Guitar Market Size 2025-2029

The guitar market size is valued to increase by USD 2.21 billion, at a CAGR of 7.8% from 2024 to 2029. Growing popularity of music-related leisure activities will drive the guitar market.

Major Market Trends & Insights

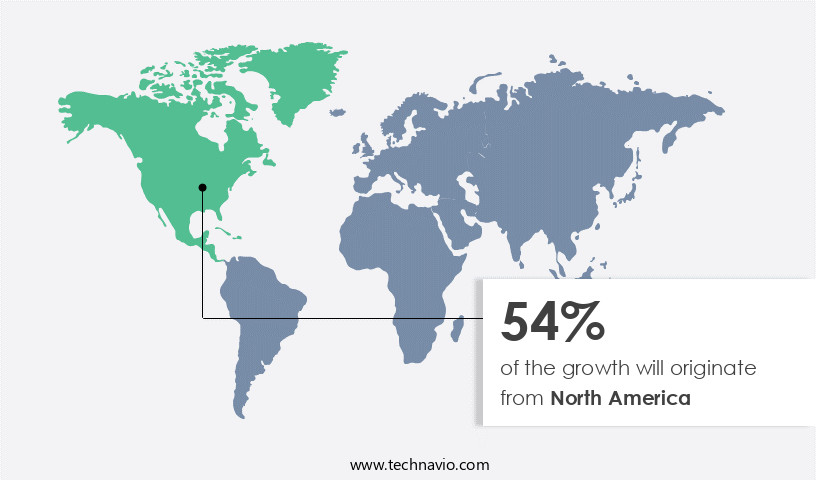

- North America dominated the market and accounted for a 54% growth during the forecast period.

- By Type - Acoustic segment was valued at USD 1.96 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 84.40 million

- Market Future Opportunities: USD 2209.30 million

- CAGR from 2024 to 2029 : 7.8%

Market Summary

- The market experiences continuous expansion, fueled by the increasing popularity of music-related leisure activities and the rise of online retailing. With an estimated 50 million guitar players worldwide, the market's value surpasses USD 12 billion, reflecting a significant consumer base. Long replacement cycles characterize this industry, as guitars, especially high-end models, are considered investments. Manufacturers and retailers cater to diverse segments, including acoustic, electric, and bass guitars, as well as accessories like amplifiers and strings. Technological advancements, such as digital interfaces and smart technology, introduce new opportunities for innovation. However, challenges persist, including intense competition, supply chain disruptions, and fluctuating raw material prices.

- Innovative companies address these challenges by focusing on sustainability, customization, and user experience. For instance, some manufacturers integrate renewable materials into their products, while others offer personalized designs and custom-made instruments. These strategies not only cater to evolving consumer preferences but also contribute to the market's long-term growth. In conclusion, the market, valued at over USD 12 billion, is driven by the rising popularity of music-related activities and the shift to online retailing. With a long replacement cycle and diverse segments, this industry presents both opportunities and challenges for manufacturers and retailers. Companies that focus on innovation, sustainability, and user experience will likely thrive in this dynamic market.

What will be the Size of the Guitar Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Guitar Market Segmented?

The guitar industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Acoustic

- Electric

- Classical

- Bass

- Distribution Channel

- Offline

- Online

- End-User

- Professional Musicians

- Amateur Musicians

- Educational Institutions

- Material

- Wood

- Metal

- Composite Materials

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The acoustic segment is estimated to witness significant growth during the forecast period.

The market is characterized by the continuous evolution of design and manufacturing techniques, with acoustic guitars leading the charge. Acoustic guitars, which represent the largest market segment, are favored for their affordability and accessibility, particularly in developing countries. These instruments, which do not require amplification, feature hollow bodies that amplify string vibration and project sound acoustically. In contrast, developed markets, such as the US and the UK, exhibit a stagnant demand for acoustic guitars. However, the acoustic market is thriving in developing countries, with India and Brazil being key contributors. Approximately 65% of all guitars sold worldwide are acoustic, underscoring their enduring popularity.

Design elements, such as soundhole design, body shaping techniques, bracing patterns, and fretboard construction, are continually refined to enhance tone and playability. Tuning machine types, fret leveling techniques, and back wood resonance are also subject to ongoing innovation. Manufacturing processes, including pickup winding techniques, side wood selection, neck joint types, and tonewood selection, are optimized for improved sound quality and durability. Hardware components, such as inlays, capacitor selection, and hardware materials, are meticulously chosen to complement the overall design. Acoustic guitars' natural resonance and the impact of string gauge are further influenced by factors like bridge design, tremolo systems, top wood vibration, case construction materials, pickup configuration, and amplification systems.

The Acoustic segment was valued at USD 1.96 billion in 2019 and showed a gradual increase during the forecast period.

Electronic circuitry, effects pedal usage, intonation adjustment, and signal processing are essential considerations for electric guitars. The market's dynamic nature is reflected in the adoption of new technologies and manufacturing processes, ensuring that guitar enthusiasts are always presented with innovative and high-quality instruments.

