Heavy-duty Truck Suspension System Market Size 2024-2028

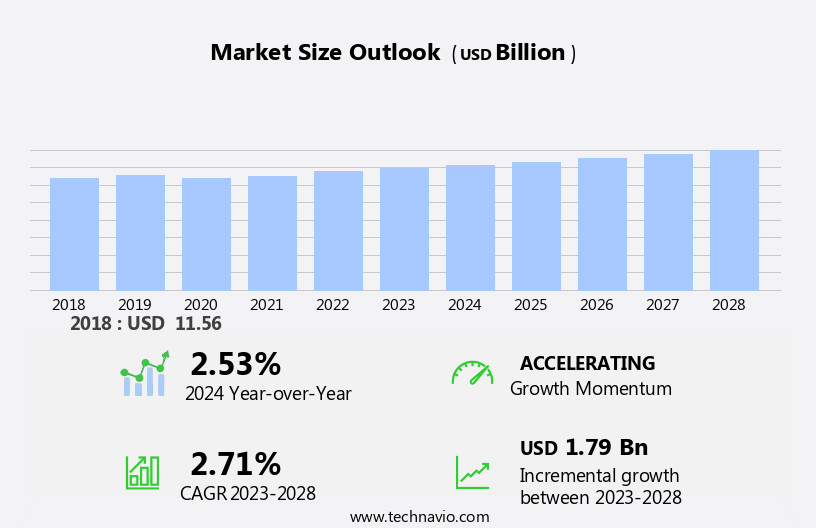

The heavy-duty truck suspension system market size is forecast to increase by USD 1.79 billion at a CAGR of 2.71% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing sales of heavy-duty trucks. This trend is driven by the strong demand for goods transportation, particularly in the manufacturing and construction industries. Moreover, technological advancements in suspension systems are revolutionizing the automotive sector, leading to the adoption of advanced systems such as air suspension in heavy-duty trucks. The use of advanced materials, such as steel and composite materials, and the integration of electronic control systems have led to the development of more durable and efficient systems. However, the complexity of air suspension systems poses a challenge to the market, as they require specialized maintenance and repair. To address this, manufacturers are investing in research and development to create more durable and user-friendly air suspension systems. Overall, the market is expected to grow steadily, driven by these market trends and challenges.

What will be the Size of the Heavy-duty Truck Suspension System Market During the Forecast Period?

- The market encompasses the production and sale of suspension components for commercial vehicles, including shocks, struts, coil springs, leaf springs, air bags, and air ride systems. This market is driven by the cargo transportation industry's demand for reliable, high-performing suspension systems in long-haul trucks and medium-duty vehicles. Truck production continues to grow, fueled by innovation in suspension design, such as carbon fiber and hybrid composite suspensions, as well as aluminum suspension for weight reduction. Performance, truck handling, and safety are key considerations, with a focus on durability and truck stability. Replacement and repair are significant market segments, with an emphasis on alignment, suspension materials, and suspension technology troubleshooting.

- The truck industry's ongoing trend towards freight transportation efficiency and truck weight reduction further drives market growth. Suspension system warranty and upgrades are also important factors, as truck owners seek to maximize their investment in their vehicles. Overall, the market is a dynamic and evolving sector, with ongoing investment in research and development to meet the demands of the commercial vehicle industry.

How is this Heavy-duty Truck Suspension System Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Class 8

- Class 7

- Distribution Channel

- OEM

- Aftermarket

- Geography

- APAC

- China

- Japan

- North America

- Mexico

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Vehicle Type Insights

The class 8 segment is estimated to grow significantly during the forecast period. The market is driven by the increasing demand for trucks in various economic activities, such as transportation of cargo and logistics. The production of trucks is on the rise due to fleet modernization and the need for efficient transportation. Class 8 trucks, which account for a significant portion of the heavy-duty truck market, utilize various suspension systems to handle higher loads and uneven terrain. Traditional mechanical leaf spring suspension systems are being replaced with advanced air suspension systems for improved ride height, roll stability, and weight distribution. This shift towards lightweight suspension systems also reduces fuel consumption and maintenance costs.

However, the lack of standardization in suspension systems across different manufacturers poses a challenge. Import/export activities and older generation trucks require aftermarket components and authorized service providers for suspension system replacement in accidental situations. Security concerns, such as corrosion resistance and durability, are also crucial factors influencing the market. Key components of heavy-duty suspension systems include linkages, coil springs, and air springs, which are subject to wear and tear due to the heavy loads and long-haul routes. Electronic control systems and materials science advancements are improving the performance and resilience of these systems.

Get a glance at the market report of share of various segments Request Free Sample

The Class 8 segment was valued at USD 8.37 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is projected to expand due to the burgeoning automotive industry and increasing demand for advanced vehicles, including safety features, infotainment systems, and HVAC. Countries like India, Japan, and China are witnessing significant adoption of ADAS, infotainment systems, and other safety technologies. With large populations and high growth rates, these countries are significantly impacting economic development, particularly in the automotive sector. Attracting global auto manufacturers, the markets in emerging economies are growing rapidly. Advanced suspension systems, such as lightweight suspension and electronically controlled suspension, are gaining popularity due to their improved performance, durability, and reduced maintenance costs.

Key components include coil springs, air springs, linkages, and electronic control systems. Factors such as weight distribution, vehicle weight, and uneven terrain influence the choice of suspension systems. Component failure and safety concerns are driving the demand for replacement parts and authorized service providers. The transportation industry's focus on efficient logistics and cargo safety further boosts market growth. Despite the benefits, challenges such as a lack of standardization and corrosion resistance persist. Trade activity and fleet modernization are also contributing factors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Heavy-duty Truck Suspension System Industry?

- Growing sales of heavy-duty trucks is the key driver of the market. The demand is driven by the increasing sales of commercial trucks, which are essential for economic activity such as import/export activities and transportation of cargo. These vehicles require strong suspension systems to handle heavy loads and maintain stability on uneven terrain. The production of heavy-duty trucks is on the rise due to the growing economic development in major markets. Heavy-duty truck suspension systems are critical components for OEMs and aftermarket providers. Older generation suspension systems, including leaf springs and coil springs, are being replaced with lightweight suspension systems made of corrosion-resistant materials like steel and aluminum.

- These systems offer improved ride height, reduced rolling resistance, and enhanced durability, leading to reduced maintenance costs and increased efficiency in transportation. Security concerns, such as accidental situations, are driving the need for advanced suspension systems with electronic control systems and adjustable ride height. Weight distribution and vehicle weight are significant factors in the design and selection of these systems for heavy-duty commercial vehicles. The market is expected to grow due to fleet modernization and the increasing demand for efficient transportation systems. The lack of standardization presents a challenge for market growth.

What are the market trends shaping the Heavy-duty Truck Suspension System Industry?

- Technological advancements in suspension systems in the automotive sector is the upcoming market trend. The market is driven by economic activity and the demand for trucks in various industries, including transportation of cargo and import/export activities. OEM components are in high demand to ensure vehicle efficiency and safety, with a focus on lightweight suspension systems addressing security concerns and weight distribution. Older generation suspension systems, such as leaf springs and coil springs, are being replaced with more advanced systems, including electronically controlled suspension and air springs. These systems offer benefits like adjustable ride height, improved stability, and reduced maintenance costs through the use of replacement parts. However, the lack of standardization in these systems presents a challenge.

- The production of heavy-duty trucks requires materials with high durability, corrosion resistance, and efficient transportation. These systems must handle uneven terrain and high loads, making resilience and linkages essential. Additionally, safety concerns, such as body roll and higher vehicle weight, are addressed through advanced technologies like electronic control systems and compressed air handling. In the aftermarket, authorized service providers play a crucial role in addressing component failure and accidental situations. These systems offer benefits like reduced maintenance costs, improved performance, and enhanced safety features. Fleet modernization and the increasing importance of cargo safety further fuel the demand for suspension systems.

