproteins and beta-glucans, for use in various applications. Quality control and shelf life are critical factors in the market, ensuring the production of safe and high-quality products. Yeast nutrition and metabolism studies continue to provide insights into optimizing yeast growth and improving product yield.

The integration of these advancements in the market is expected to drive growth during the forecast period.

Market Dynamics

The Global Yeast Market is expanding, driven by demand for baker's yeast, brewer's yeast, and nutritional yeast among health-conscious consumers. Organic yeast and non-GMO yeast cater to clean eating trends, while yeast extracts for food seasoning enhance flavor profiles in the food and beverage industry. Applications like yeast for baking, yeast in brewing, and yeast for animal feed fuel market growth. Sustainable yeast production and eco-friendly yeast processing benefits align with environmental priorities. Products such as best baker's yeast for bread making, organic yeast for vegan baking, non-GMO yeast for healthy diets, brewer's yeast for craft beer, and probiotic yeast for gut health drive consumer interest and market competitiveness.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Yeast Industry?

- The market is primarily driven by product launches of food and beverages incorporating various yeast varieties.

- The market is experiencing growth due to the rising demand for yeast in various end-use sectors. The market is primarily driven by the use of specialized yeast to enhance the quality of food and beverages. Yeast plays a crucial role in accelerating the fermentation process, thereby contributing to improved aroma, flavor, and texture in edibles. Consequently, the launch of new food and beverage products utilizing yeast varieties is on the rise. This trend is expected to significantly propel the expansion of the market during the forecast period.

- Yeast, as a vital ingredient, is essential for the production of a wide range of products, including baked goods, alcoholic beverages, and bioethanol. The increasing consumption of these products, coupled with the ongoing research and development activities, is further fueling market growth.

What are the market trends shaping the Yeast Industry?

- The increasing preference for organic products is evident in the market, with organic yeast offerings experiencing significant growth. This trend is set to continue, making organic yeast a noteworthy focus in the industry.

- The market for yeast, a key organic food ingredient, experiences significant growth due to increasing consumer preference for healthier and more sustainable food options. Yeast, particularly baker's yeast, is an essential component in various food products, including bread and pastries. However, the production of organic yeast comes with unique challenges, such as sourcing organic raw materials, ensuring yeast morphology, and implementing organic-compliant production processes. Yeast growth kinetics and yeast beta-glucans are crucial factors in the production of organic yeast. Understanding yeast strain selection and yeast genomics is essential to optimize the growth and yield of organic yeast.

- Additionally, yeast mannoproteins play a vital role in the functionality and nutritional value of organic yeast. Manufacturers of organic yeast must invest in specialized equipment and facilities to maintain the integrity of the organic production process. This includes dedicated equipment for organic production, yeast strain selection, and organic-compliant cleaning and pasteurization processes. Despite these challenges, the market for organic yeast is expected to continue growing as consumers become more conscious of the impact of their food choices on their health and the environment.

What challenges does the Yeast Industry face during its growth?

- The volatility in the cost of raw materials used in producing yeast products poses a significant challenge to the industry's growth trajectory.

- The market is influenced by the volatility of raw material prices, particularly beet and cane molasses, which are major substrates in yeast production. Fluctuations in these substrates' prices, due to their use in other industries like animal feeding and bio-ethanol production, impact the market. Additionally, the cost of other raw materials, such as ammonia and phosphoric acid, used in yeast cultivation is high due to their application as fertilizers. These factors contribute to the uncertainty in the market. Yeast fermentation is a crucial process in various food applications, and optimal yeast nutrition is essential for efficient fermentation.

- Bioreactor design plays a significant role in enhancing yeast productivity and improving yeast quality. Yeast flocculation, a natural process where yeast cells clump together, is crucial in the brewing industry for beer clarification. Autolyzed yeast and inactive dry yeast are widely used in the food industry due to their unique nutritional properties. Yeast stress response is a critical area of research to improve yeast productivity and product quality under adverse conditions. Understanding yeast stress response mechanisms can lead to the development of robust strains, enabling yeast cultivation under extreme conditions. This research can potentially lead to cost savings and increased efficiency in yeast production.

Exclusive Customer Landscape

The yeast market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the yeast market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, yeast market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Mauri UK Ltd. - This company specializes in the production and distribution of yeast products, including baker's yeast, for various industries and applications. Their offerings contribute significantly to the fermentation process in food production, enhancing the quality and consistency of final products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Mauri UK Ltd.

- AB Agri Ltd.

- Agrano GmbH and Co. KG

- Alltech Inc.

- AngelYeast Co. Ltd.

- Cargill Inc.

- Chr Hansen Holding AS

- Imperial Yeast

- Kerry Group Plc

- Koninklijke DSM NV

- LAFFORT

- Lallemand Inc.

- Leiber GmbH

- Lesaffre and Cie

- Nisshin Seifun Group Inc.

- Novus International Inc.

- Renaissance BioScience Inc.

- UNIFERM GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Yeast Market

- In January 2024, Danish yeast producer, Danisco, announced the launch of a new line of organic yeast products, catering to the growing demand for organic food and beverage offerings (Danisco Press Release).

- In March 2024, Lallemand Inc. And Bio-Techne Corporation entered into a strategic partnership, combining Lallemand's expertise in yeast and bacteria with Bio-Techne's purification technologies to enhance their respective product offerings (Bio-Techne Corporation Press Release).

- In May 2024, AB InBev, the world's largest brewer, completed the acquisition of Brazilian craft brewer, Cervejaria Colorado, marking its entry into the Brazilian craft beer market and expanding its global footprint (AB InBev Press Release).

- In February 2025, Chr. Hansen A/S, a leading bioscience company, received regulatory approval for its new yeast strain, Y-33, which is expected to significantly improve the efficiency and sustainability of the baking industry (Chr. Hansen A/S Press Release).

Research Analyst Overview

- In the dynamic market, strains undergo continuous improvement to enhance enzyme activity and functional properties for various applications. Yeast cell lysis techniques facilitate the extraction of valuable components, including antioxidants and nutritional elements, contributing to human nutrition and health benefits. Value-added products, such as cholesterol reduction and gut health, are gaining popularity in the market. Biofuel production and by-product utilization are significant trends, with yeast biomass production and waste management playing crucial roles.

- Microbial contamination remains a challenge, necessitating process control measures. Genetic engineering and sensory attributes are key factors influencing the development of probiotic properties, immune modulation, and pharmaceutical applications. Animal feed and skin health applications also leverage yeast's nutritional value and cost-effective production.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Yeast Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2024-2028 |

USD 8713.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Yeast Market Research and Growth Report?

- CAGR of the Yeast industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the yeast market growth of industry companies

We can help! Our analysts can customize this yeast market research report to meet your requirements.