Gas Sensors Market Size 2025-2029

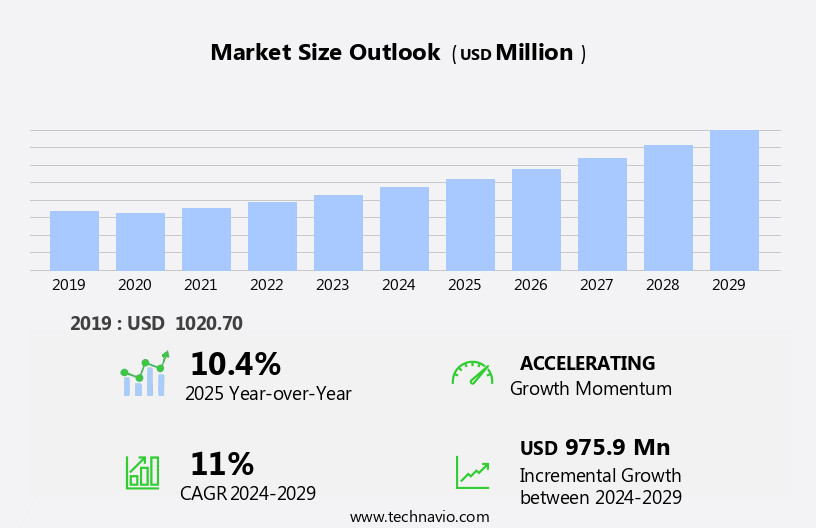

The gas sensors market size is forecast to increase by USD 975.9 million, at a CAGR of 11% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for LNG trade and the subsequent need for precise gas sensing technologies. New product launches, aiming to address this demand, are shaping the market landscape. Key applications include the monitoring of natural gas in LNG trade and the use of wireless sensors in domestic appliances. However, challenges persist in the form of sensitivity, selectivity, and stability issues with current gas sensors. These obstacles necessitate continuous research and development efforts to improve the performance and reliability of these crucial sensors.

- Companies seeking to capitalize on market opportunities must focus on addressing these challenges through innovative solutions, ensuring their offerings meet the stringent requirements of the LNG industry. By staying abreast of technological advancements and market trends, organizations can effectively navigate the dynamic and competitive market.

What will be the Size of the Gas Sensors Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Optical sensors, such as CMOS and CCD, play a crucial role in gas detection systems, while machine learning and data acquisition enhance sensor performance and accuracy. Quality control in industries relies heavily on sensor reliability and sensor integration, with automotive safety and healthcare monitoring being significant end-users. Electrochemical sensors, metal oxide sensors, and piezoresistive sensors are integral to process control and industrial automation. Humidity sensors, temperature sensors, and pressure sensors are essential components of smart buildings and home security systems.

Sensor networks, power management, signal processing, and data analytics facilitate efficient sensor operation and optimization. Artificial intelligence and sensor fusion enable advanced gas detection and environmental monitoring, while humidity sensors and thermal conductivity sensors contribute to healthcare and food safety applications. Supply chain management and sensor packaging ensure seamless sensor implementation and longevity. Flow sensors, level sensors, and ultrasonic sensors are vital in various industries, from manufacturing to transportation. Capacitive sensors and proximity sensors are increasingly used in consumer electronics and home appliances. Sensor accuracy and sensor stability remain key considerations for all applications, as the market continues to unfold with new developments and patterns.

How is this Gas Sensors Industry segmented?

The gas sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Wired

- Wireless

- End-user

- Industrial

- Petrochemical

- Building automation and domestic appliances

- Automotive

- Others

- Product Type

- Carbon dioxide

- Carbon monoxide

- Oxygen

- Methane

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

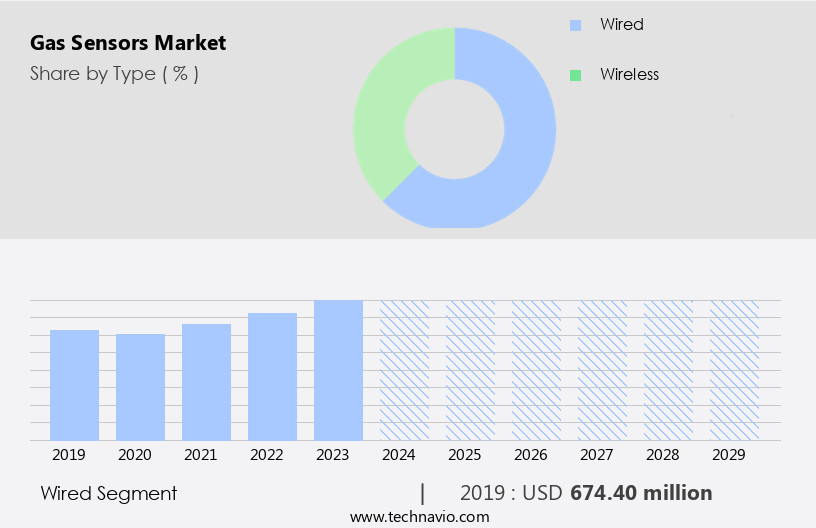

The wired segment is estimated to witness significant growth during the forecast period.

Wired gas sensors play a crucial role in industrial safety by continuously monitoring the presence of toxic and flammable gases, such as methane, propane, and butane, in manufacturing facilities and control rooms. These sensors, which are permanently installed and connected via wires to a control panel, provide real-time data on gas concentrations and oxygen depletion levels. Machine learning algorithms can be integrated with the data acquisition system to enhance gas detection accuracy and improve overall system performance. Optical sensors, including CMOS sensors and CCD sensors, are increasingly being used in gas detection systems due to their high sensitivity and reliability.

Sensor integration and network connectivity enable remote monitoring and real-time data analysis through cloud computing platforms. Sensor selection and placement are critical factors in ensuring optimal performance and sensor lifetime. Sensor reliability is a key concern in industrial applications, with sensor fusion and alarm systems employed to minimize false positives and ensure timely alerts. Industrial automation systems rely on gas sensors for process control, with temperature, pressure, humidity, and flow sensors providing additional data for comprehensive environmental monitoring. Gas sensors are also essential in healthcare monitoring, food safety, and automotive safety applications. Electrochemical sensors, piezoresistive sensors, and MEMS sensors are commonly used in these areas due to their high sensitivity and selectivity.

Humidity sensors, thermal conductivity sensors, and ultrasonic sensors are also employed in various industrial and environmental monitoring applications. Sensor packaging and power management are important considerations for ensuring sensor longevity and reliability. Artificial intelligence and data analytics are increasingly being used to optimize sensor performance and improve overall system efficiency. Supply chain management and sensor stability are also critical factors in ensuring a consistent and reliable sensor supply for industrial applications.

The Wired segment was valued at USD 674.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

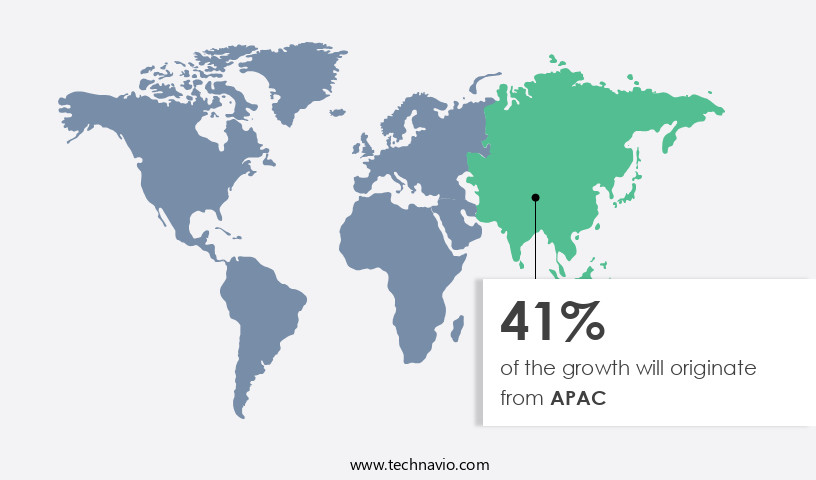

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by various industries and applications. In the field of automotive safety, the integration of gas sensors in vehicles for real-time monitoring of exhaust gases and ensuring optimal engine performance is a key trend. Machine learning algorithms and data acquisition systems are increasingly being used to enhance the accuracy and reliability of gas sensor data. Optical sensors, such as CMOS sensors, play a crucial role in gas detection systems, offering high sensitivity and selectivity. Sensor lifetime and stability are critical factors in ensuring the effectiveness of these systems. In healthcare monitoring and food safety applications, electrochemical sensors are widely used due to their ability to detect specific gases with high precision.

Industrial automation, process control, and environmental monitoring are other major sectors driving the demand for gas sensors. Cloud computing and data analytics enable remote monitoring and real-time analysis of sensor data, improving overall efficiency and productivity. Sensor integration, power management, signal processing, and sensor networks are essential components of advanced gas detection systems. In the realm of artificial intelligence and data analytics, gas sensors are being used to optimize industrial processes and improve overall system performance. Smart buildings and home security systems also rely on gas sensors for early detection of potential hazards. Sensor fusion and thermal conductivity sensors are emerging technologies in the market, offering enhanced capabilities and improved accuracy.

Supply chain management and sensor selection are critical aspects of the market. The market is expected to witness significant growth in APAC, particularly in countries such as India, China, Malaysia, and the Philippines, due to the development of important infrastructure and the growing demand from industries such as oil and gas. Pressure sensors, temperature sensors, ultrasonic sensors, level sensors, capacitive sensors, proximity sensors, humidity sensors, and piezoresistive sensors are some of the key types of gas sensors used in various applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gas Sensors Industry?

- The increase in Liquefied Natural Gas (LNG) trade serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing adoption of gas sensors in various applications, including alarm systems, industrial automation, and process control. Sensor integration with cloud computing technology is also driving market growth, enabling real-time monitoring and analysis of gas data. Several types of gas sensors are utilized in these applications, including metal oxide sensors, pressure sensors, flow sensors, temperature sensors, ultrasonic sensors, and level sensors. The demand for gas sensors is escalating in industries such as oil and gas, power generation, and chemical processing, where ensuring the safety and efficiency of operations is paramount.

- Sensor packaging technology is also advancing to improve the durability and reliability of gas sensors in harsh environments. The shift towards clean energy and the increasing focus on reducing greenhouse gas emissions are also fueling the growth of the market. Natural gas, particularly LNG (Liquefied Natural Gas), is gaining popularity as a transport fuel due to its cleaner burning properties compared to traditional fossil fuels. However, handling LNG requires adequate precautions due to its high pressure and extremely low temperature. Therefore, the need for reliable and accurate gas sensors to monitor LNG storage and transportation facilities is essential to ensure safety and efficiency.

What are the market trends shaping the Gas Sensors Industry?

- The trend in the market is toward new product launches. As a professional, I can provide you with up-to-date information on upcoming product introductions.

- The market is experiencing significant growth due to the increasing demand for sensor technologies in various industries. Sensor selection is a crucial aspect of this market, with capacitive sensors and proximity sensors being popular choices. Advanced technologies like artificial intelligence (AI) and data analytics are being integrated into sensor networks for improved power management, signal processing, and sensor accuracy. In the realm of smart buildings, humidity sensors play a vital role in maintaining optimal indoor conditions. Home security systems also rely heavily on gas sensors to detect potential hazards. Companies are prioritizing new product launches to expand their product portfolios and cater to diverse end-user needs.

- For instance, Alphasense introduced the H-Series sensor, a compact new format for portable devices, in June 2023. In October 2024, Flyability unveiled a new flammable gas sensor for the Elios 3 drone, offering real-time warnings of combustible gases for enhanced safety in hazardous environments. These strategic moves underscore the market's dynamic nature and the continuous innovation in gas sensor technology.

What challenges does the Gas Sensors Industry face during its growth?

- The sensitivity, selectivity, and stability of gas sensors pose significant challenges in the industry, as these factors are crucial for ensuring accurate and reliable detection, thereby impacting the growth and market acceptance of gas sensor technologies.

- Gas sensors are essential components in industrial facilities for environmental monitoring and safety purposes. However, their production involves raw materials like copper, silver, and aluminum, which can react to humidity, affecting sensor stability. The sensitivity of gas sensors to temperature and pressure variations further complicates the selection process for end-users. With numerous options available in the market, choosing the optimal gas sensor for a specific application can be challenging. Sensor technologies encompass various types, including thermal conductivity sensors, CCD sensors, infrared sensors, image sensors, piezoresistive sensors, MEMS sensors, and solid state sensors. Each type has unique characteristics and applications.

- For instance, thermal conductivity sensors detect gas concentration by measuring the temperature difference between the gas and a reference material. In contrast, CCD sensors use photoconductive materials to detect infrared radiation, making them suitable for specific industrial applications. Effective supply chain management is crucial in the gas sensor market to ensure the timely delivery of high-quality products. The selection process for end-users should consider the specific requirements of their facility, such as the type of gas to be detected, the operating temperature and pressure conditions, and the desired response time. By understanding the unique features and applications of various gas sensor technologies, end-users can make informed decisions and optimize their facility's performance.

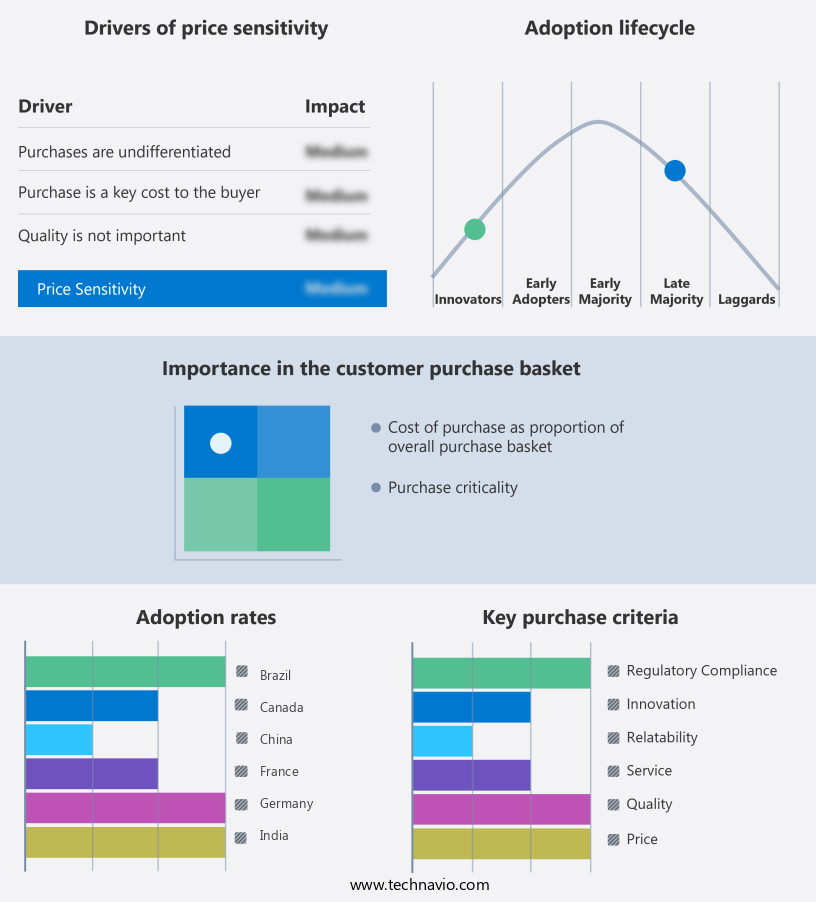

Exclusive Customer Landscape

The gas sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gas sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gas sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in advanced gas sensing technology, with a focus on FusionAir Smart Sensors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AMETEK Inc.

- Amphenol Corp.

- ams OSRAM AG

- Angst Pfister Sensors and Power AG

- Bosch Sensortec GmbH

- DENSO Corp.

- Dragerwerk AG and Co. KGaA

- eLichens

- Figaro Engineering Inc.

- GASTEC Corp.

- Honeywell International Inc.

- Industrial Scientific Corp.

- MEMBRAPOR AG

- Nemoto and Co. Ltd.

- Niterra India Pvt. Ltd.

- Senseair AB

- Sensirion AG

- Siemens Energy AG

- Techcomp Instruments Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gas Sensors Market

- In January 2024, Honeywell announced the launch of its new gas sensor, the Honeywell GasSense X40, designed for industrial applications. This sensor is said to offer higher accuracy and faster response times than its predecessor, according to Honeywell's press release.

- In March 2024, Sensirion AG and Figaro Engineering Inc. entered into a strategic partnership to expand their combined market presence in the gas sensor industry. The collaboration aimed to leverage each other's strengths in technology and market reach, as stated in a joint press release from both companies.

- In May 2024, AptarGroup, a global supplier of dispensing solutions, acquired Sensirion's gas sensor business for approximately USD 350 million. This acquisition was reported in a press release from AptarGroup, with the aim of expanding their offerings in the industrial safety market.

- In April 2025, the European Union passed new regulations on indoor air quality, which included mandatory gas sensor installations in residential and commercial buildings. This regulatory development was reported in an article by Reuters, marking a significant growth opportunity for gas sensor manufacturers in Europe.

Research Analyst Overview

- The market is witnessing significant advancements, driven by the adoption of remote monitoring solutions for real-time detection and fault tolerance. Sensor validation and maintenance are crucial aspects of ensuring accuracy and reliability, with calibration standards and sensor testing playing essential roles. Fault detection is addressed through advanced sensor characterization techniques and self-diagnostic capabilities. Solar power and energy harvesting are popular trends for powering sensors in remote locations, while wireless communication enables seamless data transmission. Security protocols and data encryption are integral to safeguarding sensitive information. Low-power design and edge computing are key considerations for extending battery life and reducing data processing costs.

- Sensor replacement is minimized through fault tolerance and sensor repair, while distributed sensor systems and sensor array technology enhance coverage and accuracy. Analog-to-digital converters (ADCs) and digital-to-analog converters (DACs) facilitate signal conditioning and data logging. Overall, the market is evolving towards more sophisticated, autonomous, and interconnected gas sensing systems.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gas Sensors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11% |

|

Market growth 2025-2029 |

USD 975.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.4 |

|

Key countries |

US, China, Japan, India, Germany, UK, France, Canada, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gas Sensors Market Research and Growth Report?

- CAGR of the Gas Sensors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gas sensors market growth of industry companies

We can help! Our analysts can customize this gas sensors market research report to meet your requirements.