Geophysical Services Market Size 2024-2028

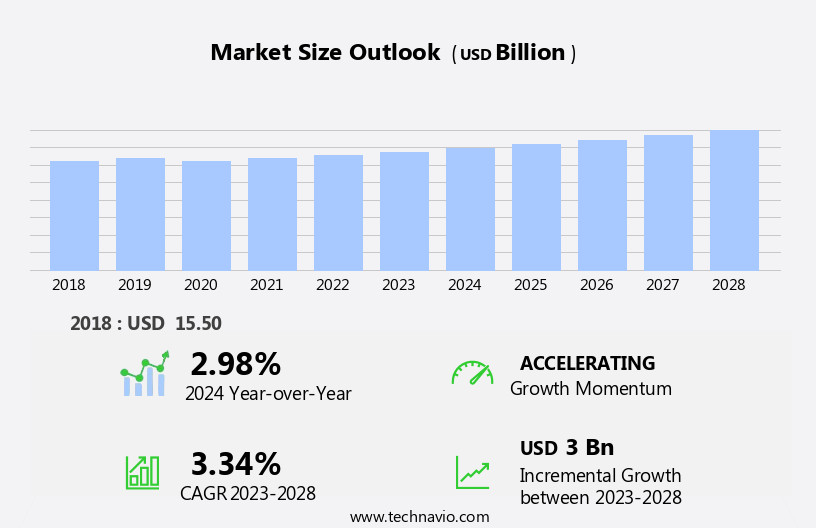

The geophysical services market size is forecast to increase by USD 3 billion at a CAGR of 3.34% between 2023 and 2028.

What will be the Size of the Geophysical Services Market during the forecast period?

How is this Geophysical Services Industry segmented?

The geophysical services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Land

- Marine

- Aerial

- Geography

- North America

- US

- Europe

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Type Insights

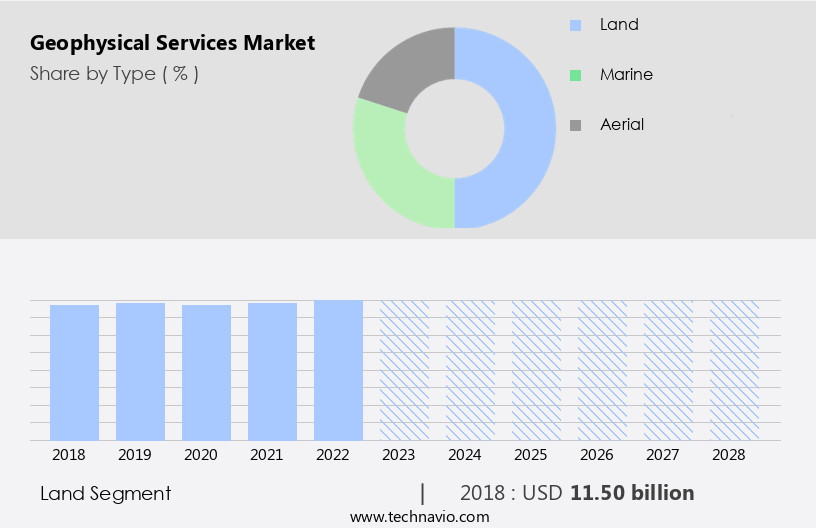

The land segment is estimated to witness significant growth during the forecast period.Geophysical services play a crucial role In the exploration and characterization of various mineral, oil, and gas reserves, as well as water and agricultural lands. These services employ various techniques, including seismic surveys, gravity surveys, magnetics, electromagnetic (EM) surveys, and electrical resistivity tomography. Seismic surveys are a significant component of land-based geophysical services, which can be executed as 2D, 3D, or 4D surveys. Two-dimensional surveys are surface-level assessments, while 3D surveys delve deeper into subsurface geology. Four-dimensional surveys combine multiple 3D technologies to enhance data acquisition efficiency. Other geophysical techniques, such as gravity and magnetic surveys, are essential for understanding Earth's mineral and geological composition, while electromagnetic surveys aid in detecting electrical conductivity variations.

Additionally, geophysical services contribute to industries like mining, engineering, and archaeology, as well as renewable energy sources like wind and geothermal. Regulatory impediments, environmental regulations, land access permissions, safety standards, and the adoption of drone technology, data analytics, and processing algorithms influence the market.

Get a glance at the market report of share of various segments Request Free Sample

The Land segment was valued at USD 11.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

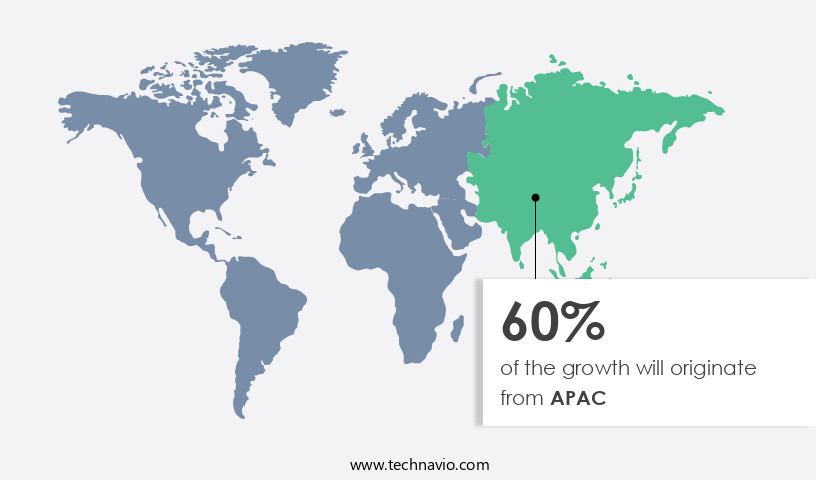

APAC is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing notable expansion, driven primarily by the oil and gas sector's increasing exploration and production activities. The US and Canada are focal regions, with substantial reserves of shale gas and oil sands, respectively. Technological innovations in seismic surveys, such as 3D and 4D seismic imaging, have significantly improved subsurface mapping's accuracy and efficiency. In the US, the resurgence of shale gas exploration, particularly In the Permian Basin, is fueling demand for geophysical services. Moreover, the push for renewable energy sources, including geothermal energy, is contributing to market growth. Seismic surveys employ various techniques, including gravity, magnetics, seismic refraction, electric fields, and electromagnetic methods, to assess Earth's mineral, geological, and structural compositions.

These services are essential for industries like mining, engineering, and construction, as well as for forensic science, agriculture, and archaeological research. Additionally, geophysical services are crucial for wind energy exploration and hydrocarbon production, both onshore and offshore. Regulatory impediments, environmental regulations, land access permissions, safety standards, and the integration of drone technology, data analytics, processing algorithms, and decision-making procedures further expand the market's scope. Geophysical sensors, data processing systems, and LIDAR, aerial-based, and land-based surveys are essential tools for water exploration, ecosystems, biodiversity, and conservation efforts. In summary, the market in North America is experiencing substantial growth due to the oil and gas sector's expansion, the push for renewable energy sources, and the technological advancements in geophysical survey techniques.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Geophysical Services Industry?

- Rising multi-client survey approach is the key driver of the market.

- Geophysical services involve the acquisition and licensing of multi-client geophysical data, primarily for use by oil and gas companies. In this approach, a geophysical company collects data over extensive acreage and licenses it to numerous clients, reducing the per-unit-area cost. The rising expense of data ownership has led to this market trend. Interpreting the data is often more valuable to companies than exclusive ownership. Geophysical companies design surveys based on E&P requirements, assuming all risks and costs. This business model allows for cost savings and shared access to valuable geophysical data. Oil and gas companies benefit from the expertise of geophysical firms in data acquisition and interpretation, enabling them to make informed decisions regarding exploration and production activities.

What are the market trends shaping the Geophysical Services Industry?

- Increasing use multi-sensors for 4D surveys is the upcoming market trend.

- Geophysical services involve the use of seismic techniques to identify mineral and hydrocarbon reserves. Traditional methods include 2D and 3D seismic acquisition, which transmits seismic waves through the Earth's surface using a geophone connected to a specialized truck. The received waves help in creating images of the subsurface. The emergence of 4D seismic techniques, also known as time-lapse seismic, has significantly improved the identification of hydrocarbon reserves. This technique monitors changes in reservoirs over time by combining 3D seismic data, enhancing image quality and enabling better understanding of reservoir behavior. The adoption of 4D seismic services has positively impacted exploration and production activities.

What challenges does the Geophysical Services Industry face during its growth?

- Slowdown in investments in oil and gas industry is a key challenge affecting the industry growth.

- The market is significantly influenced by the oil and gas industry's upstream sector, as continuous exploration and survey are essential for its growth. However, volatility in oil and gas prices can negatively impact the market's expansion. Prior to 2014, high crude oil prices led to substantial investments by upstream companies in geophysical services. Although oil prices showed recovery in 2018 and Q1 2019, they have remained unpredictable. For example, in October 2018, Brent crude oil reached a four-year high of USD86 per barrel since 2014, while WTI surpassed the USD70-per-barrel threshold. The market's growth trajectory is closely linked to the oil and gas industry's price trends.

Exclusive Customer Landscape

The geophysical services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the geophysical services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, geophysical services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abitibi Geophysics - The company specializes in providing advanced geophysical services, including subsurface imaging, seismic imaging, and least square migration, utilizing state-of-the-art technology to deliver accurate and detailed data for clients in various industries. Our services enhance exploration and production efforts by offering clear and precise subsurface visualizations, ensuring optimal resource management and exploration success.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abitibi Geophysics

- CGG SA

- China National Offshore Oil Corp.

- Dawson Geophysical Co.

- EON Geosciences Inc.

- Fugro NV

- Geophysical Survey Systems Inc.

- GeoTech

- Halliburton Co.

- PGS ASA

- Phoenix Geophysics

- Ramboll Group AS

- SAExploration Holdings Inc.

- Schlumberger Ltd.

- Sea Geo Surveys Pvt. Ltd.

- Spectrum Geophysics

- TGS NOPEC Geophysical Co ASA

- Weatherford International Plc

- Xcalibur Multiphysics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of techniques used to explore and understand the subsurface of the Earth. These methods include gravity, magnetics, seismic refraction, electric fields, and others. The primary applications of geophysical services span various industries, such as geology, engineering, mining, agriculture, and forensic science. Gravity and magnetics are two widely used geophysical techniques that provide valuable information about the Earth's geological composition and structural composition. Gravity surveys measure the Earth's gravitational field to detect variations in subsurface density, while magnetics surveys determine the distribution of magnetic minerals. Both methods contribute to the characterization of the Earth's crust and upper mantle.

Seismic surveys employ seismic refraction and other methods to study the Earth's subsurface by measuring the propagation of seismic waves. Seismic refraction uses the reflection and refraction of seismic waves to image the subsurface and determine the structural composition of the Earth. Seismic technology plays a crucial role In the oil & gas industry for hydrocarbon exploration and production. Electric fields and electromagnetic techniques are employed to investigate the subsurface electrical properties of the Earth. These methods are used in various applications, such as mineral exploration, groundwater exploration, and environmental studies. Geophysical services are also used In the mining industry for site characterization and mineral exploration.

Mining companies rely on geophysical data to assess the potential mineral deposits, evaluate the geological conditions, and optimize mining operations. In the agriculture sector, geophysical services are used for soil composition analysis and water exploration. This information helps farmers make informed decisions regarding crop selection, irrigation, and soil management. Regulatory impediments, environmental regulations, and land access permissions are some of the challenges that the geophysical services industry faces. Safety standards, drone technology, data analytics, and processing algorithms are essential tools for addressing these challenges and improving operational efficiency. Geophysical services are also used In the renewable energy sector, particularly in wind energy and geothermal exploration.

These applications help assess the potential energy resources and optimize the placement of wind turbines and geothermal wells. The integration of digital technologies, such as the Internet of Things and data processing systems, has significantly impacted the geophysical services industry. Advanced processing algorithms and decision-making procedures enable more accurate and efficient data analysis. Geophysical services are essential for various industries, including the construction sector, archaeology, and infrastructure projects. These applications range from assessing the subsurface conditions for foundation design to detecting buried structures for archaeological research. The market is constantly evolving, with ongoing research and development in seismic sensors, data processing systems, and new technologies, such as Lidar and aerial-based surveys.

These advancements contribute to more accurate and cost-effective geophysical data acquisition and analysis. In conclusion, the market plays a vital role in various industries by providing valuable insights into the Earth's subsurface. The market's ongoing innovation and advancements contribute to more efficient and accurate data acquisition and analysis, enabling informed decision-making and optimizing operations in various sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.34% |

|

Market growth 2024-2028 |

USD 3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.98 |

|

Key countries |

US, China, Russia, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Geophysical Services Market Research and Growth Report?

- CAGR of the Geophysical Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the geophysical services market growth of industry companies

We can help! Our analysts can customize this geophysical services market research report to meet your requirements.