Harness Saddlery Equipment Market Size 2025-2029

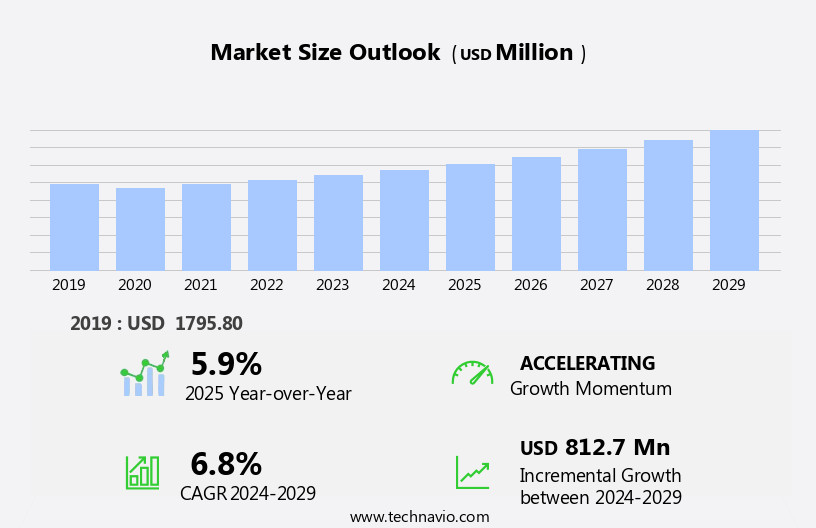

The harness saddlery equipment market size is forecast to increase by USD 812.7 million at a CAGR of 6.8% between 2024 and 2029.

- The market is witnessing significant growth due to several key trends. One of the primary factors driving market growth is the increasing awareness and popularity of equestrian events. These events have gained immense popularity in North America, leading to a rise in demand for high-quality harness saddlery equipment. Another trend influencing the market is the integration of smart technology in harness saddlery equipment. Safety and comfort are crucial considerations In the market, with high-quality materials such as leather, nylon, stainless steel, and synthetic fabrics used to ensure durability and performance. Innovative technologies, including smart sensors, 3D printing, and GPS tracking, are increasingly being adopted to enhance functionality, rider convenience, and equine welfare. This technology enhances the functionality and performance of the equipment, making it more attractive to consumers. However, the high cost and affordability of harness saddlery equipment remain challenges for market growth. Despite these challenges, the market is expected to witness steady growth In the coming years, driven by the increasing popularity of equestrian sports and the continuous innovation in harness saddlery equipment technology.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a range of tools and accessories designed for the handling and riding of horses using harnesses instead of saddles. This market caters to equestrian events, outdoor sports enthusiasts, riders, trainers, owners, and enthusiasts worldwide. Safety and comfort are paramount considerations in this market, with a focus on high-quality materials such as leather and nylon for durability and adherence to quality standards. Smart technology integration is a notable trend, enhancing the functionality and convenience of harness saddlery equipment. Customization and personalization options allow riders to tailor their equipment to their specific needs and preferences. The market includes various products, including blankets, protective gear, stirrups, bits, bridles, saddles, harnesses, and more.

- Overall, the market is experiencing steady growth, driven by the increasing popularity of harness racing and the ongoing demand for innovative, high-performance, and comfortable equipment for both horses and riders.

