North America Healthcare Packaging Market Size and Trends

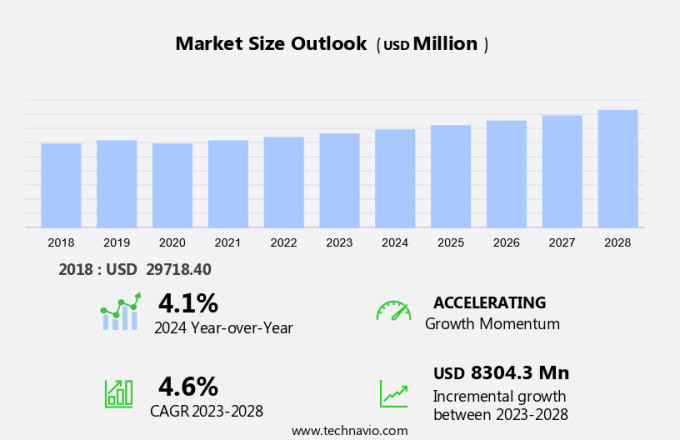

The North America healthcare packaging market size is forecast to increase by USD 8.30 billion at a CAGR of 4.6% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. One major factor is the increasing demand for advanced medical instruments, which necessitates innovative and effective packaging solutions. Contamination prevention is another critical concern, leading to the adoption of rapid-response packaging solutions such as tubs, lids, trays, and inserts. Biologics, telemedicine, and chronic disease management are driving growth in the market. Furthermore, the market is witnessing a growing need for test kits and resin supply to ensure product quality and safety. Inefficient product labeling processes are also driving the market, as solutions that streamline this process and improve accuracy are in high demand. Overall, the market is undergoing transformation to meet the evolving needs of the healthcare industry.

The market is a significant sector that plays a crucial role in ensuring the safety, efficacy, and integrity of various medical devices and pharmaceuticals. This market encompasses a wide range of packaging types, materials, and designs, each catering to specific requirements in the healthcare industry. Primary packaging, including tubs, lids, trays, inserts, and test kits, is a vital component of the market. These packaging solutions are designed to protect and preserve the contents while ensuring ease of use and patient safety. For instance, child-resistant packaging and senior-friendly designs cater to specific demographic needs. Plastic packaging, made from recyclable polymers, is a popular choice due to its versatility, lightweight, and cost-effectiveness. However, the market also recognizes the importance of sustainable packaging solutions, with an increasing focus on eco-friendly materials and reduced waste. Sterilization is another critical aspect of healthcare packaging. Proper sterilization ensures the prevention of contamination and infection, making it essential for medical devices and pharmaceuticals. The use of advanced technologies, such as digital printing and smart packaging, facilitates efficient and effective sterilization processes. Counterfeit drugs pose a significant threat to patient safety, and the market responds with robust security features.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product Type

- Bottles

- Blisters

- Vials

- Pouches

- Others

- Geography

- North America

- Canada

- Mexico

- US

- North America

By Product Type Insights

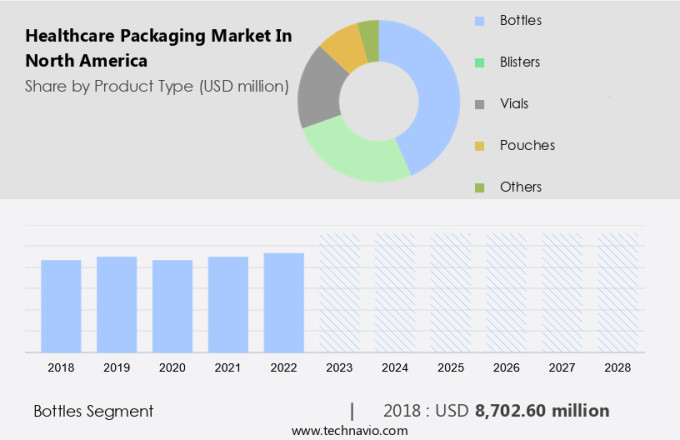

The bottles segment is estimated to witness significant growth during the forecast period. Healthcare packaging plays a crucial role in safeguarding medical instruments and preserving the integrity of pharmaceutical products. One of the most common formats for healthcare packaging is bottles. These containers are widely used for distributing oral medications to retail pharmacies, particularly for over-the-counter (OTC) medicines sold in quantities of 50 tablets or capsules.

