Hemostats And Tissue Sealants Market Size 2024-2028

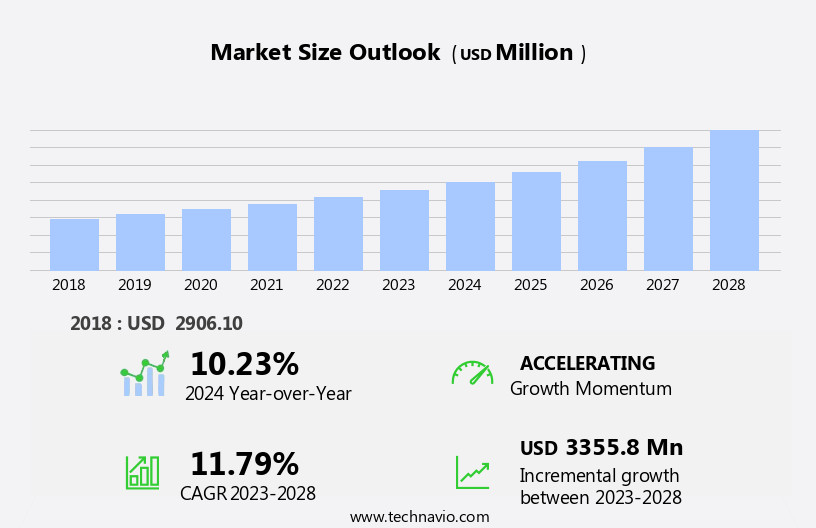

The hemostats and tissue sealants market size is forecast to increase by USD 3.36 billion, at a CAGR of 11.79% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing use of these products in various surgical procedures. The demand for hemostats and tissue sealants is fueled by their effectiveness in controlling bleeding and promoting tissue healing. Mechanical hemostats, made from materials like gelatin, collagen, cellulose, and polysaccharides, act as physical barriers to stop blood flow. Moreover, the rising number of surgeries and the growing preference for minimally invasive procedures in the healthcare industry are further boosting market growth. However, the high cost of hemostats and tissue sealants remains a significant challenge for the market. The expensive nature of these products can limit their accessibility and affordability, particularly in developing regions and low-income populations. Additionally, the increasing focus on research and development (R&D) in the field is leading to the introduction of novel hemostats and tissue sealants, which can further increase market competition and pricing pressures.

- Companies seeking to capitalize on market opportunities must navigate these challenges effectively by offering cost-effective solutions and differentiating their products through advanced technology and innovative applications.

What will be the Size of the Hemostats And Tissue Sealants Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in bleeding control technologies and their applications across various sectors. These innovations encompass a range of solutions, from gelatin sponges and cellulose-based hemostats to biologic hemostats and drug eluting stents. The market dynamics are shaped by ongoing clinical trials and the integration of bioactive molecules, synthetic hemostats, and absorbable materials into surgical procedures. Bleeding control is a critical aspect of emergency medicine and trauma care, necessitating the development of hemostatic agents with extended shelf life and efficient platelet aggregation mechanisms. The use of autologous blood and platelet-rich plasma in tissue regeneration and wound healing further expands the market's scope.

Capillary leakage and vascular injury are significant challenges in minimally invasive surgery, leading to the exploration of advanced hemostats and surgical sealants. The role of regulatory approvals and anticoagulant reversal in thrombosis prevention and hemorrhage control is also crucial. The market's continuous unfolding is reflected in the ongoing research and development of bioabsorbable materials, oxidized cellulose, collagen sponges, injectable hemostats, and fibrin sealants. The integration of advanced surgical techniques, such as the use of acellular matrix and suture materials, further enhances the market's potential. The market's evolving patterns are shaped by the interplay of various factors, including technological advancements, clinical needs, and regulatory requirements.

The market's future growth is expected to be fueled by the ongoing research and development efforts in the field of hemostasis mechanisms and tissue repair.

How is this Hemostats And Tissue Sealants Industry segmented?

The hemostats and tissue sealants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Hemostats

- Tissue sealants and adhesives

- Fibrin sealants

- End-user

- Hospitals

- Ambulatory surgical centers

- Homecare settings

- Others

- Material

- Gelatin-based Topical Hemostats

- Collagen-based Topical Hemostats

- ORC-based Topical Hemostats

- Polysaccharide-based Topical Hemostats

- Application

- General Surgery

- Minimally Invasive Surgery

- Trauma

- Hemophilia

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The hemostats segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of medical devices used to control bleeding and promote wound healing. These products are integral to various surgical procedures, including trauma care, emergency medicine, and minimally invasive surgery. Mechanical hemostats, derived from gelatin, collagen, cellulose, and polysaccharides, act as sponges that swell upon contact with blood, creating a mechanical barrier for blood flow cessation and a surface for rapid clotting. Examples include Pfizer Inc.'s GELFOAM Sterile Sponge and Johnson & Johnson Services Inc.'s SURGICEL Original Absorbable Hemostat. Bioabsorbable materials, synthetic hemostats, and tissue sealants are also significant market segments. Bioactive molecules, such as platelet aggregation promoters and thrombin, are incorporated into some hemostats and tissue sealants to enhance their efficacy.

The coagulation cascade plays a crucial role in hemostasis mechanisms, and factors like factor XIII and anticoagulant reversal agents are essential in this process. Storage conditions are essential for maintaining the efficacy of hemostats and tissue sealants. Regulatory approvals and clinical trials are necessary to ensure safety and efficacy before market release. Innovations in the field include drug eluting stents, vascular injury repair, cell culture, and platelet-rich plasma applications. Surgical techniques, such as wound closure and suture materials, are also influenced by the use of hemostats and tissue sealants. Wound healing and tissue regeneration are crucial aspects of their application, with absorbable hemostats and collagen sponges playing significant roles.

The market is continually evolving, with ongoing research in areas like oxidized cellulose, fibrin sealants, and acellular matrix technologies.

The Hemostats segment was valued at USD 2.07 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is expected to dominate the global landscape due to advanced healthcare infrastructure and an increasing number of surgical procedures. Approximately six million high-bleeding surgeries, including cardiovascular, abdominal, and spine procedures, are carried out annually in the US alone. This region will account for the largest revenue share during the forecast period, with the US and Canada being the major contributors. Advancements in drug delivery systems have led to the development of synthetic hemostats and bioabsorbable materials that enhance bleeding control mechanisms. Bioactive molecules, such as platelet aggregation promoters, are integrated into these hemostats to improve their efficacy.

Tissue sealants, including collagen sponges and fibrin sealants, are used to promote wound closure and tissue regeneration. Clinical trials are ongoing to explore the potential of bioabsorbable hemostats and tissue sealants in minimally invasive surgeries, blood vessel repair, and trauma care. Regulatory approvals for these advanced hemostatic agents are crucial to their market penetration. Factors such as shelf life, storage conditions, and anticoagulant reversal are essential considerations in the development and adoption of these products. The coagulation cascade and hemostasis mechanisms are crucial in understanding the role of hemostats and tissue sealants in hemorrhage control. Biologic hemostats, such as platelet-rich plasma and autologous blood, are gaining popularity due to their potential to minimize capillary leakage and promote tissue healing.

Innovations in surgical techniques, including the use of surgical staplers, injectable hemostats, and oxidized cellulose, are driving the market growth. The integration of hemostatic agents into drug eluting stents and suture materials is also a significant trend. The regulatory landscape for these products is evolving, with an increasing focus on thrombosis prevention and anticoagulant reversal. The market is a dynamic and innovative space, with ongoing research in cell culture, platelet aggregation, and extracellular matrix technology. The market's future potential lies in the development of advanced hemostatic agents that address the challenges of minimally invasive surgeries, emergency medicine, and trauma care.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hemostats And Tissue Sealants Industry?

- The extensive utilization of hemostats and tissue sealants in surgical procedures is the primary market driver.

- Every month, approximately 25 million surgical procedures are conducted globally, with a substantial number of these surgeries encountering complications such as bleeding and the leakage of bodily fluids. These complications can lead to serious consequences, including hemodynamic instability, hypovolemia, anemia, and an increased risk of organ failure due to reduced oxygen delivery to vital tissues. To address these challenges, medical professionals turn to advanced solutions like hemostats and tissue sealants. Hemostats, which aid in achieving rapid and effective bleeding control, have gained popularity due to their ability to inflict less pain on patients and eliminate the need for removal, unlike traditional methods such as sutures and wires.

- Additionally, tissue sealants can prevent leakages by sealing suture lines, further ensuring the success of surgical procedures. Synthetic hemostats and tissue sealants made from bioabsorbable materials and bioactive molecules have emerged as promising alternatives. These advanced materials promote platelet aggregation and enhance the natural healing process. Furthermore, they offer extended shelf life and can be stored under various conditions, making them a versatile choice for medical professionals. As clinical trials continue to validate the efficacy and safety of these advanced hemostats and tissue sealants, their use is expected to become increasingly prevalent in various surgical procedures, ultimately improving patient outcomes and reducing healthcare costs.

What are the market trends shaping the Hemostats And Tissue Sealants Industry?

- The focus on advancing research and development in novel hemostats and tissue sealants is a significant trend in the upcoming market. Professionals in this field are increasingly dedicating resources to innovations in these areas.

- In the healthcare industry, the development and application of hemostats and tissue sealants continue to advance, addressing the challenges of wound healing and minimizing blood loss during surgical procedures. companies are investing significantly in research and development (R&D) to introduce innovative products and expand their geographic reach. For instance, Baxter International has launched next-generation hemostats and sealants, along with advanced delivery systems, and is exploring additional indications for its tissue sealants. Similarly, 3-D Matrix Medical Technology is focusing on the development of synthetic hemostatic materials, such as PuraStat, a prefilled syringe indicated to reduce delayed bleeding following gastrointestinal endoscopic submucosal dissection (ESD) procedures in the colon.

