Household Appliance Market Size 2025-2029

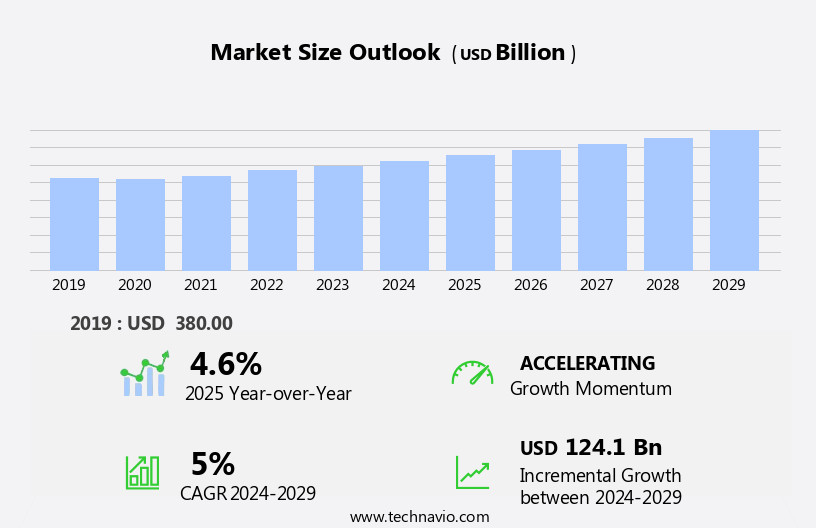

The household appliance market size is forecast to increase by USD 124.1 billion at a CAGR of 5% between 2024 and 2029.

- The market is experiencing significant growth, driven by product innovation and advancement leading to portfolio extension and product premiumization. Consumers are increasingly seeking advanced and multi-functional appliances to enhance their daily living experiences. This trend is particularly prominent in developed markets, where households are characterized by smaller sizes and a higher disposable income. Artificial intelligence (AI) and the Internet of Things (IoT) are driving innovation in household appliances, leading to the development of smart appliances and home automation systems. However, this market is not without challenges.

- Fluctuations in raw material prices and operational costs continue to pose significant challenges to market participants. These factors, coupled with increasing competition, necessitate strategic planning and operational efficiency for companies seeking to capitalize on market opportunities and navigate challenges effectively. Companies that can successfully innovate and offer value-added services and solutions are well-positioned to capture market share and thrive in this dynamic and competitive landscape.

How Big is the Market for Household Appliances?

- The market is experiencing significant growth and innovation, driven by the integration of technology into everyday life. Connected home ecosystems, voice control, and appliance automation are key trends transforming the industry. Smart kitchen and laundry appliances are increasingly popular, offering energy management systems, smart thermostat integration, appliance data analytics, and personalized settings. Predictive maintenance and repair services, appliance lifecycle management, and sustainable materials are also priorities for consumers. Renewable Energy integration and appliance recycling initiatives are important considerations for environmentally-conscious consumers. Online marketplaces, virtual showrooms, and 3D product modeling offer new ways to shop for appliances, while financing options, subscription-based services, and appliance rental programs provide flexible purchasing choices.

- Appliance safety certifications, performance testing, regulatory compliance, and industry standards ensure product quality and consumer protection. Manufacturing automation and improved customer service are essential for companies to remain competitive. Marketing strategies, including influencer and content marketing, , PPC advertising, and data analysis, help brands reach and engage consumers.

How is this Household Appliance Industry segmented?

The household appliance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- MHA

- Small household appliances

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- South America

- Brazil

-

- Middle East and Africa

- UAE

-

- APAC

By Product Insights

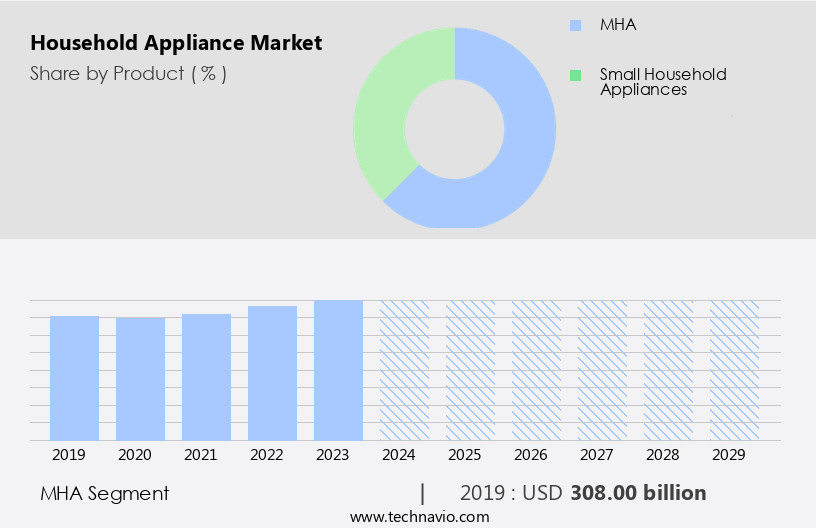

The MHA segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of products, including refrigeration and cooling appliances, large cooking appliances, and washing appliances, as well as room comfort and water heater appliances. Smart Home appliances, enabled with IoT capabilities, Wi-Fi connectivity, and smartphone integration, are gaining significant traction. Consumers are increasingly seeking remote monitoring and control features, energy efficiency, and eco-friendly innovations. Energy efficiency labeling and the availability of energy-efficient home appliances are key factors driving market growth. Sustainable manufacturing practices and the integration of AI-enabled appliances, such as connected refrigerators, washing machines, and air conditioners, are also important trends.

The semiconductor chip shortage has, however, posed a challenge to the production capabilities of major appliance manufacturers. Consumer buying behavior is influenced by factors such as disposable income, global population growth, and rising living standards. Tech-savvy consumers, particularly those with internet access, are increasingly demanding energy savings and sustainable solutions. Advanced features, such as touchless tech, sous vide, air frying, and AI-driven technologies, are also driving demand for connected home appliances. Manufacturers are adopting omnichannel strategies, utilizing virtual product demonstrations, augmented reality applications, and product visualization tools to enhance the consumer experience. Regional market demands and production capabilities vary, with some manufacturers implementing distributed manufacturing and innovative manufacturing processes to meet regional needs.

MHA sales are highest in APAC, where disposable income and changing lifestyle trends are driving demand for large appliances. In the US, demand for high-efficiency, enhanced design, and premium-quality white goods remains strong, particularly in the high-end segment. The global supply chain is also being impacted by the shift towards e-commerce and the increasing use of digital sales channels, such as online marketplaces and doorstep delivery with free shipping.

Get a glance at the market report of share of various segments Request Free Sample

The MHA segment was valued at USD 308.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

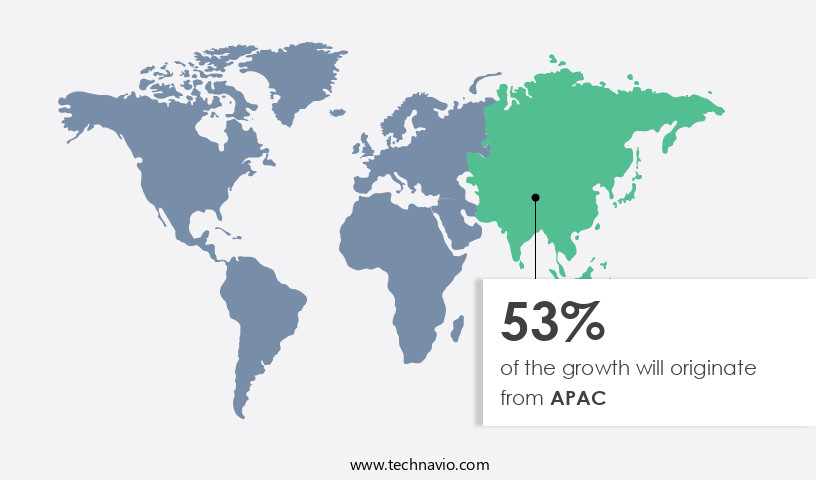

APAC is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific is experiencing significant growth, driven by the expanding middle-class population and their increasing disposable income. Urbanization and rising living standards are also contributing factors, as consumers seek advanced, energy-efficient home appliances to enhance their lifestyle. Smart home appliances, such as those with IoT capabilities, Wi-Fi connectivity, and smartphone integration, are gaining popularity for their remote monitoring and control features. Energy efficiency is a key consideration, with energy efficiency labeling and eco-friendly innovations becoming increasingly important. Sustainable manufacturing practices are also a focus, as consumers demand innovative white goods with enhanced design, high efficiency, and premium quality.

The market is embracing digital sales channels, including e-commerce and omnichannel strategies, and virtual product demonstrations through augmented reality applications and product visualization tools. Regional market demands vary, with production capabilities and manufacturing facilities adapting to meet these needs. Distributed manufacturing and AI-driven technologies, such as AI wash and AI ecobubble, are also transforming the industry. Consumer buying behavior is evolving, with tech-savvy consumers and internet users seeking energy savings and sustainable solutions through AI-enabled appliances, such as connected refrigerators, washing machines, and air conditioners. However, the semiconductor chip shortage is posing challenges for the production of connected devices and major appliances, small appliances, and connected home appliances.

Home development and improvement projects continue to drive demand for household appliances, with supermarkets and hypermarkets, specialty stores, doorstep delivery, and free shipping offering convenience to consumers.

What is the market outlook for household appliances?

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Household Appliance Industry?

- Product innovation and advancement leading to portfolio extension and product premiumization is the key driver of the market. The market experiences heightened competition due to continuous innovation and technological advancements. Companies in this sector are driven to invest in research and development to meet evolving consumer demands. Notable innovations include improvements in technology, performance, features, and design. Consumers increasingly seek multifunctional appliances that conserve resources. This dynamic market environment necessitates ongoing adaptation and differentiation among companies.

What are the market trends shaping the Household Appliance Industry?

- Increased adoption of multi- and advanced products is the upcoming market trend. The market is experiencing significant growth due to the increasing demand for innovative and advanced multifunctional products. These appliances cater to multiple household applications, offering excellent value for money. Although priced higher than traditional appliances, multifunctional household appliances provide a high return on investment by saving time, resources, and eliminating the need for multiple products. Their space-saving and convenient features make them an attractive option for consumers seeking to streamline their homes and improve operational efficiency. The market's growth can be attributed to the growing trend towards smart homes and the increasing awareness of energy efficiency and sustainability.

- Multifunctional appliances offer improved results and convenience while reducing energy consumption, making them an appealing choice for environmentally-conscious consumers. The market's competitive landscape is characterized by ongoing innovation and the introduction of new features and technologies, ensuring a diverse range of options for consumers.

What challenges does the Household Appliance Industry face during its growth?

- Fluctuations in raw material prices and operational costs is a key challenge affecting the industry growth. The market pricing is influenced by several factors, primarily manufacturing costs, labor costs, and raw material prices. Among these, manufacturing costs, labor costs, and raw material prices hold significant weight. The cost of raw materials, including steel, iron, plastic, glass, electronic equipment, petroleum products, and paints, significantly impacts the final price of appliances or the profit margins of manufacturers. Prices of these materials are subject to change and fluctuate based on international markets.

- Procuring such raw materials involves additional costs, such as transportation and necessary services, supplier constraints, and challenges in securing favorable arrangements for timely and adequate delivery. These factors collectively shape the pricing dynamics of the market.

What Industry is Household Appliances In?

Household appliances are part of the consumer goods industry, which is all about stuff made for personal and home use - not for factories or businesses. They split into two main groups: "white goods" (or major appliances) and "small appliances." Here's the breakdown:

- Major Appliances (White Goods): It includes large appliances that stay put such as fridges, washing machines, dishwashers, ovens, and air conditioners.

- Small Appliances: It includes appliances that you can move around, like toasters, blenders, coffee makers, and vacuum cleaners.

Exclusive Customer Landscape

The household appliance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the household appliance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, household appliance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arcelik A.S. - The company introduces a cutting-edge 3-door bottom freezer, engineered for optimal freshness preservation of vegetables and fruits. This innovative design ensures consistent temperature control, safeguarding the quality and nutritional value of perishable items. By utilizing advanced insulation technology and thoughtful compartmentalization, this freezer caters to modern households seeking to maintain a well-stocked and healthy pantry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arcelik A.S.

- Breville Group Ltd.

- BSH Hausgerate GmbH

- Dyson Group Co.

- Electrolux group

- Glen Dimplex Group.

- Gorenje Group

- Haier Smart Home Co. Ltd.

- Hamilton Beach Brands Holding Co.

- LG Corp.

- MIDEA Group Co. Ltd.

- Miele and Cie. KG

- MIRC Electronics Ltd.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- SEB Developpement SA

- TEKA INDUSTRIAL SA

- Transform Holdco LLC

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Smart home appliances, enabled by IoT capabilities and Wi-Fi connectivity, are increasingly popular. These appliances offer remote monitoring, control, and energy efficiency, making them attractive to tech-savvy consumers with disposable income. Energy efficiency is a significant factor influencing consumer buying behavior. Energy efficiency labeling and eco-friendly innovations are essential for manufacturers to meet regional market demands. Sustainable manufacturing practices and the use of semiconductor chips are becoming increasingly important in the production of energy-efficient home appliances. The global population's growing living standards and consumer spending power are fueling the demand for advanced features and intelligent home appliances.

Artificial intelligence and touchless tech are becoming standard offerings in various appliances, including cooking appliances, such as sous vide and air frying. E-commerce conversion rates are increasing as consumers turn to digital sales channels and online platforms for convenience. Omnichannel strategies, including virtual product demonstrations and augmented reality applications, are becoming essential for manufacturers to showcase their product visualization capabilities. The market for major appliances, such as washing machines and air conditioners, is expanding, driven by the demand for enhanced design, high efficiency, and premium-quality white goods. Small appliances, including those with smart features, are also gaining popularity, particularly in the high-end segment.

The global supply chain is being impacted by the semiconductor chip shortage, which is affecting the production capabilities of manufacturing facilities. Distributed manufacturing and innovative manufacturing processes are being explored to mitigate the effects of this shortage. Consumer behavior is being influenced by safety alerts and the availability of features such as auto restart and rat protection. The industrial complex is responding by investing in the development of laundry washer-dryer systems and bespoke refrigerators. The market for connected home appliances is growing, with connected refrigerators, washing machines, and air conditioners leading the way. These appliances offer remote control and monitoring, energy savings, and sustainable solutions.

The integration of AI-enabled appliances and the use of apps, such as SmartThings and Home Connect, are making home development and improvement projects more accessible and efficient. In , the market is experiencing significant growth, driven by advancements in technology, shifting consumer preferences, and the need for energy efficiency and sustainability. Manufacturers must adapt to meet these demands by investing in innovative white goods, AI-driven technologies, and eco-friendly manufacturing practices. The use of digital sales channels and omnichannel strategies is also essential for reaching consumers and showcasing product offerings effectively.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 124.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, China, Germany, Japan, Canada, France, UK, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Household Appliance Market Research and Growth Report?

- CAGR of the Household Appliance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the household appliance market growth of industry companies

We can help! Our analysts can customize this household appliance market research report to meet your requirements.