Automotive Audio Amplifier Market Size 2025-2029

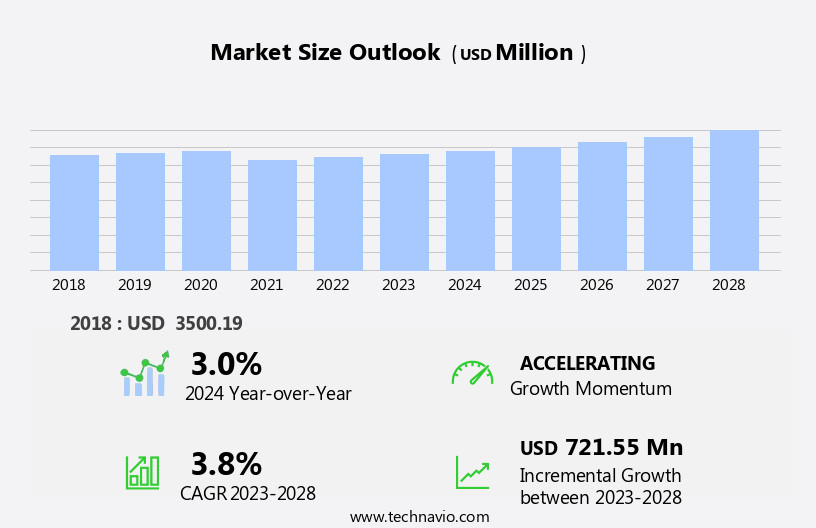

The automotive audio amplifier market size is forecast to increase by USD 696 million at a CAGR of 3.3% between 2024 and 2029.

- The market is driven by the increasing demand for differentiated in-car experiences, as consumers seek to enhance their driving experience with advanced sound systems. This trend is further fueled by technological advancements in the field of automotive audio, leading to the development of sophisticated sound systems that offer superior sound quality and personalized features. However, the market also faces challenges arising from the increased complexities of operating these advanced audio systems. This trend is driving the market, as automakers respond by integrating more sophisticated audio systems into their motor vehicles.

- Additionally, the integration of these systems with other vehicle technologies, such as infotainment systems and connectivity features, can add to the overall complexity and cost. Additionally, the growing use of electric vehicles and the need for lightweight, energy-efficient components present challenges for market participants. Companies in the market must navigate these challenges while continuing to innovate and deliver differentiated in-car audio experiences to meet consumer demand. Integration of multiple components and the need for high power output necessitate the use of sophisticated amplifiers, which can be costly and complex to manufacture and install.

What will be the Size of the Automotive Audio Amplifier Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market is witnessing significant advancements in sound reproduction technology. Audiophile listeners seek superior audio quality in their vehicles, leading to the demand for lossless audio and audiophile components. Class D amplifiers, with their high efficiency and compact size, dominate the market. However, Class A and Class AB amplifiers continue to offer their unique advantages in terms of sound quality and power handling. Audio signal processing and optimization are crucial for delivering high fidelity audio in vehicles. Audiophile software and digital audio processing technologies enable real-time adjustments to improve sound quality. Acoustic treatment and speaker upgrades are popular audiophile accessories for enhancing the listening experience.

- Passive and active crossovers, phase correction, and time alignment are essential aspects of audio system design. Acoustic environments in vehicles pose unique challenges, requiring specialized audio measurement software for accurate calibration. Audiophile formats and high-resolution audio files offer improved sound quality, while DSP tuning and audiophile-grade components ensure precise sound reproduction. In the realm of hi-fi speakers, audiophile speakers and high-end speakers continue to push the boundaries of sound quality improvement. Acoustic environments and sound enhancement technologies play a significant role in optimizing the listening experience. Lossy audio formats, despite their limitations, remain popular due to their widespread availability.

How is this Automotive Audio Amplifier Industry segmented?

The automotive audio amplifier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Six channel

- Four channel

- Two channel

- Others

- Channel

- OEM

- Aftermarket

- Power Output

- Medium power

- Low power

- High power

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period. The market is driven by the increasing adoption of advanced audio systems in passenger cars. These systems incorporate technologies such as digital signal processing, multichannel audio, and audio system tuning to enhance the in-car listening experience. The passenger cars segment dominates the market due to the high volume of sales and the standardization of audio systems in this vehicle class. New technologies, including premium audio systems and USB connectivity, are increasingly being adopted in mid-size passenger cars, catering to the early majority market. The enclosure design of automotive audio amplifiers focuses on compactness and durability, with cooling fans and heat sinks ensuring efficient heat dissipation.

