Drone Market Size 2025-2029

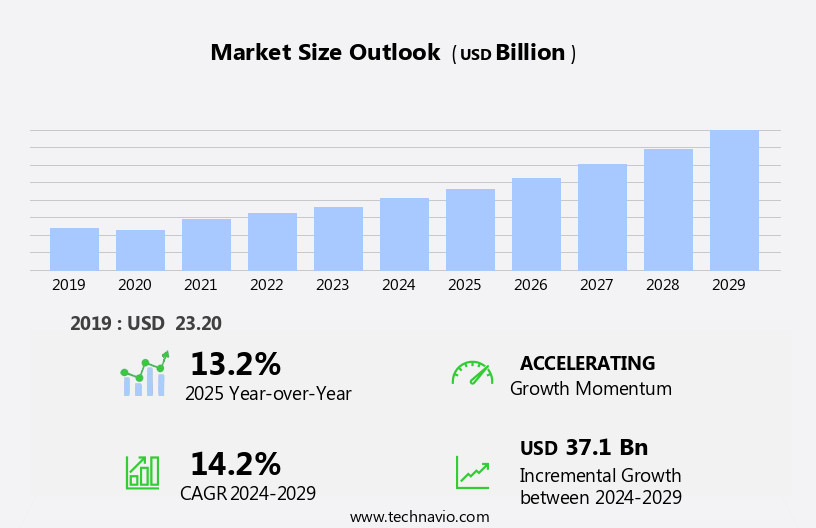

The drone market size is forecast to increase by USD 37.1 billion, at a CAGR of 14.2% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing applications of drones across various industries, including agriculture, construction, and film production.

Major Market Trends & Insights

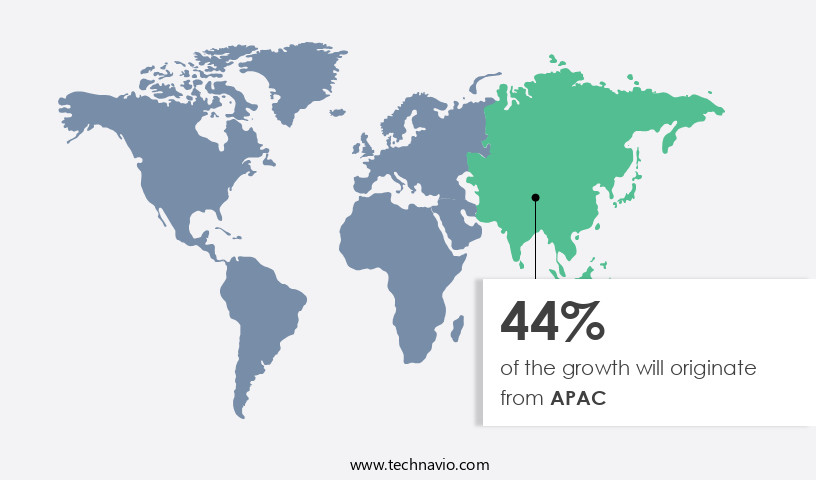

- APAC dominated the market and contributed 44% to the growth during the forecast period.

- The market is expected to grow significantly in North America region as well over the forecast period.

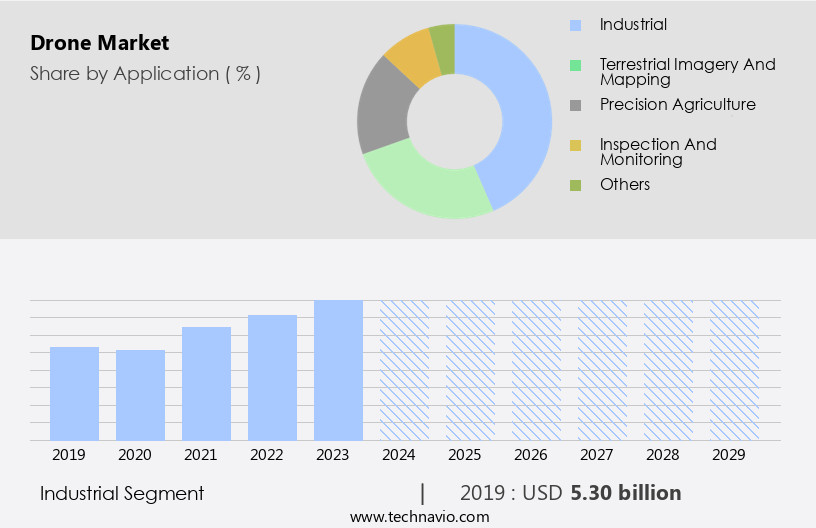

- Based on the Application, the Industrial segment led the market and was valued at USD 7.90 billion of the global revenue in 2023.

- Based on the Type, the Rotary blade segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 230.17 Billion

- Future Opportunities: USD 37.1 Billion

- CAGR (2024-2029): 14.2%

- APAC: Largest market in 2023

New developments and launches of commercial drones continue to expand their capabilities, offering enhanced features such as improved battery life, advanced sensors, and real-time data transmission. However, this market's growth is not without challenges. Restrictive laws and regulations governing the use of Unmanned Aerial Vehicles (UAVs) pose a significant obstacle, with many countries implementing strict guidelines and requirements for obtaining licenses and certifications.

Companies seeking to capitalize on the opportunities presented by the market must navigate these regulatory hurdles while staying informed of the latest technological advancements to remain competitive. Effective operational planning and strategic business decisions are essential for success in this dynamic and evolving market.

What will be the Size of the Drone Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Motor performance and payload capacity are key considerations for fixed-wing drones used in survey applications, while flight endurance is crucial for multirotor UAVs employed in delivery systems. Lidar mapping and geospatial analysis are revolutionizing industries, with a recent study revealing a 25% increase in market growth expectations for geospatial analysis in the next five years. Mapping software integration, sensor integration, and autonomous navigation are essential features for drones in precision agriculture, enabling farmers to optimize crop yields through real-time monitoring and data analytics.

Flight control systems, GPS guidance, and obstacle avoidance are essential for inspection services in industries such as energy and infrastructure. Moreover, advancements in battery technology, propeller efficiency, and software algorithms have led to improvements in flight endurance and payload capacity. Thermal imaging, object detection, and 3D modeling are increasingly used in security surveillance and aerial photography. Rotorcraft technology, camera resolution, and drone regulations continue to shape the market landscape. For instance, a leading drone manufacturer reported a 30% sales increase in 2021 due to the growing demand for drones in various industries. With the ongoing integration of sensors, software, and autonomous navigation, the future of the market looks promising, offering endless possibilities for innovation and growth.

How is this Drone Industry segmented?

The drone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Industrial

- Terrestrial imagery and mapping

- Precision agriculture

- Inspection and monitoring

- Others

- Type

- Rotary blade

- Fixed wing

- Hybrid

- Technology

- Remotely piloted

- Optionally piloted

- Fully autonomous

- End-use Industry

- Agriculture

- Logistics

- Media and Entertainment

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The industrial segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 7.90 billion in 2023. It continued to the largest segment at a CAGR of 10.13%.

The commercial market is experiencing significant growth, driven by the increasing adoption of drones in various industries. Advanced mapping software and motor performance enhance the capabilities of fixed-wing drones for survey applications in geospatial analysis and precision agriculture. Lidar mapping and spectral imaging enable accurate data analytics, while flight endurance and autonomous navigation facilitate inspection services in sectors like construction and infrastructure. Delivery systems are revolutionizing logistics, with drones expected to account for 20% of the global delivery market by 2030. Advanced flight control systems and obstacle avoidance ensure safe and efficient operations. Thermal imaging, object detection, and real-time monitoring contribute to security surveillance and emergency response.

The integration of sensor technology, software algorithms, and GPS guidance streamlines processes and improves efficiency. Drone regulations continue to evolve, enabling wider adoption in industries like energy, telecommunications, and media. With the increasing demand for high-resolution aerial photography and 3D modeling, the market is poised for continued growth, reaching an estimated USD 125 billion by 2027.

The Industrial segment was valued at USD 5.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 12.50 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, with key industries in the Asia-Pacific (APAC) region leading the charge. Technological advancements and increasing adoption in sectors such as agriculture, construction, defense, mining, and survey applications are driving this trend. For instance, China, a major contributor to the APAC market, boasts robust manufacturing capabilities, low-cost electronics, and a widespread application of drones. In January 2025, SZ DJI Technology Co., Ltd. introduced the DJI Flip, a lightweight and foldable drone for vloggers, offering manual and automated flight modes for enhanced flexibility. Drones equipped with advanced mapping software, motor performance, and fixed-wing designs are increasingly being used for survey applications and geospatial analysis.

Payload capacity, Lidar mapping, and flight endurance are essential features for these applications. Meanwhile, multirotor UAVs and delivery systems are revolutionizing industries like logistics and e-commerce. Data analytics, flight control systems, remote sensing, spectral imaging, obstacle avoidance, sensor integration, battery technology, propeller efficiency, autonomous navigation, inspection services, thermal imaging, software algorithms, GPS guidance, airspace management, security surveillance, image processing, aerial photography, object detection, 3D modeling, and rotorcraft technology are all integral components of the drone ecosystem. According to recent reports, the market is projected to grow at a steady pace, with APAC accounting for over 40% of the market share by 2029.

This growth is attributed to the increasing demand for drones in various industries and the continuous advancements in drone technology.

Market Dynamics

"The drone market is accelerating due to increasing AI adoption for autonomous navigation and analytics, with North America currently holding the largest share in the global landscape."

- Rahul Somnath, Assistant Research Manager, Technavio

StartFragment The drone market is rapidly evolving with innovations that are transforming aerial operations across industries. Technologies like advanced drone propulsion systems and efficient drone battery management are improving drone flight stability and optimizing drone flight performance, enabling longer and more reliable missions. High-precision aerial mapping and drone based 3d model generation are revolutionizing surveying and construction, while AI-powered drone image analysis and multispectral drone imaging analysis enhance data accuracy for agriculture and environmental monitoring. Real-time drone data streaming and remote drone diagnostics systems support seamless operations and maintenance. Advanced drone obstacle avoidance and effective drone payload integration are critical for safety and versatility. Meanwhile, autonomous drone cargo delivery and drone-based infrastructure monitoring are expanding commercial applications, all while reducing drone operational costs and enhancing drone communication range.EndFragment

The market is experiencing rapid growth, driven by advancements in drone technology and increasing applications across various industries. One of the key areas of innovation is in drone propulsion systems, which are becoming more advanced and efficient, enabling longer flight times and greater payload capacity. In the realm of aerial mapping, high-precision drones equipped with AI-powered image analysis are revolutionizing industries such as construction and agriculture, providing real-time data for efficient planning and decision-making. Drone battery management systems are also becoming more sophisticated, ensuring optimal performance and reducing operational costs.

Real-time data streaming is another crucial aspect of the market, allowing for drone swarm coordination techniques and autonomous drone inspection protocols to be implemented effectively. Advanced drone sensor technologies, including obstacle avoidance systems, are improving flight stability and safety, while remote diagnostics systems enable quick maintenance and repair. Effective payload integration is also a major focus, with drones being used for a range of applications from 3D model generation to autonomous cargo delivery. Drones are also being utilized for infrastructure monitoring, multispectral imaging analysis, and hyperspectral imaging solutions, providing valuable insights for industries such as energy and utilities. To enhance communication range and optimize flight performance, drone manufacturers are investing in advanced communication technologies and autonomous navigation systems. Overall, the market is poised for continued growth, with innovations in propulsion, image analysis, battery management, and sensor technologies driving new applications and use cases.

What are the key market drivers leading to the rise in the adoption of Drone Industry?

- The increasing utilization of drones is the primary factor fueling market growth.

- The market is experiencing significant growth due to the increasing adoption in various sectors, particularly defense and logistics. Innovations in drone technology have expanded their applications beyond traditional uses, reaching agriculture, construction, mapping, and surveying. In logistics, drones are poised to revolutionize delivery services, with several companies, including DHL and Amazon, exploring their implementation. These innovations offer the potential to significantly reduce delivery times compared to traditional road transport.

- According to industry reports, the market is projected to grow by over 20% annually, underscoring the immense potential of this technology. For instance, a leading logistics company reported a 30% reduction in delivery time after integrating drone services into their operations.

What are the market trends shaping the Drone Industry?

- The emerging trend in the commercial sector involves new developments and launches of drones. The commercial market is currently witnessing significant advancements with the introduction of new drone technologies and launches.

- Drones have significantly transformed various industries with their ease of deployment, low maintenance costs, and unique capabilities. They are increasingly being utilized in sectors such as wireless coverage and remote sensing, search and rescue operations, delivery services, security and surveillance, precision agriculture, and civil infrastructure inspection. In the realm of search and rescue (SAR), drones have proven to be indispensable, expediting rescue efforts during natural or man-made disasters. For instance, during floods, drones can quickly survey vast areas, providing timely disaster warnings and transporting essential supplies to inaccessible regions.

- In hazardous situations like toxic gas releases, wildfires, and avalanches, drones play a crucial role in supporting and accelerating SAR operations, minimizing risks to personnel. With the integration of advanced technologies such as thermal imaging, drones can locate victims more efficiently and effectively, making them an essential tool in disaster response and management.

What challenges does the Drone Industry face during its growth?

- The strict regulations and limiting laws imposed on the use of Unmanned Aerial Vehicles (UAVs) represent a significant challenge to the industry's growth trajectory.

- The market presents both opportunities and challenges, particularly in relation to security concerns. Malicious actors, including criminals and terrorists, can exploit the ease of use and accessibility of drones for nefarious purposes. These threats necessitate stringent regulations to ensure the secure use of drones. For instance, governments worldwide have imposed restrictions on drone usage near sensitive areas. Type certification is mandatory for drone use, and operators must obtain a drone pilot license after completing training from authorized organizations. According to industry reports, the market is expected to grow by over 20% in the next few years, driven by increasing applications in various industries such as agriculture, construction, and logistics.

- However, the potential misuse of drones for criminal and terrorist activities underscores the need for robust regulatory frameworks and ongoing security measures.

Exclusive Customer Landscape

The drone market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the drone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, drone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

DJI - This company specializes in providing advanced drone solutions, including the Vapor, Puma 3 AE, and Raven models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Robotics

- AeroVironment, Inc.

- Autel Robotics

- Boeing

- Delair

- DJI

- EHang Holdings Limited

- FLIR Systems, Inc.

- General Atomics

- Hitec Commercial Solutions

- Intel Corporation

- Kespry

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Parrot SA

- PrecisionHawk

- Skydio

- SZ DJI Technology Co., Ltd.

- senseFly

- Yuneec International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Drone Market

- In January 2024, Amazon announced the successful completion of its first drone delivery in the United States, marking a significant milestone in the commercial application of drone technology for e-commerce (Amazon Press Release).

- In March 2024, Intel and Microsoft entered into a strategic partnership to integrate Intel's drone technology into Microsoft's Azure platform, aiming to provide advanced analytics and AI capabilities for drone operations (Intel Press Release).

- In April 2024, Skydio, a leading drone manufacturer, raised a USD175 million Series D funding round, bringing its total funding to over USD 300 million, to accelerate product development and expand its market presence (Skydio Press Release).

- In May 2025, the European Union Aviation Safety Agency (EASA) issued new regulations for drone operations, requiring all commercial drones to be registered, insured, and operated by certified pilots, setting a new standard for drone safety and compliance in Europe (EASA Press Release).

Research Analyst Overview

- The market continues to evolve, with new applications emerging across various sectors, including construction, agriculture, energy, and infrastructure inspection. Point cloud processing and infrared cameras enable more accurate terrain modeling and infrastructure inspections, while wind resistance and network connectivity ensure reliable drone deployment in challenging environments. Payload optimization and power consumption are critical considerations for UAV platforms, as is data security during acquisition, storage, and transmission. For instance, a leading construction firm reported a 30% increase in project efficiency by using drones for site surveying and progress monitoring.

- Industry growth is expected to reach double-digit percentages in the coming years, driven by the adoption of advanced technologies such as high-resolution sensors, autonomous flight, and digital elevation models. Operational safety, emergency procedures, and regulatory compliance remain top priorities, with companies investing in mission planning software, weather forecasting, and maintenance procedures to ensure optimal performance and reliability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Drone Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market growth 2025-2029 |

USD 37.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.2 |

|

Key countries |

China, US, Canada, Germany, Japan, UK, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Drone Market Research and Growth Report?

- CAGR of the Drone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the drone market growth of industry companies

We can help! Our analysts can customize this drone market research report to meet your requirements.