Frozen Pizza Market Size 2025-2029

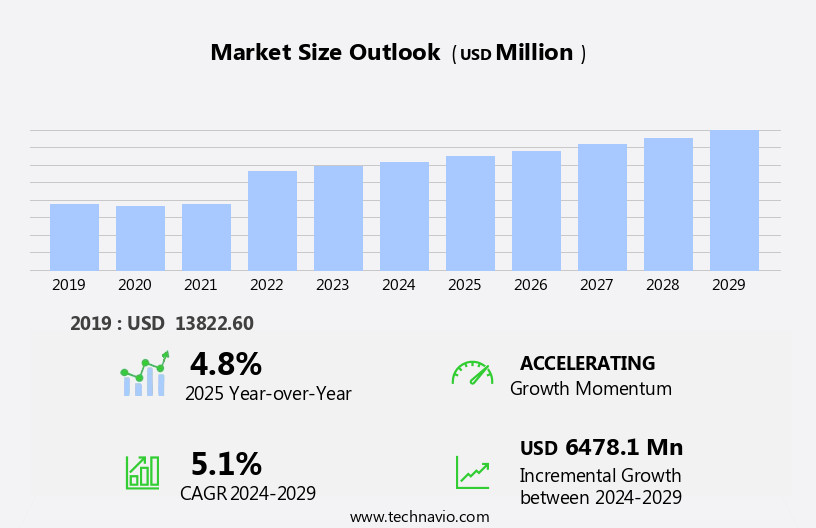

The frozen pizza market size is forecast to increase by USD 6.48 billion, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing consumer preference for convenient and affordable meal options. A notable trend in this market is the rising demand for vegan frozen pizzas, as more consumers adopt plant-based diets. However, market growth is not without challenges. Product recalls have emerged as a major obstacle, posing risks to both consumer safety and brand reputation. Manufacturers must prioritize food safety protocols to mitigate these risks and maintain consumer trust. Additionally, with increasing competition, companies must differentiate themselves through product innovation, pricing strategies, and effective marketing campaigns to capture market share.

- To capitalize on the growing demand for vegan frozen pizzas, manufacturers can invest in research and development to create unique and delicious offerings that cater to this consumer segment. Meanwhile, implementing robust quality control measures to prevent product recalls is essential to maintain market presence and customer loyalty.

What will be the Size of the Frozen Pizza Market during the forecast period?

The market continues to evolve, reflecting shifting consumer preferences and advancements in technology. Consumers seek out flavor variety, nutritional value, and dietary accommodations, driving product innovation in this sector. Packaging waste and food waste remain key concerns, prompting manufacturers to explore more sustainable solutions. Food safety and temperature control are paramount in the cold chain, ensuring the highest quality for consumers. Brand loyalty is fostered through effective marketing campaigns and social media engagement. The environmental impact of the frozen food industry is under scrutiny, leading to increased focus on ingredient sourcing and reducing carbon footprint.

Food trends, such as health consciousness and convenience, further influence market dynamics. Online ordering and home delivery services cater to busy consumers, while food service applications expand the market's reach. New product development responds to evolving consumer behavior, with gluten-free and size options becoming increasingly popular. The market's continuous dynamism underscores its relevance in the broader food industry landscape. Consumer preferences, food trends, and technological advancements all contribute to the ongoing unfolding of market activities, ensuring a vibrant and ever-evolving marketplace.

How is this Frozen Pizza Industry segmented?

The frozen pizza industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Regular frozen pizza

- Premium frozen pizza

- Gourmet frozen pizza

- Type

- Non-vegetarian toppings

- Vegetarian toppings

- Distribution Channel

- Online

- Offline

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

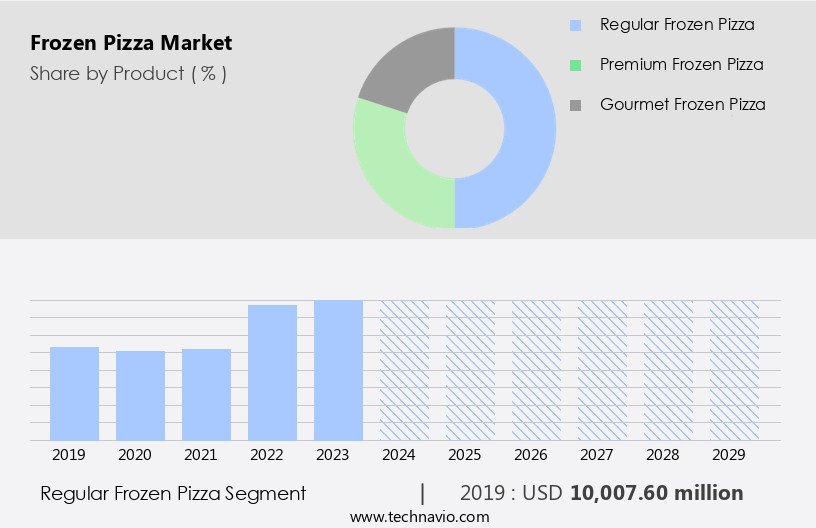

The regular frozen pizza segment is estimated to witness significant growth during the forecast period.

The market encompasses a variety of offerings, including ready meals with extended shelf life. Supply chain management plays a crucial role in ensuring product availability and temperature control throughout the distribution process. Marketing campaigns emphasize convenience, affordability, and flavor variety to appeal to consumers. Price points differ based on product innovation, with premium and gourmet pizzas featuring soft crusts, unique toppings, and higher nutritional value commanding a higher cost. Grocery stores and delivery services are key sales channels, with online ordering and home delivery options gaining popularity. Social media platforms are utilized for marketing and consumer engagement, while environmental impact and food trends influence consumer preferences.

Product innovation continues to drive the market, with new offerings catering to dietary restrictions, gluten-free options, and size variations. Food manufacturers prioritize food safety and quality control, implementing stringent measures to minimize food waste and packaging waste. The frozen food industry's carbon footprint is under scrutiny, leading to increased focus on ingredient sourcing and sustainable practices. Consumer behavior and convenience continue to shape the market, with cold chain logistics ensuring product integrity and temperature control during transportation and storage. New product development is a continuous process, with companies focusing on catering to evolving consumer preferences and food trends. The market is a significant player in the convenience foods sector, offering a wide range of options to meet diverse consumer needs.

The Regular frozen pizza segment was valued at USD 10.01 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

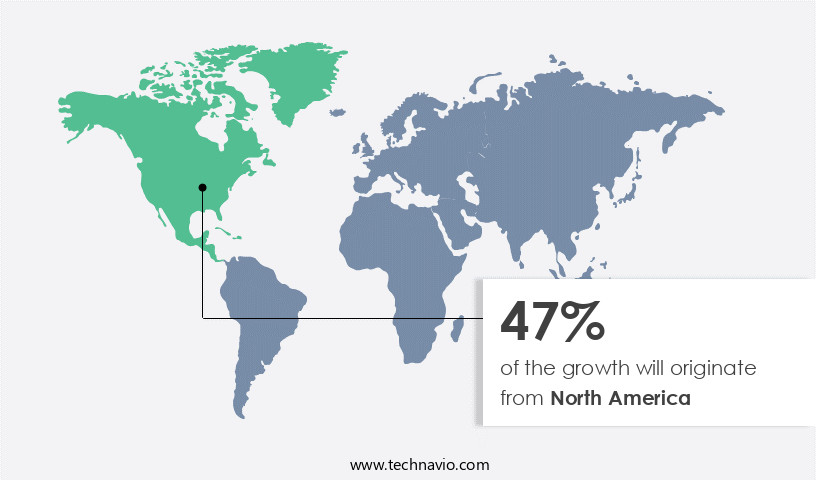

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experiences significant demand due to the convenience these products offer to consumers, particularly those with busy lifestyles. With no additional preparation required, frozen pizza is an ideal choice for individuals seeking quick and easy meal solutions. In 2024, the US market held the largest revenue share in the region. The market's growth is further fueled by the continuous launch of innovative products and marketing campaigns. Companies are utilizing creative strategies to boost product visibility and sales, contributing to the market's expansion during the forecast period. Sustainability and health consciousness are emerging trends in the frozen food industry, influencing the development of new products.

Frozen pizza manufacturers are focusing on reducing their carbon footprint by implementing efficient supply chain management and cold chain logistics. Social media platforms are being leveraged for marketing efforts, reaching a wider audience and engaging consumers. Price point remains a crucial factor in consumer decision-making, with ready meals and convenience foods continuing to gain popularity. Ingredient sourcing and food safety are essential considerations for both manufacturers and consumers. Dietary restrictions, such as gluten-free and size options, are increasingly being catered to in new product development. Food trends, including plant-based and organic options, are also impacting the market. Online ordering and home delivery services have become increasingly popular, offering consumers the convenience of having their meals delivered directly to their doors.

Temperature control and quality control are essential aspects of the supply chain, ensuring the freshness and safety of the products. In conclusion, the market in North America is driven by consumer preferences for convenience and innovative product offerings. Companies are focusing on sustainability, health, and dietary restrictions to cater to evolving consumer needs while implementing effective marketing strategies and efficient supply chain management.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Frozen Pizza Industry?

- The new product launches serve as the primary catalyst for market growth.

- The market is experiencing significant growth due to new product developments by food manufacturers. These innovations cater to various consumer preferences, including health consciousness and taste. For instance, Nestle's January 2025 launch of Vital Pursuit Max Pro frozen pizzas, offering high protein and fiber content, targets health-conscious consumers. Similarly, Newman's Own April 2024 product expansion included Southwest Ranch dressing, sourdough crust, and stone-fired crust frozen pizzas, broadening their portfolio. These new offerings increase the market's appeal, attracting more consumers and contributing to the industry's expansion. Additionally, delivery services, such as home delivery and pizza delivery, ensure temperature control and quality control, making frozen pizza a convenient and reliable food solution for consumers.

- The carbon footprint of the frozen food industry remains a concern, but companies are continuously working on reducing it through sustainable practices and efficient supply chains. Overall, the market's growth is driven by new product development, convenience, and consumer preferences.

What are the market trends shaping the Frozen Pizza Industry?

- The increasing preference for vegan options is shaping the market trend towards vegan frozen pizza. This trend signifies a significant shift in consumer behavior towards plant-based food choices.

- Consumer behavior continues to evolve in the food industry, with an increasing focus on health and dietary restrictions driving demand for plant-based options. Vegan consumers, in particular, are seeking out alternatives to animal-based food products due to health and food safety concerns. The vegan diet, which excludes all animal products, offers various health benefits, including a lower risk of cardiovascular disease and metabolic disorders. It is also rich in essential nutrients such as folate, magnesium, potassium, vitamin A, vitamin C, and vitamin E. In response to this trend, market players are introducing new vegan frozen pizza products to cater to this growing consumer base.

- Packaging waste and food waste remain concerns for consumers, leading companies to focus on sustainable and eco-friendly packaging solutions. Additionally, offering flavor variety, nutritional value, and size options are essential to meet the diverse needs of consumers. The convenience of frozen foods, especially in the food service sector, makes them a popular choice for consumers with busy lifestyles. Overall, the demand for vegan frozen pizza is on the rise, and companies must adapt to meet the changing consumer preferences.

What challenges does the Frozen Pizza Industry face during its growth?

- Product recalls pose a significant challenge to industry growth, as companies must address safety concerns and mitigate potential damage to their reputation and financial standing.

- In the market, ensuring product safety and maintaining supply chain integrity are crucial for manufacturers to uphold brand loyalty and consumer trust. Raw materials, sourced from external suppliers, significantly impact the final product's quality. Any mishandling or non-compliance with food safety regulations can lead to product recalls, negatively affecting a company's reputation and sales. Additionally, manufacturing and packaging defects can further harm brand image. Effective supply chain management and adherence to regulatory standards are essential to mitigate risks and maintain consumer confidence in ready meals, which are an increasingly popular choice for time-strapped consumers.

- Marketing campaigns and product innovation play a vital role in attracting and retaining customers, but the foundation of a successful frozen food business lies in maintaining a robust and reliable supply chain.

Exclusive Customer Landscape

The frozen pizza market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the frozen pizza market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, frozen pizza market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amys Kitchen Inc. - This company specializes in the production and distribution of a diverse range of premium frozen pizzas. Our product line includes Cheese pizza, Spanish pizza, and Vegan supreme pizza. Each pizza is meticulously crafted using high-quality ingredients to deliver an authentic and delicious dining experience. Our commitment to innovation and originality sets US apart in the market, enhancing our online presence and attracting a wide customer base. Our frozen pizzas are not only convenient but also cater to various dietary preferences, making US a go-to choice for discerning consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amys Kitchen Inc.

- Atkins Nutritionals Inc.

- Bellisio Foods Inc.

- Bernatellos Foods

- Cappellos

- Caulipower LLC

- CJ CheilJedang Corp.

- Conagra Brands Inc.

- Dr. August Oetker KG

- Freiberger Lebensmittel GmbH

- General Mills Inc.

- Hansen Foods LLC

- Nestle SA

- Newmans Own Inc.

- Nomad Foods Ltd.

- Orkla ASA

- Palermo Villa Inc.

- Richelieu Foods Inc.

- The Kroger Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Frozen Pizza Market

- In February 2023, General Mills, a leading player in the market, introduced a new line of cauliflower crust pizzas under its popular brand, Totino's. This innovation caters to the growing consumer demand for healthier and low-carb options (General Mills Press Release).

- In March 2024, Domino's Pizza, the world's largest pizza chain, announced a strategic partnership with DoorDash, the leading on-demand food delivery platform, to enhance its delivery capabilities and reach more customers. This collaboration aims to leverage DoorDash's delivery infrastructure and technology to improve Domino's delivery experience (Domino's Pizza Press Release).

- In June 2024, Nestle, the global food and beverage giant, completed the acquisition of Starbucks' at-home coffee and tea business, including its frozen pizza line, for approximately USD7.15 billion. This acquisition is expected to strengthen Nestle's presence in the frozen food market and expand its product portfolio (Reuters).

- In October 2025, the European Union approved the use of plant-based meat alternatives in frozen pizzas, marking a significant regulatory development for the industry. This decision opens up new opportunities for companies to introduce innovative, sustainable, and vegan-friendly pizza options (European Commission Press Release).

Research Analyst Overview

- In the dynamic the market, customer reviews significantly influence consumer decisions, with product differentiation playing a crucial role in shaping purchasing behavior. Marketing strategies, including price sensitivity, inventory management, and e-commerce platforms, are essential tools for brands seeking to engage customers and optimize supply chain operations. Food processing technologies enable artisan pizza makers to deliver authentic flavors, while consumer segmentation and brand positioning cater to various dietary needs and preferences. Frozen food technology advances continue to reduce preparation time and enhance consumer satisfaction, with premium offerings like gourmet pizza, pan pizza, deep dish, and thin crust catering to diverse tastes.

- Food waste reduction and sustainable packaging are key trends, providing a competitive advantage and appealing to environmentally-conscious consumers. Brand recognition and nutritional information are essential for transparency and trust, with digital marketing and social media platforms driving engagement and sales. Consumers increasingly demand clear product labeling, easy-to-follow cooking instructions, and catering to food allergies. Product lifecycle management and sustainable ingredient sourcing are essential for long-term success in this competitive landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Frozen Pizza Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 6478.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, UK, Canada, Germany, France, Italy, Spain, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Frozen Pizza Market Research and Growth Report?

- CAGR of the Frozen Pizza industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the frozen pizza market growth of industry companies

We can help! Our analysts can customize this frozen pizza market research report to meet your requirements.