- Key market dynamics include factors like weight distribution, vehicle weight, ride height, rolling resistance, vehicle speed, and emission regulations. Innovations in materials science, such as the use of steel and advanced alloys, contribute to the development of more efficient and durable suspension systems. Air springs and coil springs continue to be essential components, with air springs offering advantages like improved ride quality and adjustability.

What challenges does the Heavy-duty Truck Suspension System Industry face during its growth?

- The complexity of air suspension systems used in heavy-duty trucks is a key challenge affecting the industry's growth. The market is influenced by economic activity and the demand for trucks. OEM components, including these systems, are essential for new truck production. Import/export activities and cargo transportation require suspension systems that offer stability, weight distribution, and resilience. Component failure in older-generation suspension systems, such as leaf springs and coil springs, necessitates the need for replacement parts. Security concerns and accidental situations call for advanced suspension systems, like electronically controlled suspension and adjustable ride height. Lightweight suspension systems, made from materials like steel and corrosion-resistant alloys, contribute to reduced maintenance costs and improved fuel efficiency. Production of heavy-duty trucks involves the use of heavy-duty suspension systems, which can handle higher loads and wear and tear on uneven terrain.

- The lack of standardization in suspension systems can lead to varying performance, ride height, rolling resistance, and vehicle speed. Trade activity and fleet modernization drive the demand for aftermarket components and authorized service providers. These systems play a crucial role in efficient transportation, as they impact vehicle weight, body roll, and handling. Emission regulations and comfort requirements also influence the design and development of thesesystems. In summary, the market is driven by economic activity, demand for trucks, and the need for advanced, efficient, and cost-effective suspension systems. The market is characterized by a focus on durability, performance, and safety, with a growing emphasis on lightweight suspension systems and electronically controlled systems.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the heavy-duty truck suspension system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arnott LLC

- Bridgestone Corp.

- Buga Technic

- Continental AG

- Cummins Inc.

- EMCO INDUSTRIES

- Hendrickson Holdings LLC

- JOST Werke AG

- Link Manufacturing Ltd.

- Mando Aftermarket North America

- Marelli Holdings Co. Ltd.

- Michigan Truck Spring of Saginaw Inc.

- RoadActive Suspension

- SAF HOLLAND SE

- Simard Suspensions

- Sogefi Spa

- Suncore Industries

- thyssenkrupp AG

- VDL Groep BV

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is an essential component of the commercial vehicle industry, playing a crucial role in ensuring efficient transportation of goods and cargo over long distances. The economic activity in various sectors, such as manufacturing, construction, and logistics, drives the demand for heavy-duty trucks. OEM components, including these systems, are integral to the production of these vehicles. Import/export activities also contribute significantly to the market's growth. However, component failure in older-generation suspension systems can lead to unplanned downtime and increased maintenance costs. This has led to the adoption of lightweight suspension systems that offer improved durability, resilience, and reduced maintenance costs.

Moreover, security concerns related to vehicle weight and weight distribution are essential factors influencing the market's dynamics. The increasing focus on safety and comfort in commercial vehicles has led to the development of advanced suspension systems. These systems cater to higher loads and provide better handling and stability on uneven terrain. The lack of standardization in the aftermarket for these systems presents both opportunities and challenges. Authorized service providers offer replacement parts and maintenance services, ensuring optimal performance and longevity. However, the absence of uniform quality standards can lead to issues in accidental situations. The transportation industry's shift towards fleet modernization has led to the adoption of electronically controlled suspension systems.

Furthermore, these systems offer adjustable ride height, improved ride quality, and enhanced stability, making them ideal for long-haul routes. Materials science advancements, such as corrosion resistance and improved ride height control, have led to the development of high-performance heavy-duty suspension systems. Rolling resistance and vehicle speed are critical factors influencing the efficiency of these systems. These systems are subjected to extreme conditions and wear and tear. Air springs and coil springs are common suspension system components.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.71% |

|

Market growth 2024-2028 |

USD 1.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.53 |

|

Key countries |

US, Mexico, China, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.