HDPE Pipes Market Size 2025-2029

The HDPE pipes market size is forecast to increase by USD 6.66 billion at a CAGR of 5.6% between 2024 and 2029.

- The market is experiencing robust growth, driven primarily by the escalating demand for water supply infrastructure projects worldwide. HDPE pipes offer numerous advantages, including durability, flexibility, and resistance to corrosion, making them a preferred choice for water transportation applications. However, the market faces significant challenges. Mechanical coupling in HDPE pipes, while improving installation efficiency, can introduce potential leakage issues if not properly executed. Regulatory hurdles impact adoption, as stringent regulations governing the use of HDPE pipes in certain applications necessitate additional testing and certification. The market is witnessing significant growth due to the increasing demand for water supply systems. Couplings in HDPE pipes offer advantages such as faster installation and reduced labor costs, making them a popular choice in the industry.

- Additionally, the prevalence of substitutes, such as ductile iron and PVC pipes, tempers market growth potential. To capitalize on opportunities and navigate challenges effectively, companies must focus on enhancing the quality and reliability of their HDPE pipe products, while also addressing the regulatory landscape and fostering collaboration with industry stakeholders to promote the adoption of HDPE pipes in various end-use sectors. However, the market faces challenges from the significant prevalence of substitutes like ductile iron pipes and PVC pipes.

What will be the Size of the HDPE Pipes Market during the forecast period?

- In the dynamic US market, high density polyethylene (HDPE) pipes have gained significant traction due to their high strength and reliability in various applications. One key sector driving demand is the water supply industry, where HDPE pipes offer resistance to chemical corrosion and shifting soil, making them an ideal solution for farmlands and rural areas experiencing water scarcity. In the automotive sector, HDPE's lightweight properties contribute to fuel efficiency and reduced vehicle weight, making it a preferred choice for automakers in manufacturing fuel tanks and automotive components. However, the increasing use of HDPE in these industries raises concerns regarding plastic pollution and end-of-life management. HDPE pipes are widely used in sectors such as natural gas and petroleum distribution, water supply for farmlands and crops, and automotive components, including fuel tanks, bumpers, and interior parts.

- Jet polymer recycling plays a crucial role in mitigating these concerns by recycling HDPE materials from fuel tanks and other applications. Processing plants employ this technology to convert recycled materials into new HDPE pipes, reducing the reliance on virgin materials and promoting sustainability. Moreover, HDPE piping systems are increasingly used in natural gas transportation due to their high strength and resistance to weathering and abrasion. In the plumbing industry, HDPE pipes offer flexibility and reliability, making them a popular choice for interior parts and plumbing fixtures. Emission regulations and the need for fuel efficiency have intensified the demand for HDPE in petroleum distribution, particularly for fuel tanks and fittings. Meanwhile, concerns over the use of plastic and the environmental impact of HDPE production remain areas of ongoing research and development.

- Additionally, HDPE's resistance to chemical corrosion makes it a suitable alternative to metal pipes in various industrial applications. In conclusion, the US market is witnessing robust growth due to its versatility and wide applicability across various industries, including water supply, automotive, natural gas, and industrial sectors. The trend towards sustainability and the increasing focus on emission regulations further fuel the demand for HDPE pipes and components. HDPE resin, the primary raw material for manufacturing these pipes, is resistant to internal and external pressure and can withstand a wide range of specialty chemicals and fluids.

How is this HDPE Pipes Industry segmented?

The HDPE pipes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

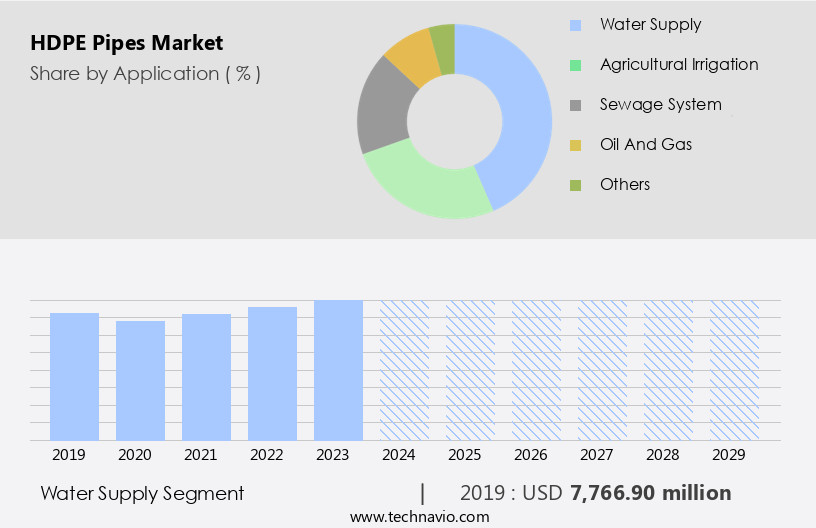

- Application

- Water supply

- Agricultural irrigation

- Sewage system

- Oil and gas

- Others

- Type

- PE 100

- PE 80

- PE 63

- Channel

- Direct sales

- Distribution sales

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The water supply segment is estimated to witness significant growth during the forecast period. The water supply market experiences growth due to the escalating demand for water, driven by population expansion and evolving water consumption patterns. Approximately 1% more water is demanded globally every year, fueled by advancements in various sectors such as industry, energy, domestic use, and infrastructure. Agriculture, which accounts for 65-70% of water consumption, remains the largest water user. A standard water supply system encompasses a pumping-based transmission and distribution network from a water source, along with a water treatment facility. In the realm of water distribution, HDPE pipes, specifically PE 100 HDPE, have gained prominence due to their durability, resistance to abrasion, and corrosion, making them suitable for both potable water and gas distribution networks. HDPE resin is also used in various automotive components such as fuel tanks, bumpers, and interior parts due to its lightweight properties and resistance to chemicals.

These pipes offer several advantages, including high strength, lightweight properties, and flexibility, which facilitate easier installation and reduced transportation costs. Moreover, HDPE pipes' resistance to temperature tolerance and weathering ensures reliability and longevity. The shift towards eco-friendly practices and emission regulations has led to increased demand for HDPE pipes in various industries. In the agricultural sector, modern farming practices rely on these pipes for efficient irrigation, minimizing water wastage. Similarly, the automotive industry incorporates HDPE bumpers and fuel tanks due to their lightweight and resistance to abrasion. HDPE piping solutions are also extensively used in processing plants, refineries, and mining activities to transport chemicals, fuels, and other fluids, ensuring resistance to chemicals and challenging environments. The automotive industry also utilizes HDPE pipes in various components, such as fuel tanks and automotive bumpers, due to their lightweight properties and resistance to chemicals.

The construction industry benefits from HDPE pipes' durability and recyclability, making them an ideal choice for sewage systems and plumbing fixtures. In the oil and gas sector, HDPE piping systems provide a cost-effective and reliable solution for transporting refined products, while their resistance to corrosion and temperature tolerance make them suitable for crude oil extraction and transportation. In conclusion, the market is witnessing significant growth due to their versatility and ability to cater to various industries' unique requirements. Their environmental benefits, such as reduced carbon footprint and resistance to plastic pollution, further solidify their position as a preferred piping solution in today's evolving market landscape.

The Water supply segment was valued at USD 7.77 billion in 2019 and showed a gradual increase during the forecast period.

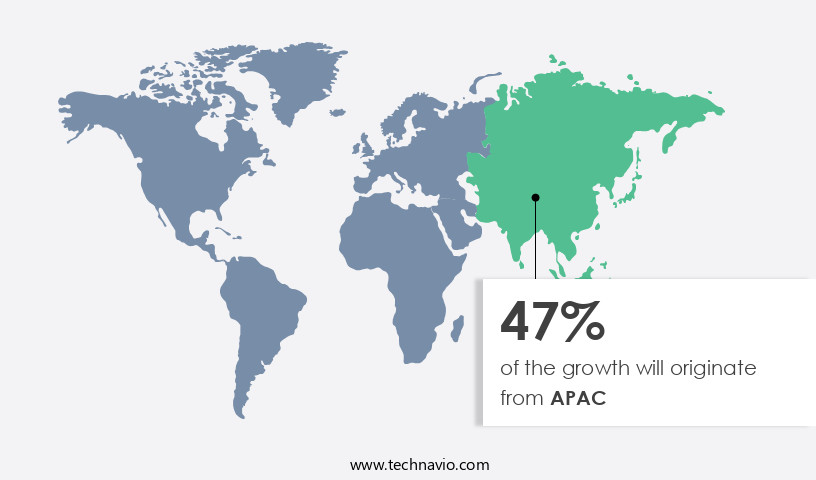

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

HDPE pipes have gained significant traction in various sectors due to their durability, resistance to corrosion, and lightweight properties. In the water distribution sector, HDPE pipes are widely used for potable water supply due to their superior resistance to weathering and chemical corrosion. Similarly, in the gas distribution networks, HDPE pipes offer fuel efficiency and reliability, making them a preferred choice over traditional metal pipes. The construction industry, particularly in luxury apartments and high-rise buildings, also relies on HDPE pipes for their high strength and resistance to shifting soil and external pressure. The agricultural sector has embraced HDPE pipes for modern farming practices, reducing water wastage and enhancing irrigation efficiency in farmlands.

The automotive industry uses HDPE pipes for fuel tanks and automotive components due to their lightweight properties and resistance to abrasion. Furthermore, HDPE pipes are increasingly being adopted in the petroleum distribution sector for their durability and resistance to chemical corrosion. Environmental awareness and emission regulations have fueled the demand for HDPE pipes in various industries. For instance, HDPE resin is used to manufacture sewage system pipes, which offer recyclability and eco-friendly practices. In the mining sector, HDPE pipes are used in extraction activities and mining exploration, providing reliable and durable piping solutions for transporting fluids and wastewater. The market is expected to grow further due to the increasing demand for natural gas and refined products in transportation networks.

The flexibility and resistance to temperature tolerance of HDPE pipes make them suitable for use in challenging environments, such as refineries and processing plants. In conclusion, HDPE pipes are versatile and offer numerous benefits, making them a preferred choice for various industries. Their resistance to abrasion, corrosion, and chemicals, coupled with their lightweight and recyclable properties, make HDPE pipes a sustainable and reliable piping solution for the future.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the HDPE Pipes market drivers leading to the rise in the adoption of Industry?

- The escalating need for water supply serves as the primary market catalyst. The global water demand is experiencing a substantial increase due to population growth, industrial activities, and changing consumption patterns. According to the United Nations, global freshwater use has risen by a factor of six over the past century and continues to grow at approximately 1% per year. The industrial and domestic sectors are projected to witness faster growth in water demand than agriculture. In response to this growing demand, HDPE pipes have emerged as a popular choice for water distribution and gas distribution networks. HDPE pipes, specifically PE 100, offer several advantages, including resistance to corrosion, weathering, and abrasion.

- These pipes are also lightweight and offer excellent fuel efficiency, making them an environmentally friendly option. In the construction sector, HDPE pipes are being increasingly used in modern water supply systems, including those in luxury apartments and commercial buildings. The durability and resistance to abrasion of HDPE pipes make them an ideal solution for agricultural irrigation and petroleum distribution. With growing environmental awareness and emission regulations, there is a rising demand for sustainable and efficient piping solutions. HDPE pipes meet these requirements and contribute to reducing water wastage and improving overall efficiency.

What are the HDPE Pipes market trends shaping the Industry?

- Mechanical couplings in high-density polyethylene (HDPE) pipes are currently gaining popularity in the market due to their numerous advantages. This trend is driven by the couplings' ability to provide a stronger and more secure connection between pipes, ensuring improved system performance and reduced maintenance costs. HDPE pipes, fabricated from thermoplastic polymer, have gained significant traction in various industries due to their superior properties and innovations. These pipes are extensively used in water supply systems, particularly in addressing water scarcity issues in farmlands and industrial processing plants. In addition, the automotive sector utilizes HDPE pipes as automotive components, such as fuel tanks, owing to their high strength, resistance to chemical corrosion, and internal pressure capabilities. Despite their advantages, HDPE pipes' installation process involves fusion techniques, which can be time-consuming and costly. Butt fusion and electrofusion are the primary techniques used to join HDPE pipes. In these methods, heat is applied to the pipe ends, and then, they are pushed against each other with a predetermined force to create a strong bond.

- However, these techniques can result in project delays due to their labor-intensive nature. Moreover, the high cost of fusion equipment and the requirement for a certified crew to perform the fusion process are significant challenges. Recycled materials, such as natural gas and chemicals, are increasingly being used to manufacture HDPE pipes, further enhancing their appeal to environmentally-conscious industries. The versatility of HDPE pipes, coupled with their durability and resistance to various environmental conditions, makes them a preferred choice for piping systems and plumbing fixtures in various sectors.

How does HDPE Pipes market faces challenges face during its growth?

- The substantial presence of substitutes poses a significant challenge to the industry's growth trajectory. The high-density polyethylene (HDPE) pipe market has significantly impacted the pipeline industry with its superior performance compared to traditional metal pipes. HDPE pipes are favored by industries such as construction, irrigation, and chemicals due to their superior characteristics. These pipes offer excellent resistance to external pressure, shifting soil, and corrosion, making them ideal for water supply and sewage systems. In addition, HDPE pipes exhibit excellent temperature tolerance, ensuring reliability and durability in various applications. Despite their advantages, HDPE pipes are more expensive than rubber ring-jointed polyvinyl chloride (PVC) pipes. However, their use is justified in specific applications, such as transporting water with high chemical or salt content.

- For instance, in the irrigation sector, the efficient delivery of a large volume of water is crucial for optimal performance. In such cases, HDPE pipes' superior properties make them a preferred choice, despite their higher cost. HDPE pipes are also environmentally friendly, as they are recyclable and have lightweight properties. They are used extensively in various industries, including water supply, sewage systems, mining activities, and refineries, due to their ability to withstand the harsh conditions associated with these applications without sustaining damage. Overall, HDPE pipes offer a reliable and durable solution for various industries, making them a valuable investment for businesses.

Exclusive Customer Landscape

The HDPE pipes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the HDPE pipes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, HDPE pipes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Drainage Systems Inc. - The company specializes in providing high-density polyethylene (HDPE) pipes, including the SB2 leach bed pipe.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Drainage Systems Inc.

- APL Apollo TUBES Ltd.

- Astral Ltd.

- Atkore Inc.

- Chevron Corp.

- Formosa Plastics Corp.

- Genuit Group Plc

- Georg Fischer Ltd.

- Hexatronic Group AB

- Infra Pipe Solutions Ltd.

- JM Eagle Inc

- Lane Enterprises Inc.

- LyondellBasell Industries NV

- Orbia Advance Corp. S.A.B. de C.V.

- POLYPLASTIC Group

- Prinsco Inc.

- PTT Public Co. Ltd.

- Qenos Pty Ltd.

- Unidelta Spa

- Wavin BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in HDPE Pipes Market

- In February 2024, LyondellBasell Industries, a leading plastics and chemical company, announced the expansion of its HDPE pipe production capacity at its site in Wesseling, Germany. This â¬100 million investment aims to increase the production capacity by 50%, making it the largest HDPE pipe manufacturing facility in Europe (LyondellBasell press release, 2024).

- In August 2025, BASF Corporation and SABIC, two global chemical companies, entered into a strategic collaboration to develop and produce circular HDPE pipes using recycled content. This partnership is expected to reduce the dependence on virgin raw materials and promote sustainability in the HDPE pipe industry (BASF press release, 2025).

- In October 2024, China National Chemical Corporation (ChemChina) completed the acquisition of Pirelli Plastics, a leading HDPE pipe manufacturer in North America. This acquisition strengthened ChemChina's position in the global HDPE pipe market and expanded its presence in the North American market (ChemChina press release, 2024).

- In December 2025, the European Union approved the use of HDPE pipes for the transportation of hydrogen in the European gas infrastructure. This regulatory approval is expected to accelerate the adoption of HDPE pipes in the hydrogen economy and create new growth opportunities for HDPE pipe manufacturers (European Commission press release, 2025).

Research Analyst Overview

HDPE pipes, fabricated from high-density polyethylene thermoplastic polymer, have emerged as a preferred choice for various applications due to their distinctive features and benefits. In the realm of water distribution, these pipes offer superior resistance to corrosion and weathering, ensuring reliable water supply systems for both domestic and industrial use. The ongoing dynamics of the market are shaped by several factors. One significant trend is the increasing focus on fuel efficiency and environmental awareness. In the context of water distribution, HDPE pipes' lightweight properties contribute to reduced fuel consumption during transportation and installation. Moreover, their resistance to abrasion and chemical corrosion makes them a durable piping solution for modern farming practices, minimizing water wastage and enhancing agricultural productivity.

Gas distribution networks have also adopted HDPE pipes due to their high strength and resistance to external pressure. The flexibility of these pipes allows for easy installation and adaptation to shifting soil conditions, making them a reliable choice for transportation networks in challenging environments. Furthermore, the automotive industry utilizes HDPE pipes for fuel tanks and automotive components, contributing to emission regulations and eco-friendly practices. The HDPE resin's durability extends to applications in sewage systems, where it offers resistance to chemicals and temperature tolerance. In the context of the oil and gas industries, HDPE pipes are employed in refineries, processing plants, and jet polymer recycling facilities, ensuring the reliable transportation of refined products and reducing the carbon footprint of these operations.

Despite their numerous advantages, HDPE pipes face competition from traditional materials like metal pipes. However, HDPE pipes' superior resistance to abrasion, corrosion, and temperature fluctuations, coupled with their lightweight properties and recyclability, positions them as a preferred choice for various applications. The market's evolving patterns are influenced by factors such as water scarcity and the growing demand for sustainable infrastructure. As water becomes an increasingly precious resource, HDPE pipes' resistance to leakage and their ability to transport fluids efficiently make them an attractive solution for water supply systems in farmlands and luxury apartments. Moreover, the mining sector's extraction activities and mining exploration have led to the adoption of HDPE pipes for wastewater and sewage systems, ensuring the efficient management of fluids and reducing the potential for damage to the environment.

In conclusion, the market is characterized by continuous growth and innovation, driven by the need for reliable, durable, and eco-friendly piping solutions. From water distribution and gas distribution networks to sewage systems and automotive components, HDPE pipes offer a versatile and sustainable alternative to traditional materials. Their resistance to abrasion, corrosion, and external pressure, coupled with their lightweight properties and recyclability, make them a preferred choice for various industries and applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HDPE Pipes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 6.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, UK, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HDPE Pipes Market Research and Growth Report?

- CAGR of the HDPE Pipes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the HDPE pipes market growth of industry companies

We can help! Our analysts can customize this HDPE pipes market research report to meet your requirements.