Gear Manufacturing Market Size 2025-2029

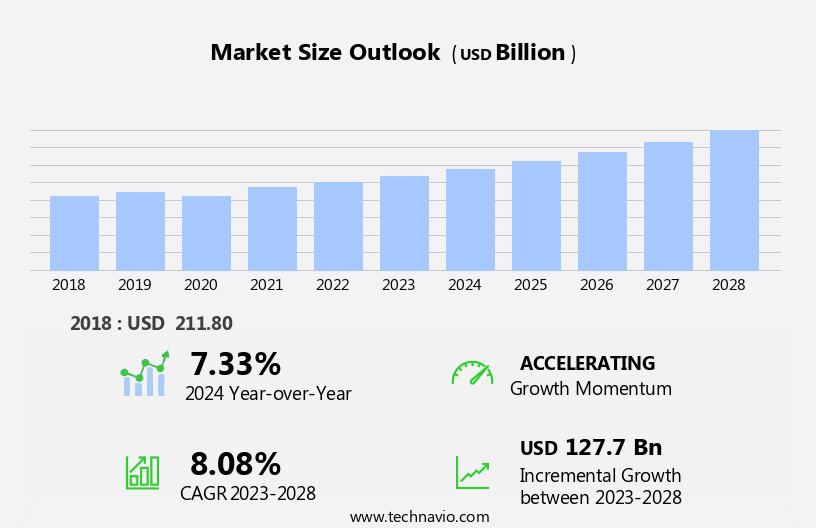

The gear manufacturing market size is forecast to increase by USD 137.8 billion at a CAGR of 8.1% between 2024 and 2029.

- The market is witnessing significant shifts, driven by the increasing adoption of industrial automation and the implementation of additive manufacturing technologies in the production of gear and gearing components. These advancements enable manufacturers to enhance productivity, reduce costs, and improve product quality. However, the market faces a notable challenge with the slowdown in the Chinese manufacturing sector, which could impact global supply chains and pricing dynamics.

- Companies must navigate these trends and challenges effectively to capitalize on growth opportunities and maintain a competitive edge. Strategic investments in automation and additive manufacturing technologies, as well as a focus on innovation and supply chain resilience, will be crucial for success in this evolving market landscape.

What will be the Size of the Gear Manufacturing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic market, demand forecasting plays a crucial role in maintaining a competitive edge. Process optimization, driven by smart manufacturing, is a key trend, integrating circular economy principles and sustainability initiatives. Ethical sourcing and reducing carbon footprint are becoming essential considerations, alongside robotics integration and computer-aided design (CAD) for efficient industrial design. Supply chain visibility, quality assurance, and digital twin technology enable predictive maintenance through condition-based and preventive strategies. Software solutions, including predictive analytics, automation systems, and lifecycle assessment tools, streamline production and waste management.

Reverse engineering and rapid prototyping facilitate corrective maintenance and assembly line optimization. Global supply chains are increasingly adopting product testing standards, ensuring compliance and enhancing customer trust. The integration of computer-aided manufacturing (CAM) further accelerates production processes, making the market an exciting and innovative landscape for US businesses. Additionally, they are used in gear units for passenger vehicles, commercial vehicles, and industrial machinery, as well as in wind turbine gearboxes, transmissions, and moventas.

How is this Gear Manufacturing Industry segmented?

The gear manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Worm gear

- Bevel gear

- Others

- End-user

- Oil and gas industry

- Power industry

- Automotive

- Others

- Material

- Steel

- Cast iron

- Polymer

- Bronze

- Composite materials

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Indonesia

- Japan

- Rest of World (ROW)

- North America

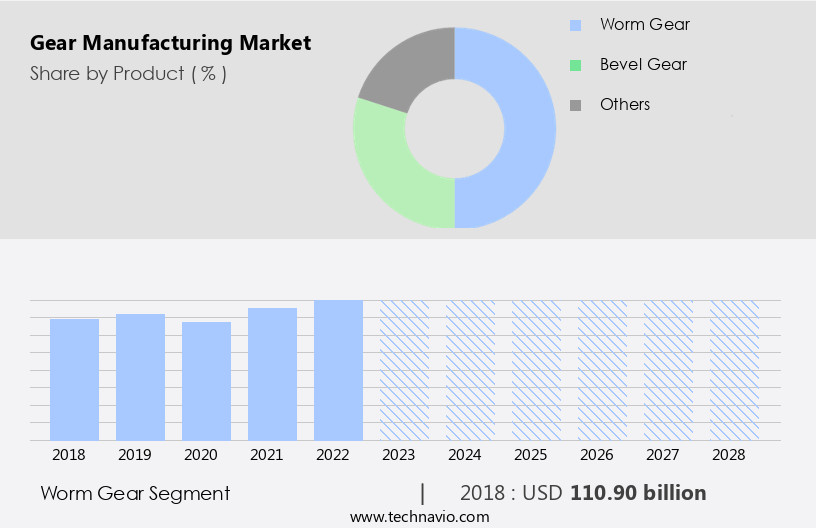

By Product Insights

The worm gear segment is estimated to witness significant growth during the forecast period. In the dynamic world of manufacturing, the gear industry continues to evolve, integrating advanced technologies and practices to enhance production efficiency, reduce waste, and improve product quality. Composite materials, such as carbon fiber reinforced polymers, are increasingly used in gear manufacturing due to their high strength-to-weight ratio and durability. Six Sigma methodologies and Lean Manufacturing principles are employed to minimize defects and streamline production processes. Capacity planning and inventory management are crucial aspects of gear manufacturing, ensuring optimal use of resources and minimizing downtime. Workforce training and continuous learning are essential to maintain a skilled workforce, enabling the adoption of new technologies like 3D printing, AI-powered manufacturing, and subtractive and additive manufacturing processes.

Supply chain management plays a vital role in maintaining a steady flow of raw materials, electronic components, and specialized equipment. Data analytics and IoT sensors help monitor and optimize production, while value engineering and modular design contribute to cost optimization and customizable solutions. Safety standards, energy efficiency, and wear resistance are key considerations in gear manufacturing, with CNC machining and injection molding being common techniques for producing gears with high precision and accuracy. Quality control measures, such as gear teeth inspection and lubrication, ensure the longevity and reliability of the final product. Gear ratios and design for manufacturing principles are essential in creating gears with optimal performance and functionality.

In the realm of mass production, gear manufacturing relies on advanced technologies and specialized equipment to maintain high production rates and meet customer demands. Corrosion resistance and customizable designs are also essential factors in catering to diverse applications and industries.

The Worm gear segment was valued at USD 116.10 billion in 2019 and showed a gradual increase during the forecast period.

The gear manufacturing market is evolving rapidly with the integration of smart technologies aimed at improving operational efficiency and reliability. Advanced remote monitoring solutions now enable real-time tracking of gear performance, reducing the risk of unexpected failures. Effective maintenance management systems are being deployed to streamline workflows and minimize downtime. There's a strong industry shift toward preventive maintenance, allowing manufacturers to address issues before they escalate. Additionally, condition-based maintenance is gaining traction, using sensor data and analytics to service equipment only when necessary.

Regional Analysis

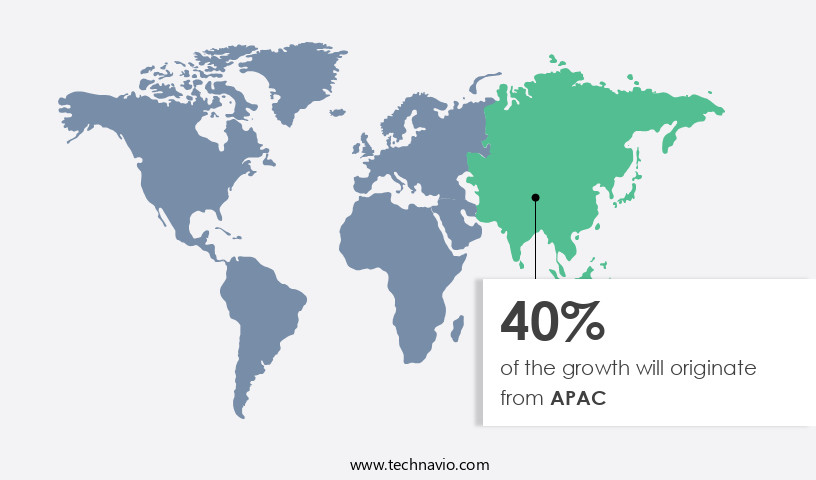

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the Asia Pacific region, the demand for gear manufacturing is driven by the expansion of renewable energy capacity in countries like China and India, aimed at reducing waste and environmental pollution to meet emission targets. The region's substantial share in the global market is due to its large oil and gas-consuming and chemical and industrial manufacturing industries. As the world's largest automotive manufacturing hub, APAC's diverse economy comprises both developed and developing countries, leading to varying demands for gear manufacturing. Companies in the region are increasingly adopting six sigma, lean manufacturing, and value engineering to enhance production efficiency and reduce defect rates.

Capacity planning and inventory management are crucial to maintaining a competitive edge in the market. The integration of IoT sensors, data analytics, and AI-powered manufacturing enables real-time monitoring and optimization of processes. The use of composite materials, customizable designs, and modular production in gear manufacturing is on the rise, contributing to the reduction of raw material waste. The adoption of additive manufacturing and 3D printing technologies allows for the production of complex gear designs with improved wear resistance and energy efficiency. Safety standards, such as those related to gear lubrication and corrosion resistance, are essential considerations in the manufacturing process.

The integration of specialized equipment, including CNC machining and injection molding, ensures precise production and high-quality output. The market is also witnessing a trend towards small-batch production and customizable designs, catering to the unique requirements of various industries. Supply chain management and materials sourcing are critical aspects of the manufacturing process, ensuring timely delivery and cost optimization. The Asia Pacific the market is dynamic and evolving, with a focus on production efficiency, waste reduction, and the adoption of advanced technologies to meet the varying demands of its diverse economy.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Gear Manufacturing market drivers leading to the rise in the adoption of Industry?

- Industrial automation adoption serves as the primary growth catalyst for the market. The market is experiencing significant growth due to advancements in technology, particularly in automation. Robots and industrial automation are increasingly being adopted across industries for high-speed, repetitive tasks. The demand for more sophisticated robots with expanded applications has driven research into producing high-precision gears. Three-dimensional (3D) printing technology is also playing a role in the manufacturing of gears, enabling the production of complex designs and customized components.

- The use of advanced materials in gear manufacturing is also a key trend, with an emphasis on selecting the right raw materials to ensure durability and performance. Overall, the market is being shaped by these technological advancements and industry trends. Furthermore, the integration of Internet of Things (IoT) sensors and data analytics in manufacturing processes is enabling real-time monitoring and optimization of gear ratios. Value engineering and modular design are becoming essential strategies in lean manufacturing, leading to efficient materials sourcing and cost savings.

What are the Gear Manufacturing market trends shaping the Industry?

- The use of additive manufacturing in gear and gearing component production is an emerging market trend. This advanced manufacturing technique allows for the production of complex, customized components with improved performance and reduced production time compared to traditional methods. Additive manufacturing is revolutionizing the manufacturing industry by moving beyond prototyping and R&D, and into mass production of critical mechanical components. This process constructs components directly through material deposition of a base filler material, offering versatility in using various materials like plastics, metals, alloys, composites, and ceramics.

- Ongoing research aims to enhance additive manufacturing techniques further, making it an essential technology for US businesses seeking cost optimization, inventory management, and safety standards in their gear manufacturing processes. Additionally, integrating AI-powered manufacturing and CNC machining with additive manufacturing can lead to energy efficiency and improved product design. Additive manufacturing provides several advantages over traditional methods: it reduces material wastage and energy costs, accelerates product development and time to market, enables manufacturing with high-strength materials at relatively lower costs, and facilitates the production of complex parts with ease.

How does Gear Manufacturing market faces challenges during its growth?

- The slowdown in China's manufacturing sector poses a significant challenge to the industry's growth trajectory. The market holds significant potential for growth, particularly in countries with robust manufacturing sectors, such as China. However, the Chinese economy and its manufacturing industry are currently experiencing a slowdown. This is due in part to declining global exports and reduced foreign investments, leading to excess manufacturing capacity and financial struggles for many companies. These firms, which had taken on substantial debt to maintain operations, have been hit hard by the manufacturing overcapacity and dwindling profits. Despite these challenges, the market continues to evolve, driven by advancements in technology and increasing demand for high-performance gears.

- Wear resistance and corrosion resistance are key factors influencing market growth, as industries seek to improve production efficiency and product durability. Customizable designs and mass production are also important trends, with specialized equipment enabling subtractive manufacturing and injection molding processes to meet diverse customer requirements. Quality control remains a top priority, with powder coating and other finishing techniques used to ensure the highest standards. Overall, the market is poised for continued innovation and growth, despite the current economic challenges in key manufacturing hubs.

Exclusive Customer Landscape

The gear manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gear manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gear manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bharat Gears Ltd. - The company specializes in gear manufacturing, delivering innovative gearboxes designed for rotary mowers and splitter applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bharat Gears Ltd.

- Bondioli and Pavesi Spa

- Bonfiglioli Riduttori Spa

- Comer Industries Spa

- Curtis Machine Co. Inc.

- Dana Inc.

- DB Santasalo Sarl

- Eaton Corp. plc

- Elecon Engineering Co. Ltd.

- Emerson Electric Co.

- FLSmidth and Co. AS

- Johnson Electric Holdings Ltd.

- KLINGELNBERG GmbH

- Nord Gear Corp.

- Regal Rexnord Corp.

- SEW EURODRIVE GmbH and Co KG

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- WEG S.A

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gear Manufacturing Market

- In January 2024, Haas Group, a leading gear manufacturing company, announced the launch of its new line of high-performance helical gears, designed to increase efficiency by up to 15% for industrial applications (Haas Group Press Release).

- In March 2024, Siemens and Schaeffler, two major players in the gear manufacturing industry, formed a strategic partnership to co-develop and commercialize digitally-enabled gearboxes for wind turbines (Siemens Press Release).

- In April 2025, NSK Ltd., a global bearing and gear manufacturer, completed the acquisition of German gear manufacturer, Fichtel & Sachs, significantly expanding its European presence and market share in the automotive industry (NSK Ltd. SEC Filing).

- In May 2025, the European Union passed new regulations on the energy efficiency of industrial gearboxes, effective from 2026, which will drive demand for advanced, energy-efficient gear solutions (European Commission Press Release).

Research Analyst Overview

The market continues to evolve, driven by the constant pursuit of waste reduction and improved efficiency across various sectors. Composite materials, six sigma, and capacity planning are among the strategies employed to enhance production efficiency. Workforce training and supply chain management are essential components of this ongoing process, ensuring a skilled workforce and seamless logistics. Defect rate reduction is a key focus, with design for manufacturing and electronic components playing significant roles. Gear teeth geometry and materials sourcing are critical factors in optimizing performance and cost. The integration of IoT sensors and data analytics enables real-time monitoring and predictive maintenance, enhancing safety standards and overall productivity.

AI-powered manufacturing, small-batch production, and inventory management are transforming the industry, enabling customizable designs and cost optimization. CNC machining and energy efficiency are also crucial, with the ongoing adoption of lean manufacturing principles and the integration of specialized equipment. Additive manufacturing and wear resistance are revolutionizing the production landscape, offering increased flexibility and improved materials properties. Production planning and value engineering are essential in balancing mass production and specialized equipment requirements. Modular design and corrosion resistance are other key trends, ensuring durability and adaptability in a rapidly changing market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gear Manufacturing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 137.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

China, US, India, Germany, UK, France, Canada, Japan, Indonesia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gear Manufacturing Market Research and Growth Report?

- CAGR of the Gear Manufacturing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gear manufacturing market growth of industry companies

We can help! Our analysts can customize this gear manufacturing market research report to meet your requirements.