Hepatitis B Therapeutics Market Size 2024-2028

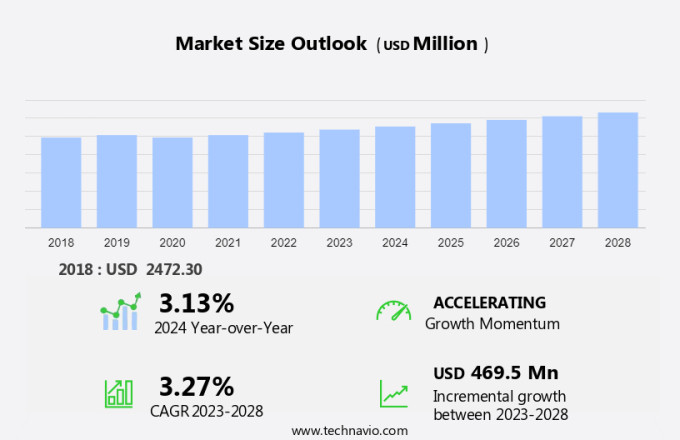

The hepatitis B therapeutics market size is forecast to increase by USD 469.5 million at a CAGR of 3.27% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing prevalence of hepatitis B infants, particularly in regions such as Asia-Pacific. New technological advancements, including the development of oral antiviral therapies and the use of gene therapy, are also fueling market growth. However, stringent regulations and high treatment costs pose challenges to market expansion.

The market is set to grow rapidly due to rising chronic hepatitis B cases, increased awareness, and new therapies. However, challenges like high treatment costs, limited reimbursement, and regulatory hurdles remain. Despite this, growth is expected, fueled by disease prevalence, technological advances, and regulatory changes.

Hepatitis B is a viral liver infection that can lead to chronic diseases such as cirrhosis and hepatocellular carcinoma. Transmission occurs primarily through prenatal transmission from infected mothers to newborns, contact with infected blood or body fluids, and through sharing needles or unprotected sex. Recombinant vaccines are the primary preventive measure against Hepatitis B, and the global market for these vaccines is expected to grow due to the increasing incidence of chronic hepatitis B and the need for effective diagnosis and follow-up care. Factors driving the market include the rising number of chronic diseases, increasing healthcare services expenditure, and the growing number of clinical trials for new drugs.

However, challenges such as drug resistance and high laboratory testing expenses hinder market growth. Alcohol, illicit drugs, and poor sanitation conditions also contribute to the spread of the disease, increasing the demand for effective therapeutics. Biomarker based testing is becoming increasingly important for accurate diagnosis and monitoring of chronic infection. The market for hepatitis B therapeutics is expected to grow significantly in the coming years, with a focus on developing new drugs to address drug resistance and improve treatment outcomes. The market for hepatitis C therapeutics is also expected to grow in parallel due to the high co-infection rate with hepatitis B.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Drugs

- Vaccines

- Geography

- North America

- Mexico

- US

- Europe

- Germany

- Asia

- Rest of World (ROW)

- North America

By Application Insights

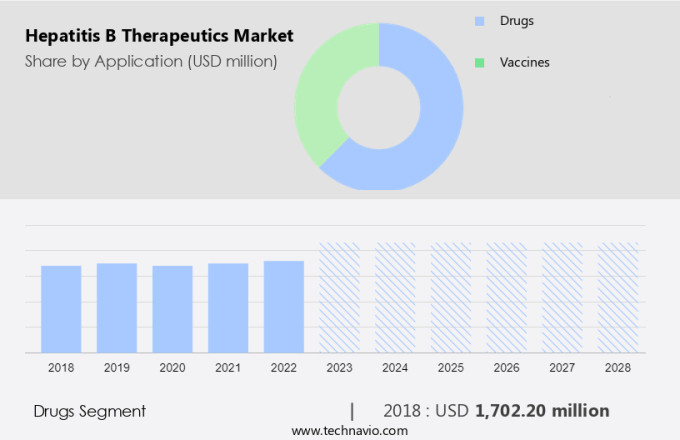

The drugs segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing prevalence of chronic hepatitis B, cirrhosis, and hepatocellular carcinoma. The transmission of the hepatitis B virus from infected mothers to newborns is a major concern, leading to a rise in the demand for effective therapeutics. Recombinant vaccines, such as HEPLISAV B and combination vaccines, are being widely used for prevention. However, the treatment market is gaining traction with the approval of new antiviral drugs, including nucleoside analogs and immunosuppressant therapy. The increasing burden of chronic infection, drug resistance, and the high cost of laboratory testing are driving the need for cost-effective and efficient therapeutic solutions.

Moreover, alcohol consumption, illicit drug use, and poor sanitation conditions contribute to the spread of the disease, necessitating continuous research and development. Pharmacy professionals play a crucial role in the distribution of clean syringes and administering vaccinations and counseling for prevention. The market for hepatitis B therapeutics is expected to grow significantly due to the increasing demand for effective treatment and diagnosis, follow-up care, and healthcare services for chronic diseases. The market includes hospital pharmacies, retail pharmacies, and online pharmacies as key distribution channels.

Get a glance at the market share of various segments Request Free Sample

The drugs segment was valued at USD 1.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

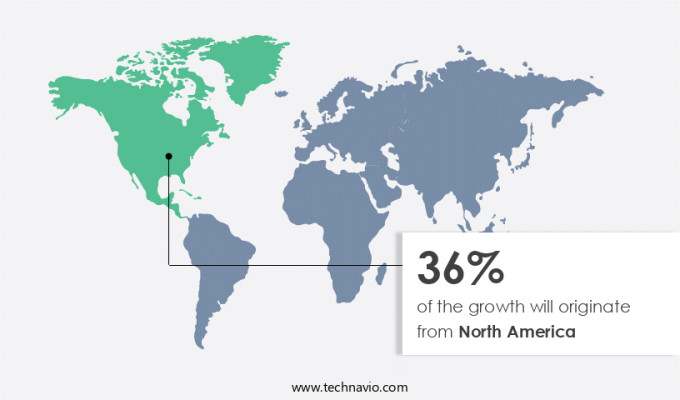

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Hepatitis B is a viral liver infection that can lead to chronic diseases such as cirrhosis and hepatocellular carcinoma. Prenatal transmission is a significant cause of newborn infections, with infected mothers being the primary carriers. Recombinant vaccines, such as HEPLISAV B and combination vaccines, are effective in preventing hepatitis B virus transmission. However, for those already infected, therapy options include antivirals, chemotherapy, and immunosuppressant therapy. Nucleoside analogues are common antiviral drugs used in treatment. Chronic infection and drug resistance can lead to high laboratory testing expenses. Alcohol, illicit drugs, and poor sanitation conditions can exacerbate the disease. Pharmacy professionals in hospital, retail, and online settings play crucial roles in providing vaccinations, counseling, and access to hepatitis B therapeutics. Biomarker-based testing aids in diagnosis and follow-up care. The hepatitis therapeutics market is expanding to meet the needs of those diagnosed with this chronic disease, offering various treatment and healthcare services.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Hepatitis B Therapeutics Market Driver

The increasing prevalence of hepatitis B infants is the key driver of the market. Hepatitis B and C are viral liver diseases that can lead to inflammation and, in severe cases, liver damage or even death. While hepatitis B can be prevented through vaccination services and safe health practices, hepatitis C is primarily spread through blood-borne pathogens, such as unsafe injections and unsafe health care. According to the Centers for Disease Control and Prevention (CDC), approximately 90% of infants infected with hepatitis B become chronically infected, compared to 2%-6% of adults. Chronic hepatitis B can lead to liver disease, including cirrhosis and liver cancer. Hepatitis C can cause acute hepatitis, which may clear on its own, or chronic hepatitis C, which can lead to cirrhosis and liver failure.

Moreover, both viruses can be fatal, especially for those who are chronically infected. Dicerna Pharmaceuticals is currently developing a 3-antigen HBV vaccine to prevent hepatitis B infection. Effective drugs exist for treating hepatitis C, including antiviral medications. It is essential to raise awareness regarding these medical conditions, particularly among those at high risk, such as individuals with a history of alcohol consumption or other medical conditions. Pregnant women who are infected with the hepatitis B virus can pass it to their infants at birth if they are not vaccinated. Prevention through vaccination and safe health practices is crucial in reducing the burden of these viruses.

Hepatitis B Therapeutics Market Trends

New technological advancements are the upcoming trend in the market. The market is witnessing significant advancements due to ongoing clinical trials for effective drugs against this liver disease. Hepatitis B, a viral infection, can lead to inflammation of the liver and, if left untreated, can result in fatal consequences, especially for those who are chronically infected. Hepatitis B is a blood-borne pathogen, and transmission can occur through unsafe injections, unsafe healthcare practices, and from an infected mother to her baby during childbirth. Prevention measures include vaccination services and avoiding alcohol consumption, especially for those with medical conditions like hepatitis C. Dicerna Pharmaceuticals is one of the companies leading in the development of innovative hepatitis B therapeutics.

