Blanket Market Size 2024-2028

The blanket market size is forecast to increase by USD 1.6 billion at a CAGR of 3.8% between 2023 and 2028.

- The market is witnessing significant growth due to various factors. One key driver is the increasing number of accidents leading to chest wounds, necessitating the use of valvular dressings. Additionally, the demand for compact and lightweight blankets, particularly for use in first aid kits, camping equipment, and survival kits, is on the rise.

- Consumers are increasingly preferring blankets that are waterproof and windproof, making silver and gold-coated blankets popular choices. The growing residential and commercial construction industry is also contributing to the market growth. Seasonality of blankets, with increased demand during colder months, further boosts market expansion.

What will be the Size of the Market During the Forecast Period?

- Blankets play a crucial role in various applications, from first aid and trauma care to camping and survival situations. This content focuses on the importance of different types of blankets, including first aid blankets, safety blankets, emergency blankets, thermal blankets, heat sheets, weather blankets, and lightweight plastic sheeting, in ensuring thermal control and protection against extreme weather conditions. First aid blankets serve as essential components in trauma care, particularly for chest wounds and valvular dressings. Their lightweight and compact size make them easy to carry in first aid kits, ambulances, and other emergency response vehicles.

- Moreover, these blankets are designed to provide insulation and prevent heat loss, minimizing the risk of hypothermia during emergency situations. Safety and emergency blankets are another essential category of blankets, widely used in various applications. These blankets are heat reflective, meaning they can reflect body heat back to the user, maintaining their body temperature in cold environments. They are also windproof and waterproof, offering protection against adverse weather conditions. Thermal blankets and heat sheets are specifically designed to maintain body temperature in cold environments. They are lightweight and compact, making them ideal for camping equipment and survival kits. These blankets work by trapping a layer of warm air between the user and the blanket, providing insulation and preventing heat loss.

- Furthermore, weather blankets, on the other hand, offer protection against both cold and sun. Silver and gold reflective blankets are commonly used for sun protection, reflecting UV rays and keeping the user cool. Plastic sheeting blankets, on the other hand, provide insulation in cold weather, preventing heat loss and maintaining body temperature. In summary, blankets are an essential component of first aid and emergency preparedness. Their versatility, lightweight, and compact size make them an indispensable addition to first aid kits, camping equipment, and survival kits. Whether used for insulation, protection against extreme weather conditions, or trauma care, blankets ensure the user's safety and wellbeing in various situations.

How is this market segmented and which is the largest segment?

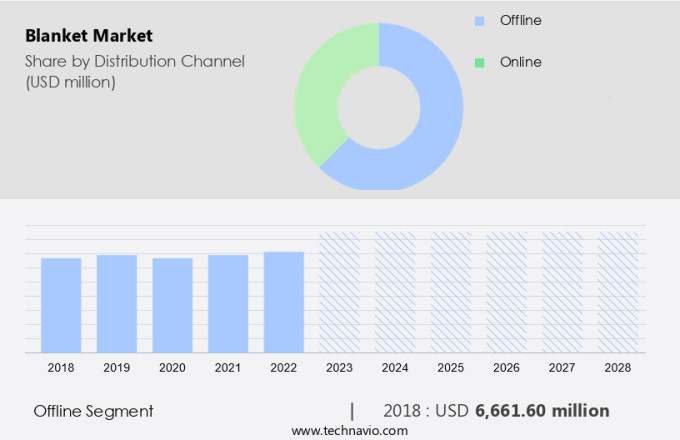

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market caters to the demand for tear-resistant, comfortable, and aesthetically pleasing coverings for survival situations and living spaces. This market offers various types of blankets, including wool and cotton, each with unique features. Wool blankets provide warmth, durability, and moisture-wicking capabilities, making them an ideal choice for extreme weather conditions. In contrast, cotton blankets offer breathability and flame resistance, making them suitable for indoor use. Consumers often prefer purchasing blankets from traditional offline distribution channels, such as retail stores. This preference stems from the ability to physically inspect the product's quality and materials. Retailers provide a unique shopping experience by offering discounts, facilitating product checks, and providing facilities for product replacement.

Additionally, they offer warranties to ensure customer satisfaction. Given the essential nature of blankets as home utility products, offline distribution channels will continue to dominate the market. The demand for blankets is expected to increase due to their role in providing comfort and warmth, making them a necessary investment for households. Therefore, retail outlets will remain a significant distribution channel for blanket sales during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 6.66 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

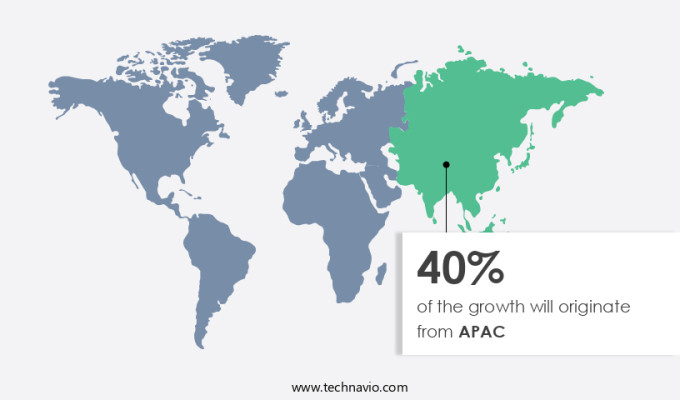

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific region has seen notable expansion, fueled by various factors. These include the rise in disposable income levels, evolving lifestyles, and increasing urbanization. Consumers in this region are placing greater emphasis on comfort and warmth, leading to a heightened demand for blankets, especially in countries with diverse climates. In China, the expanding middle class and home decor trends have sparked a growing interest in high-quality and fashionable blankets. India, with its large population and expanding urban centers, has witnessed a shift in consumer preferences towards contemporary and adaptable blanket designs.

Additionally, deep pressure stimulation through blankets offers therapeutic benefits, including anxiety reduction, improved relaxation, and enhanced sleep quality. Security blankets featuring intricate stitching and quilted patterns provide emotional reassurance and childhood comfort. Decorative blankets, available in a range of colors and designs, serve as stylish home accents. Overall, the market in the Asia Pacific region is expected to continue its growth trajectory, driven by these trends and consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Blanket Market?

The growing residential and commercial construction industry is the key driver of the market.

- The expanding residential and commercial construction sector in the United States is fueling the demand for functional bedding solutions, specifically blankets. With urbanization progressing and population growth, there is a continuous increase in the requirement for new housing and business structures. This development in construction activities results in an elevated demand for home textiles, such as blankets, which are crucial for comfort and aesthetics in both residential and commercial settings. In the realm of residential construction, there is a growing preference for eco-friendly materials in blankets due to the emphasis on energy efficiency and sustainability. Consumers are increasingly drawn to blankets made from environmentally-friendly materials that provide warmth without compromising style.

- Additionally, blankets play a significant role in interior design, making them indispensable elements in newly constructed homes. Functional bedding, including blankets, is a vital component in the US construction industry's growth.

What are the market trends shaping the Blanket Market?

Consumer preferences shifting toward sustainable blankets is the upcoming trend in the market.

- The preference for eco-friendly blankets is gaining traction in the global market, as consumers prioritize sustainability in their purchasing decisions. This trend is driven by growing awareness of environmental issues and a desire for products that align with ethical production practices. Sustainable blankets are typically crafted from organic or recycled materials, such as cotton, bamboo, and recycled polyester, which minimize the environmental impact of conventional textile manufacturing. Brands that prioritize transparency in their supply chains and possess sustainability certifications are particularly favored by eco-conscious consumers.

- Additionally, these blankets are compact in size, making them suitable for various applications, including first aid kits, camping equipment, and survival kits. They are also designed to be waterproof and windproof, ensuring their effectiveness in diverse conditions. Sustainable blankets come in silver or gold colors, adding a touch of elegance to their functionality. Keywords: eco-friendly blankets, sustainable living, organic materials, recycled materials, ethical production, transparency, sustainability certifications, first aid kits, camping equipment, survival kits, waterproof, windproof, silver, gold.

What challenges does Blanket Market face during the growth?

Seasonality of blankets is a key challenge affecting the market growth.

- The market experiences significant seasonal fluctuations, with demand peaking during colder months due to consumer preference for warmth and comfort. This concentrated sales period can result in inventory management challenges for manufacturers, potentially leading to financial strain from overproduction or stock shortages during off-peak times.

- Moreover, consumer preferences can shift, requiring companies to offer a diverse product range to accommodate lighter options in warmer months and heavier, insulated blankets in winter. These variations increase operational costs for manufacturers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Blanket Co.

- Amritsar Swadeshi Textile Corp. Pvt. Ltd.

- Barker Textiles UAB

- Biddeford Blankets LLC

- Boll and Branch LLC

- Chellco Industries Ltd.

- Faribault Woolen Mill Co.

- Geetanjali Woollens Pvt. Ltd.

- Harshit International

- Jindal Woollen Industries Ltd.

- Kanata Blanket Co.

- Medline Industries LP

- New Zealand Wool Blankets Ltd.

- Newell Brands Inc.

- Odessey Products

- Pendleton Woolen Mills Inc.

- Prakash Woollen and Synthetic Mills Ltd.

- Qbedding Inc.

- Urbanara GmbH

- Youngman Woollen Mills Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Emergency blankets, also known as first aid blankets, safety blankets, thermal blankets, heat sheets, or weather blankets, are essential components for protecting cold weather or trauma situations. These lightweight, heat reflective blankets are made of composite materials, such as polythene terephthalate and aluminum layers, making them tear-resistant, waterproof, and windproof. They are available in various sizes and are often included in first aid kits, camping equipment, and survival kits. These blankets are designed to minimize heat loss and offer thermal control, making them ideal for preventing hypothermia and other cold-related injuries. They are also used for sun protection and can be found in ambulances and hikers' backpacks.

In summary, some blankets are made of specialty materials, such as synthetic materials like polyester, which offer affordability, versatility, and breathability. Heat reflective blankets come in various forms, including silver or gold colored blankets, and are available in different sizes and weights. They provide comfort and warmth, making them an essential item for outdoor sports enthusiasts, alpinists, and those in need of survival gear. Additionally, there are specialty blankets, such as weighted blankets, which offer deep pressure stimulation and therapeutic benefits for anxiety, relaxation, and improved sleep quality. Decorative blankets, quilts, and blankets with intricate stitching and designs are also popular for their aesthetic appeal and functional use as bedding.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

128 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2024-2028 |

USD 1.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.7 |

|

Key countries |

China, US, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch