Froth Flotation Equipment Market Size 2024-2028

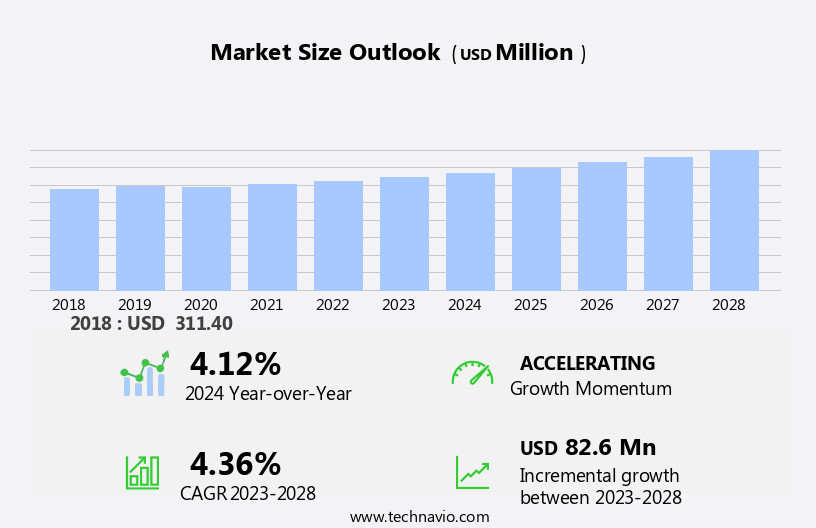

The froth flotation equipment market size is forecast to increase by USD 82.6 million at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth due to the high demand from mineral and ore processing applications. This technology is widely used In the extraction of minerals such as copper, zinc, and gold. New technology advancements, including the integration of automation and digitalization, are enhancing the efficiency and productivity of froth flotation processes. However, the slow growth of the mining industry in developed countries may hinder market growth. Additionally, stringent environmental regulations are driving the adoption of eco-friendly froth flotation technologies. Overall, the market is expected to witness steady growth In the coming years, with a focus on improving operational efficiency and reducing environmental impact. Despite these challenges, the market is expected to experience significant growth due to the increasing adoption of froth flotation technology in various industries, including mineral processing, coal, and metals and minerals.

What will be the Size of the Froth Flotation Equipment Market During the Forecast Period?

- The market is a significant segment of the mineral processing industries, utilized extensively In the extraction of various minerals such as lead, zinc, gold, copper, coal, and limestone. Froth flotation, a key process in mineral processing, employs flotation cells to separate valuable minerals from waste materials through the mechanism of froth formation. The market has experienced a slowdown in recent years due to weak domestic demand and low profitability, yet remains poised for rapid growth as mining operations in emerging economies expand. Major factors driving market expansion include the increasing demand for base metals and the need for sustainable and efficient mineral processing technologies.

- However, environmental concerns associated with froth flotation, such as the use of chemicals and energy consumption, pose challenges to market growth. Despite these challenges, leading producers continue to innovate and invest in research and development to improve the sustainability and efficiency of froth flotation processes.

How is this Froth Flotation Equipment Industry segmented and which is the largest segment?

The froth flotation equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Free-flow flotation