Moreover, their 3 antigen HBV vaccine, using RNA interference technology, targets the HBV virus and prevents its replication. For those already infected, drugs like tenofovir and entecavir are effective in managing the condition. Hepatitis C, another viral liver disease, shares some similarities with hepatitis B, and its treatment also involves antiviral drugs. Acute hepatitis C can progress to chronic hepatitis C, which can lead to liver damage and cirrhosis. Raising awareness regarding these conditions and their prevention is crucial, especially for those who have been newly infected or are at risk due to their medical history.

Hepatitis B Therapeutics Market Challenge

Stringent regulations are a key challenge affecting market growth. Hepatitis B and C are viral liver diseases that can lead to inflammation and, in severe cases, be fatal. Hepatitis B can be prevented through vaccination services, while hepatitis C primarily spreads through blood-borne pathways, such as unsafe injections and unsafe healthcare. Newly infected individuals, as well as those chronically infected, face a significant burden from these medical conditions. The market is witnessing significant advancements, with several pharmaceutical companies conducting clinical trials for new drugs. Dicerna Pharmaceuticals, for instance, is developing a 3-antigen HBV vaccine to prevent hepatitis B infection. Similarly, effective drugs are being developed to treat hepatitis C, including those targeting acute and chronic hepatitis C.

However, regulatory agencies, such as the US FDA and EMA, play a crucial role in approving these drugs. The approval process involves a rigorous evaluation of the drug's safety, efficacy, manufacturing, and labeling. Applicants must provide comprehensive data, including results from animal studies, pharmacodynamics and pharmacokinetics, and clinical studies in humans. Other essential information includes dosage, route of administration, contraindications, warnings and precautions, drug interactions, and adverse reactions. Alcohol consumption and medical conditions, such as hepatitis A, can exacerbate liver disease caused by hepatitis B and C. Raising awareness regarding these viruses and their transmission is essential to prevent further infections. Pregnant women are also at risk of transmitting hepatitis B to their infants, making it crucial to ensure proper screening and vaccination during pregnancy.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Biotest AG - The company offers hepatitis B therapeutics products such as prophylaxis.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bristol Myers Squibb Co.

- CASI Pharmaceuticals Inc.

- Cipla Inc.

- Dynavax Technologies Corp.

- Emergent BioSolutions Inc.

- F. Hoffmann La Roche Ltd.

- Gilead Sciences Inc.

- GlaxoSmithKline Plc

- Hetero Healthcare Ltd.

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Novartis AG

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing prevalence of chronic hepatitis B and its complications, such as cirrhosis and hepatocellular carcinoma. The market is driven by the need for effective treatments for chronic infection, drug resistance, and the rising number of infected newborns due to prenatal transmission. Recombinant vaccines, such as HEPLISAV B and combination vaccines, are major contributors to the market, offering protection against the hepatitis B virus (HBV). Liver infection caused by HBV can lead to chronic infection, which may result in liver damage and liver cancer.

Furthermore, factors contributing to the spread of the disease include alcohol consumption, illicit drug use, and poor sanitation conditions. Biomarker-based testing plays a crucial role in the diagnosis and follow-up of patients with hepatitis B. Antiviral drugs, chemotherapy, and immunosuppressant therapy are the primary treatments for hepatitis B. Nucleoside analogues are widely used antiviral drugs in the market. The therapy for hepatitis B includes hospital pharmacies, retail pharmacies, and online pharmacies. Pharmacy professionals play a vital role in the administration of clean syringes and vaccinations, as well as counseling for prevention and treatment. The hepatitis therapeutics market is also influenced by healthcare services and chronic diseases. The market is expected to grow further due to the increasing awareness and initiatives for the prevention and treatment of hepatitis B. The market is expected to witness significant developments in the coming years, with a focus on improving treatment outcomes and reducing the burden of chronic diseases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market Growth 2024-2028 |

USD 469.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, Germany, Mexico, China, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Biotest AG, Bristol Myers Squibb Co., CASI Pharmaceuticals Inc., Cipla Inc., Dynavax Technologies Corp., Emergent BioSolutions Inc., F. Hoffmann La Roche Ltd., Gilead Sciences Inc., GlaxoSmithKline Plc, Hetero Healthcare Ltd., Johnson and Johnson Services Inc., Merck and Co. Inc., Novartis AG, Sanofi SA, Teva Pharmaceutical Industries Ltd., and Viatris Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch