Gems and Jewelry Market Size 2024-2028

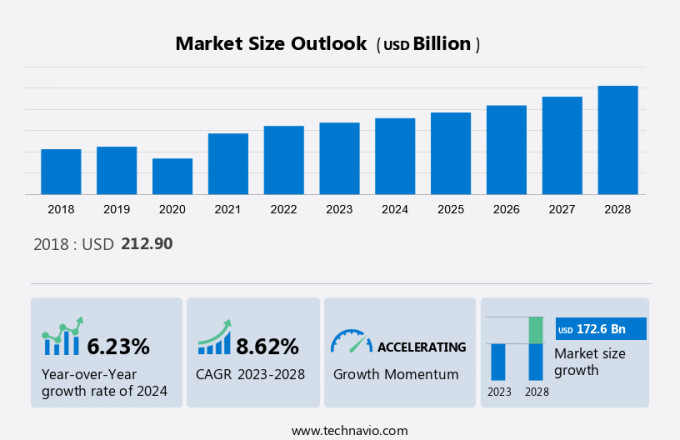

The gems and jewelry market size is estimated to grow USD 172.6 billion, at a CAGR of 8.62% between 2023 and 2028.

- The market growth is driven by escalating demand for wedding jewelry, particularly in nations like India, where cultural significance is profound and the jewelry market is thriving. Bridal collections, encompassing necklaces, wedding bands, and engagement rings, and bridal wear are coveted globally for their elegance and symbolism. The rings segment in particular holds a substantial share in the market. India's growing middle-class populace and heightened disposable income propel amplified investments in bridal assortments, establishing it as a pivotal market within the global gems and jewelry landscape.

- The gems and jewelry market is experiencing growth driven by sustainability and ethical sourcing trends, with lab-grown diamonds gaining popularity. Customization and personalization are increasingly important in the industry, reflecting consumer demand. The online jewelry retail growth supports this trend, while the luxury jewelry market continues to expand. Additionally, the resurgence of gold jewelry and emerging gems and jewelry trends are shaping the future of the market, as highlighted in recent growth analysis reports.

What will be the Gems and Jewelry Market Size During the Forecast Period?

To learn more about this market report, View Sample PDF

How is the Gems and Jewelry Market Segmented?

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Type Outlook

- Gold

- Platinum

- Silver

- Diamond

- Gemstones

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

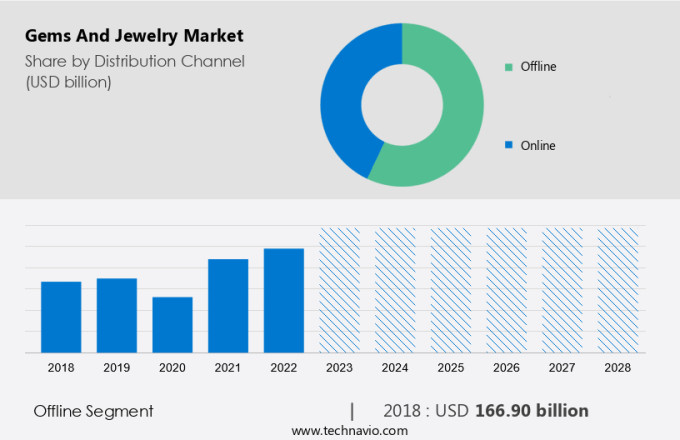

By Distribution Channel

- The market share growth by the offline segment will be significant during the forecast period. The revenue of the offline distribution channel comes from the sales of products through speciality stores (including exclusive brand stores, multi-brand stores, and premium fashion stores); hypermarkets, supermarkets, and clubhouse stores; and department stores. Over the years, the revenue of the offline distribution channel has witnessed a gradual decline due to the shift in consumer preference toward online jewelry. To fuel sales through offline channels, players are managing their sales through store expansions in the local and regional markets, which will increase the growth of the segment during the forecast period.

Get a glance at the market contribution of various segments. View Sample PDF

- The offline segment was valued at USD 166.90 billion in 2018 and continued to grow by 2022. In this segment, companies are also accelerating their offline sales by widening their store operations at different geographic locations. This helped the company generate and sell products efficiently and cater to every consumer category in large geographic areas. This not only raises the sales of jewelry products but also fuels the sales of the market. The huge growth in retail channels in different cities and regions will drive customer familiarization with different types of gems and jewelry. It will also increase the value sales of the market during the forecast period. Although the offline distribution channel is losing its market and popularity to the online channel, extensive and innovative marketing will drive sales through the channel at a steady rate.

Regional Analysis

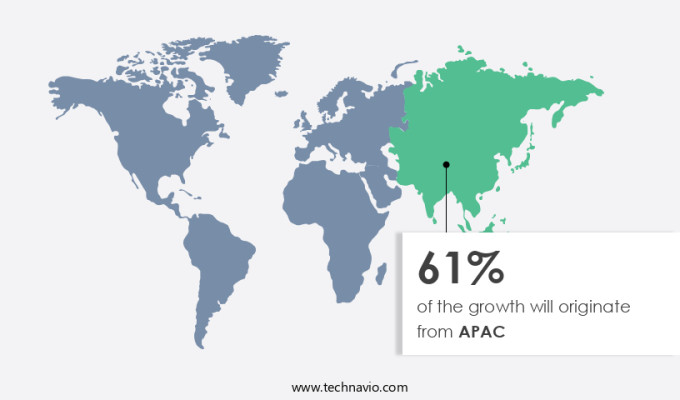

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In 2022, the market in APAC was the largest segment of the market and is expected to grow at a significant rate as compared to other regions. The growth of the market in APAC is attributable to the rising economic growth, expanding middle-class population base, and a growing number of players operating in the region. The key leading countries in the region are China, India, and Japan. The strong contribution from China and India to the market was majorly due to the great demand (especially those that are made of gold). Such factors will stimulate gems and jewelry market growth during the forecast period.

For more insights on the market share of various regions, View the Sample PDF now!

- Countries such as India, China, Australia, Malaysia, and Japan were severely affected by the COVID-19 pandemic, especially in 2020. However, the lockdown restrictions were lifted in the second half of 2020 owing to large-scale vaccination drives across APAC. This has led to the reopening of jewelry malls and shops in the first half of 2021. Moreover, the growing trend of renting men's accessories for various social events and the increase in disposable incomes are expected to recover and stabilize the growth of the market in the region during the forecast period. Moreover, companies adopt several strategies, such as the expansion of the business to increase their market reach. Such initiatives taken by companies are expected to drive the growth of the market in APAC during the forecast period.

What are the Gems and Jewelry Market Dynamics Shaping Growth?

- The market sparkles with a blend of tradition, fashion trend, and consumer preferences, offering a dazzling array of ornaments and accessories. From single-stone stud earrings to intricate pendants and rings, the industry caters to diverse tastes and spending powers. Embracing luxury metals like gold, silver, and platinum, along with exquisite gemstones and diamonds, it reflects different cultures and gift exchange practices worldwide. With a focus on authenticity, purity, and ethical practices, consumers, including the middle-class group, seek customized pieces through online retail channels. Designers leverage technology to create timeless treasures, destined for export to luxury markets across the globe.

- The gems and jewelry market is evolving with a focus on sustainability and ethical sourcing, alongside the rise of lab-grown diamonds. Customization and personalization are key drivers of consumer interest, complemented by the growth of online jewelry retail. The luxury jewelry market is expanding, while gold jewelry sees a resurgence. Emerging gems and jewelry trends, analyzed in the latest industry reports, further contribute to the market's growth and development.

Our researchers analyzed the data with 2022 as the base year and the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Drivers

- Wedding celebrations play a significant role in driving the demand for jewelry, which is primarily seen as an occasional product. The market is further fueled by the growing expenditure on bridal collections. India stands out as a major market for wedding jewelry, with increasing budgets allocated to wedding functions.

- Moreover, the expanding middle-class population and rising disposable income contribute to the growth of the market as individuals save more for their own weddings and those of their family members. This increased savings translate into higher spending power on wedding functions and related products, including bridal jewelry. Hence, such factors are driving gems and jewelry market growth during the forecast period.

Significant Market Trends

- The introduction of AR in the market is the primary trend driving market growth. Augmented reality is driving demand in the global market, particularly in the online segment. To enable customers to try on jewelry virtually before purchasing, e-commerce players are developing platforms based on augmented reality technology. Customers can use the camera on their device to see how different products look on them and choose the perfect match.

- Riddles Jewelry, a US-based player, has already launched an application for Android and iOS platforms to provide this feature. The introduction of such features will not only support informed decision-making by customers but also drive gems and jewelry market growth during the forecast period.

Major Market Challenges

- The global market is facing a major challenge with the decline in demand for gold jewelry as an investment option. Gold jewelry has traditionally been popular not only for personal adornment but also as a favoured investment choice, particularly in countries like India. Its high resale value and significance in gifting during weddings have contributed to its appeal. However, the market has witnessed a shift towards alternative investment options and intricate fashion jewelry in recent years, resulting in a decreased demand for gold jewelry. To address this, the Indian government introduced gold bonds as a measure to reduce reliance on gold as an investment avenue.

- This decline in demand for gold jewelry poses a significant challenge to the overall growth of the global market, given that it is the largest segment. Companies operating in the online jewelry retailing sector have been particularly affected by this trend, impacting their revenue. Weak consumer demand and the upward trend in gold prices are expected to further impact gems and jewelry market growth during the forecast period.

Who are the Major Gems and Jewelry Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. One of the major companies in the market include:

Kalyanje Wellers.- The company offers gems and jewelry such as gemstone jewelry. The company designs manufactures, and sells various gold, studded, and other jewelry products

The gems and jewelry market forecasting report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Aurum designer jewellers

- CHANEL Ltd.

- Chow Tai Fook Jewellery Group Ltd.

- Compagnie Financiere Richemont SA

- Emperor Watch and Jewelry Ltd

- Graff Diamonds Ltd.

- Hstern Jewellery Ltd.

- Kalyan Jewellers India Ltd.

- Kering SA

- LVMH Moet Hennessy Louis Vuitton SE

- Malabar Gold and Diamonds

- Pandora AS

- PC Jeweller Ltd.

- Rajesh Exports Ltd.

- Riddles Group Inc.

- Signet Jewelers Ltd.

- Stuller Inc.

- Swarovski AG

- Tata Sons Pvt. Ltd.

- The Swatch Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified. Furthermore, it is also quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What are the Latest Market Developments and News?

-

In December 2024, Tiffany & Co. launched a new high-end jewelry collection featuring ethically sourced gemstones, aiming to cater to the growing demand for sustainable luxury items. The collection includes diamonds and colored stones, with a focus on transparency and traceability throughout the supply chain.

-

In November 2024, De Beers introduced a new line of lab-grown diamonds, offering consumers an eco-friendly alternative to mined diamonds. The diamonds are produced using innovative technology and are designed to appeal to environmentally conscious buyers in the global jewelry market.

-

In October 2024, Pandora unveiled an expansion of its gemstone jewelry collection, incorporating rare and exotic stones like sapphires and emeralds. The collection is designed to attract consumers seeking premium and unique pieces, aligning with the increasing trend of personalized and bespoke jewelry.

-

In September 2024, Cartier launched a new range of luxury watches and jewelry that features colored gemstones and diamonds, blending classic designs with modern trends. The launch targets affluent customers who are seeking high-quality, statement pieces for special occasions.

Will Consumer Demand Drive Market Growth?

- In the dynamic world of fashion, the market stands as a beacon of sophistication and elegance. From classic single-stone stud earrings to ornate pendants, it caters to diverse tastes and occasions. With a focus on luxury goods, the industry bridges different cultures through exquisite ornaments and traditional gift exchange practices. Consumer preferences, especially among the middle-class group, drive demand, emphasizing the importance of authenticity and purity. Ethical practices are increasingly prioritized in sourcing and production, reflecting the values of both designers and consumers. Leveraging online retail platforms, the market expands its reach to export destinations, shaping the global landscape of precious metals and luxury gems.

- Moreover, the market epitomizes the ever-evolving landscape of luxury and style, influenced by prevailing fashion trends and driven by the middle-class group of consumers seeking both elegance and affordability. With a rich history, the industry encompasses both the gold and diamond sectors, offering a diverse array of luxury metals and gems including white gold and rose gold. Catering to modern lifestyles, especially among working women embracing a Western lifestyle, branded jewelers leverage computer-aided design (CAD) and rapid prototyping (RP) for innovative designs, while e-commerce platforms provide convenient access. Both offline retail stores and online retail stores play pivotal roles in this vibrant Gem and Jewellery Industry, supported by initiatives like the Gold Monetization Scheme and Special Economic Zones (SEZs).

- In addition, the market encompasses various sectors, including gold and diamond jewelry, each contributing to the rich tapestry of luxury adornments. Within the market, the real jewelry segment thrives, offering an array of exquisite pieces ranging from bracelets to chains & pendants crafted with meticulous attention to detail. Innovations like 3D printing have revolutionized manufacturing processes, allowing for intricate designs and customization. Additionally, the gem and jewelry industry benefits from infrastructure such as common facility centers (CFCs), facilitating production and fostering collaboration. Together, these elements shape a dynamic market catering to diverse consumer preferences and demands.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.62% |

|

Market growth 2024-2028 |

USD 172.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 61% |

|

Key countries |

China, US, India, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aurum designer jewellers, Chanel Ltd., Chow Tai Fook Jewellery Group Limited, Compagnie Financiere Richemont SA, Emperor Watch and Jewelry Ltd, Graff Diamonds Ltd., Hstern Jewellery Ltd., Kalyan Jewellers India Ltd., Kering SA, LVMH Group., Malabar Gold and Diamonds, Pandora AS, PC Jeweller Ltd., Rajesh Exports Ltd., Riddles Group Inc., Signet Jewelers Ltd., Stuller Inc., Swarovski AG, Tata Sons Pvt. Ltd., and The Swatch Group Ltd. |

|

Market dynamics |

Parent market analysis, Market forecasting , market report , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Gems and Jewelry Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2028.

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this gems and jewelry market research report to meet your requirements. Get in touch