Steam Turbine Market Size 2024-2028

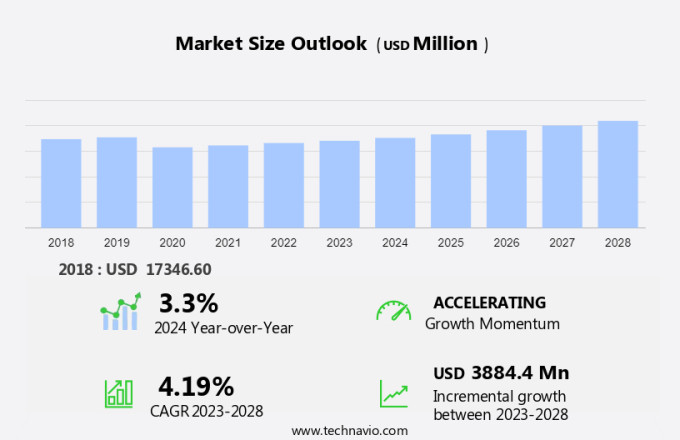

The steam turbine market size is forecast to increase by USD 3.88 billion at a CAGR of 4.19% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for power generation. Renewable energy sources, such as wind and solar, are gaining popularity, leading to a rise In the adoption of steam turbines for power generation. However, steam turbines also face several challenges, including high maintenance costs and environmental concerns.

- Despite these issues, advancements in technology, such as the integration of digitalization and automation, are helping to mitigate these challenges and improve the overall efficiency of steam turbines. Additionally, the growing focus on reducing greenhouse gas emissions and increasing energy sustainability is driving the market forward. Overall, the market is expected to continue its growth trajectory, offering numerous opportunities for key players in the energy sector.

What will be the Size of the Steam Turbine Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for clean power generation and energy optimization in power plants. With an energy deficit persisting in many regions, steam turbines continue to play a crucial role in meeting electricity demand through coal-fired power generation and combined-cycle natural gas plants. CHP installations are also gaining popularity for onsite power generation and water heating, contributing to the market's expansion. Strict emission norms and environmental regulations are driving the adoption of advanced steam turbine technologies to reduce carbon emissions.

- Furthermore, the International Energy Agency reports that global energy consumption is projected to increase by 50% by 2050, necessitating the development of more efficient steam turbine generators that convert mechanical energy from steam into rotational energy, thereby maximizing electricity production. Steam turbines, a key component of thermal power projects, are also used in steam engines and locomotive engines. Renewable technologies, such as solar and wind, are increasingly being integrated with steam turbines to enhance their efficiency and adapt to the evolving energy landscape. The market is expected to remain dynamic as the focus shifts towards sustainable energy sources and emission reduction targets.

How is this Steam Turbine Industry segmented and which is the largest segment?

The steam turbine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Utility

- Industrial

- Type

- Reaction

- Impulse

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Middle East and Africa

- South America

- APAC

By End-user Insights

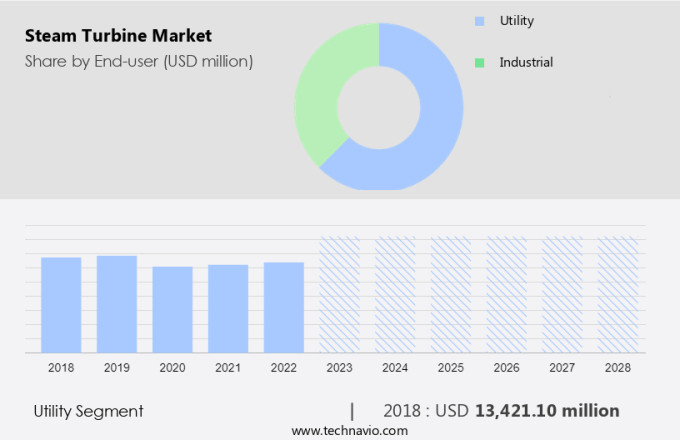

- The utility segment is estimated to witness significant growth during the forecast period.

Steam turbines play a crucial role in power generation by converting mechanical energy from high-pressure steam into electrical power. In electrical power facilities, steam turbines are the primary means of propelling generators to produce electricity. The steam turbine's size and configuration depend on the power plant's steam requirements, which can range from industrial CHP units to large utility-scale installations. Traditionally, coal has been a common fuel source for steam turbines in power generation. However, the increasing focus on clean power generation and reducing carbon emissions has led to a shift towards natural gas, renewable energy resources, and other clean energy technologies. Combined-cycle natural gas power plants, for instance, offer higher efficiency and lower emissions compared to coal-fired power plants. The industrial segment, including petrochemicals, sugar plants, refineries, and chemical facilities, also relies heavily on steam turbines for on-site power generation and steam-intensive processes.

Additionally, the market for steam turbines is influenced by various factors, including electricity demand, prices, efficiency, and emissions standards, and the availability of fuel sources such as coal, natural gas, biomass, and renewable organic materials. Logistical issues and supply chain disruptions, particularly in fuel handling and transportation, can impact the installation and operation of steam turbines. Turbine buyers consider factors like rated capacity, steam pressure, and efficiency when selecting steam turbines for their power generation needs. The market is expected to grow due to increasing electricity demand, the expansion of industrial activity, and the adoption of energy-efficient technologies like condensing steam turbines and co-generation systems.

Get a glance at the Steam Turbine Industry report of share of various segments Request Free Sample

The utility segment was valued at USD 13.42 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

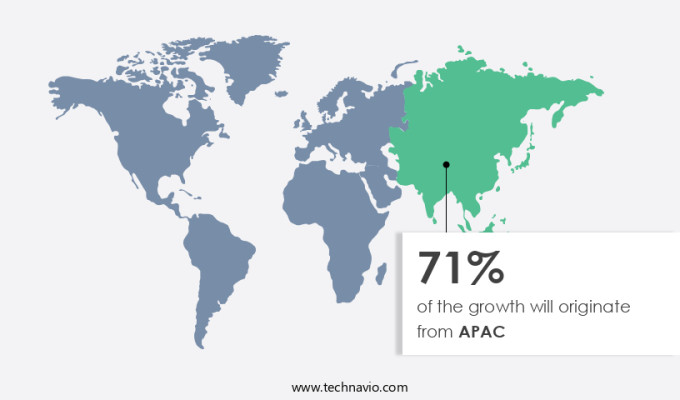

- APAC is estimated to contribute 71% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific market is projected to expand substantially due to the increasing electricity demand in countries like China, Japan, and India. The growth in industrialization and urbanization has led to a significant growth in electricity-consuming sectors, making electricity a valuable resource. Governments In the region have welcomed private players to invest in power generation, promoting competition and enhancing efficiency in electricity production and distribution. This results in reduced electricity prices and improved accessibility. The market in APAC caters to various power generation applications, including combined-cycle natural gas, industrial CHP units, petrochemicals, biomass, concentrated solar power, and renewable energy technologies. Steam turbines are integral components of electrical power facilities, providing mechanical energy from thermal energy through the conversion of rotational energy and water heating. The market comprises condensing and non-condensing steam turbines, with the former being more efficient and widely used in large-scale power generation.

Additionally, the market also includes steam turbine parts and logistical issues related to turbine installations. Buyers include industrial CHP units, self-generation units, and power utilities. The market serves various industries, including steam-intensive industries such as sugar plants, refineries, and chemical facilities. The market's growth is influenced by factors such as electricity prices, demand, international energy consumption trends, and government investment in power generation industries. The market faces challenges such as supply chain disruptions, fuel sources, and emission norms. The market includes players such as Ultra-supercritical coal plants, renewable energy sources, nuclear steam turbines, and combined cycle systems. The market's growth is driven by the need for clean power generation, energy optimization, and the increasing demand for sustainable energy networks.

Market Dynamics

Our steam turbine market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Steam Turbine Industry?

Growing demand for power generation is the key driver of the market.

- Steam turbines are a crucial component in power plants, accounting for approximately 80% of global electrical power generation. These mechanical devices convert thermal energy from pressurized steam into rotational motion, making them an efficient and preferred choice for driving electrical generators. The demand for steam turbines is on the rise due to the increasing need for dependable and efficient power sources In the context of a more digital economy. Power deficits and the push for clean power generation have led to an increase In the installation of steam turbines in various sectors. Combined-cycle natural gas and CHP installations are popular choices due to their ability to generate both power and heat. Industrial applications, such as petrochemicals, biomass, concentrated solar power, and renewable energy technologies, also rely on steam turbines for on-site power generation. Steam turbine parts, including boilers, fuel sources, heat exchangers, and turbines, are essential for maintaining consistent power output.