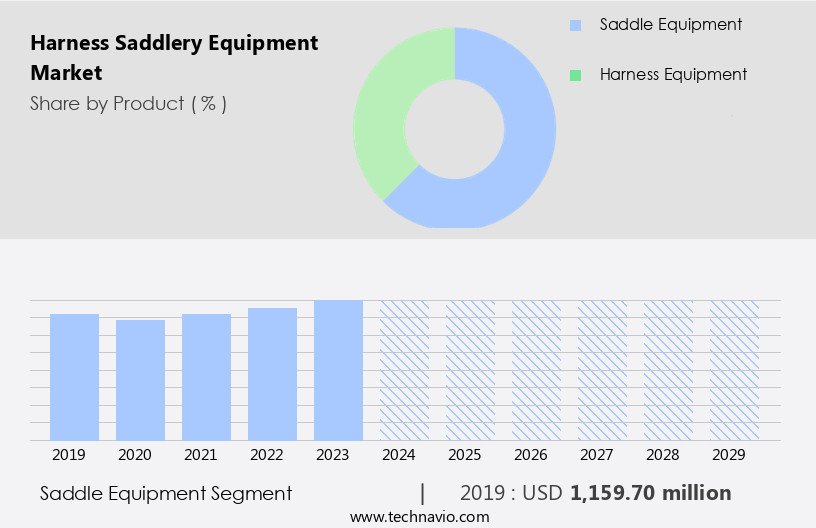

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Saddle equipment

- Harness equipment

- End-user

- Amateur

- Professional

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

- The saddle equipment segment is estimated to witness significant growth during the forecast period.

Harness saddlery equipment refers to the tools and accessories designed to ensure comfort, safety, and optimal performance for both riders and horses during equestrian events and outdoor sports. This market encompasses a variety of products, including saddles, stirrups, bits, bridles, harnesses, blankets, protective gear, and more. The focus on safety and comfort, coupled with the integration of smart technology, customization, and personalization, has driven innovation In the sector. Advanced materials such as high-quality leather, nylon, stainless steel, and synthetic fabrics are used to enhance durability and performance. Sustainability is also a key consideration, with eco-friendly products made from recycled and natural materials like cork and bamboo gaining popularity.

Get a glance at the market report of share of various segments Request Free Sample

The saddle equipment segment was valued at USD 1.16 billion in 2019 and showed a gradual increase during the forecast period.

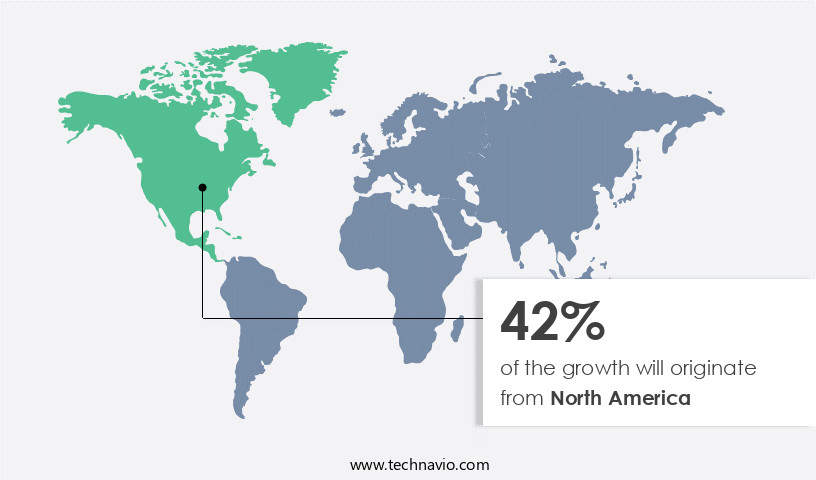

Regional Analysis

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is experiencing significant growth due to the increasing popularity of equestrian events and outdoor sports. Equestrian tourism, a thriving industry In the region, is driven by the rise in health consciousness and the adventurous spirit of consumers. The American Equestrian Trade Association (AETA) plays a pivotal role in advancing the equine trade business community, offering education, trade shows, and services to support the industry's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Harness Saddlery Equipment Industry?

Growing awareness and popularity of equestrian events is the key driver of the market.

- Harness saddlery equipment plays a crucial role in ensuring safety, comfort, and optimal performance for both horses and riders during equestrian events and outdoor sports activities. This market caters to the needs of riders, trainers, owners, and enthusiasts, providing a wide range of tools and accessories for handling and riding horses. The demand for high-quality harness saddlery equipment is driven by the growing popularity of equestrian events and the desire for peak performance and equine welfare. Innovative materials, such as leather, nylon, stainless steel, and synthetic fabrics, are used to create durable and functional equipment. Smart technology, including GPS tracking, pressure sensors, and biometric monitoring, enhances the riding experience and promotes the well-being of both horses and riders.

- Customization and personalization are also essential factors, as individual riding styles and preferences require tailored solutions. Sustainability is a growing concern In the market, with eco-friendly products made from recycled materials and sustainable resources, such as cork and bamboo, gaining popularity. Transparency and fair labor practices are also essential considerations for consumers, ensuring ethical manufacturing processes and the welfare of animals. Smart sensors, 3D printing, and functional designs contribute to the convenience and performance of harness saddlery equipment. The integration of smart technology, such as GPS tracking and biometric monitoring, enables riders to monitor their horses' vital signs and performance data, ensuring optimal conditions for both horse and rider.

What are the market trends shaping the Harness Saddlery Equipment Industry?

Rise in integration of smart technology in harness saddlery equipment is the upcoming market trend.

- The market is experiencing notable growth due to the integration of smart technology. This trend is fueled by the equestrian community's focus on enhancing rider and horse comfort and safety. Smart technology integration allows for real-time data analysis and communication between rider and horse, revolutionizing the equestrian industry. Key innovations include smart saddles that offer performance insights, enabling riders to optimize training and riding experience. Safety and comfort are paramount in harness saddlery equipment, and smart technology delivers on both fronts. High-quality materials, such as leather, nylon, stainless steel, and synthetic fabrics, ensure durability and adherence to quality standards.

- Innovative materials, like cork and bamboo, contribute to sustainability and eco-friendliness. Customization and personalization are also essential, with riders, trainers, owners, and enthusiasts seeking individual riding styles and peak performance. Smart sensors, 3D printing, and functional designs cater to rider convenience and equine welfare. The integration of GPS tracking, pressure sensors, and biometric monitoring further enhances safety and performance. Fair labor practices and the use of recycled and eco-friendly materials are essential considerations for ethical and sustainable production. The future of harness saddlery equipment lies in continuous innovation and the prioritization of rider and horse well-being.

What challenges does the Harness Saddlery Equipment Industry face during its growth?

High cost and affordability of harness saddlery equipment is a key challenge affecting the industry growth.

- The market faces challenges due to the affordability issues associated with high-priced equipment. This hinders access to quality gear for a larger demographic of riders and horse owners, negatively impacting market growth. The escalating cost of raw materials, such as high-grade leather and advanced synthetic fabrics, contributes significantly to the high prices. Embracing innovative materials, like cork and bamboo, and eco-friendly practices, such as fair labor and recycled materials, can help mitigate these costs while maintaining durability, quality, and performance.

- Additionally, integrating smart technology, such as GPS tracking, pressure sensors, and biometric monitoring, enhances safety, comfort, and functionality for both riders and horses. Customization and personalization, along with sustainable and eco-friendly products, cater to individual riding styles and equine welfare, ensuring peak performance and rider convenience.

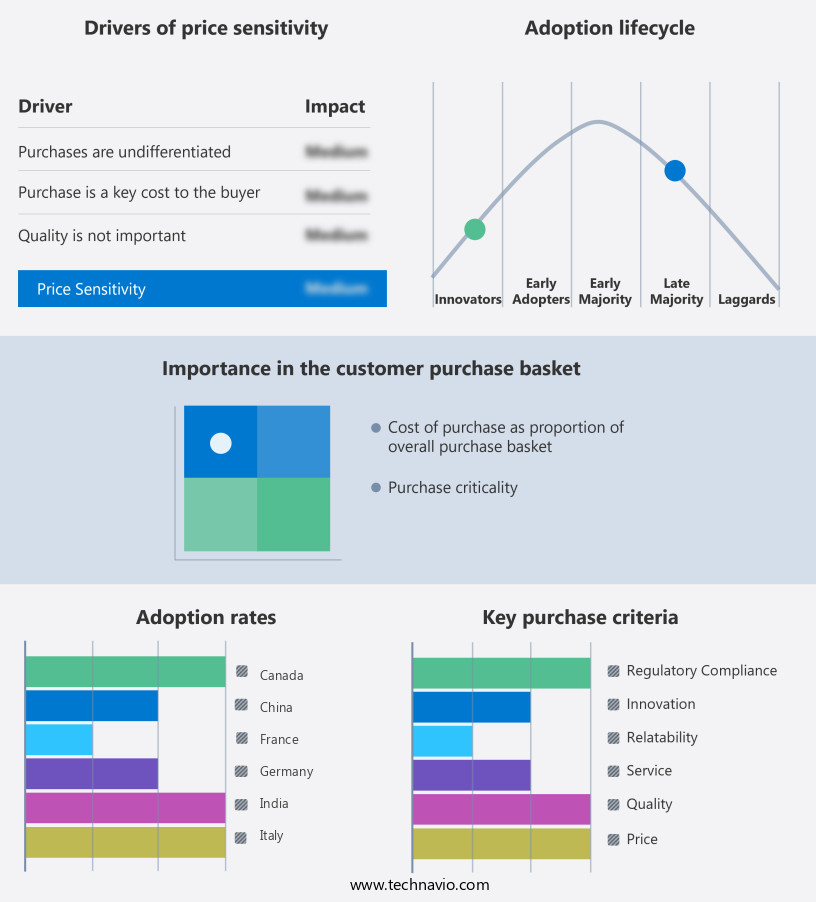

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alamo Saddlery - The company offers harness saddlery equipment such as tack and saddles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albert Kerbl GmbH

- Antares

- Billy Cook AMT LLC

- Bobs Custom Saddles

- Cactus Saddle

- Cashel Co.

- Circle Y Saddles Inc.

- County Saddlery

- Double J Saddlery

- Fabtron

- Greg Grant Saddlery

- Hammersmith Nominees Pty Ltd.

- HR Saddles and Tack

- Louisa Maria Cuomo Saddles

- Martin Saddlery

- Tex Tan Western Leather Co.

- Tory

- Tucker Saddlery

- Weaver Leather LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the needs of equestrian enthusiasts, riders, trainers, and owners, who prioritize safety, comfort, and peak performance for both horses and riders. This market encompasses a wide range of tools and accessories designed to enhance the experience of outdoor sports, such as equestrian events. Safety and comfort are paramount considerations In the harness saddlery equipment industry. Innovative materials and designs have led to the development of high-quality harnesses, saddles, blankets, protective gear, stirrups, bits, and bridles. Durability and quality standards are essential to ensure the longevity and effectiveness of these products. Leather, nylon, stainless steel, and synthetic fabrics are commonly used materials In the production of harness saddlery equipment.

In addition, high-performance materials, such as smart sensors, 3D printing, and eco-friendly fabrics like cork and bamboo, are increasingly popular due to their functionality and rider convenience. Customization and personalization are essential aspects of the market. Riders, trainers, and owners seek equipment tailored to their individual riding styles and preferences. Smart technology, such as GPS tracking, pressure sensors, and biometric monitoring, enables riders to optimize their performance and ensure the well-being of their horses. The welfare of animals is a significant concern for the equine community. The market responds to this concern by promoting fair labor practices and the use of eco-friendly and recycled materials.

In addition, transparency in manufacturing processes and sustainable production methods are becoming increasingly important to consumers. Innovative designs and smart sensors contribute to the overall functionality and convenience of harness saddlery equipment. These advancements aim to improve the riding experience for both horses and riders, ensuring an enjoyable outdoor activity. The market continues to evolve, driven by the desire for peak performance, equine welfare, and rider safety and comfort.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 812.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Canada, UK, Germany, France, Italy, The Netherlands, China, Japan, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Harness Saddlery Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.