HVAC Air Filter Market Size 2025-2029

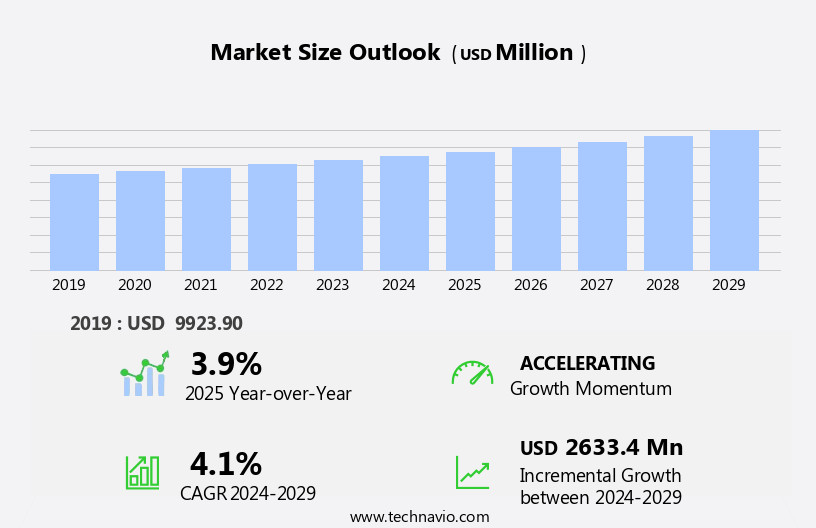

The HVAC air filter market size is forecast to increase by USD 2.63 billion at a CAGR of 4.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing number of data centers and growing awareness regarding indoor air quality. With the digital age expanding, the demand for reliable cooling systems to maintain optimal temperature and humidity levels in data centers is on the rise. HVAC air filters play a crucial role in ensuring the efficient functioning of these systems by removing contaminants and maintaining air quality. Moreover, the importance of indoor air quality in various sectors, including healthcare, education, and commercial buildings, is gaining recognition. This trend is driving the demand for advanced HVAC air filters that offer enhanced filtration capabilities and longer service life. These systems rely on air filters to ensure efficient airflow and effective removal of contaminants, making them an essential component of data center infrastructure.

- However, the market is not without challenges. The need for regular maintenance and replacement of HVAC air filters is essential to ensure optimal system performance and energy efficiency. Failure to do so can result in increased energy consumption, reduced indoor air quality, and potential health risks. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on developing innovative filter technologies, offering maintenance services, and educating consumers on the importance of regular filter replacement. Air quality systems, including air conditioners (ACs), air handlers, fan coils, terminal units, and ventilation systems, benefit from these filters.

What will be the Size of the HVAC Air Filter Market during the forecast period?

- The market is experiencing significant growth due to the increasing focus on occupant comfort and indoor environmental quality in commercial buildings. Air quality management is a top priority, with stringent air quality standards mandating effective air quality control. Filtration technology innovations, such as advanced filtration systems and humidity control, play a crucial role in managing microbial growth and addressing airborne pathogens. Filtration technology advancements, including filter efficiency comparison and selection guides, enable HVAC designers to optimize system performance and reduce operating costs. Temperature control and energy savings are also key considerations, as businesses seek to minimize expenses while maintaining a comfortable work environment. Air purifiers, dust collectors, and baghouse filters are additional filtration systems used in various applications to ensure optimal indoor air quality.

- Filtration system replacement and air filtration regulations are essential factors driving market growth. Air quality improvement and airborne particle reduction are critical for maintaining building health and ensuring compliance with regulations. Filtration solutions, including filtration system design and air quality testing, are essential for ensuring HVAC system performance and overall business success. HVAC industry trends, such as the integration of filtration technology into HVAC design software, are propelling the market forward. Energy savings and cost-effective solutions are increasingly important, as businesses seek to minimize expenses while maintaining a healthy and comfortable indoor environment.

How is this HVAC Air Filter Industry segmented?

The HVAC air filter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Building and construction

- Automotive

- Pharmaceutical

- Food and beverage

- Others

- End-user

- Non-residential

- Residential

- Product Type

- Fiberglass filter

- Pleated filter

- Electrostatic filter

- Carbon air filter

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

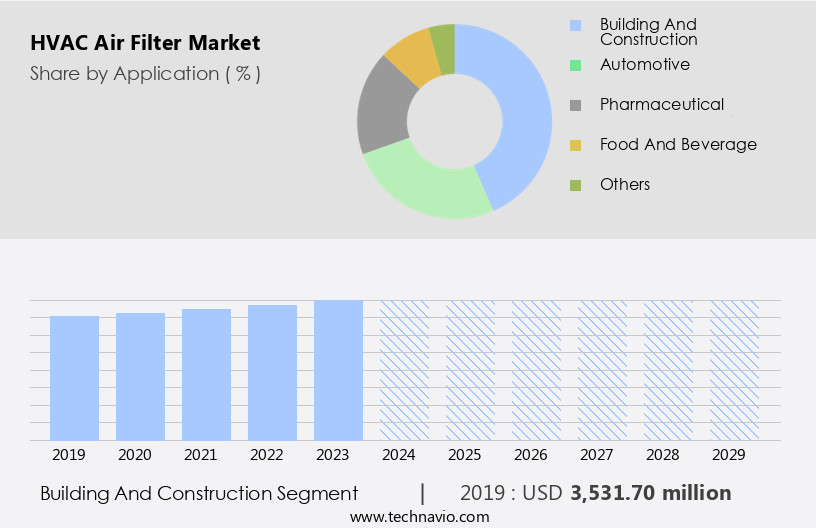

By Application Insights

The building and construction segment is estimated to witness significant growth during the forecast period. Air filtration systems play a crucial role in air conditioning, heating, and ventilation systems within commercial structures. The primary objective is to maintain optimal indoor air quality by eliminating impurities and safeguarding equipment from dirt and debris buildup. This is essential for health and safety reasons, as air filtration prevents the spread of airborne germs and viruses, reducing the risk of postoperative illnesses. Moreover, it minimizes the accumulation of dust, which helps preserve furniture, electronics, and decor from staining. Additionally, filtration systems remove lint and other particles from ducting, thereby reducing the need for frequent cleaning of interior maintenance necessities and mitigating the risk of fire.

The Building and construction segment was valued at USD 3.53 billion in 2019 and showed a gradual increase during the forecast period. Furthermore, air filtration systems help prolong the shelf life of perishable items by eliminating airborne mold. Incorporating advanced technologies like HEPA filtration, electrostatic filtration, and smart filters can enhance the system's performance and efficiency. Energy efficiency is another essential factor, with energy standards and filter performance tracking playing a significant role in optimizing the system's operation. Regular maintenance schedules and automated filter replacement systems ensure the filtration system operates at its best, providing a healthier and more productive work environment.

Regional Analysis

APAC is estimated to contribute 63% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing notable growth due to the industrial expansion in countries like India, China, and Japan. This growth can be attributed to the increasing demand for HVAC air filters in the commercial and residential construction sectors and manufacturing industries. The healthcare sector is a significant contributor to this trend, as HVAC systems play a crucial role in maintaining a contamination-free environment. Governments are investing heavily in healthcare facilities, particularly in China and India, to improve infrastructure and promote the sector's growth. For instance, India has allowed 100% foreign direct investment (FDI) in the healthcare sector, attracting private investments and driving expansion. Solar photovoltaics and Solar energy are gaining popularity as renewable energy for powering HVAC systems.

Energy efficiency, filtration efficiency, and air quality are key concerns in the HVAC industry. Filtration media, such as HEPA and carbon, are essential components of HVAC systems, ensuring the removal of airborne contaminants like mold spores, dust mites, pet dander, and other allergens. Advanced filtration technologies, including electrostatic filtration, photocatalytic oxidation, and UV air purifiers, offer enhanced filtration capabilities and improved indoor air quality. Building automation and smart filters enable remote control, filter performance tracking, and maintenance schedules, ensuring optimal filter capacity and MERV rating. Air quality monitoring and energy standards are essential considerations in HVAC design, driving the market's growth. Passive heating, ventilation, and daylighting opportunities are also being explored to reduce the reliance on mechanical systems and further improve energy efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the HVAC Air Filter market drivers leading to the rise in the adoption of Industry?

- Increasing number of data centers is the key driver of the market. The market has experienced significant growth due to the increasing number of data centers worldwide. This growth can be attributed to the rising dependency on the Internet and advancements in technology. With the expansion of technology companies and communication service providers (CSPs), there is a growing need to store and process large datasets, leading to an increase in the number of data centers. However, managing the temperature in data centers is a major challenge. Overheating can negatively impact productivity and cause downtime.

- The expansion of data centers has experienced significant growth in recent years, driven by the increasing reliance on the Internet and technological advancements. Numerous technology companies are investing in expanding their data center infrastructure to accommodate larger datasets. Communication service providers (CSPs) and co-location data center providers are also increasing their offerings to meet the connectivity demands of their clients. However, overheating remains a major concern in data centers, as it negatively impacts productivity and increases downtime. To mitigate this issue, advanced cooling systems and energy-efficient technologies are being adopted to maintain optimal operating temperatures. The data center market is expected to continue its growth trajectory, presenting opportunities for companies in the industry.

What are the HVAC Air Filter market trends shaping the Industry?

- Growing awareness about indoor air quality is the upcoming market trend. Indoor Air Quality (IAQ) plays a significant role in maintaining the health and well-being of individuals occupying a space. In developed nations, people spend approximately 90% of their time indoors, yet remain unaware of the potential pollutants present. Indoor pollution can lead to various health issues, including eye and nose irritation, headaches, dizziness, and fatigue. Long-term exposure may result in respiratory diseases, heart conditions, and cancer. To mitigate indoor pollution, the concept of green buildings is gaining popularity in many countries.

- Indoor Air Quality (IAQ) is a critical concern in developed countries where people spend a significant portion of their time indoors, often unaware of the harmful pollutants present. IAQ can negatively impact health and well-being, leading to short-term symptoms such as eye, nose, and throat irritation, headaches, dizziness, and fatigue. Long-term exposure to contaminated indoor air can result in more serious health issues, including respiratory diseases, heart diseases, and cancer. In response, many countries are promoting the concept of green buildings to mitigate indoor pollution. This market trend is driven by increasing awareness of the health risks associated with poor IAQ and growing regulatory support for green building standards. The adoption of advanced filtration technologies and the integration of IAQ monitoring systems in buildings are key factors contributing to the growth of this market. Overall, the market for HVAC air filters is expected to experience steady growth due to the increasing demand for cleaner and healthier indoor environments.

How does HVAC Air Filter market faces challenges face during its growth?

- Need for regular maintenance for HVAC air filters is a key challenge affecting the industry growth. HVAC air filters play a crucial role in maintaining the efficiency and effectiveness of heating, ventilation, and air conditioning systems. Electrostatic air filters, in particular, require regular cleaning due to their multiple layers that trap particles. However, these filters are often overlooked, leading to decreased system performance. Neglecting air filter maintenance can result in clogged filters, obstructing normal airflow and affecting the purification system's efficiency. The blocked airflow forces the system to work harder, increasing energy consumption and potentially damaging the evaporator coil. Regular cleaning and replacement of air filters are essential to ensure optimal system performance and longevity. Maintaining clean air filters not only enhances indoor air quality but also saves energy and reduces repair costs.

Exclusive Customer Landscape

The HVAC air filter market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the HVAC air filter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, HVAC air filter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company provides a range of HVAC air filtration solutions, including electrostatic filters, under the 3M Filtrete brand.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Air Filter Industries Pvt. Ltd.

- Air Filtration Solutions Ltd.

- Airsan

- Camfil AB

- Carrier Global Corp.

- Daikin Industries Ltd.

- Donaldson Co. Inc.

- Fab Tex Filtration

- FlaktGroup Holding GmbH

- Fumex Inc.

- Koninklijke Philips NV

- Lennox International Inc.

- MANN HUMMEL International GmbH and Co. KG

- Parker Hannifin Corp.

- Pearl Filtration

- Samsung Electronics Co. Ltd.

- Steril Aire LLC

- Unilever PLC

- VIRGIS FILTERS SPA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing awareness of indoor air quality and its impact on health and productivity. Air filtration technology has evolved to cater to various industries and applications, integrating data analytics, smart homes, and connected devices. Air quality regulations and green building standards have played a pivotal role in driving the demand for advanced filtration systems. These regulations ensure that air handling units (AHUs) meet specific filtration efficiency requirements to maintain acceptable indoor air quality. The integration of building automation systems and HVAC design has led to energy-efficient solutions that optimize filter life and reduce energy consumption.

HVAC equipment manufacturers have focused on developing filtration media with high filtration efficiency and low resistance to improve overall system performance. Airborne contaminants such as dust mites, pet dander, mold spores, and airborne bacteria are major concerns in both residential and commercial settings. Filtration technology has advanced to include HEPA filtration, electrostatic filtration, photocatalytic oxidation, and UV air purifiers, providing effective solutions for removing these contaminants. The market for air cleaners and air purifiers has gained momentum due to health concerns and increasing air pollution levels. Smart filters and automated filter replacement systems have been introduced to enhance convenience and reduce maintenance requirements.

Energy efficiency is a critical factor in the HVAC industry, and filter performance tracking and maintenance schedules have become essential for optimizing energy usage and ensuring consistent air quality. MERV rating and filter capacity are important considerations when selecting filters for HVAC systems, ventilation systems, and air purifiers. The HVAC industry is continually evolving, with a focus on sustainability and innovative filtration technologies. Filtration media and energy standards are being developed to address the growing demand for eco-friendly and cost-effective solutions. In the industrial sector, HVAC systems are being designed to meet stringent filtration requirements and maintain optimal air quality for worker safety and productivity.

Building codes and regulations are being updated to reflect the importance of indoor air quality and the role of filtration technology in maintaining healthy environments. The integration of filtration technology into HVAC systems and building automation has led to significant advancements in the industry. Filtration technology is no longer a standalone component but an integral part of the HVAC system, ensuring energy efficiency, improved indoor air quality, and reduced maintenance requirements. The market is expected to continue its growth trajectory, driven by increasing awareness of health concerns, evolving regulations, and advancements in filtration technology. The market is poised to offer numerous opportunities for manufacturers, suppliers, and integrators, as they strive to provide innovative and cost-effective solutions for various industries and applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HVAC Air Filter Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2025-2029 |

USD 2.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, China, Japan, India, South Korea, Canada, UK, Australia, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HVAC Air Filter Market Research and Growth Report?

- CAGR of the HVAC Air Filter industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the HVAC air filter market growth of industry companies

We can help! Our analysts can customize this HVAC air filter market research report to meet your requirements.