Frozen Vegetables Market Size 2024-2028

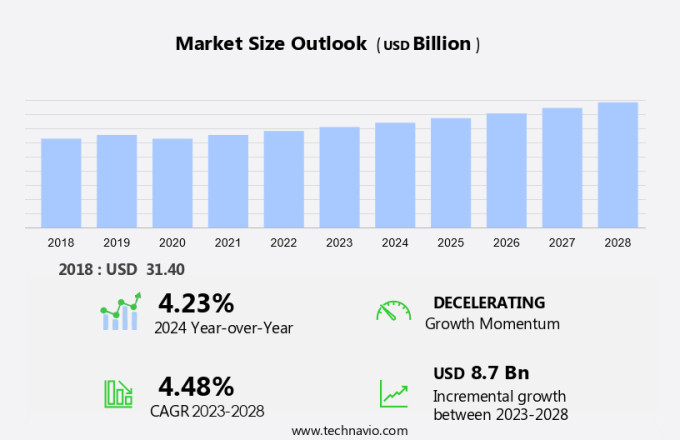

The frozen vegetables market size is forecast to increase by USD 8.7 billion at a CAGR of 4.48% between 2023 and 2028. The market is experiencing significant growth, driven by several key factors. The younger population's increasing preference for convenient and healthy meal solutions is a major trend. With professional commitments keeping people busy, the availability of frozen vegetables during off-season is a significant advantage. Technological developments in the industry, such as improved shelf life and packaging, are also contributing to market growth. However, challenges remain, including the need for better cold chain and logistics facilities to ensure product quality and freshness. RaboBank's latest research indicates that consumer favoritism towards frozen vegetables is on the rise, making it an attractive investment opportunity for businesses in the food industry.

The market continues to thrive, offering consumers a convenient alternative to fresh produce. With the increasing preference for convenience foods, the demand for frozen vegetables as snack options and ingredients has flooded. However, the sector faces challenges such as raw material shortages and shipping delays due to economic slowdown. Despite these hurdles, frozen vegetable companies have managed to maintain sales revenue by catering to the needs of younger populations, who prioritize health and convenience. Urbanization and technological developments have further boosted the market, enabling companies to innovate and offer a wider range of products. Educational initiatives promoting the nutritional benefits of frozen vegetables have also contributed to their growing popularity. Despite the challenges, the future of the market looks promising, with continued growth expected in the retail channels.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- UK

- France

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

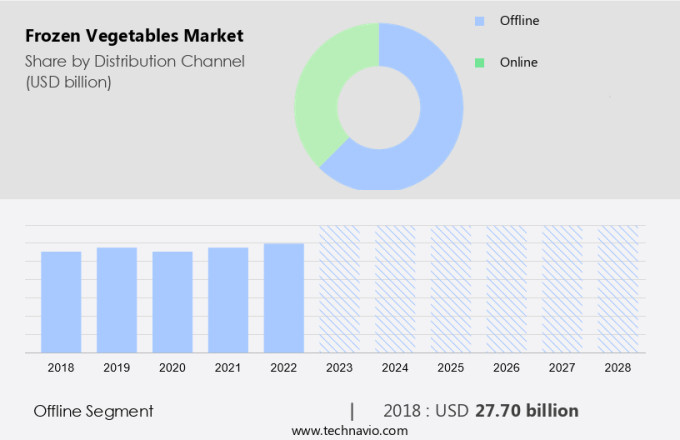

The offline segment is estimated to witness significant growth during the forecast period. The market has experienced shipping delays and economic slowdown, leading to a shift in consumer preferences towards local and regional suppliers. Younger populations are increasingly opting for frozen vegetables as a convenient snack option, driving demand in the market. According to market research, the offline distribution channel, which includes hypermarkets and supermarkets, accounted for approximately 66% of the market share in 2018. Consumers prefer buying actual veggies from these establishments due to the vast selection of products and the guidance of customer service personnel. The expansion of organized retail and the proliferation of hypermarkets and supermarkets, such as Walmart, Tesco.Com, Carrefour, SPAR International, and Target Brands Inc., have significantly contributed to the growth of this segment.