Get a glance at the market share of various segments Download the PDF Sample

The bottles segment was the largest segment and was valued at USD 8.70 billion in 2018. Companies are increasingly focusing on utilizing 100% recyclable plastic for these bottles to meet sustainability requirements. Bottles offer several advantages for healthcare packaging. They maintain the product's composition, ensuring the contents remain uncontaminated despite external environmental or climatic conditions. These bottles are typically made from rigid plastic HDPE polymers and customized to meet the unique needs of pharmaceutical and healthcare companies. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

North America Healthcare Packaging Market Driver

Increased demand for parenteral containers is notably driving market growth. In North America, the market is experiencing significant growth due to the increasing demand for unit and multi-dosage administration systems, particularly in the form of vials and ampoules for parenteral drugs. These containers are preferred for their ability to ensure high bioavailability and faster action rates of injectable drugs.

Parenteral drug containers are engineered with superior barrier properties against moisture and are sterilized using advanced methods such as steam autoclave, gamma radiation, and peroxide sterilization. This not only enhances the safety and efficacy of the drugs but also lowers the risk of cross-contamination, given that these containers are manufactured from highly aseptic raw materials. Thus, such factors are driving the growth of the market during the forecast period.

North America Healthcare Packaging Market Trends

Smart healthcare packaging is the key trend in the market. In North America, the market is witnessing significant growth due to stringent regulations set by organizations like the US Food and Drug Administration (FDA) and the increasing demand for high-quality medicines and drugs. The pharmaceutical and healthcare industries require packaging that adheres to evolving legislation and compliance standards.

This trend is driving the adoption of advanced packaging solutions, such as smart packaging, in healthcare applications. Moreover, the rising demand for drugs with high moisture sensitivity has fueled the need for packaging that offers effective moisture control. Smart packaging, with its ability to monitor and maintain the optimal environment for such drugs, is gaining popularity in the healthcare sector. Thus, such trends will shape the growth of the market during the forecast period.

North America Healthcare Packaging Market Challenge

Inefficient product labeling process is the major challenge that affects the growth of the market. In North America, the market faces challenges due to the intricate product labeling processes adopted by pharmaceutical and medical device companies. The manual nature of these processes, which involves collecting product information from various sources, rewriting labeling copy, and re-validating the data, consumes a considerable amount of time, labor, and financial resources.

Moreover, healthcare packaging companies must generate XML-based submissions to adhere to structured product labeling standards, adding to the complexity. The aging population in North America and the increasing prevalence of chronic diseases necessitate the need for efficient and effective healthcare packaging solutions. However, the current labeling processes hinder progress, as they are prone to errors and inefficiencies. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co: The company offers healthcare packaging under the brand name Scotchpak.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Avery Dennison Corp.

- Ball Corp.

- Baxter International Inc.

- Becton Dickinson and Co.

- Berry Global Inc.

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- DS Smith Plc

- DuPont de Nemours Inc.

- Gerresheimer AG

- Honeywell International Inc.

- Mitsubishi Chemical Group Corp.

- Sealed Air Corp.

- Sonoco Products Co.

- Toray Industries Inc.

- WestRock Co.

- Wihuri International Oy

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market encompasses a wide range of products and solutions designed to protect medical devices, pharmaceuticals, and other medical supplies during storage, transportation, and use. Primary packaging, including blister packaging, tubs, lids, trays, inserts, and test kits, plays a crucial role in maintaining sterility and preventing contamination. Medical instruments, such as syringes and surgical tools, also require specialized packaging for safe transport and storage. Packaging materials, including plastic packaging, recyclable polymers, glass packaging, and paper & paperboard, are essential for creating effective packaging solutions. Advanced technologies, such as RFID chips, QR codes, and bar codes, enable tracking and traceability, while customizable shapes, thermoformed packaging, reclosable packaging, and sustainable packaging cater to diverse customer needs. The aging population and the rise of chronic diseases necessitate innovative solutions for child-resistant packaging, senior-friendly packaging, on-the-go convenience, and anti-counterfeiting measures. Medical device packaging, vaccine packaging, and personalized healthcare packaging are other key areas of focus. Rigid packaging formats, secondary packaging, and tertiary packaging are essential for ensuring the safety and efficacy of medical supplies during transportation and storage. Shock protection, temperature fluctuations, and protection against light and moisture are critical considerations for healthcare packaging. The market is also witnessing the adoption of digital printing technology, smart packaging, and RFID chips for enhanced functionality and patient safety.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 8.30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Amcor Plc, Avery Dennison Corp., Ball Corp., Baxter International Inc., Becton Dickinson and Co., Berry Global Inc., CCL Industries Inc., Constantia Flexibles Group GmbH, DS Smith Plc, DuPont de Nemours Inc., Gerresheimer AG, Honeywell International Inc., Mitsubishi Chemical Group Corp., Sealed Air Corp., Sonoco Products Co., Toray Industries Inc., WestRock Co., and Wihuri International Oy |

|

Market dynamics |

Parent market analysis, market report, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch