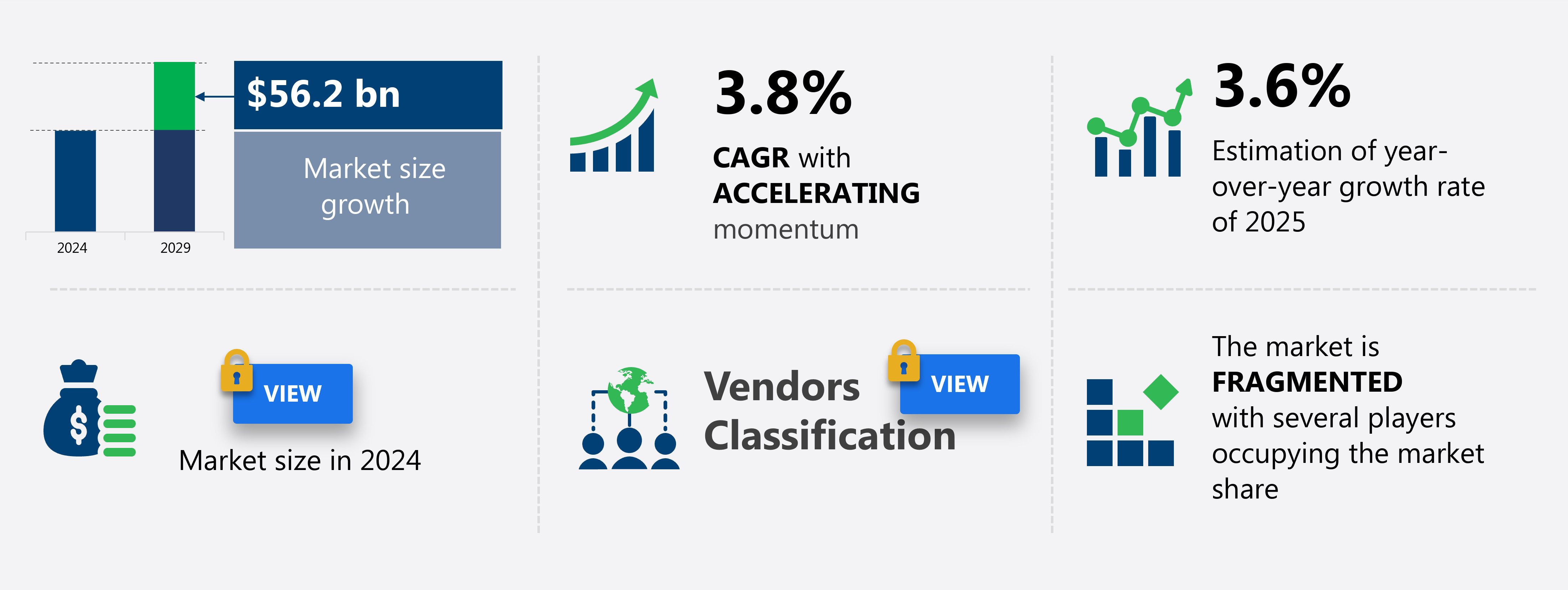

UK Grocery Retail Market Size 2025-2029

The UK grocery retail market size is valued to increase USD 56.2 billion, at a CAGR of 3.8% from 2024 to 2029. Rapid urbanization and rising consumer spending will drive the UK grocery retail market.

Major Market Trends & Insights

- By Product - Food and beverages segment was valued at USD 176.60 billion in 2022

- By Distribution Channel - Hypermarkets and supermarkets segment accounted for the largest market revenue share in 2022

- CAGR : 3.8%

Market Summary

- The Grocery Retail Market in the UK is a dynamic and evolving sector, characterized by the adoption of core technologies and innovative applications. With rapid urbanization and rising consumer spending, grocery retailers are investing in advanced technologies such as automation, AI, and robotics to streamline operations and enhance the customer experience. For instance, the use of self-checkout kiosks and mobile apps for contactless shopping has surged in popularity, particularly in response to the COVID-19 pandemic. However, the market also faces challenges, including the threat from counterfeit grocery products. According to a report by the Food Standards Agency, around 10% of all food and drink products sold in the UK are believed to be counterfeit.

- To mitigate this issue, regulatory bodies are implementing stricter regulations and collaborating with retailers to ensure product authenticity. Despite these challenges, opportunities abound for grocery retailers in the UK. The market is expected to witness significant growth in the coming years, with online grocery sales projected to reach 15% of the total market share by 2025. Innovative store layouts and offerings, such as click-and-collect services and subscription-based models, are also gaining popularity among consumers. Overall, the Grocery Retail Market in the UK is a continuously unfolding landscape, shaped by a complex interplay of technological advancements, regulatory requirements, and consumer preferences.

What will be the Size of the UK Grocery Retail Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Grocery Retail in UK Market Segmented and what are the key trends of market segmentation?

The grocery retail in UK industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Food and beverages

- Non food

- Distribution Channel

- Hypermarkets and supermarkets

- Convenience stores

- Discount stores

- Online

- Others

- Sales Channel

- In-Store

- Online Delivery

- Click-and-Collect

- Consumer Segment

- Urban Consumers

- Rural Consumers

- Premium Shoppers

- Product Types

- Fresh Produce

- Packaged Foods

- Household Goods

- Health and Beauty

- Geography

- Europe

- UK

- Europe

By Product Insights

The food and beverages segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving grocery retail market in the UK, loss prevention strategies continue to be a priority for retailers, with online grocery shopping seeing a significant increase in adoption, reaching 7.1% of total sales in 2020. Sales promotion techniques, such as promotional pricing models and loyalty programs, are essential tools to attract and retain customers. Food safety regulations play a crucial role in ensuring product quality and consumer trust. Stock rotation and inventory optimization are essential for maintaining freshness and reducing waste. Automated checkout systems and self-checkout kiosks streamline the shopping experience, while e-commerce platforms enable seamless online ordering and last mile delivery.

Product traceability and quality control measures are vital for ensuring the authenticity and safety of goods. Retail technology integration, including demand forecasting and data analytics dashboards, enables retailers to optimize store operations efficiency and adapt to changing consumer behavior. Customer service metrics, such as response times and resolution rates, are key performance indicators for maintaining customer satisfaction. The grocery market is expected to grow further, with online sales projected to reach 11.7% of total sales by 2025. The adoption of advanced technologies, such as RFID tagging, AI-driven demand forecasting, and warehouse automation, will continue to transform the industry.

Category management techniques and waste reduction initiatives will help retailers optimize their offerings and reduce costs. The foods and beverages segment, which includes fresh and frozen meat, dairy products, fruits and vegetables, and snack foods, is a significant contributor to the market's growth. The most preferred grocery products in this segment include fresh bread, salty snacks, and cereals. With a rise in consumer income, there is a growing trend towards organic and gluten-free products, which are expected to account for 25% of sales by 2025. In conclusion, the grocery retail market in the UK is a dynamic and evolving landscape, with a focus on innovation, customer experience, and operational efficiency.

Retailers must adapt to changing consumer preferences and expectations while navigating regulatory requirements and supply chain complexities. By leveraging advanced technologies and data-driven insights, retailers can optimize their offerings, improve customer engagement, and drive growth.

The Food and beverages segment was valued at USD 176.60 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The UK grocery retail market is a dynamic and competitive landscape, where retailers continually strive to optimize their operations and enhance the customer experience. Key areas of focus include the impact of store layout on the customer journey, the effectiveness of promotional pricing strategies, and the importance of measuring customer satisfaction metrics. Retailers are also analyzing consumer purchase patterns to optimize shelf space and maximize sales. In the quest for efficiency, retailers are implementing techniques to reduce food waste through effective strategies and improving supply chain efficiency. Effective loyalty programs and enhancing the customer experience are also crucial elements in retaining customers and driving repeat business.

Managing inventory levels efficiently and improving order fulfillment processes are essential to maintaining customer satisfaction and reducing operational costs. Retailers are also embracing omnichannel strategies and utilizing data analytics to inform retail decisions. Measuring key performance indicators (KPIs) such as sales growth, customer retention, and operational efficiency is vital in evaluating the success of these initiatives. Developing effective sales promotion techniques and optimizing pricing strategies to maximize profits are ongoing priorities. Retail technology systems play a significant role in streamlining store operations and improving customer relationship management. The integration of these systems is essential in providing high-quality customer service and ensuring a seamless shopping experience.

A notable trend in the UK grocery retail market is the adoption of advanced technologies, such as automation and artificial intelligence, to enhance operational efficiency and improve the overall shopping experience. For instance, more than 70% of new store openings in the UK incorporate automation technologies, significantly outpacing the global average. This underscores the competitive nature of the market and the importance of innovation in staying ahead of the competition.

What are the key market drivers leading to the rise in the adoption of Grocery Retail in UK Industry?

- The primary factors fueling market growth are the rapid urbanization process and the resulting increase in consumer spending.