Get a glance at the market share of various segments Request Free Sample

The offline segment accounted for USD 27.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Europe experiences significant demand due to various factors. Economic recovery and advanced infrastructure facilitate the growth of this market. Health consciousness among consumers, driven by concerns about nutritional deficiencies, fuels the consumption of nutrient-rich vegetables. Major contributors to the European market include the UK, Germany, and France. These countries also lead in importing frozen vegetables from other nations in terms of value. Urbanization has resulted in increased disposable income for consumers, making convenience products like frozen vegetables a popular snack option. Despite shipping delays, the market continues to thrive, catering to the needs of younger populations who value the benefits of actual veggies without compromising on convenience.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The availability of frozen vegetables during off-season is the key driver of the market. Frozen vegetables have gained significant popularity in the US market due to their year-round availability and convenience. Unlike fresh produce, some seasonal vegetables can only be obtained during specific periods. By freezing these vegetables, they become accessible throughout the year, catering to consumer demand. Moreover, the frozen vegetable processing method results in a longer shelf life of approximately 10-12 months. This factor is a significant market driver, enabling consumers to enjoy their preferred vegetables regardless of the season. The yield per kilogram (kg) of frozen vegetables is typically higher than that of fresh vegetables, as they are pre-cleaned, blanched, and ready-to-cook. This attribute further adds to their appeal. Despite the availability of raw materials from various regions, including Europe, Africa, and South America, potential raw material shortages may impact the frozen vegetable industry.

Market Trends

Technological developments in the frozen vegetables market is the upcoming trend in the market. The market has witnessed significant advancements in preservation technologies, with innovations such as dehydrofreezing and individually quick-frozen (IQF) gaining popularity. Dehydrofreezing is a process that combines drying and freezing, ensuring vegetables maintain an optimal moisture content. The vegetables are first dehydrated using osmotic dehydration in a sodium chloride solution, followed by freezing at temperatures below -18 degrees Celsius. IQF, on the other hand, quickly freezes each individual vegetable, preserving their texture and flavor. These technological advancements cater to the growing demand for convenience foods and the increasing preference for fresh produce in retail channels. Frozen vegetable companies continue to invest in research and development to meet consumer expectations and address raw material shortages.

Market Challenge

Inadequate cold chain and logistics facilities is a key challenge affecting the market growth. The market faces a significant hurdle due to inadequate cold chain and transportation infrastructure. Preserving frozen vegetables in optimal cold storage conditions during transportation from processing units to retail outlets is essential to prevent contamination, spoilage, or damage. The Global Cold Chain Alliance (GCCA) highlights that developing countries encounter numerous challenges due to insufficient cold chain facilities and logistics. Inadequate refrigerated transport systems can result in temperature fluctuations, posing a risk to the quality and safety of frozen vegetables. The importance of investing in advanced cold chain technology and infrastructure cannot be overstated to ensure the integrity and availability of these convenience foods in retail channels.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ardo Coordination Center NV - The company offers frozen vegetables such as Classics, Express, and Bio Organic.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- B and G Foods Inc.

- Conagra Brands Inc.

- Congeladora Horticola S.A. de C.V.

- General Mills Inc.

- Goya Foods Inc.

- Greenyard NV

- Hormel Foods Corp.

- J.R. Simplot Co.

- Kellogg Co.

- McCain Foods Ltd.

- Nestle SA

- Newberry International Produce Ltd.

- Nomad Foods Ltd.

- The Hain Celestial Group Inc.

- The Kraft Heinz Co.

- Uren Food Group Ltd.

- Waitrose and Partners

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for convenience foods among younger populations and millennials. Urbanization and professional commitments have made it challenging for consumers to prepare fresh produce daily, leading them to opt for frozen vegetable options. Frozen vegetable companies face challenges such as raw material shortages, shipping delays, and economic slowdowns, which impact operational costs, raw materials, and storage facilities. Technological developments, including cold chain solutions and aesthetic packaging, help maintain the nutritional value and extend the shelf life of these products. The novel coronavirus pandemic has further fueled the demand for convenience food products as consumers seek meal solutions that minimize contact with external environments.

Further, the frozen food market is expected to grow, with sustainability becoming a crucial factor in production methods, energy use, and packaging materials. The principal consultant for Rabobank's Food & Agribusiness Research and Advisory team notes that consumer favoritism towards frozen vegetables as a snack option and meal solution is on the rise. The convenience and nutritional value of these products make them an attractive choice for health-conscious individuals. Social media platforms play a significant role in promoting frozen vegetables as a trendy and convenient food choice. The frozen vegetable market is expected to continue its growth trajectory, offering numerous opportunities for stakeholders.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 4.48% |

|

Market growth 2024-2028 |

USD 8.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 56% |

|

Key countries |

US, Germany, UK, China, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ajinomoto Co. Inc., Ardo Coordination Center NV, B and G Foods Inc., Conagra Brands Inc., Congeladora Horticola S.A. de C.V., General Mills Inc., Goya Foods Inc., Greenyard NV, Hormel Foods Corp., J.R. Simplot Co., Kellogg Co., McCain Foods Ltd., Nestle SA, Newberry International Produce Ltd., Nomad Foods Ltd., The Hain Celestial Group Inc., The Kraft Heinz Co., Uren Food Group Ltd., and Waitrose and Partners |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch