Full-Service Carrier Market Size 2025-2029

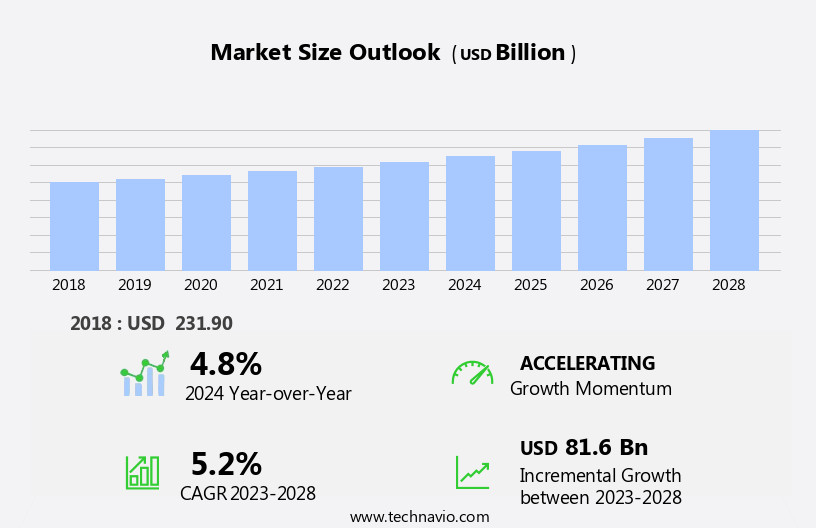

The full-service carrier market size is forecast to increase by USD 87.9 billion at a CAGR of 5.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend of business travel and the digital transformation of the aviation industry. The rise in business travel is fueled by a robust global economy and the growing preference for face-to-face interactions in various sectors. This trend presents a lucrative opportunity for Full-Service Carriers to cater to the demands of corporate clients and leisure travelers alike. However, the market landscape is not without challenges. The presence of Low-Cost Carriers (LCCs) poses a significant threat to Full-Service Carriers, as they offer lower fares and a streamlined business model. These competitors have successfully captured a significant market share by catering to price-sensitive travelers.

- As a result, Full-Service Carriers must focus on enhancing their offerings, such as in-flight services, loyalty programs, and seamless digital experiences, to differentiate themselves and retain customers. Adapting to these market dynamics and effectively navigating the challenges will be crucial for Full-Service Carriers seeking to capitalize on the growth opportunities in this market. Fuel-efficient aircraft and digital transformation are driving operational efficiency, while customer service systems, machine learning, and connectivity enhance the travel experience.

What will be the Size of the Full-Service Carrier Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the market, ground support equipment plays a crucial role in airport operations and terminal operations. Aviation regulations and economic regulations shape the industry, with weather forecasting and pilot training ensuring safety and efficiency. Carbon offsetting and environmental regulations are increasingly important, driving the adoption of airworthiness directives, navigation systems, engine technology, and aircraft design that reduce emissions.

- Safety standards are upheld through rigorous air traffic management, gate management, international air law, and communication systems. Lightweight alloys and composite materials enhance aircraft performance, while safety is further bolstered by autonomous flight and cabin crew training. Route networks expand, offering more options for passengers, and artificial intelligence (AI) and route optimization technologies streamline flight schedules. Sustainability initiatives, such as electric aircraft and drone delivery, are transforming the market, with airport infrastructure and aircraft parts suppliers adapting to meet evolving demands.

How is this Full-Service Carrier Industry segmented?

The full-service carrier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- International aviation

- Domestic aviation

- Type

- Fixed-wing aircraft

- Rotary-wing aircraft

- Service

- In-flight services

- Ground services

- Cargo services

- Loyalty programs

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

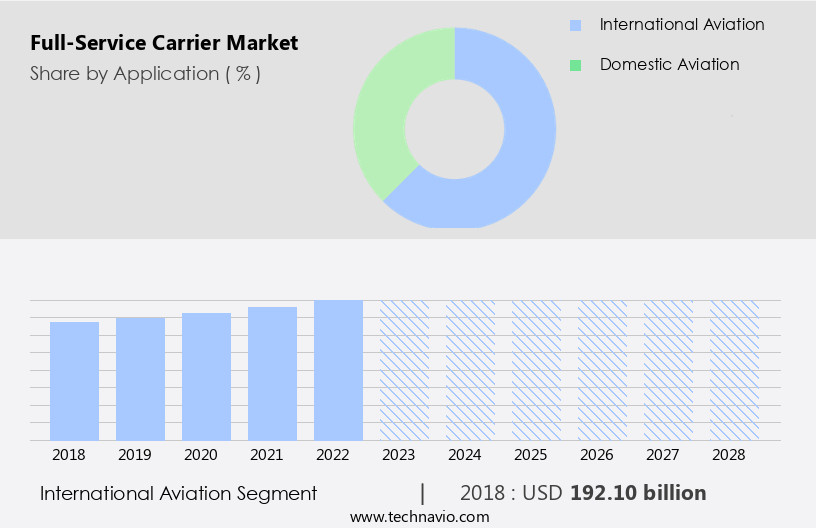

The international aviation segment is estimated to witness significant growth during the forecast period. Full-service carriers are pivotal players in international aviation, providing a comprehensive suite of offerings to passengers traversing international borders. These carriers connect diverse countries and continents, fostering global tourism and cultural exchange. International aviation significantly contributes to economic growth by enabling the transportation of people and goods across borders. Air cargo, an integral part of full-service airlines, facilitates the swift movement of perishable goods, electronics, and industrial products. Cargo capacity is crucial for time-sensitive shipments, ensuring efficient global supply chains. Network optimization, airport security, and airline alliances are essential elements of full-service carriers' operations. Ancillary revenue streams, such as in-flight entertainment, seat assignment, mobile check-in, and online booking, enhance the passenger experience.

Route planning and flight planning ensure efficient use of aircraft utilization and fuel efficiency. Charter airlines offer flexibility for businesses and individuals, while aviation safety remains a top priority. Crew costs, maintenance, and engine maintenance are significant operational expenses. Low-cost carriers challenge the market with their pricing strategies, while revenue management and yield management help maximize profits. Air traffic control, freight services, regional airlines, and aircraft maintenance are crucial components of the aviation industry's intricate ecosystem. Passenger handling, e-commerce integration, and aircraft technology continually evolve to meet the changing needs of passengers and businesses. In-flight catering, cargo airlines, aircraft financing, frequent flyer programs, airline management software, aircraft tracking, and operational costs are essential aspects of full-service carriers' operations.

Pricing strategies, baggage allowance, data analytics, and aircraft performance are critical factors in the competitive landscape.

The International aviation segment was valued at USD 199.30 billion in 2019 and showed a gradual increase during the forecast period.

The Full-Service Carrier Market is experiencing steady growth as airlines diversify to meet evolving passenger and cargo demands. These carriers often operate alongside regional airline partners to expand connectivity to smaller destinations. The inclusion of charter airline and cargo airline services allows for greater flexibility and revenue diversification, catering to specialized and logistical needs. Loyalty-driven strategies like frequent flyer program offerings enhance customer retention and boost brand value. In-flight entertainment systems have advanced with on-demand content, interactive screens, and personalized entertainment choices. Furthermore, collaboration through airline alliance networks increases global reach and operational synergy. Enhanced business intelligence tools are being adopted to optimize route planning, pricing strategies, and customer engagement.

Regional Analysis

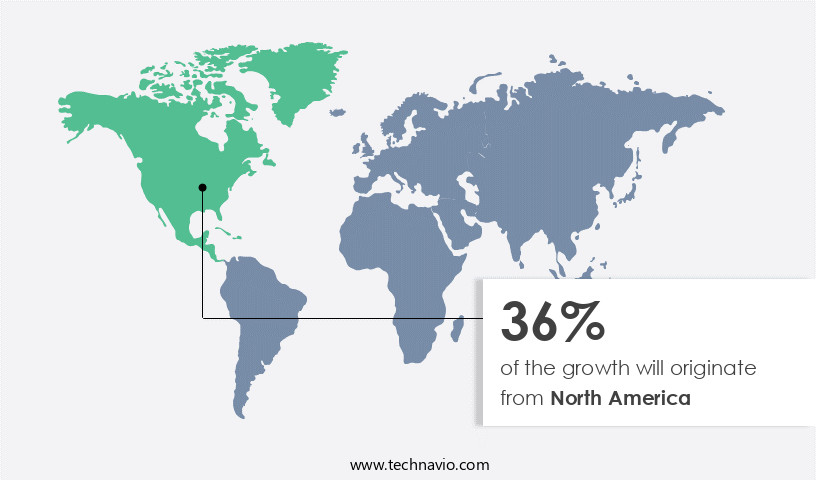

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth due to the region's robust economy and increasing consumer spending. Business travel, driven by numerous multinational corporations, tech hubs, financial centers, and industry events, remains a significant contributor to the market's expansion. Full-service carriers cater to business travelers with premium services and flexibility, making them the preferred choice for many. North America's well-established airport infrastructure, with major international airports strategically located, enhances the market's growth. In-flight entertainment, baggage handling, network optimization, airport security, and route planning are essential components of full-service carriers' offerings, ensuring a seamless travel experience for passengers.

Ancillary revenue streams, such as online booking, seat assignment, mobile check-in, and ancillary services like in-flight catering and cargo services, contribute significantly to the market's revenue. Airline alliances and route planning enable carriers to expand their reach and offer more extensive networks to passengers. Yield management, revenue management, and pricing strategies are crucial elements of the market. Operational costs, including aircraft financing, maintenance, fuel consumption, crew costs, and engine maintenance, are continually optimized for efficiency. Air traffic control, freight services, regional airlines, aircraft maintenance, and ground handling are integral parts of the market's ecosystem. Aviation safety, passenger safety, and fuel efficiency are top priorities for full-service carriers, ensuring a high-quality passenger experience.

The market's evolution is influenced by advancements in aircraft technology, data analytics, aircraft performance, and route optimization software. Aircraft leasing, aviation security, crew scheduling, and passenger experience are continually improving, making full-service carters more competitive.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Full-Service Carrier market drivers leading to the rise in the adoption of Industry?

- The increasing prevalence of business travel is the primary factor fueling market growth. Full-service carriers cater to the unique needs of business travelers, offering premium services that prioritize comfort, convenience, and productivity. These airlines provide spacious seating, priority boarding, in-flight entertainment, Wi-Fi connectivity, and quality dining options, making business class and first-class cabins an attractive choice for frequent flyers. The revenue generated from premium cabin bookings plays a significant role in the profitability of full-service carriers. With business travelers constituting a consistent and substantial customer base, these airlines benefit from steady revenue streams. Moreover, understanding the importance of flexibility for business travelers, full-service carriers adapt to their changing itineraries and offer flexible flight schedules.

- To optimize their operations, full-service carriers employ advanced technologies such as aircraft utilization, load factor, yield management, and revenue management systems. These tools help airlines maximize their cargo capacity, fuel efficiency, and passenger safety while minimizing operational costs. Furthermore, they invest in flight simulation, air traffic control, freight services, regional airlines, and aircraft maintenance to ensure seamless flight operations. From boarding processes to in-flight services, every aspect of the journey is designed to cater to the specific requirements of business travelers. By emphasizing safety, efficiency, and exceptional service, full-service carriers differentiate themselves in the competitive aviation market.

What are the Full-Service Carrier market trends shaping the Industry?

- Digital transformation is gaining significant traction in today's market, becoming an increasingly important trend for businesses. It is essential for professionals to stay informed and adapt to this rising trend in order to remain competitive. The market is experiencing significant changes due to digital transformation. This process integrates technology into various business operations and customer experiences to boost efficiency, enhance services, and cater to evolving customer demands. Digital transformation has revolutionized the booking process, enabling travelers to search, compare, and purchase tickets via intuitive websites and mobile apps. It has also facilitated self-service check-in, mobile boarding passes, and digital payment options, ensuring a seamless travel experience. In-flight services have evolved with digital platforms, offering advanced entertainment systems featuring on-demand content, interactive screens, and personalized options.

- Digital transformation has also impacted operational aspects, such as maintenance costs. Airline management software and aircraft tracking systems help optimize engine maintenance and reduce fuel consumption. Crew costs are managed through scheduling tools and loyalty programs, while reservation systems and ticket sales are streamlined for improved on-time performance. Aircraft financing and frequent flyer programs have also been transformed through digital platforms, offering more convenience and customization for passengers. Overall, digital transformation is a game-changer for the market, driving innovation and enhancing the customer experience. Effective communication with passengers is now possible through email, social media, and mobile applications.

How does Full-Service Carrier market face challenges during its growth?

- The expansion of low-cost carriers (LCCs) poses a significant challenge to the aviation industry's growth, requiring strategic adjustments from traditional carriers to maintain competitiveness within the market. Full-service carriers (FSCs) face intense competition in the aviation industry, with low-cost carriers (LCCs) offering lower fares through a no-frills business model. This competition necessitates FSCs to reevaluate their pricing strategies, as some passengers opt for LCCs' competitive fares despite foregoing premium services. To differentiate their offerings and retain customers, FSCs must focus on enhancing the passenger experience.

- E-commerce integration is essential for FSCs to provide a seamless booking experience and personalized offerings. FSCs must prioritize these areas to maintain competitiveness and meet evolving customer expectations. Operational costs, such as baggage allowance, crew scheduling, passenger handling, ground handling, and aviation security, are critical areas for optimization. FSCs can leverage data analytics to gain insights into operational efficiency and passenger preferences. Aircraft technology, including route optimization software and aircraft leasing, can also contribute to cost savings and improved performance.

Exclusive Customer Landscape

The full-service carrier market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the full-service carrier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, full-service carrier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air China Ltd. - This company specializes in providing premium carrier services, including Forbidden Pavilion First Class and Capital Pavilion Business Class.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air China Ltd.

- AIR France

- American Airlines Group Inc.

- Ana Holdings Inc.

- China Eastern Airlines Co. Ltd.

- Delta Air Lines Inc.

- Etihad Airways PJSC

- International Consolidated Airlines Group SA

- Japan Airlines Co. Ltd.

- Lufthansa Group

- Qantas Airways Ltd.

- Qatar Airways Group Q.C.S.C.

- Singapore Airlines Ltd.

- Southwest Airlines Co.

- THAI AIRWAYS INTERNATIONAL PUBLIC Co. Ltd.

- The Emirates Group

- Turkish Airlines

- United Airlines Inc.

- WestJet Encore Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Full-Service Carrier Market

- In January 2024, United Airlines Holdings, a major full-service carrier, announced the launch of its new premium economy cabin on select international flights. The new cabin class, named "Premium Plus," offers enhanced seating, additional legroom, and improved meal options (United Airlines Press Release).

- In March 2024, Delta Air Lines and American Express, a leading global payment card issuer, expanded their long-term partnership. The collaboration includes the co-branding of Delta's SkyMiles loyalty program on American Express cards, offering enhanced rewards and benefits to customers (Delta Air Lines Press Release).

- In July 2024, Emirates, the Dubai-based full-service carrier, completed the acquisition of a 49% stake in Flydubai, a low-cost carrier. The strategic move aims to strengthen Emirates' position in the Middle East market and expand its reach to underserved destinations (Reuters).

- In May 2025, Singapore Airlines and Scoot, its low-cost subsidiary, received regulatory approval from the European Union Aviation Safety Agency to launch non-stop flights between Singapore and Europe. The new service is expected to boost the carriers' market share in the long-haul travel segment (Bloomberg).

Research Analyst Overview

The market continues to evolve, with dynamic market dynamics shaping various sectors. In-flight catering and cargo airlines adapt to changing consumer preferences, while maintenance costs remain a significant focus. Engine maintenance and low-cost carriers challenge traditional business models, and crew costs and loyalty programs influence customer retention. Reservation systems and ticket sales optimize revenue, with on-time performance and fuel consumption driving operational efficiency. Aircraft financing and frequent flyer programs leverage data analytics to enhance passenger experience. Airline management software and aircraft tracking streamline operations, with pricing strategies and baggage allowances adapting to evolving market conditions. Ancillary revenue streams, such as seat assignment and mobile check-in, provide additional revenue opportunities.

Network optimization, airport security, and air traffic control ensure seamless passenger handling. Freight services and regional airlines expand offerings, while aircraft leasing and aviation security address safety concerns. Flight planning and revenue management strategies adapt to changing passenger load and yield management. The continuous unfolding of market activities shapes the aviation industry, with ongoing developments in aircraft technology, passenger safety, and customer service.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Full-Service Carrier Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 87.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, Canada, China, Germany, UK, France, Mexico, India, Japan, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Full-Service Carrier Market Research and Growth Report?

- CAGR of the Full-Service Carrier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the full-service carrier market growth of industry companies

We can help! Our analysts can customize this full-service carrier market research report to meet your requirements.