MOSFET transistors and high-performance integrated circuits are used to optimize power output and dynamic range. The use of acoustic tuning, component selection, and custom installation further enhances audio fidelity. Car audio systems and home theater systems employ amplifier classes, such as Class D and Class AB, to optimize power efficiency and audio performance. High-end audio systems may incorporate advanced features like line level inputs, RCA connectors, and speaker wire for custom speaker configurations. Bluetooth connectivity and vibration control add to the convenience and functionality of these systems. OEM audio and aftermarket audio solutions cater to different customer preferences and budgets.

Test equipment and sound quality measurement tools are essential for audio calibration and ensuring optimal audio performance. Speaker efficiency and impedance are crucial factors in determining the power distribution requirements for automotive audio amplifiers. In the realm of mobile audio, subwoofer integration and channel configuration are critical aspects of system design. Power distribution and amplifier installation require careful planning and consideration, with wiring harnesses and amplifier mounting solutions ensuring reliable power supply and signal routing. The evolving automotive audio market continues to prioritize sound quality, innovation, and customization.

The Passenger cars segment was valued at USD 1.86 billion in 2019 and showed a gradual increase during the forecast period.

The Automotive Audio Amplifier Market is advancing with innovations in crossover network technology, optimizing sound clarity. Managing speaker impedance ensures efficient audio transmission, while digital-to-analog converter and analog-to-digital converter technologies enhance signal precision. Integration of line level input, high level input, and auxiliary input allows seamless connectivity. Reliable RCA connector improve signal integrity, while heat sink and cooling fan regulate temperature for longevity. The adoption of MOSFET transistors, integrated circuit, and circuit board enhances performance and durability. A focus on midrange response refines sound depth, catering to audiophile grade expectations. The rise in demand for high end audio solutions fuels market growth, making automotive sound systems more engaging and sophisticated than ever.

The Automotive Audio Amplifier Market is driven by the evolution of class A amplifier, class AB amplifier, and class D amplifier, offering superior sound quality with audiophile grade components. Innovations in active crossover and passive crossover systems enhance frequency separation, enabling precise speaker upgrade. The demand for audiophile speaker, HiFi speaker, and high-end speaker is shaping premium in-car audio experiences. Optimizing the acoustic environment in audiophile listening rooms ensures top-tier audio reproduction. The adoption of audiophile formats and audiophile file formats supports high resolution audio, refining sound fidelity. Cutting-edge audio engineering software aids in audio system optimization, providing crystal-clear playback. Car audio system installation and audio system upgrades remain a significant focus, with 2-channel amplifiers and stereo amplifiers providing powerful and efficient solutions.

Regional Analysis

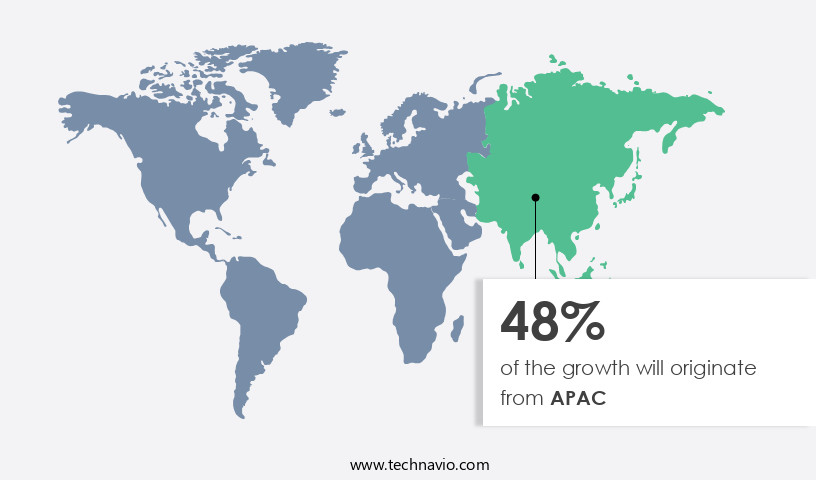

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the automotive audio market, the integration of advanced technologies has led to the development of sophisticated amplifiers. Circuit boards with digital signal processing capabilities enhance audio performance, while analog-to-digital converters ensure accurate audio measurement and calibration. Remote control functionality offers convenience, and multichannel audio systems cater to diverse audio preferences. Enclosure designs prioritize cooling fans for efficient heat dissipation, ensuring the longevity of MOSFET transistors. The market for automotive audio amplifiers is witnessing a trend towards high-end audio systems, with a focus on audio system tuning and frequency response. High dynamic range, low total harmonic distortion, and audiophile-grade components are essential for delivering superior sound quality.

Integrated circuits and speaker wires facilitate custom installation, while power distribution and channel configuration optimize power output. Car and home theater systems alike benefit from these advancements, with power supplies and digital-to-analog converters ensuring audio fidelity. Amplifier classes, such as Class D, offer high power efficiency and reduced heat generation. Line level inputs and RCA connectors enable seamless integration with various audio sources, including USB connectivity and Bluetooth. Custom installation and sound insulation are crucial for optimizing audio performance in vehicles. Component selection, acoustic tuning, and damping factor are essential considerations for subwoofer integration and speaker efficiency. Power distribution and test equipment facilitate efficient power management and signal routing, ensuring optimal audio performance.

In the automotive audio market, the demand for advanced audio systems continues to grow, driven by the increasing popularity of mobile audio and aftermarket audio systems. OEM audio systems are also incorporating these advanced features to cater to consumers' evolving preferences. The market's focus on sound quality, signal routing, and audio fidelity is expected to drive innovation and growth in the coming years. USB connectivity enables audio customization, allowing users to connect their devices and play their preferred music.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Automotive Audio Amplifier market drivers leading to the rise in the adoption of Industry?

- The increasing demand for personalized in-car experiences is the primary factor fueling market growth. The global automotive industry is undergoing significant transformations, driven by both consumer demands and technological advancements. The increasing integration of electronics in vehicles and the emergence of technology companies have intensified competition in the automotive sector. In response, automotive manufacturers are focusing on offering differentiated features to meet evolving consumer needs. This trend is propelling the growth of the market.

- Integrated circuits and power distribution systems enable efficient amplification and signal routing. Damping factor and test equipment are crucial in ensuring optimal performance and maintaining sound quality. The market is poised for growth, driven by the increasing demand for advanced audio systems in vehicles. Advanced automotive technologies have gained significant traction in the last decade, with USB connectivity, acoustic tuning, and speaker wire becoming standard features in modern vehicles. Audio engineering, component selection, and channel configuration are critical factors in ensuring superior sound quality and audio fidelity.

What are the Automotive Audio Amplifier market trends shaping the Industry?

- Advanced automotive sound systems are experiencing significant advancements, emerging as a notable market trend in the automotive industry. The automotive audio market encompasses the development and installation of advanced sound systems in vehicles. Amplifier class, speaker efficiency, and impedance are crucial factors in optimizing the audio experience. High-level input amplifiers and wiring harnesses ensure seamless integration with various audio sources. Leading suppliers in the automotive audio industry are focusing on enhancing sound insulation, vibration control, and Bluetooth connectivity. One notable example is the High-End Surround Sound System by Burmester Audio, which boasts 27 high-performance speakers and a total output of nearly 1,600 Watts.

- This system's unique 3D sound algorithm, achieved by integrating speakers inside the vehicle's roof, offers a distinctive listening experience. Moreover, companies are emphasizing the importance of advanced amplifier chassis designs to minimize distortion and improve overall system performance. As the demand for superior automotive audio continues to grow, these advancements are expected to further refine the in-car listening experience. The market is witnessing significant advancements, driven by the demand for high-fidelity audio experiences in vehicles. wireless connectivity and voice control are becoming essential features, enabling seamless integration of smartphones and other devices. Phase correction and digital signal processing automotive technologies ensure accurate audio signal filtering and time alignment.

How does Automotive Audio Amplifier market face challenges during its growth?

- The complexity of operating advanced audio systems poses a significant challenge to the growth of the industry. This intricacy increases as technology advances, requiring specialized expertise and continuous investment in research and development. These advanced systems incorporate digital signal processing, multichannel audio, and audio system tuning for optimal sound quality. Auxiliary inputs, such as USB and Bluetooth, enable seamless connectivity to various media devices. Remote control functionality allows users to manage audio settings from outside the vehicle. Circuit boards in these amplifiers are designed for high input sensitivity, ensuring clear audio output even from low-level sources. An enclosure design that minimizes vibration and external noise is crucial for maintaining a high signal-to-noise ratio. Cooling fans are integrated into the amplifier design to prevent overheating during prolonged use.

- Crossover networks and RCA connectors facilitate the separation and routing of audio signals to different speakers for optimal performance. Digital signal processing and analog-to-digital converters ensure accurate audio measurement and calibration. Bass response is enhanced through various equalization and filtering techniques. In-car audio systems are continually evolving, with ongoing research and development focusing on improving sound quality, energy efficiency, and ease of use. These advancements contribute to the overall enhancement of the driving experience while ensuring driver safety remains a top priority.

Exclusive Customer Landscape

The automotive audio amplifier market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive audio amplifier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive audio amplifier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Analog Devices Inc. - The company specializes in providing a range of advanced automotive audio amplifiers, including Class A, Class B, and Class D models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Cirrus Logic Inc.

- Diodes Inc.

- ESS Technology Inc.

- ICEpower as

- Infineon Technologies AG

- Integrated Silicon Solution Inc.

- Monolithic Power Systems Inc.

- Nuvoton Technology Corp.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Qualcomm Inc.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- Samsung Electronics Co. Ltd.

- Silicon Laboratories Inc.

- Sony Group Corp.

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Audio Amplifier Market

- In March 2023, Panasonic Automotive and NXP Semiconductors announced a strategic collaboration to develop advanced automotive audio amplifiers with integrated Bluetooth and voice recognition technologies. This partnership aims to cater to the growing demand for connected car solutions and personalized in-cabin experiences (Panasonic Press Release).

- In July 2024, Bosch Automotive Solutions unveiled its new 12-channel Class-D audio amplifier, delivering an impressive 1,200 watts of power. This technological advancement sets a new benchmark in automotive audio systems, offering superior sound quality and efficiency (Bosch Press Release).

- In October 2024, Continental AG and Harman International entered into a strategic partnership to develop and manufacture next-generation automotive audio systems. This collaboration combines Continental's expertise in automotive technology with Harman's audio expertise, aiming to create innovative and cinematic in-car audio experiences (Continental AG Press Release).

- In February 2025, DSP Group, a leading provider of wireless communication and voice processing solutions, launched its new line of automotive audio amplifiers with built-in voice control and advanced connectivity features. This development aligns with the growing trend of voice-activated systems and connected cars, enhancing the user experience and convenience (DSP Group Press Release).

Research Analyst Overview

The market is characterized by its continuous evolution, with dynamic market activities unfolding across various sectors. Amplifier class and high-level input solutions are increasingly adopted in automotive audio systems to enhance sound quality and performance. Amplifier installation and wiring harness designs are optimized for seamless integration with speaker systems, ensuring efficient energy transfer and improved audio fidelity. Speaker efficiency and impedance are critical factors in the design of automotive audio systems. Advanced enclosure designs, digital signal processing, and acoustic tuning are employed to optimize speaker performance and minimize distortion. OEM audio systems and aftermarket solutions leverage the latest technologies, such as multichannel audio, audio system tuning, and analog-to-digital converters, to deliver superior sound quality.

Mobile audio systems and home theater installations also benefit from the ongoing advancements in amplifier technology. Bluetooth connectivity, vibration control, and amplifier chassis designs are essential components in delivering high-performance audio solutions. The integration of advanced features, such as cooling fans, dynamic range, and power distribution, ensures optimal audio performance and reliability. The market for automotive audio amplifiers is driven by the growing demand for enhanced in-car entertainment systems and the pursuit of superior audio performance. The integration of advanced technologies, such as signal routing, audio calibration, and test equipment, enables audio engineers to fine-tune audio systems for exceptional sound quality and audio measurement accuracy.

The ongoing development of amplifier technology is reflected in the adoption of advanced components, such as MOSFET transistors and integrated circuits, and the integration of features like bass response, treble response, and subwoofer integration. The market for automotive audio amplifiers is poised for continued growth, with a focus on delivering high-end audio solutions that cater to the evolving needs of consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Audio Amplifier Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 696 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

China, US, Japan, Canada, India, Germany, France, South Korea, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Audio Amplifier Market Research and Growth Report?

- CAGR of the Automotive Audio Amplifier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive audio amplifier market growth of industry companies

We can help! Our analysts can customize this automotive audio amplifier market research report to meet your requirements.