- These advancements are crucial in addressing challenges like capillary leakage and ensuring effective blood vessel repair, particularly in minimally invasive surgeries. The use of autologous blood and biologic hemostats is also gaining popularity due to their ability to promote tissue regeneration and reduce the risk of complications associated with synthetic hemostats. Overall, the market for hemostats and tissue sealants is witnessing significant growth and innovation, driven by the increasing demand for effective wound healing solutions and the ongoing advancements in medical technology.

What challenges does the Hemostats And Tissue Sealants Industry face during its growth?

- The escalating costs of hemostats and tissue sealants pose a significant challenge to the growth of the industry. These essential medical supplies are indispensable for effective surgical procedures, making their high cost a critical concern for healthcare providers and patients alike.

- The market encompasses a range of products used to control bleeding during surgical procedures and trauma care. These include platelet-rich plasma, absorbable hemostats, surgical sealants, and collagen sponges. The high cost of advanced hemostats and tissue sealants is a significant barrier to market growth. For instance, the per-unit cost of fibrin sealants can range from USD50 to USD600, while mechanical hemostats cost an average of USD50 to USD200 per unit, and active flowable hemostats range from USD200 to USD300. The use of multiple hemostats and tissue sealants during surgeries increases the overall cost for end-users. In many regions, passive hemostatic agents are preferred due to their lower cost.

- Additionally, in developing economies with limited healthcare budgets, insurance coverage for hemostats and tissue sealants is often unavailable. Regulatory approvals and advancements in hemostatic agents, such as anticoagulant reversal agents and tissue regeneration technologies, continue to drive market growth. Suture materials and endothelial cells are also used in conjunction with hemostats and tissue sealants for effective wound closure and healing.

Exclusive Customer Landscape

The hemostats and tissue sealants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hemostats and tissue sealants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hemostats and tissue sealants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Medical Solutions Group Plc - The company specializes in providing hemostats and tissue sealants through its brands, including LiquiBand and ActivHeal.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Medical Solutions Group Plc

- B.Braun SE

- Baxter International Inc.

- Becton Dickinson and Co.

- BioCer Entwicklungs GmbH

- Cardinal Health Inc.

- CSL Ltd.

- CuraMedical BV

- Hemostasis LLC

- Integra Lifesciences Corp.

- Johnson and Johnson Services Inc.

- KATSAN KATGUT SANAYI VE TICARET A.S

- Medtronic Plc

- Pfizer Inc.

- Smith and Nephew plc

- Stryker Corp.

- Teijin Ltd.

- Teleflex Inc.

- Tricol Biomedical Inc.

- Vivostat AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hemostats And Tissue Sealants Market

- In January 2024, Ethicon, a part of Johnson & Johnson, announced the US Food and Drug Administration (FDA) approval of its new hemostat and tissue sealant, TissuGlu Surgical Adhesive. This product, which uses fibrin sealant technology, is designed to control bleeding and promote tissue healing in various surgical procedures (Johnson & Johnson press release, 2024).

- In March 2024, Baxter International and Sealantis, an Israeli biotech company, entered into a strategic partnership to develop and commercialize Sealantis' hemostatic and tissue sealant technologies. The collaboration aims to expand Baxter's portfolio in the advanced wound care and surgical hemostasis markets (Baxter press release, 2024).

- In May 2024, CryoLife, Inc., a leading supplier of cardiovascular and biomaterials products, completed the acquisition of BioGlue Surgical, a business unit of Cook Medical. The acquisition included BioGlue's tissue adhesive portfolio and strengthened CryoLife's presence in the market (CryoLife press release, 2024).

- In February 2025, Merck KGaA and VersaSeal, a US-based medical device company, announced the successful completion of a clinical trial for their novel hemostat and tissue sealant, VaseSeal. The product, which uses a combination of fibrin sealant and a proprietary hydrogel, demonstrated significant reductions in blood loss and operative time in patients undergoing liver resection surgery (Merck KGaA press release, 2025).

Research Analyst Overview

- The market encompasses a range of medical devices designed to control bleeding and promote tissue healing. Market dynamics are influenced by various factors, including pricing strategies, intellectual property, and product performance. In vivo studies and clinical trials are crucial for assessing long-term stability, sterilization techniques, and biocompatibility. Ambulatory surgical centers and surgical suites increasingly utilize these products due to their efficiency and effectiveness. Quality control, degradation rate, and material properties such as tensile strength and immune response are key considerations in materials engineering. Healthcare professionals rely on these devices for trauma centers, emergency rooms, and operating rooms. Competition analysis, patent protection, and distribution channels are essential aspects of market access.

- Toxicity testing and compliance with regulatory standards ensure safety and efficacy. In vitro studies and shelf-life stability are critical for ensuring consistent performance. Overall, the market is driven by advancements in biomaterials science and polymer chemistry, as well as the growing demand for minimally invasive procedures.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hemostats And Tissue Sealants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.79% |

|

Market growth 2024-2028 |

USD 3355.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.23 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hemostats And Tissue Sealants Market Research and Growth Report?

- CAGR of the Hemostats And Tissue Sealants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hemostats and tissue sealants market growth of industry companies

We can help! Our analysts can customize this hemostats and tissue sealants market research report to meet your requirements.