- Furthermore, logistical issues, such as fuel sources and solid fuel handling, can impact turbine installations and the overall performance of power and utility plants. Environmental norms and emission standards continue to shape the market. Coal-fired power plants and other fossil fuel-based energy sources are being replaced by renewable energy resources, such as wind and solar, to reduce carbon emissions. Nuclear steam turbines in nuclear power plants also contribute to the market, as they provide a low-carbon alternative to coal-fired power generation. The industrial segment, including industrial CHP units, high-energy industrial users, and steam-intensive industries such as sugar plants, refineries, and chemical facilities, is a significant consumer of steam turbines. The 151-300 MW and above 300 MW segments cater to the commercial and utility segments, respectively. Global energy consumption continues to grow, and the demand for electricity is increasing due to urbanization, industrialization, and the expansion of the chemical sector, pharmaceutical sector, and waste material processing industries.

- Thus, the combined cycle segment and impulse segment are key areas of focus In the market. Government investment in power generation industries and the geothermal energy segment is also driving market growth. Efficiency and emissions standards continue to evolve, with ultra-supercritical coal plants and renewable energy sources becoming increasingly popular. Condensing steam turbines, noncondensing steam turbines, and co-generation systems are key technologies driving market growth In the condensing segment and noncondensing segment, respectively. In summary, the market is expected to grow due to the increasing demand for efficient and dependable power generation, the shift towards clean energy, and the expansion of various industries. The market dynamics are influenced by factors such as fuel sources, efficiency standards, emissions standards, and government investment.

What are the market trends shaping the Steam Turbine Industry?

Increasing focus on renewable energy is the upcoming market trend.

- The market is experiencing significant growth due to the increasing energy deficit and the shift towards clean power generation. Steam turbines play a crucial role in various power plants, including combined-cycle natural gas, CHP installations, and industrial applications. These mechanical devices convert mechanical energy into electrical power and can be used in conjunction with thermal storage for dispatchable, carbon-neutral power. Renewable energy sources, such as concentrated solar power, biomass, and waste-to-energy, are driving the demand for steam turbines. Steam turbines are essential components of thermal-based renewable energy production, providing affordable and reliable power. In addition, the use of steam turbines in conjunction with thermal storage ensures grid stability and supply security. The focus on reducing carbon emissions and adhering to emission norms and environmental regulations is also fueling the demand for steam turbines. Industrial segments, such as petrochemicals, sugar plants, refineries, and chemical facilities, are significant consumers of steam turbines. These industries require large amounts of steam for their processes, making steam turbines an essential component. Logistical issues, such as supply chain disruptions and fuel sources, can impact the market.

- However, advancements in efficiency standards and emissions standards are driving innovation In the industry. Condensing steam turbines and noncondensing steam turbines are two segments of the market, with high-pressure steam and lower-pressure steam being used in various applications. Global energy consumption continues to increase, and the International Energy Agency anticipates a capacity glut In the electricity sector. However, the demand for electricity and heat from high-energy industrial users, onsite power generation, and self-generation is expected to drive the market. The market is diverse, with various fuel sources, including fossil fuels, coal, natural gas, biomass, and renewable energy resources, being used in steam turbine installations. The market is dynamic, with various players offering steam turbine parts and services. The market is expected to continue growing as the world transitions to cleaner energy sources and industries seek to optimize their energy usage.

What challenges does the Steam Turbine Industry face during its growth?

Several problems associated with steam turbines are key challenges affecting the industry's growth.

- In the power generation sector, steam turbines play a pivotal role in converting thermal energy into electrical power in various industries, including power utilities and industrial applications. The demand for steam turbines is driven by the increasing energy deficit, which necessitates the need for clean power generation and the adoption of efficient technologies to meet electricity demand and supply gaps. Steam turbines are used in power plants fueled by fossil fuels, such as coal and natural gas, as well as in renewable energy resources like biomass, concentrated solar power, and geothermal energy. In the industrial segment, steam turbines are employed in in-house power plants, CHP installations, and steam-intensive industries like petrochemicals, sugar plants, refineries, and chemical facilities. The market encompasses both condensing and noncondensing steam turbines, with the condensing segment accounting for a larger market share due to its higher efficiency. The global energy consumption continues to rise, leading to an increased demand for power and heat from various industries. As a result, there is a growing focus on onsite power generation, self-generation, and co-generation to reduce electricity prices and meet electricity demand.

