Zinc Chloride Market Size 2024-2028

The zinc chloride market size is forecast to increase by USD 173.3 million at a CAGR of 4.5% between 2023 and 2028.

- The market exhibits significant growth potential driven by its extensive applications in various industries. Notably, the automotive sector's increasing adoption of zinc chloride as a coagulant in cooling systems and battery production is a key market driver. In addition, textile processing industries rely on zinc chloride for its use as a mordant and desizing agent, further expanding market opportunities. However, the market faces challenges due to the toxic nature of zinc chloride, which poses serious health risks for workers and the environment.

- Producers and consumers must adhere to stringent safety regulations to mitigate these concerns. Despite these challenges, the market's growth trajectory remains , offering potential for companies to capitalize on the strategic landscape by investing in innovative technologies and sustainable production methods.

What will be the Size of the Zinc Chloride Market during the forecast period?

- The market encompasses the global trade of zinc chloride, a white crystalline solid with the chemical formula ZnCl2. This versatile inorganic compound is widely used in various industries due to its antimicrobial properties and ability to act as a catalyst. Key end-use sectors include energy storage devices, water treatment, and personal care applications such as cosmetics and oral hygiene solutions. Zinc chloride is produced through the reaction of zinc metal with hydrochloric acid. Its demand is driven by its use in antiseptics, water treatment, and as a raw material in the production of zinc salts and zinc oxide.

- In the energy sector, zinc chloride plays a crucial role in the production of chlorine gas, which is used in the manufacturing of PVC and other chemicals. The market is expected to grow significantly due to increasing demand from the electronics industry for its use in solar cells and other applications. Additionally, its use as a micronutrient in fertilizers and its role in the EU REACH regulation as a replacement for chlorine gas in water treatment further boosts market growth. Overall, the market is a dynamic and expanding industry that plays a vital role in various sectors, from energy and water treatment to personal care and electronics.

How is this Zinc Chloride Industry segmented?

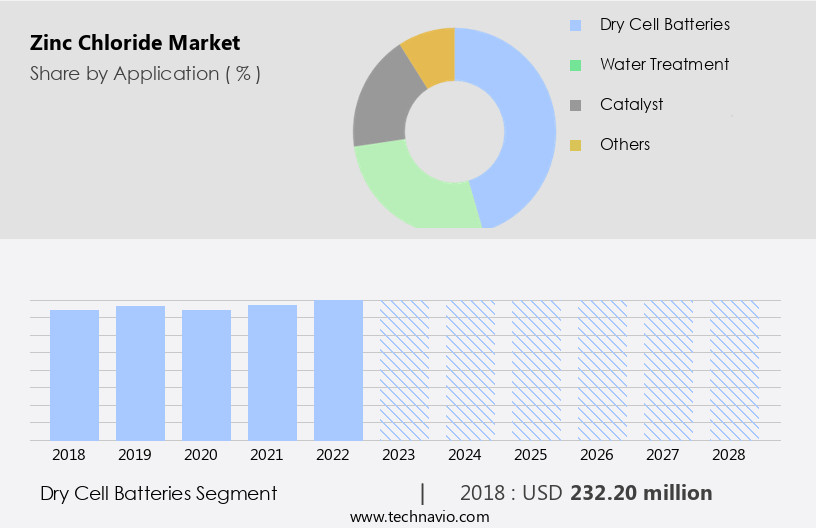

The zinc chloride industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Dry cell batteries

- Water treatment

- Catalyst

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

The dry cell batteries segment is estimated to witness significant growth during the forecast period.

Zinc chloride (ZnCl2), a crucial zinc salt, plays a significant role in various industries, including pharmaceuticals, chemicals, textiles, and agriculture. In the pharmaceuticals sector, it serves as a catalyst in the production of antiseptics, cosmetics, and medicine. The textile segment utilizes zinc chloride as a raw material for manufacturing processes, imparting antimicrobial properties to textiles. The chemicals sector employs zinc chloride in the production of plastics, fertilizers, and batteries. Zinc chloride is a vital component in the manufacturing of zinc oxide, which is used in sunscreens, rubber, and construction materials. Solar cells and renewable energy technologies utilize zinc chloride in product formulations.

In the medicine sector, it is used in oral hygiene solutions and wound care products due to its antimicrobial properties. Environmental regulations have led to the increased adoption of zinc chloride in water treatment processes as an alternative to chlorine gas. The cosmetics sector uses zinc chloride as a micronutrient in energy storage devices and sustainable energy sources. In the consumer goods sector, zinc chloride is used in toothpaste and personal care products. Emerging economies have a growing demand for zinc chloride due to its applications in various industries. The use of zinc chloride in agriculture sector enhances crop yields.

In the electronics industry, zinc chloride is used in batteries, such as zinc air batteries, and in hydrochloric acid production. Zinc chloride's chemical formula is ZnCl2. It is a white crystalline solid that is soluble in water and has various applications in diverse industries.

Get a glance at the market report of share of various segments Request Free Sample

The Dry cell batteries segment was valued at USD 232.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

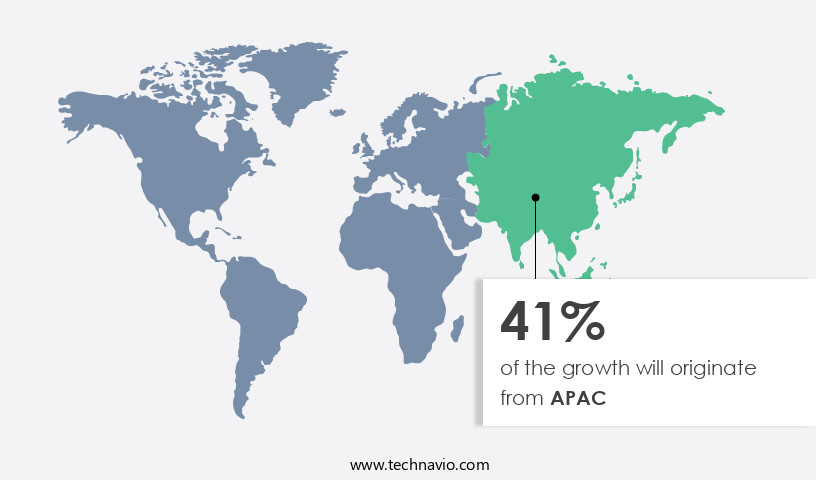

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market holds significant importance in various industries, including pharmaceuticals, textiles, chemicals, consumer goods, and renewable energy technologies. Zinc chloride, a zinc salt, acts as a catalyst in several manufacturing processes, such as the production of antiseptics, cosmetics, and medicine. In the pharmaceuticals sector, it is used in the manufacturing of oral hygiene solutions and wound care products due to its antimicrobial properties. The textile segment utilizes zinc chloride as a mordant in dyeing processes, while the chemicals sector employs it in the production of hydrochloric acid, chlorine gas, and other chemicals. The cosmetics sector uses zinc chloride in product formulations, and the consumer goods industry incorporates it in batteries, solar cells, and water treatment solutions.

APAC is the largest market for zinc chloride, with China and India accounting for a significant share. China's demand for zinc chloride is driven by its extensive use in the agriculture sector for the production of liquid fertilizers and organic synthesis. India is expected to be a high-growth market due to increasing opportunities in the textile, chemical, and automotive industries. Zinc chloride is also used in the production of zinc oxide, which is a critical component in the manufacturing of rubber, construction materials, and plastics. Additionally, it plays a crucial role in energy storage devices, sustainable energy sources, and batteries, such as zinc air batteries.

The chemical formula for zinc chloride is ZnCl2. Environmental regulations are a key factor influencing the market, as it is used in the production of chlorine gas, which contributes to greenhouse gas emissions. However, the increasing demand for zinc chloride in renewable energy technologies, such as solar cells and batteries, offsets this concern. In summary, the market is a vital component in various industries, with APAC being the largest market due to its extensive use in manufacturing processes, particularly in the agriculture and chemical sectors. The increasing demand for zinc chloride in renewable energy technologies and sustainable energy sources is expected to drive market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Zinc Chloride Industry?

- Increasing use of zinc chloride as a coagulant in the automotive industry is the key driver of the market.

- The global market for zinc chloride is experiencing significant growth due to its increasing usage in the production of batteries, particularly in the automotive industry. indicates that zinc chloride batteries offer several advantages, such as high energy density, longer shelf life, and improved performance, making them a viable alternative to lithium-ion batteries in electric vehicles. This shift towards zero-emission transportation is a key factor driving the market's expansion. While lithium-ion batteries currently dominate the electric vehicle battery market, the affordability and weight reduction benefits of zinc chloride batteries are expected to fuel their demand in the forecast period.

- Overall, the market's growth can be attributed to the environmental benefits of electric vehicles and the continuous advancements in battery technology.

What are the market trends shaping the Zinc Chloride Industry?

- Increasing usage in the textile processing industry is the upcoming market trend.

- The global zinc chirlde market is experiencing significant growth due to its extensive usage in the textile industry. In particular, zinc chloride is a crucial component in the resin system for imparting durable press to synthetic and cotton fabrics. Moreover, its application in fabric fresheners to eliminate unpleasant odors is gaining popularity. Approximately 64% of zinc chloride is dissolved in water and utilized for dissolving silk, starch, and cellulose in textile processing.

- Additionally, zinc chloride functions as a coagulant for textile dyes, addressing the issue of dye sludge generation. Overall, the increasing demand for eco-friendly and efficient textile processing solutions is fueling the growth of the market.

What challenges does the Zinc Chloride Industry face during its growth?

- High toxicity nature of zinc chloride leading to serious health issues is a key challenge affecting the industry growth.

- Zinc chloride is a hazardous compound with potential health risks, including lung damage, skin irritation, and gastrointestinal issues. Exposure to zinc chloride smoke screens, which are used for civilian and military screening purposes, has led to several lethal incidents in confined spaces. While the use of zinc chloride in open air is considered relatively safe with specific limitations, the health hazards associated with this compound cannot be overlooked. The detrimental effects of zinc chloride on the lungs have been a subject of concern in .

- Despite its applications, the safety measures required to handle and use zinc chloride must be strictly adhered to to minimize potential health risks. It is essential for companies and users to prioritize safety protocols and follow industry guidelines when dealing with this compound.

Exclusive Customer Landscape

The zinc chloride market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the zinc chloride market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, zinc chloride market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AUREA SA - Zinc chloride is a versatile inorganic compound extensively utilized in various industries. In the realm of materials science, it plays a pivotal role in nylon production and the vulcanization of cellulose fibers in paper manufacturing. Within the water treatment sector, zinc chloride serves as an essential component for disinfection and corrosion inhibition. Pharmaceuticals benefit from its application as an active ingredient in numerous medications. Additionally, zinc chloride is indispensable in surface treatment processes, enhancing adhesion and providing protective coatings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AUREA SA

- American Elements

- Benzer Multitech India Pvt. Ltd.

- Eurocontal SA

- Global Chemical Co. Ltd.

- Haihang Industry Co. Ltd.

- Haryana Chemical Industries

- Merck KGaA

- Pan Continental Chemical Co. Ltd.

- PT. INDO LYSAGHT

- SA Lipmes

- Shanxi Wencheng Chemical Co. Ltd.

- Tianjin Nanping Chemical Co. Ltd.

- TIB Chemicals AG

- Vinipul Inorganics Pvt. Ltd.

- Vishnupriya Chemicals Pvt. Ltd.

- Weifang Hengfeng Zinc Industry

- Zaclon LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Zinc chloride is a vital inorganic compound with the chemical formula ZnCl2. This white crystalline micronutrient is widely used in various industries due to its unique properties and versatile applications. The market is driven by its extensive utilization in diverse sectors, including pharmaceuticals, textiles, chemicals, consumer goods, renewable energy technologies, and others. In the pharmaceuticals sector, zinc chloride serves as a catalyst in the production of several drugs. It is used in the synthesis of antiseptics and medicines, including oral hygiene solutions. Its antimicrobial properties make it an essential ingredient in wound care products, ensuring effective healing and infection prevention.

The textile segment is another significant consumer of zinc chloride. It is used as a finishing agent to improve fabric quality, enhance color retention, and provide flame retardancy. In the cosmetics sector, zinc chloride is used in product formulations as a stabilizer and preservative, contributing to the shelf life and effectiveness of various cosmetic products. The chemicals segment is a significant contributor to the market. It is used as a raw material in the manufacturing processes of various chemicals, such as chlorine gas, hydrochloric acid, and zinc oxide. In the agriculture sector, zinc chloride is used as a fertilizer to improve crop yields.

The solar cells industry relies on zinc chloride as a key component in the production of energy storage devices, such as zinc air batteries. In the plastics industry, zinc chloride is used as a plasticizer and stabilizer, enhancing the properties of various polymers. The use of zinc chloride extends to the construction materials sector, where it is used as a reinforcing agent in rubber and concrete. In the water treatment industry, zinc chloride is used as a disinfectant and corrosion inhibitor, ensuring the safe and efficient distribution of water. The personal care sector also utilizes zinc chloride in various product formulations, including toothpaste, due to its antimicrobial properties.

In the electronics industry, zinc chloride is used in the production of various components, including batteries and renewable energy technologies. Environmental regulations play a crucial role in the market. Strict regulations regarding the disposal of hazardous waste and the implementation of sustainable energy sources have led to the development of eco-friendly manufacturing processes. This trend is expected to drive the demand for zinc chloride in the production of green energy sources. In , the market is driven by its extensive utilization in various industries, including pharmaceuticals, textiles, chemicals, consumer goods, renewable energy technologies, and others. Its unique properties and versatile applications make it an essential component in various manufacturing processes and product formulations.

The market is expected to grow significantly due to the increasing demand for sustainable manufacturing processes and eco-friendly products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 173.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Zinc Chloride Market Research and Growth Report?

- CAGR of the Zinc Chloride industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the zinc chloride market growth of industry companies

We can help! Our analysts can customize this zinc chloride market research report to meet your requirements.