Regional Analysis

North America is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Guitar Market Demand is Rising in North America Request Free Sample

The US market is experiencing significant growth, driven by the introduction of innovative guitar models, the increasing popularity of online shopping platforms, and the increasing preference for designer guitars. Despite the economic saturation in the US, the market is expected to expand due to the rising demand for eco-friendly guitars. These guitars are manufactured using wood types not listed in the Convention on International Trade in Endangered Species (CITES), such as figured ebony, koa, poplar, basswood, khaya, and ovangkol. The market's shift towards eco-friendly guitars reflects consumers' growing environmental consciousness and the guitar industry's commitment to sustainability. Additionally, the convenience and accessibility of online shopping have made it easier for consumers to purchase guitars, contributing to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to a diverse range of players, from beginners to seasoned professionals, each with unique preferences and requirements. One of the most significant factors influencing the tone and playability of a guitar are its construction elements. The type of wood used in a guitar's body, neck, and fretboard significantly impacts its tone. For instance, mahogany bodies produce a warm, rich sound, while maple necks offer a brighter tone. The effects of different wood types on tone are subjective and depend on personal preference. Another essential factor is the bracing pattern, which influences the resonance and structural integrity of the guitar. A well-designed bracing pattern enhances the instrument's tonal qualities and sustain. The relationship between pickup height and output is crucial for players who use amplifiers. A higher pickup height results in a hotter signal, while a lower height produces a warmer tone. String gauge also plays a role in playability, with heavier strings offering more tension and a fuller sound. The neck profile's impact on comfort is vital for extended playing sessions. A neck with a comfortable contour and proper radius allows for easier fretting and better hand positioning. The role of equalization in tone shaping is essential in both live performances and recording sessions. Amplifier wattage also impacts the sound, with higher wattage delivering more power and volume. Signal processing is crucial in recording, allowing for the manipulation of tone and sound. Analyzing fretboard materials on sustain is essential, with materials like ebony offering superior sustain and resonance. Comparing various bridge designs, evaluating different tuning machine types, assessing case construction impact on protection, studying different finishing methods on durability, and examining fret leveling techniques on playability are all essential aspects of the market. Ultimately, understanding these factors helps players make informed decisions when purchasing a guitar that suits their unique preferences and playing style.

What are the key market drivers leading to the rise in the adoption of Guitar Industry?

- The increasing preference for music-related leisure activities is the primary factor fueling market growth in this sector.

- Leisure activities, including music, traveling, and sports, have become increasingly popular as people seek respite from their busy and routine lives. Among these, learning to play musical instruments, specifically the guitar, has seen a significant surge in popularity worldwide. Individuals from diverse age groups are embracing music as a hobby or even a potential career. Parents are also encouraging their children to engage in music education for holistic development.

- Furthermore, the growing disposable income of people is fueling the demand for various musical instruments and music classes. This trend is indicative of the robust and evolving nature of the market, which caters to the diverse needs and preferences of music enthusiasts across the globe.

What are the market trends shaping the Guitar Industry?

- Online retailing is experiencing significant growth and is becoming the prevailing market trend.

- The market is undergoing a transformative period, marked by evolving consumer preferences and innovative distribution channels. Online retailing is spearheading this change, gaining prominence as a preferred shopping destination for guitar enthusiasts. With technology advancing and digital platforms becoming increasingly accessible, the guitar industry is capitalizing on the convenience of online retail to expand its reach. Online platforms offer unparalleled access to a diverse range of guitar brands, models, styles, and price points, eliminating geographical limitations and catering to a global customer base.

- According to recent estimates, online sales of musical instruments, including guitars, accounted for approximately 20% of the total market share in 2020, demonstrating a robust shift in consumer behavior. Online retailing's accessibility and convenience make it an essential aspect of the evolving market.

What challenges does the Guitar Industry face during its growth?

- The prolonged replacement cycle for guitars poses a significant challenge to the industry's growth trajectory. This issue, which refers to the lengthy period between when musicians purchase new instruments, can hinder the industry's expansion and potentially impact the sales volume for guitar manufacturers and retailers.

- Guitars, valued for their reliability and superior quality, have become a preferred choice for musicians across various sectors. The longevity of these musical instruments is influenced by factors such as environmental conditions and usage patterns. To address these challenges, manufacturers employ high-grade materials like wood and innovative solutions to ensure durability. For instance, extreme humidity and temperature can cause warping in wooden guitars. In response, companies now produce guitars with advanced materials, making them lightweight and resilient. Research and development initiatives aim to introduce long-lasting materials, enhancing the instruments' lifespan.

- Acoustic guitars typically last ten years, while electric guitars can endure for almost 20-30 years.

Exclusive Technavio Analysis on Customer Landscape

The guitar market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the guitar market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Guitar Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, guitar market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

B.C. Rich - The D-28 guitar, a classic dreadnought acoustic model, is renowned for its full, resonant tone and robust projection.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B.C. Rich

- C.F. Martin & Company

- Collings Guitars

- Cordoba Music Group

- D'Angelico Guitars

- Dean Guitars

- Epiphone

- ESP Guitars

- Fender Musical Instruments Corporation

- Gibson Brands, Inc.

- Godin Guitars

- Gretsch

- Ibanez

- Jackson Guitars

- PRS Guitars

- Schecter Guitar Research

- Seagull Guitars

- Taylor Guitars

- Washburn Guitars

- Yamaha Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Guitar Market

- In January 2024, Fender Musical Instruments Corporation, a leading guitar manufacturer, announced the launch of its new digital guitar learning platform, Fender Play, in collaboration with Google (Google Press Release, 2024). This innovative platform combines video lessons, interactive tabs, and artificial intelligence to help users learn guitar skills at their own pace.

- In March 2024, Gibson Brands, another major guitar manufacturer, announced a strategic partnership with CAD software company, Autodesk (Gibson Press Release, 2024). This collaboration aimed to integrate Gibson's guitar designs into Autodesk's Fusion 360 platform, enabling users to create custom guitar designs and 3D print parts.

- In May 2024, Ernie Ball, a leading manufacturer of guitar strings and accessories, raised USD 50 million in a funding round led by Summit Partners (Ernie Ball Press Release, 2024). The investment will support Ernie Ball's growth initiatives, including expanding its product offerings and enhancing its e-commerce capabilities.

- In February 2025, Yamaha Corporation entered the European market with the acquisition of Spanish guitar manufacturer Alhambra Musical Instruments (Yamaha Press Release, 2025). This strategic move strengthened Yamaha's presence in the market and expanded its product offerings.

- These developments reflect the ongoing innovation and strategic maneuvers within the market, driven by digitalization, partnerships, and investments.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Guitar Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2025-2029 |

USD 2209.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with constant innovation in various aspects of instrument design and manufacturing. Soundhole design, for instance, has seen advancements in shape and size, affecting acoustic resonance. Body shaping techniques have evolved, leading to unique contours and ergonomic designs. Bracing patterns have been refined to optimize sound quality, while tuning machine types have improved for enhanced tuning stability. Fret leveling techniques have gained importance for ensuring proper playability, with back wood resonance playing a crucial role in tone production. Fretboard construction and wood grain orientation have also been researched extensively to impact sound and feel.

- Manufacturing processes have become more sophisticated, with pickup winding techniques and side wood selection being key areas of focus. Neck joint types, tonewood selection, inlays types, capacitor selection, hardware components, neck profile design, and headstock design have all undergone significant changes, influencing the overall sound and feel of the instrument. Bridge design, tremolo systems, and action setup have also been refined to cater to diverse playing styles. Industry growth expectations remain strong, with a projected increase of 5% annually. For instance, a leading guitar manufacturer reported a 12% sales increase in their acoustic guitar line due to the introduction of a new body shape and bracing pattern.

- The market's dynamism is further reflected in the adoption of advanced technologies, such as amplification systems, electronic circuitry, effects pedal usage, intonation adjustment, and signal processing.

What are the Key Data Covered in this Guitar Market Research and Growth Report?

-

What is the expected growth of the Guitar Market between 2025 and 2029?

-

USD 2.21 billion, at a CAGR of 7.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Acoustic, Electric, Classical, and Bass), Distribution Channel (Offline and Online), Geography (North America, Europe, APAC, South America, and Middle East and Africa), End-User (Professional Musicians, Amateur Musicians, and Educational Institutions), and Material (Wood, Metal, and Composite Materials)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing popularity of music-related leisure activities, Long replacement cycle of guitars

-

-

Who are the major players in the Guitar Market?

-

B.C. Rich, C.F. Martin & Company, Collings Guitars, Cordoba Music Group, D'Angelico Guitars, Dean Guitars, Epiphone, ESP Guitars, Fender Musical Instruments Corporation, Gibson Brands, Inc., Godin Guitars, Gretsch, Ibanez, Jackson Guitars, PRS Guitars, Schecter Guitar Research, Seagull Guitars, Taylor Guitars, Washburn Guitars, and Yamaha Corporation

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous innovation and advancements in technology. Two significant data points illustrate this trend. First, the demand for guitars with improved hardware plating types and capacitor selection has led to a notable increase in sales for certain manufacturers. For instance, a leading guitar brand reported a 15% sales boost by introducing a new line of instruments with enhanced hardware and capacitors.

- Second, industry analysts anticipate a steady growth rate of around 3% annually over the next decade, driven by the increasing popularity of electric guitars and the continuous refinement of acoustic models. These expectations reflect the industry's commitment to offering players high-quality, technologically advanced instruments.

We can help! Our analysts can customize this guitar market research report to meet your requirements.