- Furthermore, combined-cycle natural gas power plants and combined-cycle systems are becoming increasingly popular due to their high efficiency and ability to meet environmental norms and emission standards. The market for steam turbines is also influenced by logistical issues related to turbine installations, steam turbine buyers, and the availability of steam turbine parts. The market for steam turbines is expected to grow significantly due to the increasing demand for electricity and the need for cleaner, more efficient power generation technologies. The market is also driven by government investment in power generation industries and the adoption of energy-efficient technologies like condensing steam turbines, co-generation, and central power plants. Despite the growth opportunities, the market faces challenges such as supply chain disruptions due to fuel sources like coal, solid fuel handling, and waste exhaust heat. The market is also influenced by the carbon emissions from coal-fired power plants and the need to reduce CO2 emissions to meet International Energy Agency standards.

- In summary, the market is a dynamic and complex industry driven by the increasing demand for electricity, the need for cleaner and more efficient power generation technologies, and the challenges of meeting environmental norms and emission standards. The market is expected to grow significantly In the coming years due to these factors and the increasing focus on onsite power generation and renewable energy sources.

Exclusive Customer Landscape

The steam turbine market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the steam turbine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, steam turbine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALSTOM SA

- Baker Hughes Co.

- Dongfang Electric Corp. Ltd.

- Doosan Corp.

- Downer EDI Ltd.

- Ebara Corp.

- General Electric Co.

- Hangzhou Steam Turbine Power Group Co. Ltd.

- Harbin Turbine Co. Ltd.

- Heinzmann GmbH and Co. KG

- Howden Group Ltd.

- Mitsubishi Heavy Industries Ltd.

- Moog Inc.

- Nanjing Turbine and Electric Machinery Group Co. Ltd.

- Porsche Automobil Holding SE

- Shandong Qingneng Power Co. Ltd.

- Shanghai Electric Group Co.

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- Triveni Engineering and Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a significant portion of the global power generation industry, with them being utilized in various applications to convert mechanical energy into electrical power. This mechanical device functions by harnessing the energy contained in high-pressure steam, which causes the turbine blades to rotate, generating electricity. It plays a crucial role in power plants that run on fossil fuels, such as coal and natural gas, as well as in renewable energy sources like biomass, concentrated solar power, and nuclear. In combined-cycle natural gas power plants, they are employed In the second cycle, which recovers waste heat and generates additional electricity. Industrial applications, including CHP installations and in-house power plants, also utilize it for power and heat generation. In these settings, it serves as an essential component of industrial processes, providing steam for water heating, steam requirements for high-energy industrial users, and contributing to the overall power generating capacity. The market is influenced by various factors, including the energy deficit, emission norms, and environmental norms.

Furthermore, the increasing demand for clean power generation and the push towards reducing carbon emissions have led to the adoption of clean energy technologies and renewable energy resources. The industrial segment, particularly in sectors like petrochemicals, sugar plants, refineries, and chemical facilities, continues to be a significant consumer. Steam turbines are available in various types, including condensing and noncondensing ones. Condensing steam turbines, which convert all the energy In the steam into electrical power, offer higher efficiency compared to noncondensing type. The condensing segment dominates the market due to its higher efficiency and lower emissions. Logistical issues, such as the availability of fuel sources and the efficient handling of solid fuels, can impact the market. Fuel sources include coal, natural gas, biomass, and renewable organic materials, among others. Waste exhaust heat and municipal solid waste can also serve as fuel sources for steam turbines.

Thus, the market is subject to supply chain disruptions due to factors like electricity prices, electricity demand, and international energy agency reports on global energy consumption. The electricity prices and demand-supply gap influence the adoption of on-site power generation, self-generation, and co-generation. The market is segmented based on power generation capacity, with segments ranging from 151-300 MW to above 300 MW. The commercial segment is a significant consumer of steam turbines, with power utilities, central power, and geothermal energy segments being key contributors to the market's growth. The market is subject to efficiency and emissions standards, which drive the adoption of energy-efficient technologies and sustainable energy networks. The development of ultra-supercritical and supercritical technology in coal-fired power plants and nuclear steam turbines is a notable trend In the market. In summary, the market plays a vital role In the global power generation industry, providing power and heat to various industries and applications. The market is influenced by various factors, including energy deficits, emission norms, and the adoption of clean energy technologies. The market's growth is driven by the increasing demand for power and heat, particularly In the industrial and commercial sectors, and the push towards reducing carbon emissions.

|

Steam Turbine Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.19% |

|

Market growth 2024-2028 |

USD 3.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.3 |

|

Key countries |

China, US, India, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Steam Turbine Market Research and Growth Report?

- CAGR of the Steam Turbine industry during the forecast period

- Detailed information on factors that will drive the Steam Turbine growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the steam turbine market growth of industry companies

We can help! Our analysts can customize this steam turbine market research report to meet your requirements.