Hunting Apparel Market Size 2025-2029

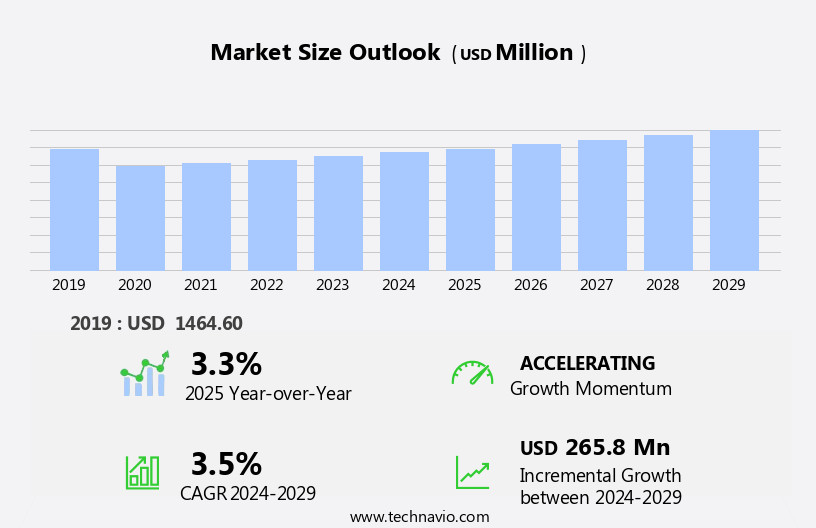

The hunting apparel market size is forecast to increase by USD 265.8 million at a CAGR of 3.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by key trends such as product innovation and product line extension, which contribute to the premiumization of hunting gear. These advancements cater to the increasing demand for smart clothing.

- Additionally, the growing number of hunting license holders fuels market expansion. Specialty hunting stores cater to this market, offering a diverse selection of jackets, pants, and other apparel designed for specific hunting seasons and climates, with the added convenience of e-commerce that allows customers to browse and purchase gear online from anywhere However, regulations on hunting and hunting bans in certain regions pose challenges to market growth.

- Adherence to these regulations is crucial for market players to maintain their market position and ensure ethical and sustainable hunting practices. The market is expected to continue its growth trajectory, with a focus on providing functional, comfortable, and stylish clothing for hunters.

What will be the Size of the Hunting Apparel Market During the Forecast Period?

- The market encompasses a wide range of clothing designed for hunters to blend into their natural environment while ensuring protection and comfort. Key product categories include camouflaged jackets, pants, gloves, and other accessories. Camouflage patterns, derived from foliage and climate, are essential for concealment. Hunters prioritize durability, weather resistance, and quiet fabrics to withstand various conditions. Insulation, moisture-wicking fabrics, and scent control technologies are crucial for maintaining body temperature and minimizing detection by game animals. Ethically sourced materials and recycled fabrics are gaining popularity among environmentally-conscious hunters. Layering systems enable hunters to adapt to changing temperatures and moisture levels during their hunt.

How is the Hunting Apparel Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Top wear

- Bottom wear

- Footwear

- Others

- End-user

- Men

- Women

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Spain

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

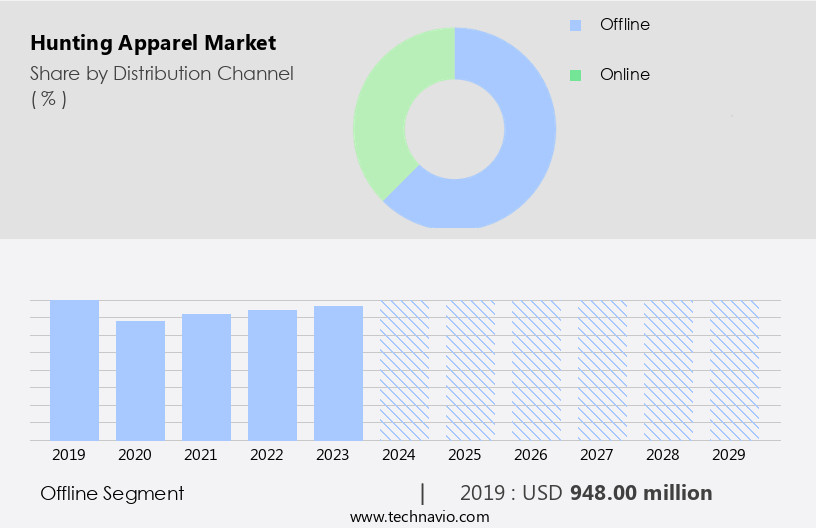

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period. The market experienced significant growth in 2024, with specialty stores accounting for the largest market share in offline distribution. The popularity of hunting apparel and accessories has led to an increase in the number of specialty retail stores. These stores offer a wide selection of brands and product portfolios, setting them apart from department stores. Companies are investing in marketing, advertising, promotions, brand building, training, and IT support to differentiate themselves. Exclusive designer collections and private-label brands provide a competitive edge. Hunters prioritize functionality, durability, and weather resistance in their apparel choices, including jackets, pants, gloves, and moisture-wicking fabrics.

- Camouflage patterns, scent control technologies, and layering systems cater to varying temperatures, moisture levels, and hunting conditions. Consumer preferences for ethically sourced and recycled materials, as well as compliance with regulations, are also influencing market trends. Online platforms and retail networks expand hunting apparel accessibility, with a global presence and brand recognition driving consumer trust and loyalty.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 948.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The North American market is dominated by the United States and Canada, driven by the large hunter population in these countries. Trophy hunting, a recreational activity, is popular among North American hunters, leading them to travel to destinations such as Canada, Mexico, and Africa.

For more insights on the market size of various regions, Request Free Sample

Hunting apparel is essential for hunters to blend with the natural environment, ensuring protection from harsh weather conditions and game animals. Camouflaged clothing with camouflage patterns, durable materials, and weather-resistant fabrics are preferred. Moisture-wicking fabrics and scent control technologies enhance performance in varying temperatures and moisture levels. Hunting jackets, pants, gloves, and specialized hunting stores cater to the functional features and consumer preferences for layering systems. The hunting culture values brand loyalty, quality, and performance, with innovative designs and smart features continuing to influence the market. Compliance with regulations and public opinions shape consumer choices, with ethical sourcing and recycled materials gaining significance. Online platforms and retail networks offer diverse wardrobe options for hunters, expanding the global presence and brand recognition of hunting apparel.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hunting Apparel Industry?

- Product innovation and product line extension leading to product premiumization is the key driver of the market. The market is experiencing growth due to the integration of advanced technologies and innovative designs in hunting clothing. Manufacturers are focusing on creating camouflaged clothing that protects from various hunting conditions, ensuring hunters blend seamlessly into their natural environment. Camouflage patterns, durable materials, and weather-resistant fabrics are essential features in hunting apparel, enabling hunters to withstand harsh climates and changing temperatures. Moreover, the demand for hunting jackets, pants, gloves, and other essentials with moisture-wicking fabrics and scent control technologies has increased among outdoor enthusiasts. Consumer preferences prioritize durability, weather resistance, ethically sourced materials, and recycled materials.

- Layering systems are popular, allowing hunters to adapt to varying moisture levels and hunting conditions. Brand loyalty is strong within the hunting community, with many consumers seeking functional features, moisture-wicking properties, and performance-driven designs. Specialty hunting stores and online platforms cater to this demand, offering a wide range of wardrobe options for hunters. The global presence of these retail networks ensures availability to consumers worldwide. As regulations and public opinions continue to shape the hunting culture, compliance with regulations and controversies surrounding hunting practices influence consumer preferences. The historical significance and tradition of hunting as a recreational activity remain strong, with game animals, hunting terrains (forests, mountains, plains, and wetlands), and diverse game species attracting hunters worldwide.

What are the market trends shaping the Hunting Apparel Industry?

- Growing demand for hunting licenses is the upcoming market trend. Hunting apparel continues to be a significant market as the popularity of hunting activities grows worldwide. The increasing international tourism, particularly in North America, significantly contributes to market expansion. Adventure travel and tourism have been key drivers, with governments easing travel restrictions and lockdown norms. Hunters seek camouflaged clothing for protection and blending into the natural environment, with camouflage patterns mimicking foliage and game animals. Durable and weather-resistant materials, quiet fabrics, moisture-wicking properties, and scent control technologies are essential features.

- Layering systems cater to changing temperatures and moisture levels. Jackets, pants, gloves, and other hunting apparel must offer functional features, including ventilation for rain and wind, safety, and compliance with regulations. Consumer preferences prioritize quality, performance, and ethical sourcing of materials, including recycled options. Online platforms and specialty hunting stores offer a wide range of wardrobe options for outdoor enthusiasts, reflecting the hunting culture's historical and cultural significance.

What challenges does the Hunting Apparel Industry face during its growth?

- Regulations on hunting and hunting bans is a key challenge affecting the industry growth. Hunting apparel plays a crucial role in ensuring hunters' safety, comfort, and success in their pursuit of game animals. Camouflaged clothing is a significant segment of hunting apparel, with camouflage patterns designed to blend hunters into the natural environment, including foliage and terrain. Durable and weather-resistant materials, such as moisture-wicking fabrics and scent control technologies, are essential for hunters, as they face varying climate and seasonal conditions. Jackets, pants, gloves, and other hunting apparel are engineered with functional features, including ventilation, rain protection, wind resistance, insulation, and layering systems, to accommodate changing temperatures and moisture levels. Specialty hunting stores cater to outdoor enthusiasts, offering a wide range of hunting jackets, pants, and other performance-driven designs that prioritize safety, comfort, and compliance with regulations.

- Ethically sourced materials and recycled fabrics are increasingly popular among consumers, reflecting a growing trend toward sustainability in the hunting industry. Brand loyalty is strong among hunters, who value quality, performance, and innovation in their hunting apparel. Regulations and public opinions, including controversies and cultural significance, continue to shape the market. Consumers prefer retail networks and online platforms that offer wardrobe options for various hunting terrains, including forests, mountains, plains, and wetlands. The global presence of leading brands and consumer trust in their products contribute to the market's growth and recognition.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ariat- The company offers hunting apparel such as Hot Leaf Hunting Jacket.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Stitchco Inc.

- BPS Direct LLC

- Clarkfield Outdoors

- Compass Group Diversified Holdings LLC

- DICKS Sporting Goods Inc.

- Drake Waterfowl Systems

- Exxel Outdoors LLC

- Fabbrica dArmi Pietro Beretta S.p.A.

- Gamehide

- Haas Outdoors Inc.

- Kryptek

- KUIU Ultralight Hunting

- NTA Enterprise Inc.

- Prois Hunting

- Scentlok Technologies

- ScoNZ Imports Ltd.

- TOPGUN LTD.

- Under Armour Inc.

- VF Corp.

- W. L. Gore and Associates Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the needs of hunters seeking functional and protective clothing for their outdoor pursuits. This market encompasses a wide range of garments designed to ensure comfort, safety, and blending with the natural environment. Camouflaged clothing, a significant segment within this market, plays a crucial role in enabling hunters to approach game animals undetected. The primary focus of hunting apparel is to provide hunters with adequate protection from various elements of the natural environment. This includes insulation against changing temperatures and moisture levels, as well as durability and weather resistance. Jackets and pants, essential components of hunting apparel, are engineered with quiet fabrics to minimize noise and maintain stealth.

Moreover, camouflage patterns, an essential feature of hunting clothing, are designed to mimic foliage and blend seamlessly with the surroundings. These patterns are meticulously engineered to ensure effective concealment, enhancing the hunter's ability to remain undetected. Durable materials, such as ripstop nylon and heavy-duty denim, are commonly used in the production of hunting apparel. Weather-resistant materials, like Gore-Tex and other waterproof membranes, are also employed to protect hunters from rain and wind. Moisture-wicking fabrics are another essential component, keeping hunters dry and comfortable during their outdoor adventures. Scent control technologies are increasingly becoming popular in hunting apparel, allowing hunters to minimize their scent signature and remain unnoticed by game animals.

Furthermore, ethically sourced materials and recycled fabrics are also gaining traction in the market, appealing to consumers who prioritize sustainability and eco-consciousness. Layering systems are crucial for hunters, enabling them to adapt to varying temperatures and conditions. Hunting jackets and pants are often designed with multiple layers, allowing hunters to add or remove layers as needed. Gloves, hats, and other accessories are also essential components of a hunter's wardrobe, ensuring they are well-equipped for their outdoor activities. The market is driven by the growing popularity of hunting as a recreational activity and outdoor lifestyle trend. Hunting culture, tradition, and the desire for positive experiences in nature contribute significantly to the market's growth. By leveraging retail analytics, hunting apparel brands can better understand consumer preferences and optimize their product offerings, including hunting equipment accessories, to enhance overall sales and customer satisfaction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 265.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.3 |

|

Key countries |

US, China, Germany, UK, France, Canada, Japan, Italy, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hunting Apparel Market Research and Growth Report?

- CAGR of the Hunting Apparel industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hunting apparel market growth of industry companies

We can help! Our analysts can customize this hunting apparel market research report to meet your requirements.