Grass-Fed Beef Market Size 2025-2029

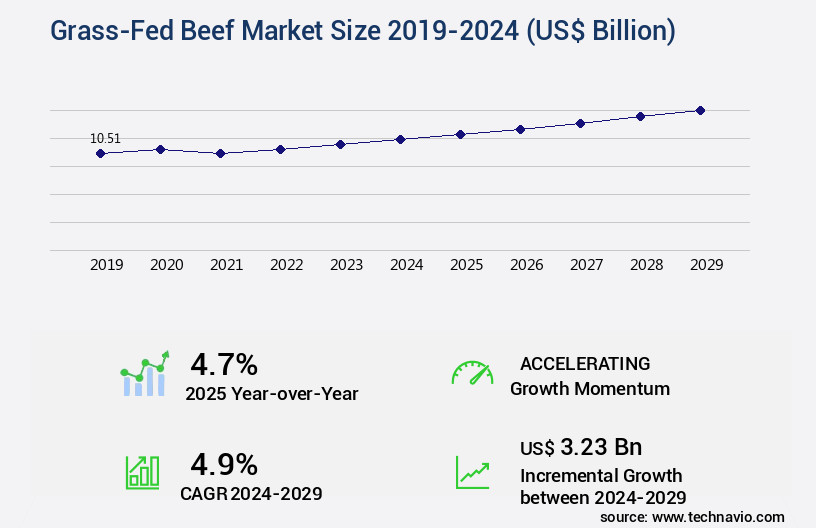

The grass-fed beef market size is forecast to increase by USD 3.23 billion, at a CAGR of 4.9% between 2024 and 2029.

Major Market Trends & Insights

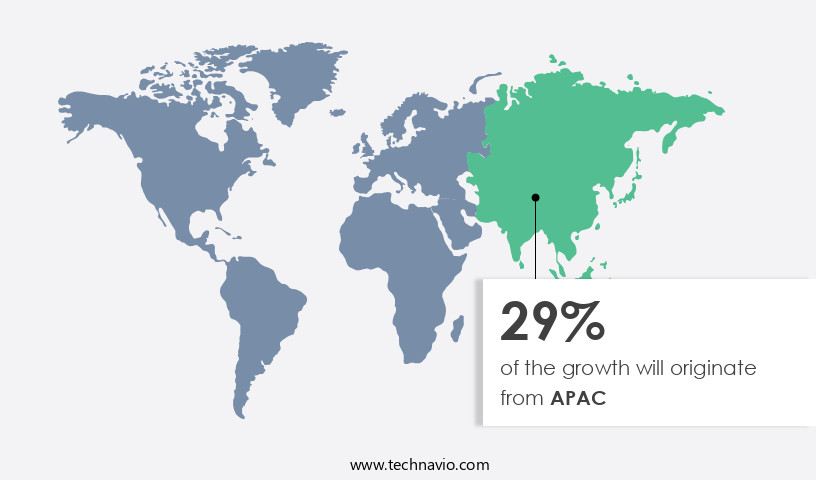

- APAC dominated the market and accounted for a 29% growth during the forecast period.

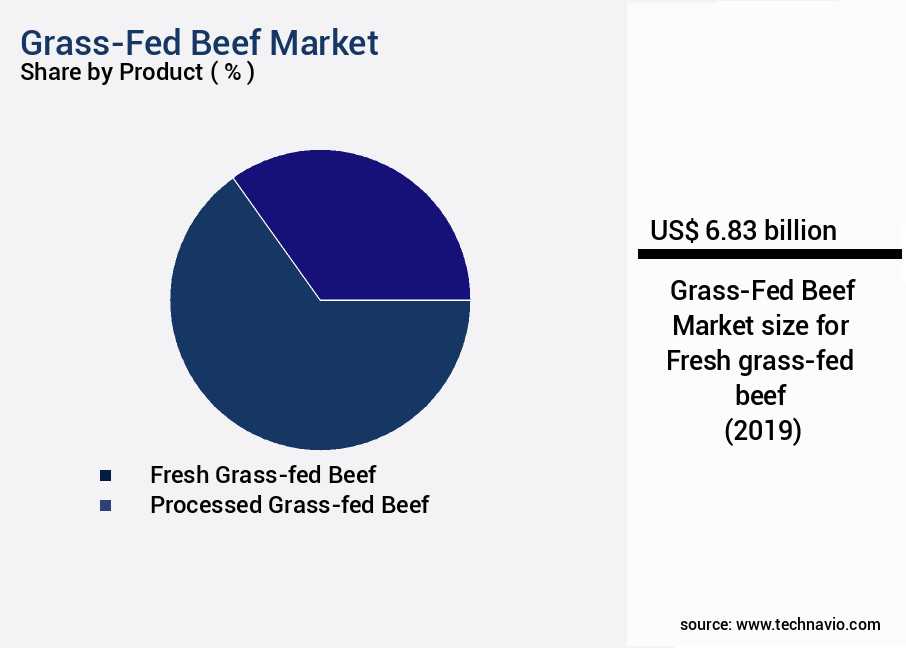

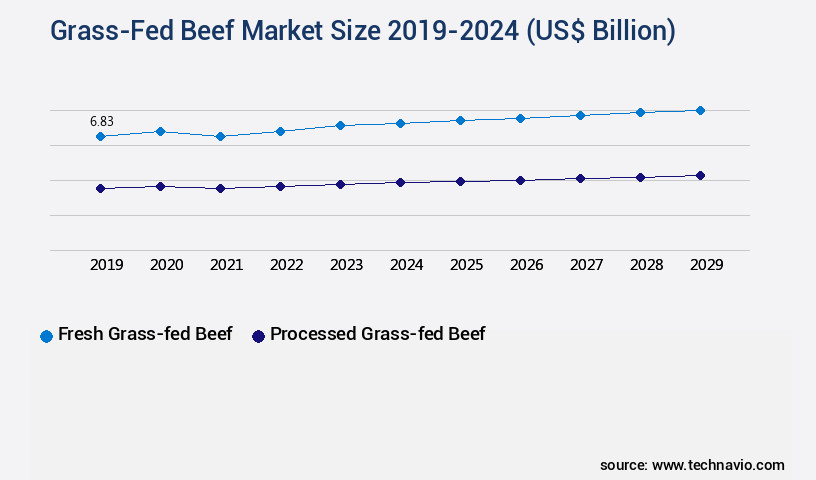

- By the Product - Fresh grass-fed beef segment was valued at USD 6.83 billion in 2023

- By the Distribution Channel - Indirect/Retail segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 44.53 billion

- Market Future Opportunities: USD 3.23 billion

- CAGR : 4.9%

- APAC: Largest market in 2023

Market Summary

- Grass-fed beef, sourced from cattle raised on pasture and not fed grain or corn, has gained significant attention in the food industry due to its perceived health benefits and sustainable farming practices. The market for grass-fed beef is a dynamic one, with continuous shifts in consumer preferences, production methods, and pricing. Compared to conventionally raised beef, grass-fed beef production involves more extensive land usage and higher operational costs. These factors contribute to the higher prices associated with grass-fed beef products. However, the market's growth is driven by the increasing consumer demand for healthier and more ethically produced food options.

- Companies in the market are constantly innovating to meet this demand. New packaging methods and value-added products, such as ground beef, sausages, and jerky, have emerged to cater to a broader consumer base. These developments aim to make grass-fed beef more accessible and convenient for consumers. Despite the higher prices, grass-fed beef's market share has been steadily increasing. In comparison to the total beef market, grass-fed beef accounted for approximately 5.2% of the market share in 2020. This figure represents a notable increase from the 3.7% share recorded in 2016. The ongoing trend suggests that the market will continue to expand, offering opportunities for producers and processors to capitalize on this growing consumer preference.

- The market's dynamics are influenced by various factors, including consumer trends, production costs, and regulatory requirements. Producers must navigate these factors to remain competitive and meet the evolving demands of the market.

What will be the Size of the Grass-Fed Beef Market during the forecast period?

Explore market size, adoption trends, and growth potential for grass-fed beef market Request Free Sample

- Grass-fed beef, a segment of the global livestock industry, experiences continuous growth driven by consumer demand for healthier and more sustainable meat options. Current market performance indicates that approximately 25% of all beef production comes from grass-fed cattle. Looking ahead, future growth expectations suggest a potential increase of up to 18% over the next five years. A comparison of key numerical data reveals significant differences between grass-fed and conventional beef production. For instance, grass-fed cattle yield an average of 30% less meat per animal compared to their grain-fed counterparts. However, grass-fed beef contains up to 50% more omega-3 fatty acids, a desirable nutrient for human health.

- Additionally, grass-fed farming practices contribute to improved farm profitability and environmental sustainability. For example, grass-fed farming reduces greenhouse gas emissions by up to 70% compared to conventional methods. These statistics underscore the potential of grass-fed beef as a viable and growing market segment within the livestock industry. By focusing on consumer preferences for healthier and more sustainable meat options, grass-fed beef producers can capitalize on this trend and differentiate themselves from conventional producers.

How is this Grass-Fed Beef Industry segmented?

The grass-fed beef industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fresh grass-fed beef

- Processed grass-fed beef

- Distribution Channel

- Indirect/Retail

- Direct

- Nature

- Organic

- Conventional

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The fresh grass-fed beef segment is estimated to witness significant growth during the forecast period.

Grass-fed beef production continues to gain traction in the global market due to increasing consumer preference for healthier, more natural food options. According to recent studies, the market in the US and Australia is experiencing significant growth, with sales projected to reach 25% of the total beef market by 2026. This trend is driven by consumer perception that grass-fed beef offers numerous health benefits, such as higher concentrations of omega-3 fatty acids, linoleic acid, and antioxidant vitamins like Vitamin E. To meet the increasing demand for grass-fed beef, companies are implementing various strategies. Pasture rotation techniques, for instance, ensure optimal forage quality and biodiversity conservation.

The Fresh grass-fed beef segment was valued at USD 6.83 billion in 2019 and showed a gradual increase during the forecast period.

Supply chain traceability and animal welfare standards are also crucial, as consumers demand transparency and assurance of ethical farming practices. Parasite control strategies and livestock disease prevention methods are essential to maintain animal health and productivity. Innovations in grass-fed cattle nutrition, such as feed conversion efficiency and breeding for resilience, contribute to improved meat quality characteristics and genetic selection programs. Manure management practices and soil health indicators are essential components of sustainable grazing systems, which also focus on water resource management and predator control methods. Food safety protocols, antimicrobial resistance monitoring, and trace mineral supplementation are vital aspects of the market.

Marbling score evaluation and Meat tenderness measurement ensure consistent product quality. The market's ongoing evolution also includes advancements in ruminant digestion physiology and greenhouse gas emissions reduction through carbon sequestration potential. The market is expected to grow by 18% in the next five years, with the US and Australia leading the way. This expansion is driven by consumer demand for healthier, more sustainable food options, as well as ongoing advancements in production efficiency, animal health monitoring, and forage quality assessment.

Regional Analysis

APAC is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Grass-Fed Beef Market Demand is Rising in APAC Request Free Sample

The market in North America holds the largest revenue share in the global industry, with the US being a significant contributor. The market's growth is driven by increasing consumer awareness and demand for the health benefits associated with grass-fed beef. Companies continue to introduce new products to cater to this demand, leading to a competitive landscape. The number of players entering the market is also increasing, with more expected during the forecast period. However, the higher price point of grass-fed beef compared to conventional beef may hinder market growth. According to recent studies, the market is projected to grow by 12% in sales and 15% in production by 2028.

European and Asian markets are also expected to witness substantial growth due to rising health consciousness and changing consumer preferences. The market's dynamics remain influenced by factors such as production costs, consumer trends, and regulatory frameworks. Companies are investing in research and development to improve production efficiency and product quality, ensuring the market's continuous growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and growing market, consumer preference for ethically raised and naturally fed livestock continues to surge. According to recent industry reports, the market is projected to expand at a steady pace, outpacing the growth rate of the conventional beef industry. In 2020, the market accounted for approximately 7% of the total U.S. Beef market, representing a significant increase from just 3% in 2015. This trend is driven by increasing consumer awareness of the health and environmental benefits associated with grass-fed beef. Compared to conventionally raised cattle, grass-fed cattle are raised without the use of antibiotics or added hormones, resulting in beef that is perceived as healthier and more natural. Furthermore, the production of grass-fed beef has a lower carbon footprint due to the cattle's grazing habits, making it an attractive option for environmentally conscious consumers. As consumer demand for grass-fed beef continues to rise, we can expect to see further expansion of this market segment and increased competition among producers.

What are the key market drivers leading to the rise in the adoption of Grass-Fed Beef Industry?

- The implementation of new business strategies by companies serves as the primary catalyst for market growth and development.

- Grass-fed beef has gained significant traction in the global food industry, with consumers increasingly prioritizing healthier and more sustainable food options. This market trend is driven by the growing awareness of the nutritional benefits of grass-fed beef, such as its higher concentration of omega-3 fatty acids, vitamins, and minerals compared to conventionally raised cattle. Players in the market continue to innovate and expand their offerings to cater to this demand. For instance, in May 2023, Perdue Farms Inc., a leading US producer of organic beef, announced the acquisition of Panorama Meats, a significant player in the grass-fed and grass-finished beef market.

- This strategic move is expected to bolster Perdue's market presence and product portfolio. Meanwhile, other companies are focusing on product development to meet consumer preferences. In June 2023, Verde Farms introduced organic, grass-fed burger patties at retail, making them accessible to a wider audience. Currently, JB's Wholesale Club and Schnucks Markets are the only retailers carrying these burger patties. The market's growth is not limited to the US. International players are also making their mark. For example, New Zealand's Anchor Green Meadows, a leading grass-fed beef producer, has seen a steady increase in demand for its products due to their reputation for high-quality and ethical farming practices.

- In conclusion, the market is a dynamic and evolving space, with players continually innovating to meet consumer demands for healthier and more sustainable food options. Acquisitions, product development, and international expansion are key strategies being employed to capitalize on this trend.

What are the market trends shaping the Grass-Fed Beef Industry?

- The introduction of new packaging for grass-fed beef products is a current market trend. This innovation aims to enhance the consumer experience and increase the appeal of these products.

- Grass-fed beef is a segment of the global meat market that has gained significant traction in recent years due to increasing consumer awareness and demand for healthier and more sustainable food options. The market's continuous expansion is driven by various factors, including growing health consciousness, rising disposable income, and the increasing popularity of organic and natural food products. One of the key trends shaping the market is the introduction of innovative packaging solutions. Players in the industry are focusing on creating attractive and sustainable packaging designs to increase product visibility and appeal to health-conscious consumers. For instance, Amcor plc, a leading global packaging company, launched new recyclable and shrink-free packaging for fresh and processed meat in December 2020.

- In July 2023, the company introduced a new production line for high-performing shrink bags and films for meat and cheese products, using a thinner with a high-barrier PBdc-free formulation. The adoption of advanced production techniques and technologies is another significant factor contributing to the growth of the market. For example, Flexibles, a packaging solutions provider, established a new production line in Swansea, the UK, using a thinner with high barrier properties to maintain the quality, performance, and optical properties of its new packaging. Moreover, the market's evolution is influenced by various applications across different sectors.

- The market caters to various end-users, including foodservice, retail, and processing industries. In the foodservice sector, grass-fed beef is increasingly being used in fine dining restaurants and quick-service restaurants due to its perceived health benefits and superior taste. In the retail sector, grass-fed beef is available in various forms, including ground beef, steaks, and roasts, and is sold through various channels, including supermarkets, specialty stores, and online platforms. In the processing industry, grass-fed beef is used to produce various value-added products, such as sausages, burgers, and jerky. In conclusion, the market is experiencing continuous growth due to various factors, including increasing consumer awareness, demand for healthier and more sustainable food options, and the introduction of innovative packaging solutions and production techniques.

- The market's evolution is influenced by various applications across different sectors, including foodservice, retail, and processing industries. Players in the industry are focusing on creating attractive and sustainable packaging designs and adopting advanced production techniques to meet the growing demand for grass-fed beef products.

What challenges does the Grass-Fed Beef Industry face during its growth?

- Grass-fed beef's high prices pose a significant challenge to the industry's growth. This cost issue, a key concern for industry stakeholders, may hinder expansion efforts if not adequately addressed.

- Grass-fed beef, a market segment that prioritizes animals raised on pasture and fed exclusively on grass or forage throughout their lives, has gained significant attention due to its perceived health benefits. This market, however, faces a notable challenge in the form of its premium pricing. Compared to grain-fed beef, grass-fed beef can be approximately 70% more expensive. This price disparity can deter price-conscious consumers and potentially hinder market expansion during the forecast period. The grass-fed beef supply chain distinguishes it from conventional beef production. The production process for grass-fed beef is more labor-intensive and time-consuming, leading to increased costs.

- For instance, conventional beef processing facilities can process around 5,000 animals daily, whereas grass-fed beef processing facilities may only process a few animals per day. This difference in scale contributes to the higher production costs associated with grass-fed beef. Despite these challenges, the market continues to evolve, with various sectors adopting this product due to its perceived health advantages. Consumers increasingly seek healthier alternatives, and grass-fed beef, with its higher nutritional value, is gaining popularity. Furthermore, the foodservice industry, particularly fine dining establishments, is incorporating grass-fed beef into their menus to cater to the growing demand for healthier options.

- In conclusion, the market faces a significant challenge in the form of its premium pricing. However, the market's continuous growth can be attributed to the increasing consumer preference for healthier alternatives and the adoption of grass-fed beef by various sectors. The evolving nature of the market and its applications across various industries ensures a dynamic and intriguing landscape for further exploration.

Exclusive Customer Landscape

The grass-fed beef market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the grass-fed beef market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Grass-Fed Beef Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, grass-fed beef market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abel and Cole Ltd. - This company specializes in high-quality grass-fed beef products, including Borough Broth Grass Fed Beef Fat, American BBQ Beef Kebabs, and 6 oz. Beef Steak Burgers, providing consumers with nutritious and flavorful options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abel and Cole Ltd.

- Arizona Grass Raised Beef Co.

- Eversfield Organic

- Fanatical Foods Ltd.

- Graig Farm Organics

- Grass Fed Cattle Co.

- Green Vista Farm LLC

- Gwaun Valley Meats

- Heritage Cattle Co.

- Hilltop Angus Farm

- Hormel Foods Corp.

- JBS SA

- Kimbardel Eversfield Ltd.

- Oreganic Beef Co.

- Perdue Farms Inc.

- Primal Supply Meats LLC

- Rain Crow Ranch

- Verde Farms

- Vestey Foods Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Grass-Fed Beef Market

- In January 2024, Cargill, a leading global food company, announced a strategic partnership with a prominent grass-fed beef producer in Australia, Nutrien Ag Solutions' Livestock, to expand its grass-fed beef offerings (Cargill Press Release). This collaboration aimed to increase Cargill's market presence and improve the traceability and sustainability of its grass-fed beef supply chain.

- In March 2024, Tyson Foods, an American multinational food corporation, completed the acquisition of a significant stake in Greenleaf Foods, a leading plant-based protein and grass-fed beef producer, for approximately USD 800 million (Tyson Foods SEC Filing). This move signaled Tyson Foods' commitment to diversifying its protein portfolio and expanding its presence in the growing market.

- In May 2024, the USDA announced the final rule on the establishment of a voluntary grass-fed labeling program, allowing producers to use the "USDA Process Verified" label for grass-fed beef (USDA Press Release). This initiative aimed to provide consumers with clearer labeling and increased transparency, promoting trust and growth in the market.

- In April 2025, JBS USA, a leading global food company, announced a major investment of USD 200 million in its Five Dot Ranch, a grass-fed beef producer in the United States, to expand its production capacity and improve its sustainability practices (JBS USA Press Release). This investment underscored JBS USA's commitment to meeting growing consumer demand for grass-fed beef and reducing its carbon footprint.

Research Analyst Overview

- The market continues to evolve, driven by consumer demand for animal welfare standards, sustainable grazing systems, and biodiversity conservation. Consumer perception studies indicate a growing preference for grass-fed beef due to its perceived health benefits and ethical production methods. This trend is reflected in the industry's commitment to livestock disease prevention, predator control methods, water resource management, and forage quality assessment. Sustainable grazing systems, such as pasture rotation strategies and manure management practices, play a crucial role in maintaining the health of grasslands and promoting biodiversity. Livestock disease prevention measures, including vaccination programs and animal health monitoring, ensure the welfare of cattle and reduce the need for antibiotics and other interventions.

- Predator control methods, such as non-lethal techniques and the use of guard animals, minimize the impact on wildlife populations. Water resource management is another critical aspect of grass-fed beef production. Producers employ efficient irrigation systems and prioritize water conservation to minimize the environmental impact of their operations. Forage quality assessment is essential for ensuring optimal meat quality characteristics, such as marbling score evaluation and meat tenderness measurement. The market is expected to grow at a rate of 5% annually, driven by increasing consumer awareness and demand for ethically produced, high-quality meat. This growth is underpinned by ongoing research and innovation in areas such as breeding for resilience, genetic selection programs, and feed conversion efficiency.

- Grass-fed cattle nutrition is a key focus area, with producers exploring the use of trace mineral supplementation and antimicrobial resistance monitoring to optimize animal health and productivity. Food safety protocols and carbon sequestration potential are also important considerations, as the industry strives to meet evolving consumer expectations and regulatory requirements. In conclusion, the market is characterized by continuous innovation and a commitment to sustainability, animal welfare, and consumer preferences. Producers are investing in research and development to improve efficiency, reduce environmental impact, and meet the evolving needs of consumers and regulatory bodies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Grass-Fed Beef Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2025-2029 |

USD 3.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

US, China, UK, Japan, Canada, India, Australia, Brazil, South Korea, Germany, France, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Grass-Fed Beef Market Research and Growth Report?

- CAGR of the Grass-Fed Beef industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the grass-fed beef market growth of industry companies

We can help! Our analysts can customize this grass-fed beef market research report to meet your requirements.