Hand Held Surgical Instruments Market Size 2024-2028

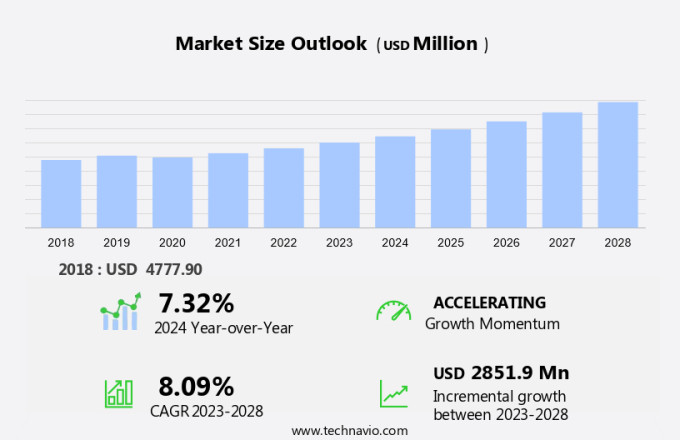

The hand held surgical instruments market size is forecast to increase by USD 2.85 billion at a CAGR of 8.09% between 2023 and 2028. Handheld surgical instruments have gained significant importance in the healthcare industry due to the increasing volume of surgeries driven by chronic conditions such as cancer, diabetes, and orthopedic disorders. Moreover, the demand for single-use surgical instruments is increasing due to the risks and complications associated with reusable instruments. In conclusion, the handheld surgical instruments market is expected to grow significantly due to the increasing volume of surgeries driven by chronic diseases and an aging population. The demand for single-use instruments is also increasing due to the risks associated with reusable instruments. the global supply chains for medical devices have been impacted by travel restrictions and the adoption of telemedicine, leading to increased demand for disposable incomes and healthcare expenditure. Key medical specialties, including cardiology, ophthalmology, wound care, and urology, are expected to drive the growth of the market.

The market is evolving with advancements in plastic surgery and non-surgical treatment options. While traditional hand-held instruments remain essential, innovations such as robotic-assisted surgery and image-guided interventions are enhancing precision and patient outcomes. The market is experiencing growth driven by the increasing prevalence of orthopedic ailments, as more individuals seek surgical solutions for musculoskeletal conditions. According to the OECD, the demand for these instruments is rising in both developed and emerging economies, where healthcare systems are increasingly adopting advanced surgical technologies. The surgical instruments continue to play a critical role in procedures, offering flexibility and control that complement robotic systems. With ongoing developments, the market is set to expand, supporting a range of medical disciplines from plastic surgery to orthopedic care.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Ambulatory surgical centers

- Clinics

- Long-term care centers

- Product

- Forceps

- Retractors

- Dilators

- Graspers and others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

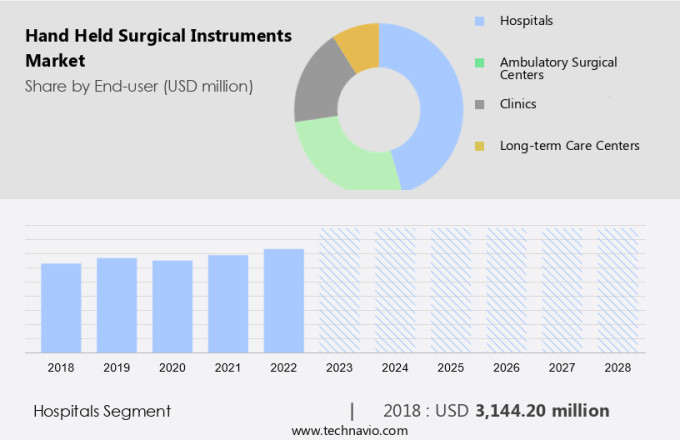

The hospitals segment is estimated to witness significant growth during the forecast period. In the healthcare industry, hospitals serve as significant venues for conducting various surgical procedures, including those for chronic disorders. Multi-specialty hospitals, private institutions, and hospital groups collaborating with public and private entities are key market participants. The expansion of healthcare infrastructure is anticipated to fuel the growth of this sector. The proliferation of hospitals in developed and emerging economies, such as the US, China, and India, coupled with government initiatives to enhance hospital infrastructure, has led to an increase in surgical interventions for chronic conditions, including urological diseases, diabetes, cancers, and orthopedic deformities.

Additionally, elective surgical procedures, such as cardiovascular disorders treatment through cardiovascular surgery and breast surgery, are also common in hospitals. Surgeons play a crucial role in performing these procedures using handheld surgical instruments. The geriatric population's increasing need for orthopedic surgery further bolsters the market's growth.

Get a glance at the market share of various segments Request Free Sample

The hospitals segment accounted for USD 3.14 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

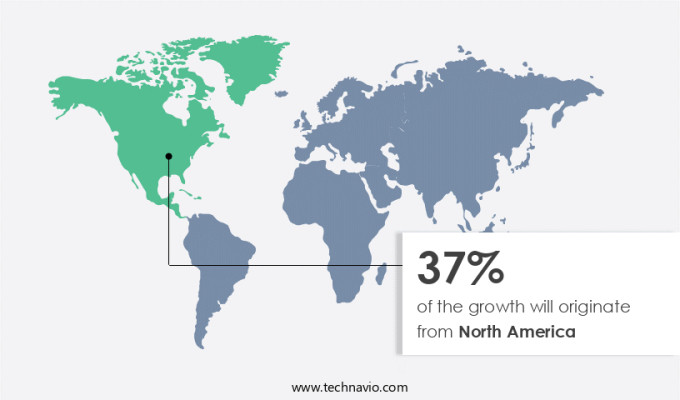

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the global landscape, North America held a significant share of the market in 2023. This region's market growth can be attributed to several factors, including an aging population and the prevalence of chronic diseases. As per the Centers for Disease Control and Prevention (CDC), approximately 133 million Americans had one or more chronic conditions in 2020, with cardiovascular diseases (CVDs) and chronic respiratory diseases being the most common. Moreover, the incidence of colorectal cancer, ulcerative colitis, orthopedic surgeries, and gynecological surgeries is on the rise, further fueling market expansion. The adoption of alternative treatment methods, such as laser therapy and robotic-assisted surgery, is also driving market growth in this region. The North American healthcare expenditure and disposable incomes continue to rise, making advanced medical technology more accessible to patients.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

An increase in volume of surgeries coupled with chronic diseases and older population is the key driver of the market. Surgical instruments play a crucial role in managing various healthcare conditions, including orthopedic, ENT, thoracic, and others. The rising prevalence of chronic diseases and an aging population with obesity will fuel the demand for these instruments. Complex surgeries, such as those related to the spine, neuro, and cranial, necessitate advanced and precise surgical tools. According to the Centers for Disease Control and Prevention (CDC), approximately 19.9 million ambulatory visits in 2020 resulted in 43% of surgeries being conducted in freestanding ambulatory surgery centers, while 57% were performed in hospitals. Image-guided interventions and pharmaceutical interventions are transforming surgical procedures, leading to increased efficiency and accuracy.

Global supply chains are essential to ensuring the availability of these medical devices, especially during travel restrictions and the shift towards telemedicine. The hand-held surgical instruments market is expected to grow significantly due to these factors.

Market Trends

Growing demand for single-use surgical instruments is the upcoming trend in the market. Hand held surgical instruments are essential tools used in various medical procedures, including gynecology surgery and neurosurgery. These instruments come in both disposable and reusable categories to ensure optimal patient safety. Companies provide a range of single-use hand held surgical instruments to minimize the risk of surgical site infections and contamination. For instance, surgical forceps and dilators are commonly used in gynecology surgeries, while graspers and cannulas are utilized in neurosurgeries. Disposable surgical instruments, such as scalpels, are gaining popularity due to their reduced risk of contamination. Swann Morton, for example, offers standard, guarded, and Sabre disposable sterile scalpels that are widely used in emergency units and trauma centers for making incisions for chest drains, opening coronary arteries, and removing calcifications.

