Hand Tools Market Size 2024-2028

The hand tools market size is forecast to increase by USD 2.66 billion at a CAGR of 4.45% between 2023 and 2028.

- The hand tools market is driven by the demand for hand tools from developing economies, where rapid urbanization and industrialization are fueling construction and manufacturing activities. An upcoming trend in the market is the introduction of ergonomically designed hand tools. As consumer awareness increases regarding health and safety, there is a rising demand for power tools that offer greater comfort and reduce the risk of strain or injury, enhancing productivity and user satisfaction in both professional and DIY settings.

- However, the market is also facing challenges such as the fluctuating prices of raw materials used in manufacturing hand tools. These price fluctuations can impact the profitability of hand tool manufacturers and suppliers. Despite these challenges, the market is expected to continue its growth trajectory, driven by the increasing demand for hand tools, including non-ferrous industrial hand tools, in various industries and the ongoing innovation in hand tool design and technology.

What will be the Size of the Hand Tools Market During the Forecast Period?

- The market encompasses a diverse range of instruments, including screwdrivers, pliers, wrenches, hammers, saws, and various specialized tools, catering to both industrial and household applications. This market is characterized by continuous innovation, with a focus on hand tool design manipulations, robustness, and reliable performance to meet the evolving needs of various industries and DIY enthusiasts.

- Customizations, extended tips, and lightweight tools are increasingly popular trends, enabling users to tackle a wider range of tasks with ease. The labor force and infrastructure supporting building activities continue to drive demand for hand tools, particularly in sectors such as automotive and construction. The market is further influenced by the rise of automation, sustainability, and digital platforms, including e-commerce sites and mobile apps, which facilitate convenient access to an expansive selection of hand tools.

- Despite increasing material costs, the hand tools industry remains dynamic and responsive to market demands.

How is this Hand Tools Industry segmented and which is the largest segment?

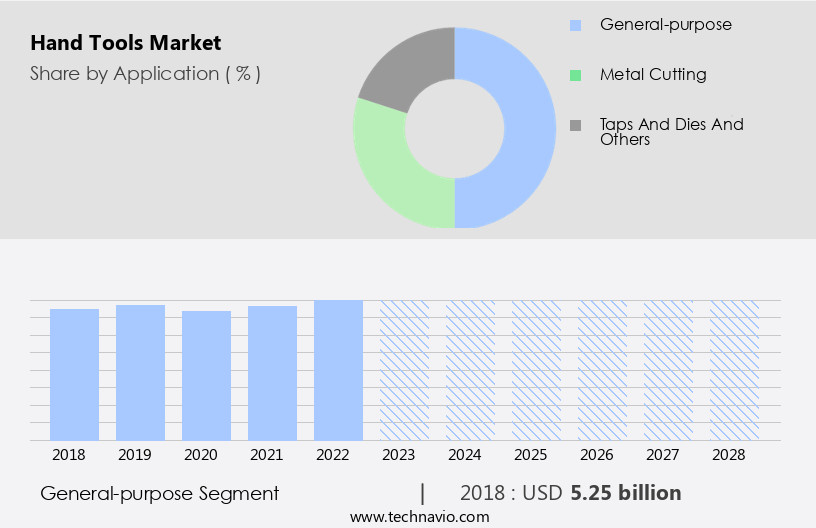

The hand tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- General-purpose

- Metal cutting

- Taps and dies and others

- End-user

- Industrial

- Household

- Distribution Channel

- In Store

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- South America

- Brazil

- Middle East and Africa

- UAE

- North America

By Application Insights

- The general-purpose segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide range of instruments, including hammers, nail guns, screwdrivers, pliers, wrenches, and saws. These tools cater to various applications within the industrial, household, and DIY sectors. Hammers are utilized for tasks such as driving, shaping, and breaking, while screwdrivers are essential for turning different types of screws. Wrenches offer support in applying torque to turn objects, and pliers are used for gripping, turning, twisting, and cutting. Mallets provide a soft striking force and positive drive for objects on any surface.

The growth of this market is influenced by factors such as the increasing labor force, infrastructure development, building activities, consumer disposable income, and renovation activities. Additionally, the rise in material costs, online sales channels, and the DIY culture have contributed to the market's expansion. The market is further characterized by the emergence of multi-function tools, clear view toolboxes, cost-effectiveness, aftermarket repair services, and the increasing popularity of lightweight and cordless tools. The market is expected to continue growing due to automation, sustainability, digital platforms, and e-commerce sites.

Get a glance at the Hand Tools Industry report of share of various segments Request Free Sample

The General-purpose segment was valued at USD 5.25 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

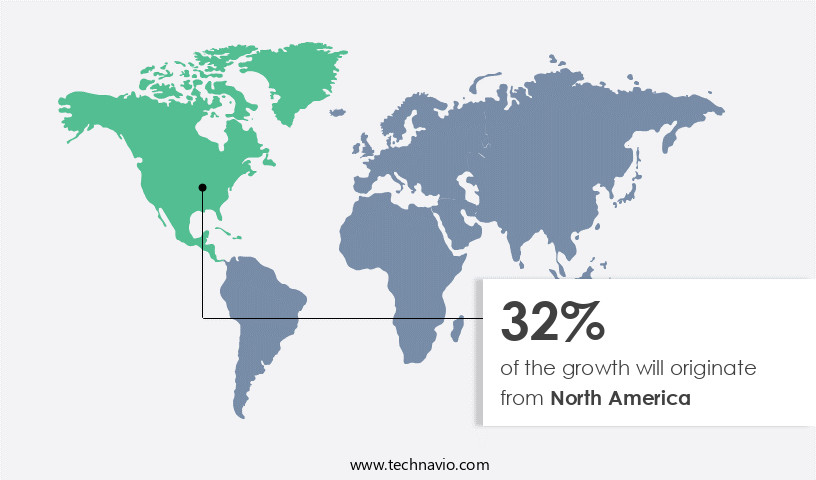

- North America is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is projected to expand steadily over the forecast period, with the US being a significant contributor to its revenue growth. Factors driving this expansion include the thriving construction sector, commercial and industrial development, and the presence of a substantial customer base for global hand tool manufacturers In the US. However, the US's economic saturation may hinder market growth during the forecast period. Key product categories include screwdrivers, pliers, wrenches, hammers, saws, power tool accessories, and automotive hand tools, used extensively in DIY projects and the automotive industry. The market is characterized by a diverse range of offerings, from industrial-grade tools to lightweight, cordless, and multi-function tools.

Consumer disposable income, renovation activities, and the vacancy rate of houses also influence market dynamics. The market's growth is further influenced by trends such as automation, sustainability, digital platforms, and e-commerce sites. Despite these opportunities, cost effectiveness and aftermarket repair services remain crucial considerations for both small and large players.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Hand Tools Industry?

Huge demand for hand tools from developing economies is the key driver of the market.

- The market has experienced notable growth in developing economies, including India, Brazil, South Africa, and Indonesia, due to the expansion of industries such as automobiles and construction. This growth is fueled by increasing economic activities and rising consumer disposable income. Hand tools are essential for various applications In these industries, including the assembly of automotive parts and building activities like renovation projects and the development of infrastructure. These tools are multifunctional, serving purposes such as tightening screws, bending pipes, and cutting materials. The labor force In these industries relies on hand tools for their efficiency and cost-effectiveness. The market for hand tools encompasses a wide range of products, including screwdrivers, pliers, wrenches, hammers, saws, and automotive hand tools.

- As the DIY industry continues to gain popularity, there is a rising demand for lightweight, cordless, and multi-function tools. Additionally, the increasing focus on automation, sustainability, and digital platforms In the industrial sector is influencing the market. The market dynamics are further shaped by factors such as material costs, employment opportunities in technical jobs, and the availability of aftermarket repair and service providers. The market offers quality products at competitive prices, making them a valuable investment for both industrial and household use.

What are the market trends shaping the Hand Tools Industry?

Introduction of ergonomically designed hand tools is the upcoming market trend.

- Hand tools continue to evolve with innovative designs and enhanced features, catering to the demands of various industries and consumers. companies prioritize the production of hand tools that boost the productivity of commercial and industrial facilities. Ergonomics is a significant focus, with electricians seeking lightweight, ergonomically designed tools with a comfortable grip for optimal muscle engagement. Customizations, extended tips, and multi-functionality are also essential aspects of modern hand tools. The labor force relies on hand tools for infrastructure building activities, renovation projects, and maintaining production units. Consumer disposable income, DIY culture, and the growing popularity of vacant houses have fueled the demand for hand tools In the household sector.

- The DIY industry thrives on the availability of a wide range of hand tools, from screwdrivers and pliers to hammers and saws. Automotive hand tools are essential for the automotive sector, while cordless and lightweight tools cater to the needs of DIY enthusiasts. The market dynamics also include factors like pricing, efficiency, cost-effectiveness, aftermarket repair, and service providers. The hand tool market encompasses a diverse range of materials, including metal and wood, and caters to both industrial and household applications. The market is further influenced by sustainability, digital platforms, e-commerce sites, mobile apps, and the rising material costs. Employment opportunities in technical jobs continue to grow in this sector, with an emphasis on quality and efficiency.

What challenges does the Hand Tools Industry face during its growth?

Fluctuating raw material prices of hand tools is a key challenge affecting the industry growth.

- Hand tools are essential instruments used in various building activities, renovation projects, and DIY initiatives. The market for hand tools is influenced by several factors, including the labor force, infrastructure development, and consumer disposable income. The demand for hand tools is driven by the increasing number of construction projects and the DIY industry's growth. Manufacturers use substrates such as iron, steel, aluminum, plastic, and carbon fibers to produce hand tools. However, the prices of these raw materials are subject to volatility due to fluctuations in crude oil prices and the availability of natural forest products. This volatility, coupled with increasing competition from local manufacturers, particularly in emerging economies, poses a significant challenge to hand tool companies.

- Hand tools include a range of instruments, including screwdrivers, pliers, wrenches, hammers, saws, and automotive hand tools. Multi-function tools, lightweight tools, cordless tools, and automation are gaining popularity due to their efficiency and cost-effectiveness. The aftermarket repair and service providers play a crucial role in maintaining the reliability and durability of hand tools. The hand tool market is witnessing the emergence of digital platforms, e-commerce sites, and mobile apps as significant sales channels. The DIY culture is driving the demand for hand tools online, and the rising material costs are increasing the importance of cost-effective production units and technical jobs.

- Sustainability and efficiency are becoming essential considerations for hand tool manufacturers, leading to innovations in tool design manipulations and extended tips.

Exclusive Customer Landscape

The hand tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hand tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hand tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Akar Auto Industries Ltd. - The market encompasses a range of essential instruments, including spanners, wrenches, and ring spanners. These tools are indispensable for various applications across industries, enabling efficient and precise fastening and loosening of bolts and nuts. The hand tools sector continues to evolve, driven by advancements in materials, design, and manufacturing processes. Market growth is underpinned by increasing industrialization, infrastructure development, and DIY culture. Manufacturers focus on enhancing product durability, ergonomics, and functionality to cater to evolving customer needs and preferences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akar Auto Industries Ltd.

- Apex Tool Group LLC

- Cementex Products Inc.

- Channellock Inc.

- Emerson Electric Co.

- Estwing Manufacturing Co.

- IDEAL Industries Inc

- Ingersoll Rand Inc.

- JCBL Group

- Klein Tools Inc.

- Malco Tools Inc.

- Martin Sprocket and Gear Inc.

- Snap On Inc.

- STAHLWILLE Eduard Wille GmbH and Co. KG

- Stanley Black and Decker Inc.

- Swanson Tool Co. Inc.

- Taparia Tools Ltd.

- Techtronic Industries Co. Ltd.

- The L.S. Starrett Co.

- Toughbuilt Industries Inc.

- TOYA S.A.

- Vaughan Manufacturing

- Wera

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of instruments designed to manipulate various materials for building activities, maintenance, and DIY projects. These tools are essential for both industrial and household applications, with their robustness and reliable performance being crucial factors In their demand. Customizations and extended tips are becoming increasingly popular In the market, as users seek to optimize their tools for specific tasks. The labor force and infrastructure required for hand tool production are significant, with the number of employment opportunities in technical jobs related to tool design and manufacturing continuing to grow. The market is influenced by several factors, including consumer disposable income, renovation activities, and the availability of vacant houses for DIY projects.

The demand for hand tools is also driven by the need for efficient and cost-effective solutions for various industries. Quality and pricing are key considerations for consumers In the market. Multi-function tools, clear view toolboxes, and lightweight tools are popular choices due to their durability, efficiency, and cost-effectiveness. Aftermarket repair and service providers play a vital role in maintaining the longevity of hand tools, ensuring they continue to perform optimally. Power tools and hand tools share some similarities but serve distinct purposes. While power tools rely on electricity or batteries for operation, hand tools require no external power source.

Hand tools are typically used for precision work, while power tools are preferred for heavy-duty tasks. Materials such as metal and wood are common In the market, with the product price being a significant factor In their adoption. Industrial hand tools are typically more expensive due to their larger size and increased durability, while household hand tools are more affordable and compact. The market is undergoing significant changes due to automation, sustainability, and digital platforms. Automation is leading to the development of more efficient production processes, while sustainability is driving the adoption of eco-friendly materials and manufacturing practices.

Digital platforms, including e-commerce sites and mobile apps, are making it easier for consumers to purchase hand tools online, leading to rising material costs and increased competition among small sized players. In conclusion, the market is a dynamic and evolving industry, driven by factors such as consumer demand, technological advancements, and economic conditions. The market is expected to continue growing, with a focus on cost-effectiveness, efficiency, and sustainability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.45% |

|

Market growth 2024-2028 |

USD 2.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.15 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hand Tools Market Research and Growth Report?

- CAGR of the Hand Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hand tools market growth of industry companies

We can help! Our analysts can customize this hand tools market research report to meet your requirements.