Omega-3 Fatty Acid Market Size 2025-2029

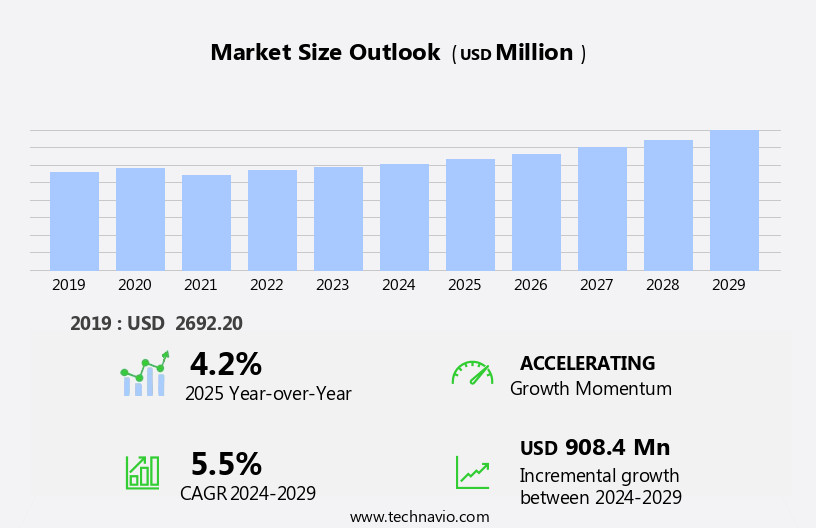

The omega-3 fatty acid market size is forecast to increase by USD 908.4 billion at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth due to increasing consumer awareness regarding the health benefits associated with these essential nutrients. Key market trends include new product launches by companies to cater to this growing demand and address sustainability issues in sourcing Omega-3 from various sources. The market is witnessing a surge in demand for sustainable and ethically sourced Omega-3 products and fatty acid, with consumers prioritizing health and wellness. companies are responding by focusing on transparency and traceability in their supply chains to meet these evolving consumer preferences.

- Additionally, the market is being driven by the growing prevalence of various health conditions, such as cardiovascular diseases and inflammatory disorders, which are known to be alleviated by Omega-3 supplementation. These factors collectively contribute to the robust growth of the market in North America.

What will be Omega-3 Fatty Acid Market Size During the Forecast Period?

- The omega-3 market continues to gain momentum as consumers increasingly recognize the health benefits of these essential fatty acids. Omega-3 fatty acids, including eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), are essential for brain and heart health. Traditional sources of omega-3s include fish oil and krill oil, but alternatives such as flaxseed, walnuts, algae, and certain dietary supplements and functional foods are gaining popularity. Brain health is a primary focus for omega-3s, as they play a crucial role in cognitive function, memory, and mood regulation. Heart health is another significant area, with omega-3s known to help reduce inflammation, lower blood pressure, and improve cholesterol levels, all of which contribute to a reduced risk of chronic diseases.

- Monounsaturated fatty acids and plant-based ingredients are also gaining attention in the omega-3 market. These innovative ingredients offer non-fish sources for consumers who prefer not to consume fish or krill oil. Algae, for instance, is a sustainable and eco-friendly source of omega-3s, particularly EPA and DHA. The demand for omega-3s continues to grow as sedentary lifestyles and an increasing prevalence of cardiovascular disease fuel the need for health and wellness solutions. However, supply chain disruptions and fluctuations in raw material availability can impact the market dynamics. The omega-3 market encompasses a diverse range of products, from dietary supplements to functional foods, all aimed at providing consumers with the health benefits of omega-3 fatty acids, including alpha-linolenic acid (ALA), EPA, and DHA.The market's future growth is expected to be driven by ongoing research into the health benefits of omega-3s and the development of new, sustainable sources and delivery methods.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Concentrates

- Fish oil

- Algae oil

- Others

- Application

- Dietary supplements

- Functional food

- Infant formulae

- Pharmaceuticals

- Animal feed

- Geography

- North America

- Canada

- US

- Asia

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Rest of World (ROW)

- North America

By Source Insights

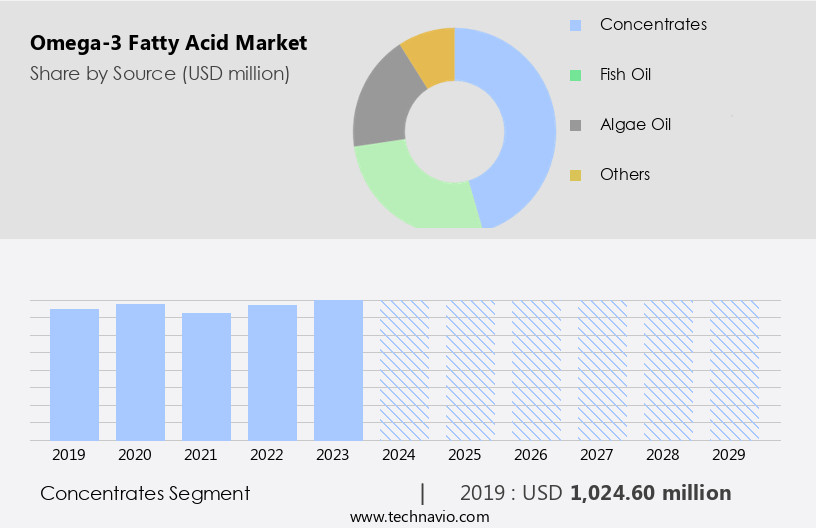

- The concentrates segment is estimated to witness significant growth during the forecast period.

Omega-3 concentrates, which contain elevated levels of EPA (Eicosapentaenoic acid) and DHA (Docosahexaenoic acid), offer superior efficacy and purity compared to standard fish or algae oils. These concentrates undergo a refining process to separate EPA and DHA from other fatty acids, resulting in a more potent product. The demand for omega-3 concentrates is growing due to their precision in delivering essential nutrients. They are widely used in various applications, including dietary supplements, functional foods, pharmaceuticals, and animal feed. Consumer awareness of the health benefits associated with precise levels of EPA and DHA is driving the market for omega-3 concentrates. Non-fish sources, such as flaxseed, walnuts, and algae, are also contributing to the market's growth as alternatives to fish oil.Omega-3 concentrates provide a more effective and consistent dose of these essential nutrients, making them a valuable addition to various industries.

Get a glance at the market report of share of various segments Request Free Sample

The Concentrates segment was valued at USD 1024.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

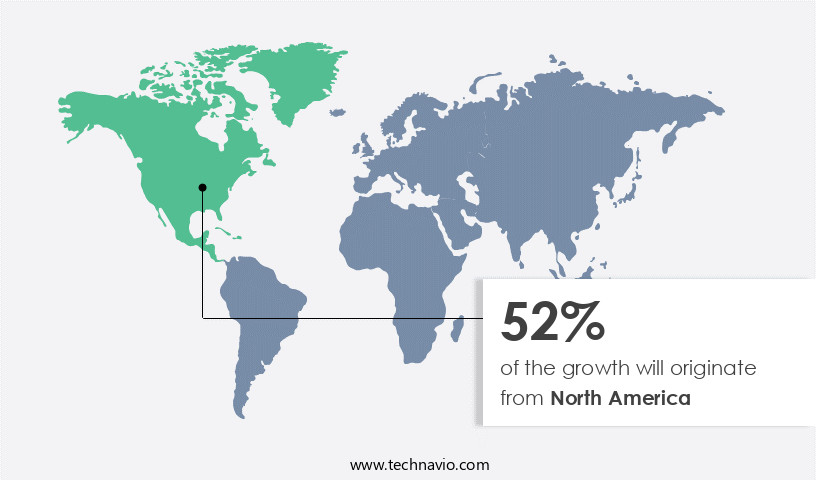

- North America is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America, specifically in the US and Canada, experiences significant growth due to increasing consumer awareness of its health benefits, particularly for cardiovascular health, cognitive function, and inflammation reduction. The region's leading position is attributed to the high prevalence of chronic conditions, such as cardiovascular diseases, diabetes, and joint-related disorders. In the US, heart disease is the leading cause of death for both men and women, with someone succumbing to it every 33 seconds. To address this health concern, consumers are turning to omega-3 fatty acids, which are available in various forms, including fish oil, algae oil, and flax seeds.

Additionally, the market for lipid-based supplements is expanding due to their organoleptic properties, making them more appealing to consumers. The market in North America is expected to continue its growth trajectory, driven by the increasing demand for natural, non-GMO ingredients.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Omega-3 Fatty Acid Market ?

Growing awareness of health benefits is the key driver of the market.

- The market in the US has experienced notable growth due to the increasing awareness of their health benefits, particularly in preventing and managing chronic diseases such as heart disease, diabetes, obesity, and cognitive decline. Omega-3 fatty acids, specifically Eicosapentaenoic acid (EPA) and Docosahexaenoic acid (DHA), have been extensively researched for their cardiovascular benefits, which include reducing the risk of heart attack, stroke, and high blood pressure. Consumers are increasingly seeking natural solutions to improve heart health, leading to a significant increase in demand for omega-3 supplements. Non-fish sources of omega-3s, such as flaxseed, walnuts, algae, and certain fortified foods, offer alternatives for those who do not consume fish regularly.

- Algae oil, a popular non-fish source, contains both DHA and EPA. Plant-based sources, such as flax seeds, contain Alpha-Linolenic Acid (ALA), which the body converts to EPA and DHA. The market for omega-3s extends beyond human health applications. Omega-3s are also used in pet food and animal feed to improve cardiovascular health and cognitive function. Additionally, omega-3s have applications in dermatology and functional foods. The omega-3 market faces challenges in the supply chain due to environmental pollutants in fish and concerns over the sustainability of marine sources. Innovative ingredients, such as plant-based sources and non-GMO ingredients, are gaining popularity to address these concerns.

- In conclusion, the omega-3 market is driven by the growing demand for natural solutions to prevent and manage chronic diseases, particularly heart disease. The market offers various sources, including fish oil, algae oil, flax seeds, and fortified foods, to cater to diverse consumer preferences and needs. The market also faces challenges in the supply chain, which are being addressed through innovative solutions and the development of sustainable sources.

What are the market trends shaping the Omega-3 Fatty Acid Market?

New launches by vendors is the upcoming trend in the market.

- The market in the US is experiencing significant growth due to the rising awareness of the health benefits associated with these essential nutrients. Omega-3 fatty acids, including EPA (Eicosapentaenoic acid) and DHA (Docosahexaenoic acid), are essential for brain and heart health. While fish oil is a traditional source of Omega-3s, non-fish sources such as krill oil, algae oil, flaxseed, walnuts, and plant-based supplements are gaining popularity. The health benefits of Omega-3s extend beyond brain and heart health, as they have been linked to the prevention and management of chronic diseases, such as diabetes, cancer, and arthritis. With sedentary lifestyles and lifestyle-related diseases on the rise, the demand for Omega-3 supplements and fortified foods has increased.

- Innovative ingredients, such as plant-based Omega-3s and non-GMO ingredients, are being developed to cater to consumers' preferences. For instance, dsm-firmenich's new product, lifesDHA B54-0100, is a highly potent DHA algal oil that delivers a high concentration of Omega-3s per serving. This ingredient enables the production of smaller, cost-effective capsules and new supplement formats, such as gummies and chews, which are free from fishy odors. The Omega-3 market also includes applications in dermatology, infant formula, pet foods, animal feed, and cardiovascular disease prevention. However, the supply chain disruption due to environmental pollutants and the need for personalized nutrition are challenges that market players are addressing. Overall, the Omega-3 market is expected to continue growing as consumers prioritize health and wellness.

What challenges does Omega-3 Fatty Acid Market face during the growth?

Sourcing and sustainability issues is a key challenge affecting the market growth.

- The market is driven by the growing awareness of the health benefits associated with these essential nutrients, particularly for brain and heart health. Omega-3 fatty acids, including Eicosapentaenoic acid (EPA) and Docosahexaenoic acid (DHA), are essential for maintaining cardiovascular health, reducing inflammation, and improving cognitive function. Traditional sources of omega-3s, such as fish oil, have faced sustainability challenges due to overfishing and depletion of fish stocks. This has led to an increased interest in non-fish sources, such as krill oil, algae oil, flaxseed, walnuts, and other plant-based ingredients. Fortified foods and nutritional supplements are major applications for omega-3 fatty acids, with growing demand for personalized nutrition and preventive care.

- The omega-3 market also includes pet food and animal feed applications. However, environmental pollutants in fish and concerns about the bioavailability of plant-based sources can impact the market. Innovative ingredients, such as lipid-based supplements and organoleptic properties, are being explored to enhance the consumer experience. The omega-3 market faces challenges in the supply chain due to the dependence on marine sources and the need for sustainable practices. The market is expected to grow as consumers seek to incorporate omega-3s into their nutritional diet to prevent lifestyle-related diseases and promote health and immunity. Non-GMO ingredients and plant-based sources are gaining popularity as alternatives to fish oil. Overall, the omega-3 market is dynamic, with ongoing research and development to address sustainability, bioavailability, and consumer preferences.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aker BioMarine ASA - This company specializes in the production and distribution of Omega-3 fatty acid products, specifically krill oil, for the US market. Krill oil is a rich source of EPA and DHA, two essential fatty acids, in their phospholipid form. The phospholipid structure of krill oil enhances absorption, making it an effective choice for supporting heart, brain, and joint health. Our Omega-3 products are sourced from sustainable and eco-friendly practices, ensuring the highest quality and purity for our customers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aker BioMarine ASA

- Arctic Nutrition Oy

- BASF SE

- Cargill Inc.

- Corbion nv

- Croda International Plc

- Epax

- FERMENTALG

- GC Rieber VivoMega AS

- Golden Omega S.A.

- KD Pharma Group

- Koninklijke DSM NV

- Lonza Group Ltd.

- Nordic Naturals Inc.

- Novotech Nutraceuticals Inc.

- Nufarm Ltd.

- OLVEA Group

- Omega Protein Corp.

- Pharma Marine AS

- Polaris

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Omega-3 fatty acids are essential nutrients that play a crucial role in maintaining various aspects of human and animal health. These polyunsaturated fatty acids are primarily classified into three types: eicosapentaenoic acid (EPA), docosahexaenoic acid (DHA), and alpha-linolenic acid (ALA). Omega-3 fatty acids have gained significant attention in recent years due to their numerous health benefits, which include supporting brain health, heart health, and improving the condition of various chronic diseases. The global omega-3 market has experienced substantial growth due to the increasing consumer awareness regarding the importance of preventive care and maintaining a healthy lifestyle.

The market encompasses various sources, including marine sources (fish oil and krill oil), plant sources (flaxseed, walnuts, and algae), and fortified foods and nutritional supplements. Marine sources, particularly fish oil and krill oil, have long been recognized for their high omega-3 content. Fish oil, rich in EPA and DHA, has been extensively studied for its health benefits, including cardiovascular health and brain development. Krill oil, on the other hand, offers the added advantage of astaxanthin, an antioxidant that enhances the bioavailability of omega-3 fatty acids. However, the market for omega-3 alternatives to fish oil has gained traction due to various factors, including sustainability concerns, environmental pollutants, and ethical considerations.

Plant sources, such as flaxseed, walnuts, and algae, have emerged as viable options for obtaining omega-3 fatty acids. Algae oil, for instance, is a rich source of DHA and EPA, making it a popular alternative to fish oil. The health benefits of omega-3 fatty acids extend beyond cardiovascular health and brain function. They have also been linked to improving the symptoms of chronic diseases such as arthritis, diabetes, and certain cancers. Furthermore, omega-3 fatty acids have gained popularity in the dermatology field due to their potential role in skin health and anti-aging properties. The omega-3 market also includes various applications, such as functional foods, infant formula, pet foods, and animal feed.

The demand for omega-3 fortified foods and beverages has increased significantly due to their convenience and ease of consumption. In the pet food sector, omega-3 fatty acids are used to improve the health and wellness of pets, particularly in addressing skin conditions and joint health. The omega-3 market faces several challenges, including supply chain disruptions and the need for innovative ingredients. The increasing demand for non-GMO and plant-based ingredients has led to the development of new technologies to enhance the bioavailability and organoleptic properties of omega-3 fatty acids. Lipid-based supplements have gained popularity due to their improved bioavailability compared to traditional capsules.

In conclusion, the omega-3 fatty acids market growth is driven by the growing awareness of the health benefits of these essential fatty acids and the increasing demand for sustainable and ethical sources. The market encompasses various sources, applications, and health benefits, making it a dynamic and diverse industry. As research continues to uncover new applications and health benefits, the omega-3 market is poised for continued growth.

| Omega-3 Fatty Acid Market Scope | |

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 908.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Japan, Germany, UK, India, France, Canada, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch