Hearing Amplifiers Market Size 2024-2028

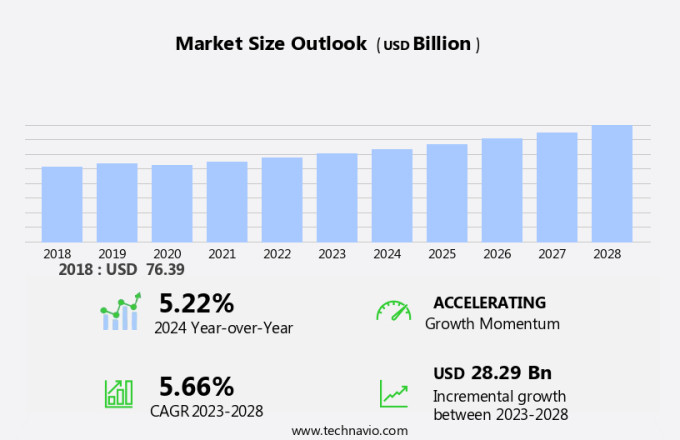

The hearing amplifiers market size is forecast to increase by USD 28.29 billion, at a CAGR of 5.66% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing number of individuals diagnosed with hearing loss. This trend is driven by an aging population and rising awareness of the importance of early intervention for hearing health. Furthermore, the integration of Internet of Things (IoT) technology into hearing amplifiers is adding value to the market. These advanced devices offer additional features such as connectivity to smartphones, TVs, and other devices, enhancing the overall user experience. However, challenges persist in the form of battery concerns.

- As hearing amplifiers require frequent battery replacements, addressing this issue through innovative battery technologies or alternative power sources could be a key differentiator for market participants. Companies that successfully navigate these challenges and capitalize on the growing demand for hearing solutions will be well-positioned to succeed in this dynamic market.

What will be the Size of the Hearing Amplifiers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and growing demand for effective solutions to address various types and degrees of hearing loss. Hearing amplifiers, also known as personal sound amplification products (PSAPs), offer customizable sound amplification for individuals with normal hearing or mild to moderate hearing loss. These devices incorporate features such as directional microphones, gain adjustment, and noise reduction algorithms to enhance sound quality and improve listening experiences in diverse environments. In-the-ear models, including in-the-canal and completely-in-canal designs, cater to individual preferences and offer discreet solutions. Moreover, hearing amplifiers are increasingly compatible with cochlear implants and wireless connectivity options, enabling seamless integration with other devices like smartphones and televisions.

Advanced features like tinnitus maskers, open-fit designs, and sound localization capabilities further expand the market's reach and applications. As technology progresses, hearing amplifiers continue to evolve, offering improved performance, longer battery life, and more sophisticated features tailored to meet the unique needs of various user profiles. The market's ongoing dynamism reflects the growing importance of effective hearing solutions in various sectors, including healthcare, education, and entertainment.

How is this Hearing Amplifiers Industry segmented?

The hearing amplifiers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Behind-the-ear

- In-the-ear

- Geography

- North America

- US

- Europe

- Germany

- Italy

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

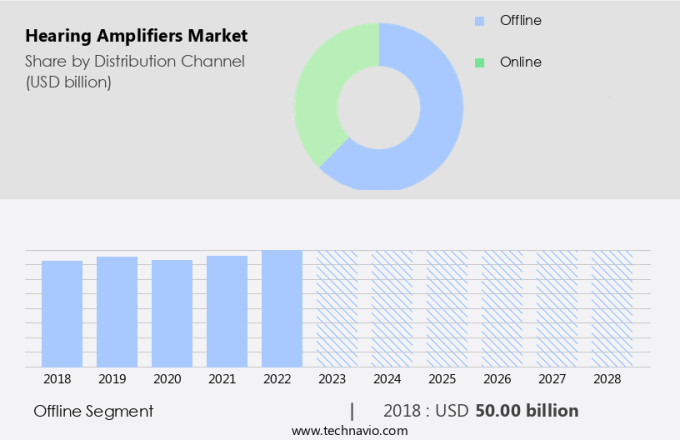

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic market of 2023, the offline segment dominates due to the surge in availability of amplifiers in retail stores and hospitals. The segment's growth is driven by the rising number of young and adult populations with hearing impairments worldwide. Additionally, the demand for personalized sound amplification products (PSAP) recommended by healthcare professionals for the geriatric population further fuels the segment's expansion. The proliferation of standalone pharmacies and hospitals, particularly in developing countries, is expected to boost the market significantly. This trend is attributed to the growing need for hearing aid devices, including hearing amplifiers, which are increasingly accessible through the offline segment.

Digital signal processing, custom-fit hearing aids, and directional microphones are essential features that cater to diverse hearing loss needs. Hearing amplifiers with telecoil technology, Bluetooth connectivity, and tinnitus maskers offer enhanced functionality and convenience. Adjustable volume control, feedback cancellation systems, and speech enhancement are other essential features that contribute to the market's growth. Hearing loss severity and auditory processing capabilities influence the demand for various types of hearing amplifiers, including behind-the-ear, in-the-canal, receiver-in-canal, and completely-in-canal models. The market is also witnessing the integration of advanced technologies such as high-frequency and low-frequency amplification, noise reduction algorithms, and sound localization features to cater to the evolving needs of consumers.

Power hearing aids with rechargeable battery life and cochlear implant compatibility are gaining popularity due to their extended usage hours and compatibility with other assistive listening devices. In conclusion, the market is experiencing significant growth, driven by the increasing prevalence of hearing loss, the availability of various types and features, and the expanding distribution channels.

The Offline segment was valued at USD 50.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

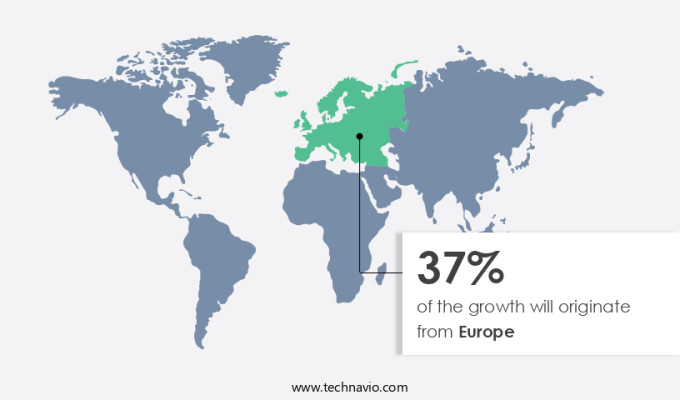

Europe is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market holds a significant share in the global hearing amplifiers industry, driven by the increasing prevalence of hearing loss and technological advancements. With countries like the UK, Germany, and France reporting rising instances of hearing impairments, there is a growing emphasis on the adoption of hearing devices. Notably, government bodies and healthcare providers are actively promoting their use. For instance, in early 2021, the French Ministry of Health and Prevention approved reimbursements for various hearing aid designs. Innovations in hearing aid technology, such as digital signal processing, directional microphones, and feedback cancellation systems, enhance user experience.

Additionally, features like adjustable volume control, wireless connectivity options, and tinnitus maskers cater to diverse user needs. Hearing aids come in various styles, including custom-fit, behind-the-ear, in-the-canal, and completely-in-canal, providing users with a range of choices based on their preferences and hearing loss severity. Moreover, advancements in audio amplification technology, including high-frequency and low-frequency amplification, improve sound quality for users. Cochlear implant compatibility, noise reduction algorithms, and speech enhancement further enhance the functionality of these devices. Furthermore, telecoil technology and Bluetooth connectivity enable seamless integration with other devices, such as smartphones and televisions. Rechargeable battery life and power hearing aids cater to users' convenience, ensuring uninterrupted use.

As the market continues to evolve, advancements in auditory processing and sound localization features will further enhance the overall user experience.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hearing Amplifiers Industry?

- The significant increase in the global population experiencing hearing loss serves as the primary market driver.

- The global hearing amplifier market is witnessing notable growth due to the rising prevalence of hearing impairments and related disorders. According to the Centers for Disease Control and Prevention (CDC), approximately 6,000 infants in the US were born with permanent hearing loss in June 2021. The geriatric population's growth is another significant factor driving market expansion. Hearing amplifiers cater to various types of hearing loss, including those requiring custom-fit solutions using hearing aid microphones and personal sound amplification devices. Advanced technologies such as digital signal processing and hybrid hearing aids, including behind-the-ear models, offer improved sound quality and reduced acoustic feedback.

- Assistive listening devices are also gaining popularity due to their ability to enhance the listening experience in noisy environments. Noise pollution, a growing concern worldwide, further increases the demand for hearing amplifiers.

What are the market trends shaping the Hearing Amplifiers Industry?

- The integration of Internet of Things (IoT) technology into devices and the subsequent addition of advanced features is a significant market trend. This development signifies a major shift towards more connected and intelligent devices.

- The market is experiencing significant growth due to the increasing demand for IoT-integrated devices. Advanced audio amplification technology, including high-frequency and low-frequency amplification, is driving the market forward. Receiver-in-canal hearing aids, equipped with telecoil technology and output limiting, are gaining popularity. The frequency response curve is being optimized to cater to various hearing loss needs. Bluetooth hearing aids, which enable seamless connectivity with smartphones, are a top preference for users.

- The integration of voice search options, RFID sensors, and biometric analysis further enhances the functionality and convenience of these devices. The global market is witnessing a shift towards these advanced features, as users seek improved monitoring capabilities and effortless connectivity.

What challenges does the Hearing Amplifiers Industry face during its growth?

- The growth of the hearing amplifier industry is significantly impacted by the challenge of addressing battery concerns. This issue, which is of great importance, necessitates continuous innovation and improvement in battery technology to ensure uninterrupted use and user satisfaction.

- Hearing amplifiers, a vital solution for individuals with hearing difficulties, have seen significant advancements in technology. However, one persistent challenge remains: battery life. The longevity of hearing amplifiers is influenced by several factors, including battery milliamp-hour (mAh) rating, signal intensity, gain control, sound input, and discharge voltage level. For instance, the amount of gain control and battery current depends on the settings of volume and filter controls in the amplifiers. Advanced and multipurpose hearing amplifiers, featuring directional microphones, wireless connectivity options, tinnitus maskers, and sound localization features, often face the issue of shorter battery life due to their power-consuming functionalities.

- Cochlear implant compatibility and open-fit hearing aid designs further add to the power requirements, impacting battery life. By addressing these concerns, manufacturers can improve the overall user experience and satisfaction with their products.

Exclusive Customer Landscape

The hearing amplifiers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hearing amplifiers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hearing amplifiers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Austar Hearing Science and Technology Xiamen Co. Ltd. - The company specializes in providing a range of hearing amplification solutions, including over-the-counter digital rechargeable RIC and BTE open fit models. Their offerings prioritize affordability and advanced technology, catering to diverse hearing needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Austar Hearing Science and Technology Xiamen Co. Ltd.

- Beurer GmbH

- Claratone

- Cochlear Ltd.

- Demant AS

- Eargo Inc.

- Foshan Vohom Technology Co. Ltd.

- GN Store Nord AS

- Huizhou Jinghao Medical Technology Co. Ltd.

- InnerScope Hearing Technologies Inc.

- Intricon Corp.

- MDHearingAid Inc.

- MEDca Hearing

- Otofonix Hearing Solutions

- Sonova AG

- Sound World Solutions

- Starkey Laboratories Inc.

- WS Audiology AS

- ZipHearing LLC

- Lucid Hearing Holding Co. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hearing Amplifiers Market

- In January 2024, Sonova Holding AG, a leading provider of hearing solutions, launched the new Phonak Bolero B-Direct hearing aids, enabling direct streaming from Apple and Android devices without the need for an intermediary device (Sonova press release, 2024).

- In March 2024, Starkey Hearing Technologies and Google announced a strategic partnership to integrate Google Assistant directly into Starkey's Livio AI hearing aids, allowing users to access Google Assistant features hands-free (Starkey press release, 2024).

- In May 2024, Signia, a Sivantos brand, received FDA approval for its new Xperience X hearing aids, featuring the world's most advanced Bluetooth technology, allowing for high-definition binaural streaming and better speech recognition (Sivantos press release, 2024).

- In April 2025, Widex, a Danish hearing aid manufacturer, secured a USD 100 million investment from EQT Ventures to accelerate its digital transformation and expand its market presence (EQT Ventures press release, 2025).

Research Analyst Overview

- The hearing amplifier market is characterized by advancements in technology, with adaptive noise cancellation and binaural processing becoming increasingly popular. Multi-channel processing enhances sound clarity improvement, while total harmonic distortion remains a crucial factor in ensuring speech intelligibility testing. Connectivity protocols, such as Bluetooth Low Energy, enable wireless range expansion. Battery power consumption is a significant concern, with peak clipping prevention and automatic gain control addressing this issue. Data transmission rate and directional audio processing improve user experience, while output impedance and fitting procedure ensure proper device functionality. Maintenance procedures and troubleshooting techniques are essential for long-term use, with environmental noise reduction and automatic gain control contributing to improved sound quality.

- Audio compression and frequency shaping optimize battery life, and input impedance and amplifier gain settings cater to individual user preferences. Speech intelligibility testing, signal-to-noise ratio, and harmonic distortion measurement are key performance indicators, while frequency response range and microphone sensitivity determine device capabilities. User interface design and device latency are critical factors in ensuring user satisfaction.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hearing Amplifiers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.66% |

|

Market growth 2024-2028 |

USD 28.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.22 |

|

Key countries |

US, Germany, Italy, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hearing Amplifiers Market Research and Growth Report?

- CAGR of the Hearing Amplifiers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hearing amplifiers market growth of industry companies

We can help! Our analysts can customize this hearing amplifiers market research report to meet your requirements.