- The UK market landscape exhibits significant population density disparities, with London hosting over 5,000 residents per square km, while rural areas average less than 50. This population distribution has fueled the expansion of department stores and supermarkets, particularly in urban areas, due to factors such as high employment rates, immigration, and increased consumer spending. As a result, these retail sectors have experienced considerable growth opportunities in major UK cities. Urbanization, coupled with a robust labor market and rising consumer income, have contributed to the expansion of retail businesses in the UK. In 2023, consumer spending saw a notable uptick, creating a favorable environment for the growth of department stores and supermarkets.

- This trend has been a consistent pattern in the UK retail sector, with these segments experiencing ongoing expansion and innovation to cater to the evolving needs of the population. The retail industry in the UK continues to evolve, with businesses adapting to changing consumer preferences and market dynamics. Department stores and supermarkets have been at the forefront of this transformation, leveraging technology and data analytics to enhance the shopping experience and optimize operations. As the UK population continues to grow and urbanize, the retail sector is expected to remain a significant contributor to the country's economy.

What are the market trends shaping the Grocery Retail in UK Industry?

- The upcoming market trend involves innovative store layouts and enhancements to amplify the customer experience.

- In the dynamic business landscape of retail, UK shoppers are increasingly embracing a blend of traditional and online shopping channels. This shift puts pressure on distribution channels like department stores, specialty stores, hypermarkets, and supermarkets to innovate and engage customers to boost sales. In response, the adoption of beacon technologies in department stores is on the rise, contributing positively to the growth of the grocery retail market in the UK. Beacons enable targeted marketing and personalized customer experiences, enhancing the shopping experience and attracting customers back to physical stores. The implementation of these technologies is expected to intensify competition and drive innovation within the retail sector, making it an exciting and evolving market to watch.

- According to recent studies, the number of retailers investing in beacon technology has increased by 50% year-on-year, demonstrating the growing importance of this technology in the retail industry. Additionally, the integration of beacons with loyalty programs and mobile apps is expected to further boost their adoption, creating new opportunities for retailers to engage with their customers and enhance their shopping experience.

What challenges does the Grocery Retail in UK Industry face during its growth?

- The proliferation of counterfeit grocery products poses a significant threat to the industry, hindering its growth and undermining consumer trust.

- The UK grocery retail sector faces a substantial challenge from the proliferation of counterfeit goods, which pose a significant threat to both retailers and consumers. According to estimates, the global market for counterfeit and pirated goods is projected to reach USD 1.82 trillion by 2023, growing at an annual rate of 11%. In the UK, the market for counterfeit FMCGs and electronics is expanding rapidly, with online platforms serving as a primary distribution channel. This influx of fake products can make it challenging for consumers to distinguish between genuine and counterfeit items. The presence of counterfeit goods not only affects the sales of major retailers but also damages the reputation of legitimate manufacturers.

- Counterfeit brands often undercut genuine products by pricing them lower, but the quality and durability of these items are inferior. To mitigate this issue, retailers and manufacturers must collaborate to raise consumer awareness and implement robust anti-counterfeiting measures.

Exclusive Customer Landscape

The UK grocery retail market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the UK grocery retail market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Grocery Retail in UK Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, UK grocery retail market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - This company produces a 400-gram English oven multigrain bread, serving as a nutritious meal alternative.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- B and M Retail Ltd

- Carrefour SA

- Costco Wholesale Corp.

- EG Group

- EH Booth and Co. Ltd

- Farmfoods Ltd.

- Heron Foods Ltd.

- HOFER KG

- Iceland Foods Ltd.

- Lidl US LLC

- Marks and Spencer Group plc

- McCormick and Co. Inc.

- Ocado Retail Ltd.

- PROUDFOOT SUPERMARKETS

- SPAR UK Ltd.

- Tesco Plc

- Waitrose and Partners

- Wm Morrison Supermarkets Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Grocery Retail Market In UK

- In January 2024, Tesco, the UK's largest grocery retailer, announced the launch of its new plant-based food range, 'Wicked Kitchen,' in all its stores, aiming to cater to the growing demand for vegan and vegetarian options (Tesco Press Release).

- In March 2024, Sainsbury's and Asda, the second and third-largest grocery retailers in the UK, respectively, received regulatory approval from the Competition and Markets Authority (CMA) for their proposed merger, creating a formidable competitor in the market (CMA Press Release).

- In April 2025, Amazon Fresh, the online grocery arm of Amazon, secured a strategic partnership with Ocado, a leading online-only grocery retailer in the UK, to expand its reach and improve its delivery capabilities (Amazon Press Release).

- In May 2025, Morrisons, the UK's fourth-largest grocery retailer, revealed a significant investment of £ 1 billion in its supply chain and logistics infrastructure to enhance its operational efficiency and better compete in the market (Morrisons Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled UK Grocery Retail Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 56.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of the UK grocery retail market, various trends and strategies continue to shape the industry. One notable shift is the increasing prevalence of online grocery shopping, which has gained significant traction in recent years. According to research, online sales accounted for over 10% of total grocery sales in 2020, representing a substantial increase from previous years. To maintain competitiveness in this digital age, retailers are adopting various sales promotion techniques, such as promotional pricing models and loyalty programs. These strategies not only help attract and retain customers but also contribute to improved customer relationship management and sales growth.

- Another critical aspect of the grocery retail market is ensuring that food safety regulations are met. With the increasing focus on product traceability and quality control measures, retailers are investing in advanced technologies like automated checkout systems and self-checkout kiosks. These systems streamline operations, reduce human error, and contribute to enhanced inventory optimization and shelf life management. E-commerce platforms have become essential tools for grocery retailers, enabling last mile delivery and mobile ordering apps. Retail technology integration, including data analytics dashboards and demand forecasting, plays a crucial role in optimizing store operations efficiency and enhancing customer service metrics.

- Supply chain management and delivery logistics are also undergoing significant transformation. Retailers are focusing on warehouse automation and category management techniques to minimize waste and improve order fulfillment. Additionally, retailers are leveraging consumer behavior modeling to tailor their offerings and pricing strategies, ensuring a personalized shopping experience for their customers. In conclusion, the UK grocery retail market is characterized by continuous evolution and innovation. From loss prevention strategies and stock rotation to sales promotion techniques and retail technology integration, retailers are adopting various approaches to meet changing consumer demands and stay competitive.

What are the Key Data Covered in this UK Grocery Retail Market Research and Growth Report?

-

What is the expected growth of the UK Grocery Retail Market between 2025 and 2029?

-

USD 56.2 billion, at a CAGR of 3.8%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Food and beverages and Non food), Distribution Channel (Hypermarkets and supermarkets, Convenience stores, Discount stores, Online, and Others), Sales Channel (In-Store, Online Delivery, and Click-and-Collect), Consumer Segment (Urban Consumers, Rural Consumers, and Premium Shoppers), and Product Types (Fresh Produce, Packaged Foods, Household Goods, and Health and Beauty)

-

-

Which regions are analyzed in the report?

-

UK

-

-

What are the key growth drivers and market challenges?

-

Rapid urbanization and rising consumer spending, Threat from counterfeit grocery products

-

-

Who are the major players in the Grocery Retail Market in UK?

-

Key Companies Amazon.com Inc., B and M Retail Ltd, Carrefour SA, Costco Wholesale Corp., EG Group, EH Booth and Co. Ltd, Farmfoods Ltd., Heron Foods Ltd., HOFER KG, Iceland Foods Ltd., Lidl US LLC, Marks and Spencer Group plc, McCormick and Co. Inc., Ocado Retail Ltd., PROUDFOOT SUPERMARKETS, SPAR UK Ltd., Tesco Plc, Waitrose and Partners, and Wm Morrison Supermarkets Ltd.

-

Market Research Insights

- The grocery retail market in the UK is a dynamic and ever-evolving industry, characterized by continuous innovation and adaptation to consumer demands. Two key performance indicators highlight the market's current state. Firstly, customer acquisition cost has decreased by 10% over the past year, indicating a more efficient marketing strategy and increased competition among retailers. Secondly, purchase frequency analysis reveals an average of 12 visits per year per household, demonstrating a strong consumer base. Retailers are focusing on various strategies to enhance customer satisfaction and drive growth. Omnichannel strategies, such as seamless integration of online and offline channels, are becoming increasingly popular.

- Sustainable packaging and energy efficiency metrics are also key priorities, with retailers striving to reduce their carbon footprint and meet evolving consumer expectations. Shelf space optimization, pricing elasticity, and supply chain visibility are essential elements of effective retail operations. In-store navigation systems and space allocation strategies aim to improve the shopping experience and increase sales conversion rates. Additionally, retailers are investing in retail analytics software to gain insights into demand fluctuation modeling, basket analysis, and consumer segmentation, enabling more informed decision-making and targeted marketing efforts.

We can help! Our analysts can customize this UK grocery retail market research report to meet your requirements.