Gluten Free Pizza Crust Market Size 2024-2028

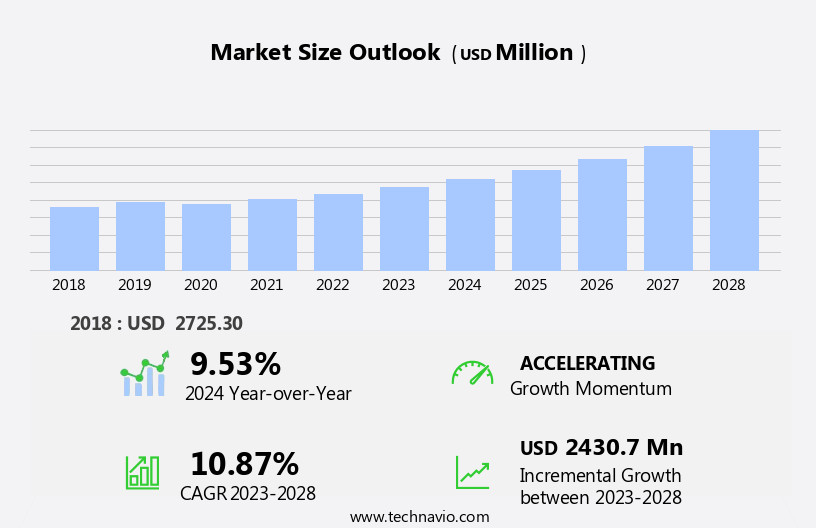

The gluten free pizza crust market size is forecast to increase by USD 2.43 billion at a CAGR of 10.87% between 2023 and 2028.

- The gluten-free pizza crust market is witnessing significant growth due to the increasing demand for gluten-free products. This trend is driven by the growing number of people with celiac disease or gluten intolerance, as well as those following a gluten-free diet for health reasons. Additionally, the consumer preference for vegan pizza over frozen pizza is also fueling market growth.

- However, stringent regulations and the risk of product recalls due to contamination pose challenges for market players. Ensuring compliance with these regulations and implementing robust quality control measures are essential to mitigate these challenges and maintain consumer trust. The market is expected to continue its growth trajectory in the coming years, driven by these trends and the increasing awareness and acceptance of gluten-free food options.

What will be the Size of the Gluten Free Pizza Crust Market During the Forecast Period?

- The gluten-free pizza crust market is a significant segment of the larger gluten-free food products industry, driven by the rising prevalence of autoimmune disorders such as celiac diseases and gluten sensitivity. These conditions affect the small intestine, making it difficult for individuals to digest gluten, a protein found in wheat, barley, and rye. As a result, consumers seek alternatives, leading to increased demand for gluten-free pizza crusts. Rice flour, almond flour, potato starch, and tapioca starch are common ingredients used to create these crusts, catering to various dietary preferences and restrictions. Retail chains, retail outlets, supermarkets and hypermarkets, bakeries, and pizza outlets are key distribution channels.

- Consumers prioritize health, energy, insulin management, and the alleviation of sickness symptoms, such as acne, cholesterol, and inflammation, when choosing gluten-free pizza crusts. Conventional pizza crusts, made with wheat, oil, organic sugar, and salt, are increasingly being replaced by their gluten-free counterparts. The market is expected to continue growing, driven by increasing awareness and the expanding availability of these alternatives at various outlets.

How is this Gluten Free Pizza Crust Industry segmented and which is the largest segment?

The gluten free pizza crust industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Conventional

- Organic

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Italy

- APAC

- South America

- Middle East and Africa

- North America

By Product Insights

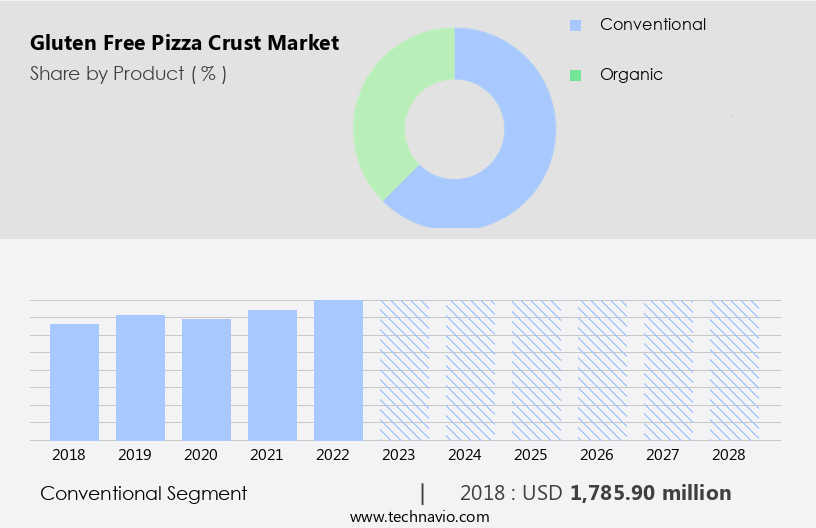

- The conventional segment is estimated to witness significant growth during the forecast period.

The gluten-free pizza market is experiencing significant growth due to the rising prevalence of autoimmune disorders, including celiac disease and gluten sensitivity. As a response, numerous food manufacturers have introduced gluten-free pizza crusts made from alternative flours like rice, almond, potato starch, and tapioca starch. Consumers are increasingly seeking gluten-free options to address health concerns related to insulin levels, sickness, acne, cholesterol, and severe health problems. Retail chains, retail outlets, supermarkets and hypermarkets, bakeries, franchise outlets, pizza outlets, and online platforms offer a wide range of gluten-free pizza crusts. Innovative and exotic flavors are gaining popularity, particularly among millennials. Developing economies, such as China, India, Brazil, South Africa, and Indonesia, are emerging markets for gluten-free pizza crusts due to their growing focus on healthy food and improving quality of life.

Get a glance at the Gluten Free Pizza Crust Industry report of share of various segments Request Free Sample

The Conventional segment was valued at USD 1.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

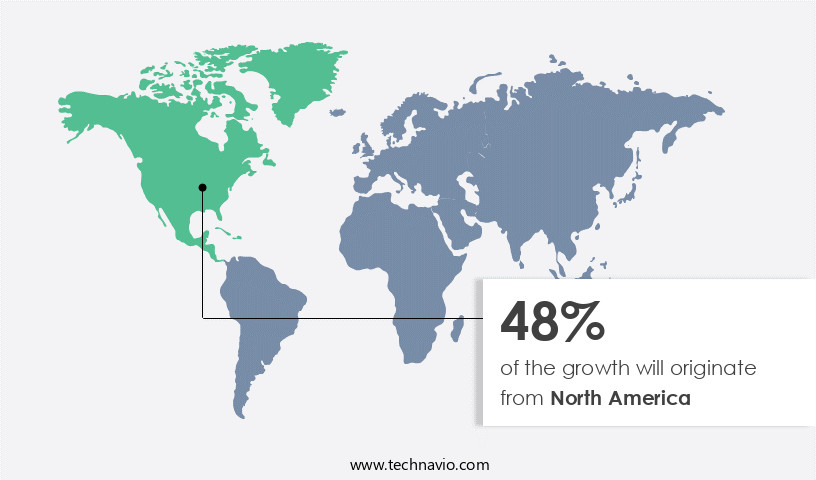

- North America is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The gluten-free pizza crust market in North America is experiencing significant growth due to the increasing prevalence of autoimmune disorders, particularly celiac disease.Celiac disease affects the small intestine and can lead to severe health problems when individuals consume gluten. In the US, Canada, and Mexico, the incidence of celiac disease is on the rise, leading to a surge in demand for gluten-free alternatives, including pizza crusts. These crusts are often made from rice flour, almond flour, potato starch, or tapioca starch, and are available at retail chains, retail outlets, supermarkets and hypermarkets, bakeries, franchise outlets, pizza outlets, and online.

Major players In the market include Cali'flour Foods and others. The convenience and taste of these healthy substitutes have made them popular among consumers seeking to manage their health conditions or follow a gluten-free diet for other reasons, such as gluten sensitivity or personal preference. These factors are driving the growth of the gluten-free pizza crust market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Gluten Free Pizza Crust Industry?

Growing demand for gluten free food products is the key driver of the market.

- The gluten-free food market In the US has experienced significant growth due to the increasing prevalence of autoimmune disorders such as celiac disease and gluten sensitivity. These conditions require individuals to avoid gluten, a protein found in wheat, barley, and rye. As a result, there is a high demand for gluten-free alternatives to traditional food products, including pizza crust. Gluten-free pizza crust is now widely available in retail chains, retail outlets, supermarkets and hypermarkets, bakeries, franchise outlets, and even online and at pizza outlets. Manufacturers use various substitutes like rice flour, almond flour, potato starch, and tapioca starch to create these crusts.

- The global gluten-free pizza crust market is expected to continue growing due to the increasing health consciousness among consumers. Gluten-free pizza is not only preferred by individuals with celiac disease or gluten intolerance but also by those who choose to follow a gluten-free diet for other health reasons, such as managing insulin levels, acne, cholesterol, or severe health problems. The market is driven by the increasing consumption of Western food, which often contains gluten, and the need for healthy and energy-giving alternatives. The production and distribution of gluten-free pizza crust require a well-established logistic network to ensure freshness and quality.

- The market is competitive, with several players offering various options, including organic and low-calorie versions. The taste and texture of gluten-free pizza crust have improved significantly over the years, making it a viable substitute for traditional pizza crust for a growing number of consumers.

What are the market trends shaping the Gluten Free Pizza Crust Industry?

Growing consumer inclination for vegan pizza is the upcoming market trend.

- Gluten-free pizza crusts have become a popular alternative for individuals with autoimmune disorders such as celiac disease or gluten sensitivity. These disorders affect the small intestine, making it difficult for individuals to consume foods containing gluten, a protein found in wheat, barley, and rye. As a result, the demand for gluten-free food products, including pizza crusts, has been on the rise. Manufacturers are responding to this trend by introducing various gluten-free pizza crust options made from alternative flours like rice, almond, potato starch, and tapioca starch. These crusts are available at retail chains, retail outlets, supermarkets and hypermarkets, bakeries, franchise outlets, and pizza outlets.

- Online sales have also gained traction as consumers increasingly opt for the convenience of home delivery. The gluten-free pizza market caters to a wide range of consumers, including those with severe health problems like diabetes, acne, high cholesterol, and insulin resistance. These consumers prioritize health, energy, and insulin management, making gluten-free pizza a desirable option. The market dynamics are driven by the growing awareness of gluten sensitivity and celiac diseases, as well as the increasing preference for healthy food and substitute products. Gluten-free pizza crusts are made with minimal oil, sugar, and salt, making them a healthier alternative to conventional pizza crusts.

- Companies offer cauliflower-based pizza crusts that are low in calories and high in fiber, appealing to health-conscious consumers. Overall, the gluten-free pizza market is expected to continue growing as more consumers seek out healthier alternatives to traditional pizza crusts.

What challenges does the Gluten Free Pizza Crust Industry face during its growth?

Stringent regulations cause product recalls is a key challenge affecting the industry growth.

- The gluten-free pizza crust market caters to individuals with autoimmune disorders such as celiac diseases or gluten sensitivity. These disorders affect the small intestine, causing severe health problems including sickness, acne, insulin intolerance, cholesterol imbalance, and energy depletion. In response, the market offers various substitutes for conventional pizza crusts made from rice flour, organic options, and alternative flours like almond, potato starch, and tapioca starch. Retail chains, retail outlets, supermarkets, and hypermarkets, bakeries, franchise outlets, pizza outlets, and even online platforms sell these gluten-free pizza crusts. The market's growth is driven by the increasing prevalence of gluten-related disorders and the demand for healthy food alternatives.

- Manufacturers adhere to strict regulations, including international food standards (Codex Alimentarius) and US FDA guidelines. These regulations ensure that gluten-free food products contain less than 20 parts per million (ppm) of gluten, preventing cross-contamination. Failure to comply can lead to costly product recalls and reputational damage. Consumers value taste and convenience, making it essential for manufacturers to maintaIn the taste and texture of traditional pizza crusts while adhering to gluten-free standards. The market's growth is fueled by the rising awareness of gluten sensitivity and celiac diseases, making it a significant sector In the Western food industry.

Exclusive Customer Landscape

The gluten free pizza crust market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gluten free pizza crust market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gluten free pizza crust market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amys Kitchen Inc.

- Authentic Foods

- BFree Foods USA Inc.

- Bobs Red Mill Natural Foods Inc.

- Califlour Foods

- Chebe

- Conagra Brands Inc.

- DeIorios Foods Inc.

- Dr. Schar

- GGZ srl

- Ittella International LLC

- KSKT Agro Mart Pvt. Ltd.

- MrJims. Pizza

- Namaste Foods LLC

- Nestle SA

- OGGI FOODS Inc.

- Rich Products Corp.

- The Essentials Baking Co.

- TULI HOUSE

- US Foods Holding Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The gluten-free pizza crust market represents a significant segment withIn the broader gluten-free food industry. This market caters to consumers with autoimmune disorders, specifically those affected by gluten sensitivity or celiac disease. These individuals require a strict adherence to a gluten-free diet due to the potential health complications associated with consuming gluten. Gluten, a protein found in wheat, barley, and rye, can cause a range of adverse health effects. In the small intestine, gluten triggers an immune response that can lead to severe health problems. Symptoms can include energy depletion, insulin intolerance, acne, sickness, and even cholesterol imbalances. For those diagnosed with celiac disease, the ingestion of gluten can result in more severe consequences, including damage to the intestinal lining and malnutrition.

To cater to this growing consumer base, various pizza crust alternatives have emerged. These alternatives include rice flour, organic, and other non-wheat-based options such as almond flour, potato starch, and tapioca starch. These substitutes allow consumers to enjoy the taste and convenience of pizza without the health risks associated with gluten. The gluten-free pizza market is diverse and expansive, encompassing various retail channels. Retail chains, retail outlets, supermarkets and hypermarkets, bakeries, franchise outlets, pizza outlets, and even online platforms offer gluten-free pizza crusts. The availability of these options has been instrumental in driving the growth of the market.

The production and distribution of gluten-free pizza crusts require a robust transportation and logistic network. Ensuring the integrity of the product during transportation and storage is crucial to maintaining the quality and safety of the final product. The taste and texture of gluten-free pizza crusts have been a topic of discussion withIn the industry. While some consumers argue that these alternatives do not compare to their conventional counterparts, others appreciate the health benefits and find the taste satisfactory. As the market continues to evolve, innovation and advancements in technology are expected to improve the taste and texture of gluten-free pizza crusts.

The gluten-free pizza market is driven by the increasing awareness and diagnosis of celiac disease and gluten sensitivity. As more individuals adopt a gluten-free lifestyle, the demand for gluten-free pizza crusts is expected to grow. Additionally, the trend towards healthy eating and the desire for convenient meal options further bolsters the market's growth. The gluten-free pizza crust market represents a significant opportunity for businesses looking to cater to consumers with dietary restrictions. With a diverse range of options and a growing consumer base, this market is poised for continued growth. The production and distribution of these alternatives require a robust logistic network, ensuring the quality and safety of the final product. As awareness and diagnosis of celiac disease and gluten sensitivity continue to rise, the demand for gluten-free pizza crusts is expected to grow.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 2.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, Italy, Canada, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gluten Free Pizza Crust Market Research and Growth Report?

- CAGR of the Gluten Free Pizza Crust industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gluten free pizza crust market growth of industry companies

We can help! Our analysts can customize this gluten free pizza crust market research report to meet your requirements.