- Cell-to-cell flotation

- Application

- Mineral and ore processing

- Wastewater treatment

- Paper recycling

- Geography

- APAC

- China

- India

- Europe

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

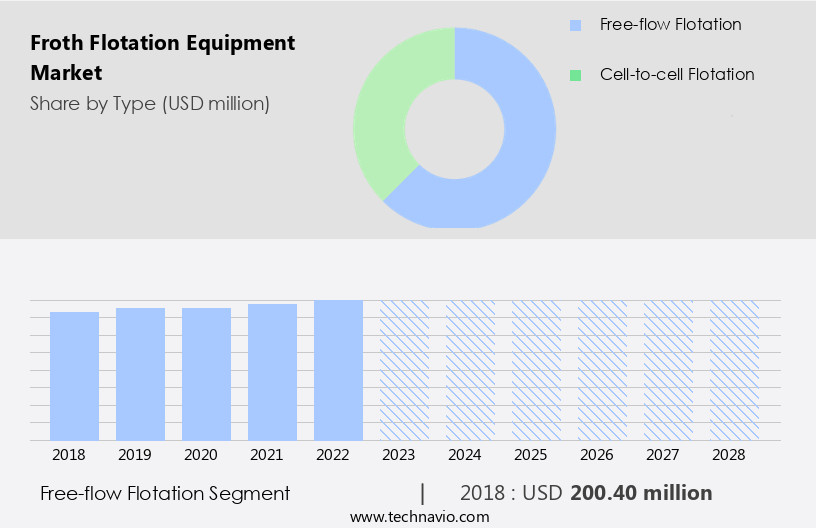

- The free-flow flotation segment is estimated to witness significant growth during the forecast period. The global market for flotation equipment has witnessed significant investments in recent years due to the increasing demand for efficient mineral processing solutions. Free-flow flotation equipment, a type of froth flotation technology, has gained prominence in this market due to its ability to handle larger tonnages in bulk flotation circuits. This equipment, which does not have intermediate partitions between cells, offers benefits such as high flotation efficiency, ease of operation, and minimal operator attention. The free-flow flotation segment is currently dominating the market and is projected to experience rapid growth during the forecast period. The demand for this technology is driven by its applications in various industries, including mineral and ore processing and wastewater treatment.

- Despite the benefits, environmental concerns associated with flotation processes and mining operations pose challenges to market growth. Minimizing soil contamination, optimizing treatment processes, and recycling water are key areas of focus for market participants. Companies are investing in automated machines, international expansion, and the development of high-selectivity flotation cells, such as fomented rectangular and tubes haped cells, as well as flotation columns and deinking equipment. Market trends include the widening of flotation grades, enhancement of equipment performance, and the use of hydrophobic and hydrophilic materials in mineral processing, paper reusing, and flotation processes. The market is competitive, with key players offering a range of fixed equipment, spare parts, consumables, consultancy, and professional services. Despite the challenges, the market is expected to continue its growth trajectory, driven by the increasing demand for minerals, metals, and aggregates.

Get a glance at the market report of share of various segments Request Free Sample

- The free-flow flotation segment was valued at USD 200.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

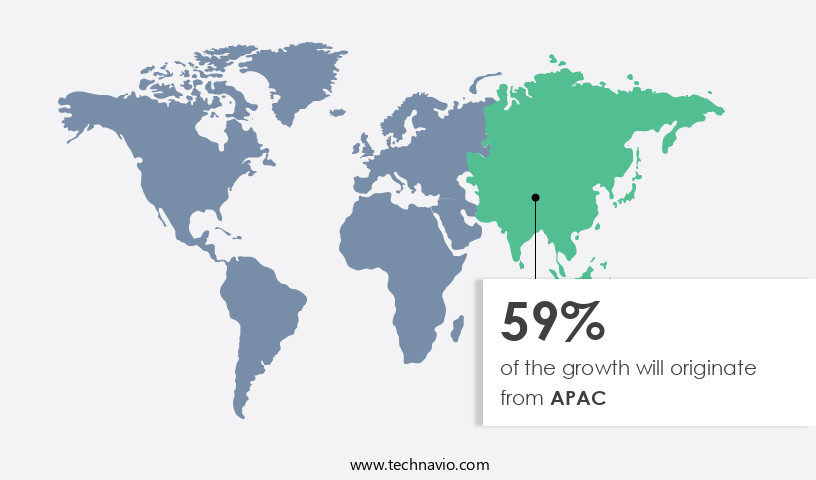

- APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

- The market In the Asia Pacific (APAC) region is experiencing significant growth due to the increasing demand for minerals and metals in infrastructure development and various industries. Major economies like China and Australia, with substantial mining operations, are the primary drivers of this market. The construction, automotive, and technology sectors' expansion in APAC has fueled the need for ferrous and non-ferrous metals, such as steel, aluminum, and copper. Froth flotation equipment is essential for mineral processing, particularly for sulfide ores like lead, zinc, molybdenum, gold, and others. However, environmental concerns related to soil contamination, wastewater treatment, and freshwater resources are crucial factors influencing the market.

- Companies focus on recycling water, using hydrophobic materials, and hydrophilic treatment processes to minimize environmental impact. Despite the benefits of froth flotation equipment, including high selectivity, low power consumption, and long service life, the market faces challenges such as erosion, wear rate, and routine mining activities' hazards. Market leaders invest in automated machines, international expansion, and enhancement of their product offerings to meet the growing demand and stay competitive.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Froth Flotation Equipment Industry?

- High demand from mineral and ore processing applications is the key driver of the market. Froth flotation is an essential mineral processing technique used to extract valuable minerals from ores by separating them based on their surface properties. With the global demand for minerals escalating due to their extensive use in various industries, including construction, manufacturing, and technology, the need for efficient and eco-friendly mineral processing methods, such as froth flotation, is increasingly significant. Froth flotation equipment plays a pivotal role in maximizing the recovery of valuable minerals, such as lead, zinc, molybdenum, gold, and sulfide ores, while minimizing waste and environmental impact. The mining industry's reliance on metals and minerals is substantial, and as the world population grows and economies develop, the demand for more efficient and effective mineral processing methods is intensifying. Froth flotation processes involve hydrophobic materials being selectively attached to air bubbles and carried to the froth layer, while hydrophilic materials remain In the liquid phase. Mining operations employ various types of froth flotation equipment, including fomented rectangular and tube shaped cells, flotation columns, and flotation deinking machines. These machines require regular maintenance, including floor space, power consumption, and wear rate considerations.

- Environmental concerns, such as soil contamination, treatment processes, wastewater treatment, and freshwater resources, are increasingly important In the mining industry. The recycling of water and minimizing the use of hazardous chemicals are essential to reducing the environmental impact of mining activities. Automated machines and international expansion are current trends In the market, aiming to enhance the efficiency and selectivity of the process while addressing environmental concerns. Major factors driving the market's significant investments in recent years include the decline in profitability and weak domestic demand for some minerals, the benefits of froth flotation in extracting valuable minerals, and the widened grades of minerals and metals In the aggregates industry. The future estimations indicate imminent investments in froth flotation equipment as the market continues to grow rapidly. A detailed analysis of the competitive intensity, fixed equipment, spare parts, consumables, consultancy, and professional services is crucial for businesses looking to invest in this sector.

What are the market trends shaping the Froth Flotation Equipment Industry?

- New technology advancements is the upcoming market trend. Froth flotation equipment plays a crucial role in mineral processing industries, particularly In the separation of minerals such as lead, zinc, molybdenum, gold, and sulfide ores. The market for this technology has seen significant investments in recent years due to its benefits, including high selectivity and efficient mineral preparation. However, environmental concerns have become major factors In the market's dynamics. Mining operations can lead to soil contamination and the release of hazardous chemicals into surface waters through spills, leaks, and sediment loading. To address these concerns, froth flotation equipment manufacturers focus on developing technologies that minimize water and energy consumption, as well as automated machines that reduce the need for human intervention. For example, Metso Outotec Corp.'s new Concorde Cell flotation technology, launched in November 2021, is a Planet Positive solution that minimizes plant operating costs and contributes to sustainable operations.

- This groundbreaking technology is the first fine and ultra-fine flotation solution for more finely disseminated and complex orebodies, which were previously inaccessible. The market for froth flotation equipment is expected to continue its slowdown in some regions due to weak domestic demand and low profitability. However, there is also rapid growth in other areas, driven by the mining industry's need for high-performance, low-waste equipment. The market is characterized by intense competition, with leading companies offering a range of products, including fomented rectangular and tube shaped cells, flotation columns, and flotation deinking equipment.

- Froth flotation equipment includes fixed equipment, spare parts, consumables, consultancy, and professional services. The market's growth is driven by the need for improved mineral processing, enhanced production, and the recycling of water. The market's future estimations indicate that the demand for froth flotation equipment will continue to grow, with a proportion of investments increasing In the minerals, metals, and aggregates industry. The market's major factors include the benefits of froth flotation, such as high selectivity, floor space efficiency, and low power consumption, as well as the wear rate and environmental concerns.

What challenges does the Froth Flotation Equipment Industry face during its growth?

- Slow growth of mining industry in developed countries is a key challenge affecting the industry growth. The market has experienced varying growth trends in recent years. In developed regions like Europe and North America, the mining industry has seen a slowdown due to economic crises, stringent environmental regulations, and weak domestic demand. High energy costs and low profitability are additional challenges. In contrast, developing economies, particularly in Asia Pacific, have witnessed rapid growth in mining activities due to increasing demand from major industries and favorable government policies. Froth flotation is a widely used mineral processing technique for separating hydrophobic materials from hydrophilic ones. The process is commonly used In the extraction of minerals such as lead, zinc, molybdenum, gold, and sulfide ores.

- However, environmental concerns have emerged as a major factor influencing the market dynamics. Mining operations can lead to soil contamination, wastewater treatment, and the consumption of freshwater resources. The recycling of water and the use of automated machines are essential to mitigate these issues. Major investments have been made In the development of advanced flotation equipment, including fomented rectangular and tube shaped cells, flotation columns, and flotation deinking. These innovations offer benefits such as increased floor space, reduced power consumption, and enhanced selectivity. Environmental concerns have led to the development of more efficient and eco-friendly flotation equipment. Despite these advancements, the market faces challenges such as wear rate, erosion, and exposure to hazardous chemicals. The mining industry's future estimations indicate significant investments in fixed equipment, spare parts, consumables, consultancy, and professional services. The market is expected to widen its scope, with applications In the minerals, metals, and aggregates industry. The market's competitive intensity is high, with leading companies focusing on innovation and expansion to maintain their market position.

Exclusive Customer Landscape

The froth flotation equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the froth flotation equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, froth flotation equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Della Toffola Spa

- Derek Parnaby Cyclones Ltd.

- Eriez Manufacturing Co.

- FLSmidth and Co. AS

- Henan Fote Heavy Machinery Co. Ltd.

- Jiangxi Shicheng Mine Machinery Factory

- Metso Outotec Corp.

- Prominer (Shanghai) Mining Technology Co., Ltd.

- SGS SA

- Tenova Spa

- Westpro Machinery Co.

- Yantai Jinpeng Mining Machinery Co. Ltd.

- Zhengzhou Zhongding Heavy Duty Machine Manufacturing Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The froth flotation market is a significant segment of the mineral processing industries, playing a crucial role In the extraction and concentration of various minerals and metals. Froth flotation is a process that utilizes hydrophobic materials to selectively separate hydrophilic minerals from complex mineral mixtures. This technique is widely used In the extraction of sulfide ores, such as those containing lead, zinc, molybdenum, gold, and copper. Mining operations worldwide rely heavily on froth flotation equipment to optimize their mineral preparing processes. The market for this technology has experienced varying dynamics in recent years, with a slowdown in some regions due to weak domestic demand and low profitability, while others have seen rapid growth due to significant investments in mining activities. The benefits of froth flotation are numerous, including the ability to enhance the grades of minerals and metals, reduce waste rock piles, and minimize the amount of water used In the mining process. However, environmental concerns have emerged as a major factor in the market, with the potential for soil contamination, wastewater treatment, and the use of freshwater resources becoming increasingly important considerations. Froth flotation equipment includes various types of cells, such as fomented rectangular and tube shaped cells, as well as flotation columns. These machines require regular maintenance to ensure optimal performance, including the replacement of worn parts and the consumption of consumables.

The market for froth flotation equipment is diverse, with applications in the production of minerals, metals, and aggregates. The leading producers of this technology include companies specializing in fixed equipment, spare parts, consumables, consultancy, and professional services. Current trends In the market include the automation of machines, international expansion, and the widening of grades to enhance the selectivity of the process. Looking forward, the future estimations for the market are positive, with imminent investments expected to drive growth. The competitive intensity in the market is high, with companies continually seeking to improve the efficiency and sustainability of their offerings. Mineral processing, paper reusing, and flotation deinking are among the industries that benefit from this technology. Despite the benefits of froth flotation, challenges remain, including power consumption, erosion, and the potential for spills and leaks of hazardous chemicals. These issues must be addressed to ensure the long-term sustainability and growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 82.6 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.12 |

|

Key countries |

China, US, Australia, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Froth Flotation Equipment Market Research and Growth Report?

- CAGR of the Froth Flotation Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the froth flotation equipment market growth of industry companies

We can help! Our analysts can customize this froth flotation equipment market research report to meet your requirements.