The demand for disposable surgical instruments is increasing as they offer enhanced safety and convenience for medical professionals and patients alike. In conclusion, hand held surgical instruments play a crucial role in medical procedures, and their demand continues to grow due to their effectiveness in minimizing contamination and ensuring optimal patient safety. Disposable surgical instruments, such as scalpels, are becoming increasingly popular due to their reduced risk of contamination and convenience. companies, such as Swann Morton, offer a range of high-quality disposable surgical instruments to cater to the needs of medical professionals and patients.

Market Challenge

Risks and complications associated with surgical instruments is a key challenge affecting the market growth. Surgical instruments play a crucial role in various medical procedures, including those related to cancer, diabetes, orthopedic conditions, cardiology, ophthalmology, wound care, and urology. These tools are essential for performing functions such as dissecting, cutting, grasping, retracting, and suturing during surgeries. However, the improper or inaccurate usage of these instruments by surgeons and failure to follow aseptic sterilization techniques could result in post-operative complications for patients.

Additionally, inadequate cleaning techniques could lead to disease transmissions, prolonging hospital stays. For instance, surgical scalpels, which are commonly used during surgeries and other medical procedures, are extremely sharp and require precise handling to avoid complications. Ensuring proper usage and maintenance of surgical instruments is essential for optimal patient outcomes and reducing healthcare costs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aspen Surgical Products Inc. - The company offers hand held surgical instruments such as Bard-Parker disposable scalpels.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B.Braun SE

- Becton Dickinson and Co.

- Conmed Corp.

- Dolphin Surgicals

- Gebruder Martin GmbH and Co. KG

- Hebson Surgical Co.

- Integra Lifesciences Corp.

- Johnson and Johnson Services Inc.

- KARL STORZ SE and Co. KG

- Lepu Medical Technology Beijing Co. Ltd.

- Medtronic Plc

- Olympus Corp.

- Richard Wolf GmbH

- Smith and Nephew plc

- Stryker Corp.

- Teleflex Inc.

- The Cooper Companies Inc.

- THOMSON SURGICALS PVT.LTD.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Handheld surgical instruments play a crucial role in the healthcare industry, particularly in the context of chronic disorders and elective surgical procedures. With an aging geriatric population and a rise in cardiovascular disorders, orthopedic surgery, breast surgery, and aesthetic surgeries have become increasingly common. Surgeons rely on a wide range of surgical instruments, including retractors, forceps, dilators, graspers, scalpels, cannulas, and more, to ensure patient safety, surgical efficiency, and optimal surgical outcomes during patient recovery. Hospitals, ambulatory surgical centers, and clinics are the primary healthcare facilities utilizing these instruments for various surgical procedures. Chronic diseases such as cardiovascular diseases, cancer, diabetes, orthopedic conditions, and others necessitate surgical interventions.

Further, medical technology advancements, such as laser therapy, robotic-assisted surgery, image-guided interventions, and pharmaceutical interventions, have revolutionized surgical procedures. However, alternative treatment methods, such as OECd-recommended preventive measures, may influence the demand for handheld surgical instruments. Overall, the handheld surgical instruments market is poised for growth, driven by the increasing prevalence of chronic disorders and the need for efficient, safe, and effective surgical procedures.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 2.85 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aspen Surgical Products Inc., B.Braun SE, Becton Dickinson and Co., Conmed Corp., Dolphin Surgicals, Gebruder Martin GmbH and Co. KG, Hebson Surgical Co., Integra Lifesciences Corp., Johnson and Johnson Services Inc., KARL STORZ SE and Co. KG, Lepu Medical Technology Beijing Co. Ltd., Medtronic Plc, Olympus Corp., Richard Wolf GmbH, Smith and Nephew plc, Stryker Corp., Teleflex Inc., The Cooper Companies Inc., THOMSON SURGICALS PVT.LTD., and Zimmer Biomet Holdings Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch