Helicopter-Based Transportation Market Size 2025-2029

The helicopter-based transportation market size is forecast to increase by USD 1.88 billion at a CAGR of 3.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of helicopters in various applications, including emergency medical services, offshore oil and gas exploration, and military operations. The emergence of super medium helicopters, which offer enhanced capabilities and greater efficiency, is further fueling market expansion. However, regulatory hurdles and supply chain inconsistencies pose challenges to market growth. Regulatory frameworks governing helicopter operations and maintenance vary across regions, necessitating compliance with multiple regulations, which can increase costs and complexity. Additionally, the integration of unmanned aerial vehicles (UAVs) in helicopter operations presents both opportunities and challenges.

- While UAVs can enhance situational awareness and support helicopter missions, they also require robust communication systems and coordinated control mechanisms to ensure safe and effective operation. Companies seeking to capitalize on the market opportunities must navigate these challenges by investing in regulatory compliance, supply chain optimization, and advanced technologies to integrate UAVs seamlessly into helicopter operations.

What will be the Size of the Helicopter-Based Transportation Market during the forecast period?

- In the dynamic market, various trends and advancements are shaping the industry's future. Autonomous flight and synthetic vision systems are revolutionizing helicopter safety, with manufacturers like Boeing and Airbus investing heavily in these technologies to enhance operational efficiency and reduce accidents. Night vision technology and advanced navigation systems are also crucial for enhancing safety during low-visibility conditions. Urban air mobility is gaining traction, with helicopter operators exploring new business models, such as air taxi services and helicopter sightseeing tours, to cater to the growing demand for urban transportation. Cargo drones and electric helicopters are further disrupting the market, offering cost-effective and eco-friendly alternatives for cargo transportation.

- Meanwhile, helicopter safety audits, flight data recording, and predictive analytics are essential tools for maintaining fleet optimization and ensuring regulatory compliance. Helicopter high-definition videography and 3D modeling are also transforming industries like construction and mining, providing accurate data for planning and execution. Aviation insurance and financing are critical components of the helicopter market, with insurers and financiers adapting to the evolving landscape by offering customized solutions to meet the unique needs of helicopter operators. The digital transformation of the helicopter industry is also accelerating, with data management and analysis becoming increasingly important for optimizing fleet performance and improving operational efficiency.

- Helicopter aerial survey, mapping, and accident investigations are other key applications, with companies leveraging flight data analysis to gain valuable insights and make informed decisions. Noise mitigation and helicopter tourism destinations are also areas of focus, as operators seek to minimize environmental impact and attract more passengers.

How is this Helicopter-Based Transportation Industry segmented?

The helicopter-based transportation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Energy industry

- Mining construction and logging

- Others

- Type

- Light

- Medium

- Heavy

- Application

- Passenger transportation

- Cargo transportation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The energy industry segment is estimated to witness significant growth during the forecast period.

The market plays a pivotal role in various industries, with the energy sector being the largest consumer. The oil and gas and wind power industries, in particular, heavily rely on helicopter services for their operations. Offshore oil rigs, such as Petronius Tower operated by Chevron in the Gulf of Mexico, require helicopter transportation for crew transfers. Helicopter operators enter into contracts with oil companies for multiple daily flights. Forestry management also utilizes helicopters for remote access to forests for firefighting, logging, and other operations. Emissions reduction is a significant trend in the helicopter industry, with companies investing in fuel-efficient turbine engines and noise reduction technologies.

Helicopter safety is a top priority, with stringent aviation safety standards and advanced avionics systems ensuring operational efficiency. Landing zones are essential infrastructure for helicopter operations, requiring careful planning and maintenance. Cost optimization is a key concern, with fleet management, flight planning, and predictive maintenance strategies employed to minimize expenses. Environmental impact is another consideration, with helicopter tourism and wildlife conservation initiatives promoting sustainable aviation practices. Helicopter regulations and aircraft maintenance are critical aspects of the industry, with regulatory bodies and advanced avionics ensuring safety and compliance. Cargo transportation, power line inspection, emergency medical services, and search and rescue are other applications of helicopter-based transportation.

Geospatial data, data analytics, and weather forecasting are essential tools for optimizing helicopter operations. Helicopter charter services cater to various industries, including executive transportation, aerial photography, and aerial surveillance.

The Energy industry segment was valued at USD 3.39 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

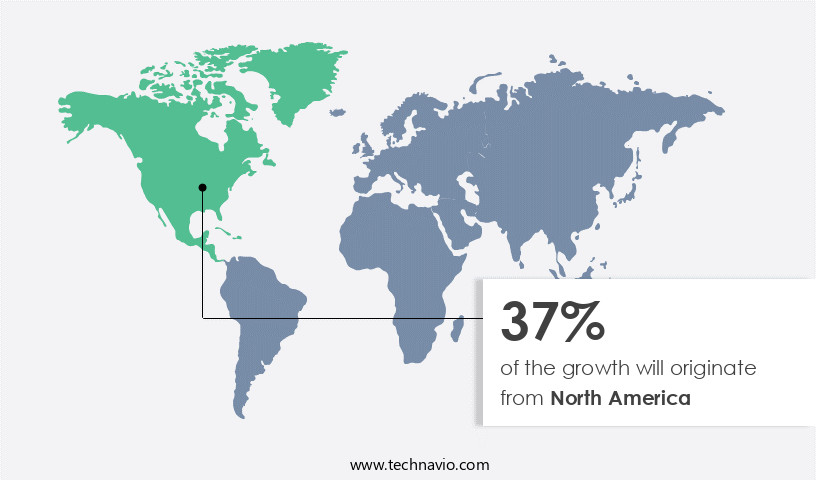

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Helicopter-based transportation is a vital sector in North America, with the US and Canada being the leading markets. Prominent companies such as CHC Helicopter, PHI, and Erickson operate extensively in these countries. The oil and gas industry is a significant contributor to the market's growth, with approximately 425 rigs in the Gulf of Mexico and surrounding waters. The US, projected as the largest oil producer, further boosts the demand for helicopter transportation. Forestry management, emissions reduction, and wildlife conservation are other sectors utilizing helicopters for remote access and environmental monitoring. Helicopter safety, landing zones, cost optimization, and operational efficiency are key concerns for industry players.

Rotorcraft technology, avionics systems, and advanced avionics enhance safety and operational capabilities. Helicopter pilot training, fleet management, and predictive maintenance ensure high-quality services. Offshore transportation, cargo, and executive services cater to diverse customer needs. Environmental impact, noise reduction, and fuel efficiency are essential considerations for sustainable aviation. Aviation safety standards, weather forecasting, and disaster relief are critical for ensuring operational readiness. Geospatial data, pipeline inspection, aerial photography, and aerial surveillance provide valuable insights for various industries. Helicopter regulations, aircraft maintenance, and aircraft leasing further support the market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Helicopter-Based Transportation market drivers leading to the rise in the adoption of Industry?

- The rise of super medium helicopters serves as the primary catalyst for market growth in this sector.

- Helicopter-based transportation encompasses various applications, including emergency medical services, wildlife conservation, customer service, search and rescue, geospatial data collection, helicopter tourism, sustainable aviation, and cargo transportation. Heavy helicopters, capable of carrying up to 19 passengers, offer increased capacity but are costly to operate. Lightweight helicopters, with lower passenger capacity, are more economical. The oil and gas industry predominantly uses heavy helicopters, but declining prices have led to operational cost reductions, impacting their usage. Super medium helicopters, offering increased passenger capacity at the cost of a medium helicopter, represent an attractive alternative.

- Additionally, this market is driven by ground handling, aviation safety standards, operational efficiency, flight simulators, and air traffic control. Sustainability and customer service are also significant factors influencing the market's growth.

What are the Helicopter-Based Transportation market trends shaping the Industry?

- The adoption of helicopters is on the rise in various applications, representing an emerging market trend. This growth can be attributed to the versatility and efficiency of helicopters in numerous industries, including emergency medical services, search and rescue operations, and offshore oil exploration.

- Helicopters offer unique advantages for transportation in various industries due to their ability to operate in inaccessible areas and land in limited spaces. Their mechanical complexity is counterbalanced by lower purchase and operating costs compared to fixed-wing aircraft. Several civil applications leverage helicopter capabilities, including: 1. Aerial cranes: Helicopters' ability to lift and hover over heavy loads makes them indispensable for construction logistics, pipeline inspection, and disaster relief efforts. 2. Noise reduction and fuel efficiency: Helicopter manufacturers and operators continue to invest in noise reduction technologies and fuel-efficient turbine engines to expand their market reach. 3. Weather forecasting: Helicopters' versatility extends to meteorological applications, enabling accurate and timely weather data collection and analysis.

- 4. Executive transportation: Helicopters cater to the executive transportation market, offering convenience, privacy, and time savings for high-profile individuals. 5. Aerial photography and surveillance: Helicopters are extensively used for aerial photography, film production, and surveillance purposes due to their maneuverability and flexibility. In summary, helicopter-based transportation plays a crucial role in various industries, from construction and disaster relief to executive transportation and aerial photography, thanks to their unique capabilities and cost-effectiveness.

How does Helicopter-Based Transportation market faces challenges face during its growth?

- The increasing prevalence of unmanned aerial vehicles (UAVs) poses a significant challenge to the growth of the industry.

- The market encompasses advanced avionics systems, fleet management, flight planning, high-resolution imaging, helicopter maintenance, and predictive maintenance. Helicopter operations involve intricate flight operations, adhering to stringent helicopter regulations, and ensuring aircraft maintenance for optimal performance. Advanced avionics, such as flight scheduling and VIP transportation systems, enhance operational efficiency and provide superior passenger experience. Despite the growing popularity of unmanned aerial vehicles, helicopters maintain their relevance in various industries. While drones offer convenience and cost savings for certain applications, helicopters boast superior payload capacity, reach, and versatility. Helicopter maintenance remains a critical aspect, with predictive maintenance strategies ensuring optimal aircraft performance and safety.

- Flight planning and fleet management systems streamline operations, ensuring efficient utilization of resources and minimizing downtime. High-resolution imaging applications, such as search and rescue, surveying, and environmental monitoring, require the capabilities only helicopters can offer. As the market evolves, the focus on advanced technologies and regulatory compliance will continue to shape the helicopter-based transportation landscape.

Exclusive Customer Landscape

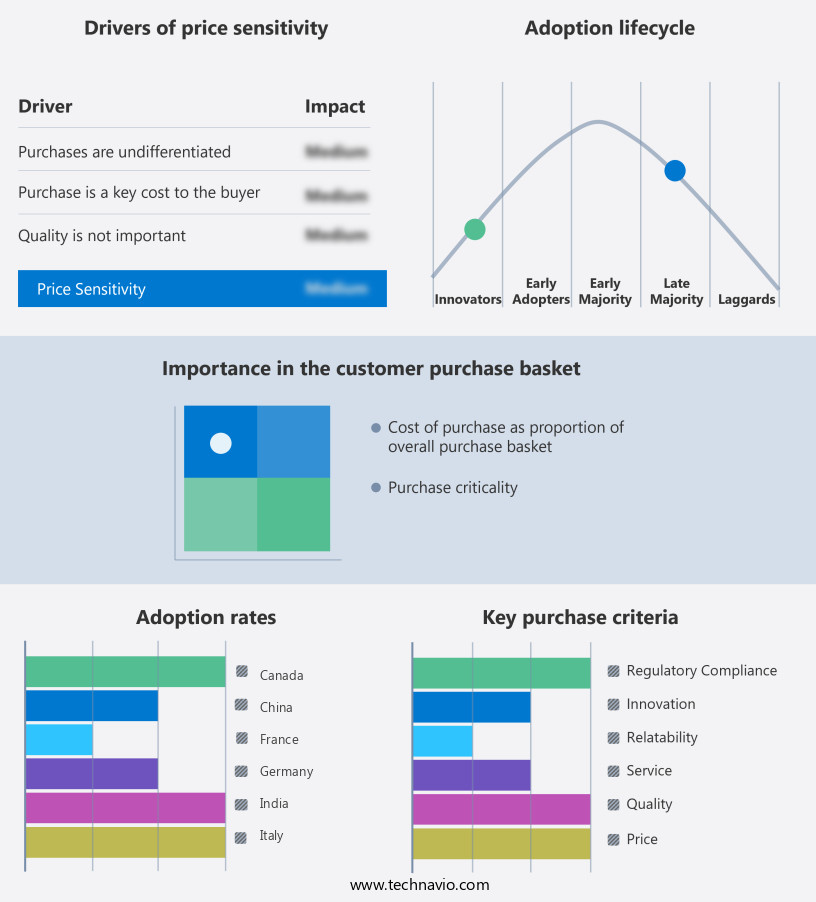

The helicopter-based transportation market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the helicopter-based transportation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, helicopter-based transportation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AIR CENTER HELICOPTERS - The DFW Metroplex is home to a premier helicopter transportation company, delivering exceptional scenic tours and charter services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AIR CENTER HELICOPTERS

- Air Charter Service India Pvt. Ltd.

- BLADE Air Mobility Inc.

- Bristow Group Inc.

- CHC Group LLC

- CHS Central Helicopter Services AG

- Directional Aviation

- Erickson Inc.

- Falcon Aviation

- Global Helicopter Service GmbH

- Heli Central

- Leonardo Spa

- Nationwide Transport Services LLC

- Pawan Hans Ltd.

- PHI Group Inc.

- Polar Helicopters

- Saf Helicopteres

- The Egyptian General Petroleum Corp.

- Thumby Aviation Pvt. Ltd

- Ultimate Heli Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Helicopter-Based Transportation Market

- In February 2024, Bell Helicopter, a Textron Inc. Company, introduced the Bell Nexus, an innovative electric vertical takeoff and landing (eVTOL) aircraft, marking a significant technological advancement in the market (Bell Helicopter Press Release, 2024). This eVTOL aircraft is expected to offer increased efficiency, reduced emissions, and enhanced safety features, positioning Bell Helicopter at the forefront of sustainable aviation.

- In October 2024, Airbus Helicopters and Safran Helicopter Engines announced a strategic partnership to develop and produce the next-generation helicopter engines, aiming to improve fuel efficiency and reduce emissions (Airbus Helicopters Press Release, 2024). This collaboration represents a major step forward in the helicopter industry, as both companies focus on reducing the carbon footprint and enhancing the performance of their helicopters.

- In March 2025, Sikorsky, a Lockheed Martin Company, secured a contract from the United States Army to produce the new H-172A helicopter, marking a significant military expansion for the company (Lockheed Martin Press Release, 2025). This contract, valued at over USD1 billion, is expected to boost Sikorsky's market share in the military helicopter segment and further solidify its position as a leading player in the market.

- In July 2025, the European Union Aviation Safety Agency (EASA) granted certification for the AgustaWestland AW169 helicopter, enabling its commercial operation in Europe (AgustaWestland Press Release, 2025). This certification marks a key regulatory approval for AgustaWestland, allowing the company to expand its market presence in Europe and further strengthen its position in the competitive helicopter market.

Research Analyst Overview

The market continues to evolve, driven by the diverse needs of various sectors. Avionics systems play a crucial role in enhancing operational efficiency and safety, while fleet management and flight planning solutions optimize costs and resources. High-resolution imaging and geospatial data enable applications in forestry management, emissions reduction, and environmental impact assessments. Helicopter maintenance and predictive maintenance strategies ensure fleet readiness, reducing downtime and enhancing safety. Flight operations are further streamlined through helicopter regulations, advanced avionics, and flight simulators. The integration of vip transportation, helicopter charter, and cargo transportation services caters to the demands of executive travel and logistics.

Helicopter safety is a paramount concern, with ongoing efforts to improve landing zones, helicopter pilot training, and aviation safety standards. Rotorcraft technology advances, including turbine engines and noise reduction, contribute to fuel efficiency and environmental sustainability. Applications in offshore transportation, power line inspection, pipeline inspection, emergency medical services, wildlife conservation, search and rescue, aerial photography, aerial surveillance, and helicopter tourism continue to expand. Data analytics and air traffic control further enhance operational efficiency and safety, ensuring the market remains a dynamic and evolving industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Helicopter-Based Transportation Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 1883.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

US, UK, Canada, China, France, Germany, India, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Helicopter-Based Transportation Market Research and Growth Report?

- CAGR of the Helicopter-Based Transportation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the helicopter-based transportation market growth of industry companies

We can help! Our analysts can customize this helicopter-based transportation market research report to meet your requirements.