Geothermal Energy Power Equipment Market Size 2025-2029

The geothermal energy power equipment market size is forecast to increase by USD 1.39 billion, at a CAGR of 6.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in geothermal power plants for enhanced efficiency and productivity. These technologies enable real-time monitoring and predictive maintenance, reducing downtime and optimizing energy output. Moreover, the market is witnessing a steady decline in the high levelized cost of energy, making geothermal power increasingly competitive with conventional energy sources. However, challenges persist, including the limited availability of suitable geothermal resources in certain regions and the high upfront capital investment required for geothermal power projects. To capitalize on market opportunities, companies must focus on expanding their presence in regions with abundant geothermal resources and collaborating with technology partners to develop cost-effective and efficient solutions for geothermal power generation.

- Additionally, strategic partnerships and mergers and acquisitions can help companies overcome the high capital investment barrier and gain a competitive edge in the market.

What will be the Size of the Geothermal Energy Power Equipment Market during the forecast period?

The geothermal energy market continues to evolve, driven by advancements in technology and increasing demand for renewable energy sources. Geothermal heat pumps are gaining traction as a sustainable solution for heating and cooling, integrating seamlessly into various sectors such as residential, commercial, and industrial applications. The market dynamics are shaped by ongoing activities in geothermal resource assessment, management, and exploration. Enhanced geothermal systems and advanced geothermal technologies are at the forefront of innovation, with private investment and public-private partnerships playing a crucial role in financing and construction management. Geothermal power plants are being optimized through the use of machine learning, artificial intelligence, and power electronics, while regulations and permitting processes are evolving to accommodate the industry's growth.

The importance of community engagement, environmental impact assessments, and revenue generation cannot be overlooked in the market's unfolding. Geothermal sustainability is a key consideration, with thermal energy storage, hydrothermal resources, and geothermal reservoir management playing essential roles in ensuring long-term viability. The market's continuous evolution is further influenced by government incentives, renewable energy credits, and capital expenditures. Seismic surveys, drilling technology, and well completion techniques are continually advancing, enabling the exploration of new geothermal resources and the expansion of existing ones. The market's complexity is further underscored by the need for efficient plant operation and maintenance, as well as the integration of data acquisition systems and control systems into geothermal power generation.

How is this Geothermal Energy Power Equipment Industry segmented?

The geothermal energy power equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Turbines

- Generators

- Heat exchangers

- Others

- Application

- Electricity generation

- District heating

- Industrial heating

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- APAC

- Indonesia

- Japan

- New Zealand

- Philippines

- South America

- Chile

- Rest of World (ROW)

- North America

By Type Insights

The turbines segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements in various segments, including geothermal resource assessment, energy storage, and geothermal sustainability. Enhanced geothermal systems (EGS) have emerged as a major technological development, with Mazama Energy, Inc. Recently receiving a grant from the US Department of Energy's Geothermal Technologies Office to demonstrate a superhot rock (SHR)-EGS on Newberry Volcano in Oregon. This innovative system utilizes artificial intelligence and machine learning to optimize drilling and plant operations, reducing costs and increasing efficiency. Private investment in geothermal energy is on the rise, with green bonds and renewable energy credits providing financing opportunities. Advanced geothermal technologies, such as binary power cycles and direct use geothermal, are gaining popularity due to their ability to generate electricity and provide thermal energy for heating and cooling applications.

Geothermal resource management and exploration are crucial for identifying and assessing hydrothermal resources, while geothermal regulations ensure sustainable practices. The permitting process and construction management are essential for the successful implementation of geothermal power plants. Seismic surveys and electromagnetic surveys are used to assess geothermal reservoirs and locate geothermal wells. Thermal energy storage and data acquisition systems enable efficient power generation and revenue generation. Community engagement and environmental impact assessment are vital for public acceptance and long-term success. Geothermal power plants employ various components, such as heat exchangers, power electronics, control systems, and geothermal regulations, to ensure optimal performance and efficiency.

Government incentives and geothermal financing schemes provide additional support for the industry's growth. Overall, the market is evolving, with a focus on sustainability, efficiency, and innovation.

The Turbines segment was valued at USD 1.52 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Asia-Pacific (APAC) region is experiencing significant growth in the market due to increasing renewable energy initiatives and sustainability efforts. New Zealand, in particular, is leading the charge with projects like the Taheke Geothermal Power Project, which received government consent in November 2024, contributing to the country's renewable energy objectives. Ormat Technologies' EPC contract for the Te Mihi 2 Geothermal Power Plant in January 2024 adds another 101 MW of capacity, following Contact Energy's approval for the same project in August 2022. Geothermal resource assessment and management are crucial aspects of this market, with private investment playing a vital role in financing projects.

Advanced geothermal technologies, such as enhanced geothermal systems and binary power cycles, are driving innovation. Energy storage solutions, including thermal energy storage and battery systems, are essential for optimizing plant performance and ensuring grid stability. The permitting process and construction management are intricate parts of geothermal power plant development. Seismic surveys, electromagnetic surveys, and environmental impact assessments are integral to understanding geothermal reservoirs and minimizing potential risks. Artificial intelligence and machine learning are being employed to analyze data from drilling technology and optimize plant operations. Geothermal regulations, direct use geothermal, and government incentives are shaping the market landscape.

Heat exchangers, power electronics, and control systems are essential components of geothermal power plants. Community engagement and revenue generation are essential for public acceptance and long-term success. Geothermal financing, drilling technology, and plant optimization are key focus areas for market players. Renewable energy credits and capital expenditures are significant factors influencing return on investment. Geothermal sustainability and efficiency are becoming increasingly important, with a growing emphasis on reducing operating costs and improving overall performance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Geothermal Energy Power Equipment Industry?

- Focusing on capacity additions is the primary factor fueling market growth. In order to maintain a professional tone, it is essential to add new capacities to meet increasing demand and expand business opportunities within the industry.

- The market is experiencing significant growth due to the increasing emphasis on expanding capacity and enhancing efficiency. This trend is evident in recent orders and agreements for new and upgraded geothermal power plant equipment. For instance, Toshiba Energy Systems and Solutions Corp announced a major order for a 30-megawatt steam turbine and generator in October 2024 for the Wayang Windu Geothermal Power Plant in Indonesia. This expansion project aims to boost the plant's output and reliability, reflecting the growing demand for geothermal energy in the region. Advancements in technology, such as artificial intelligence and machine learning, are also playing a crucial role in the market's growth.

- Thermal energy storage solutions are being integrated into geothermal power plants to ensure consistent power generation and stability in the grid. Geothermal financing mechanisms are being put in place to facilitate the development of new projects. Plant optimization and drilling technology are other key areas of focus, with data acquisition systems being used to improve operational efficiency and reduce downtime. Geothermal regulations are being put in place to encourage the adoption of direct use geothermal applications in various industries, providing new revenue streams for market participants. Community engagement and public acceptance are also essential factors influencing the market's growth.

- As the industry continues to expand, it is crucial to maintain a transparent and collaborative approach to project development and stakeholder engagement.

What are the market trends shaping the Geothermal Energy Power Equipment Industry?

- The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) represents a significant market trend. This convergence of technologies is transforming industries by enabling advanced data analysis, predictive maintenance, and automated decision-making in real-time.

- The market is experiencing notable advancements, particularly in the integration of artificial intelligence (AI) and the Internet of Things (IoT) for enhancing operational efficiency and reducing downtimes. Recent developments in this sector include the introduction of AI-based monitoring systems that utilize IoT components to offer predictive maintenance and real-time diagnostics. These innovations are revolutionizing geothermal power plants by enabling continuous equipment monitoring and proactive management. The collection and analysis of extensive data from various sensors and devices through AI and IoT integration facilitate early issue detection and minimize unplanned outages.

- Additionally, environmental impact assessments, electromagnetic surveys, well completion, and the binary power cycle are crucial aspects of geothermal exploration and power generation. Operating costs, operation and maintenance, power electronics, and control systems are essential factors influencing market growth. Government incentives continue to play a significant role in the expansion of the geothermal energy market.

What challenges does the Geothermal Energy Power Equipment Industry face during its growth?

- The high levelized cost of energy poses a significant challenge to the growth of the industry. This cost, which represents the total cost of producing and delivering energy over its entire lifecycle, is a critical factor that must be addressed by industry professionals to ensure sustainable and profitable business operations.

- The market is characterized by a higher levelized cost of energy (LCOE) compared to other renewable sources, such as solar and wind energy. Geothermal energy's LCOE ranges from USD45 to USD75 per megawatt hour, which is significantly higher than solar energy's range of USD30 to USD49 per megawatt hour and wind energy's range of USD30 to USD57 per megawatt hour. This cost disparity can be attributed to the substantial initial capital investment required for geothermal projects. This investment covers expenses for exploration, drilling, and the development of geothermal power plants. Despite these challenges, the geothermal energy sector continues to gain traction due to its ability to provide consistent and reliable power generation.

- The market's growth is driven by factors such as government incentives, increasing environmental awareness, and technological advancements in geothermal power equipment. The market is expected to grow steadily, offering opportunities for industry participants to innovate and improve the cost-effectiveness of geothermal energy power equipment.

Exclusive Customer Landscape

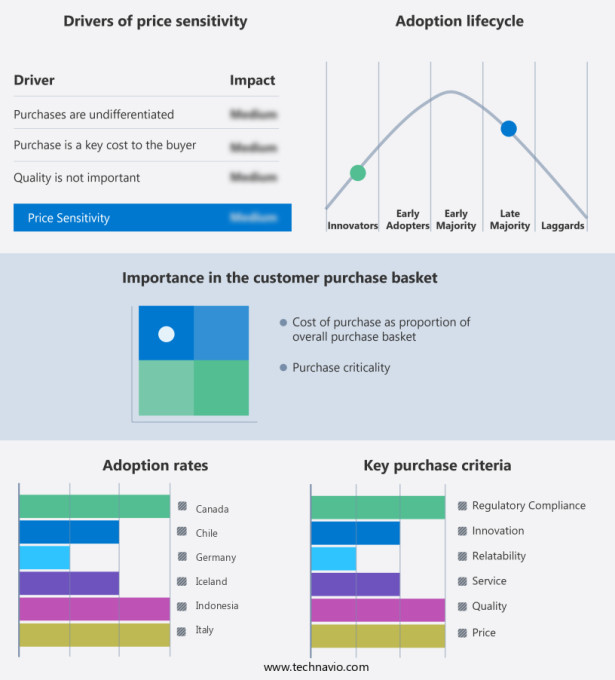

The geothermal energy power equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the geothermal energy power equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, geothermal energy power equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ansaldo Energia Spa - The company specializes in providing advanced geothermal energy solutions through the supply of innovative turbomachinery and steam turbine technology. Our offerings are designed to maximize energy efficiency and minimize environmental impact. By harnessing the natural heat from the earth, we contribute to sustainable and renewable power generation. Our expertise lies in delivering high-performance equipment that meets the evolving demands of the global energy market. With a focus on continuous research and development, we remain at the forefront of geothermal energy technology, providing clients with cutting-edge solutions to meet their energy needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ansaldo Energia Spa

- Baker Hughes Co.

- BauGrund Sud Gesellschaft fur Geothermie mbH

- Bosch Thermotechnik GmbH

- ElectraTherm Inc

- Enel Spa

- ERGIL

- EthosEnergy Group Ltd.

- First Gen Corp

- Fuji Electric Co. Ltd.

- Holtec International

- IHI Corp.

- Mitsubishi Gas Chemical Co. Inc.

- Ormat Technologies Inc.

- Schlumberger Ltd.

- Toshiba Corp.

- Turboden SpA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Geothermal Energy Power Equipment Market

- In February 2023, Enel Green Power, a leading international renewable energy player, announced the successful start of operations at the 110 MW Krafla Geothermal Power Plant in Iceland. This expansion marks a significant milestone in Enel's commitment to geothermal energy, increasing its installed capacity in this segment by over 50% (Enel Green Power Press Release, 2023).

- In June 2024, Siemens Gamesa Renewable Energy and Ormat Technologies, two major players in the renewable energy sector, entered into a strategic partnership to combine their expertise in wind and geothermal energy technologies. This collaboration aims to create integrated renewable energy solutions, offering customers a more comprehensive and efficient energy mix (Siemens Gamesa Renewable Energy Press Release, 2024).

- In October 2024, the European Investment Bank (EIB) committed â¬350 million to finance the expansion of geothermal energy projects in Iceland, Italy, and Kenya. This substantial investment is expected to boost the global geothermal energy market by increasing the capacity of existing power plants and supporting the development of new projects (European Investment Bank Press Release, 2024).

- In December 2025, Cerro Dominador, a Chilean energy company, unveiled its geothermal-solar hybrid power plant, the world's largest of its kind. This innovative project combines geothermal and solar energy, providing a more stable and reliable energy source while reducing greenhouse gas emissions (Cerro Dominador Press Release, 2025). These developments underscore the growing importance of geothermal energy as a key contributor to the global renewable energy landscape.

Research Analyst Overview

- The geothermal energy market is experiencing significant growth, driven by the need for sustainable development, energy security, and climate change mitigation. This renewable energy source, which harnesses the heat from geothermal fluids beneath the earth's surface, offers a reliable and low-carbon alternative to traditional fossil fuels. However, it is essential to address the interconnected challenges of land use, carbon capture, noise pollution, and environmental justice. Certification bodies play a crucial role in ensuring industry standards are met, including best practices for steam separation, corrosion resistance, and life cycle assessment. The geothermal industry also focuses on grid integration, capacity factor optimization, and feed-in tariffs to enhance energy transition.

- Geothermal power output is subject to intermittent renewable energy generation, necessitating scaling control and efficient energy management. Additionally, water use and greenhouse gas emissions must be minimized, while carbon sequestration is explored as a potential solution. As the geothermal industry expands, it's essential to consider the impact on indigenous communities and address their concerns regarding visual impact and noise pollution. The implementation of renewable portfolio standards and geothermal brine utilization can contribute to the overall sustainability of the sector. Geothermal energy policy and geothermal industry standards must evolve to address emerging challenges, such as the integration of carbon capture technology and addressing the potential for geothermal fluids' interaction with groundwater resources.

- Professional development and ongoing research are vital to ensuring the industry's continued growth and success.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Geothermal Energy Power Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 1392.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, Indonesia, Iceland, Philippines, Italy, Canada, New Zealand, Chile, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Geothermal Energy Power Equipment Market Research and Growth Report?

- CAGR of the Geothermal Energy Power Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the geothermal energy power equipment market growth of industry companies

We can help! Our analysts can customize this geothermal energy power equipment market research report to meet your requirements.