Hydrogen Sulfide (H2S) Scavenger Market Size 2025-2029

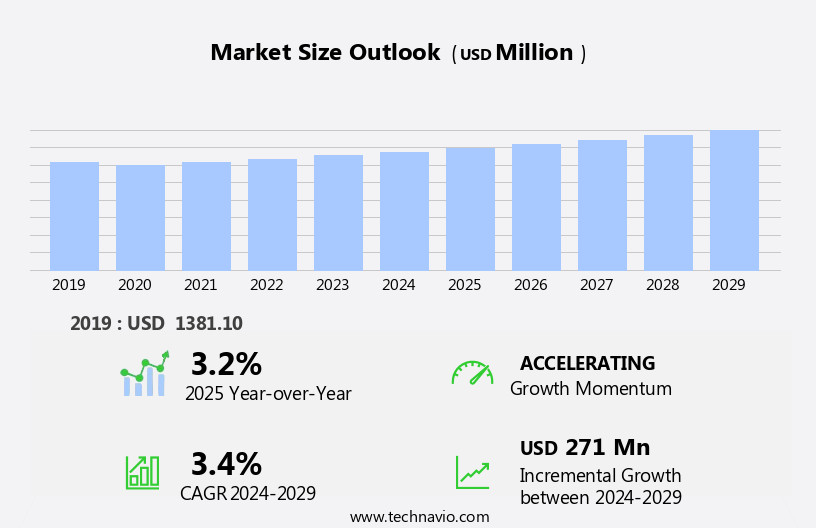

The hydrogen sulfide (h2s) scavenger market size is forecast to increase by USD 271 million, at a CAGR of 3.4% between 2024 and 2029.

- The market is driven by the global expansion of oil and gas refinery capacity, as these facilities require effective H2S removal systems to ensure safe and efficient operations. Additionally, the adoption of Internet of Things (IoT) technology in industrial emission control systems is a significant trend, enabling real-time monitoring and optimization of H2S scavenging processes. However, the market faces challenges, including the volatility of crude oil prices, which can impact the profitability of H2S scavenging projects. Furthermore, stringent regulations on H2S emissions necessitate continuous innovation and improvement in scavenging technologies to meet evolving compliance requirements.

- Companies seeking to capitalize on market opportunities must stay abreast of technological advancements and regulatory developments, while navigating the price volatility in the oil and gas sector.

What will be the Size of the Hydrogen Sulfide (H2S) Scavenger Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, driven by the diverse needs of various sectors, including natural gas processing, refining processes, and petrochemical processes. H2S, a corrosive and toxic gas, poses significant risks to both human health and safety and the environment. In natural gas processing, H2S is often encountered during the production and processing of sour gas. To mitigate the risks associated with H2S, remote monitoring and control systems are employed for leak detection and real-time gas analysis. Industrial hygiene practices, such as respiratory protection, are essential to safeguard workers from exposure. Refining processes also require H2S scavenging to prevent corrosion and maintain pipeline integrity.

Life cycle assessment and cost reduction are critical factors in the selection of scavenging technologies. Amine treating and data analytics are commonly used to optimize processes and improve efficiency. Gas treating processes employ reactive scavengers to remove H2S from natural gas streams, ensuring regulatory compliance and reducing emissions. In pipeline integrity management, H2S scavenging plays a crucial role in preventing corrosion and maintaining the structural integrity of pipelines. The ongoing focus on process safety and environmental regulations necessitates the adoption of advanced monitoring systems, safety showers, emergency response plans, and emission control technologies. H2S scavengers are integral to these systems, ensuring the safe and efficient production and processing of hydrocarbons.

Material selection, spill containment, and sulphur recovery are other areas where H2S scavengers find applications. The market dynamics in the H2S scavenger market are shaped by the evolving needs of these sectors, with a constant emphasis on cost reduction, process optimization, and risk management.

How is this Hydrogen Sulfide (H2S) Scavenger Industry segmented?

The hydrogen sulfide (h2s) scavenger industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Oil and gas

- Water and wastewater treatment

- Others

- Type

- Non-regenerative

- Regenerative

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

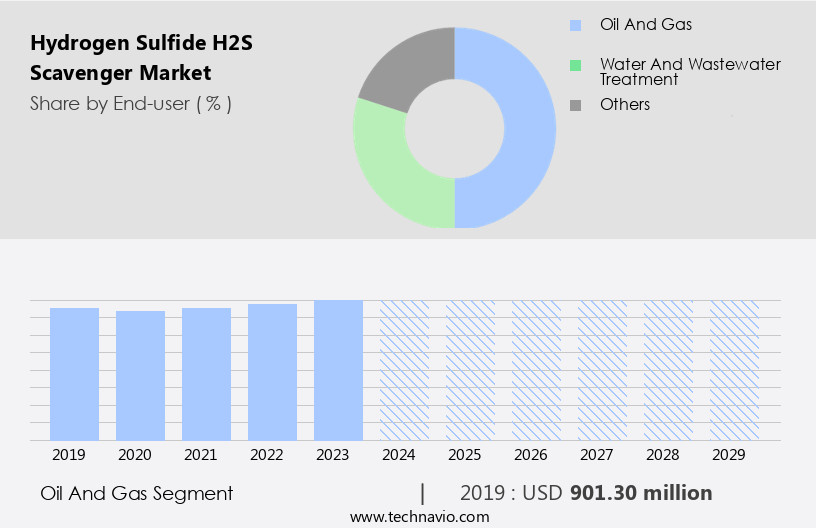

The oil and gas segment is estimated to witness significant growth during the forecast period.

The market is a critical component in the oil and gas industry, particularly in natural gas processing. Hydrogen sulfide, a byproduct of crude oil and natural gas production, can pose significant risks to both occupational safety and environmental impact. To mitigate these risks, H2S scavengers are employed to minimize the concentration of hydrogen sulfide in hydrocarbon production fluids. Hydrogen sulfide is formed during the decay of organic matter in sedimentary formations and is released during drilling, completion, and servicing operations. The H2S scavenger, which can be reactive or oxidative, is injected into the hydrocarbon stream to neutralize hydrogen sulfide and prevent its release.

This not only ensures compliance with environmental regulations and improves process safety but also enhances pipeline integrity, reduces corrosion, and optimizes refining processes. Maintenance procedures, such as chemical injection and monitoring systems, play a crucial role in the effective implementation of H2S scavenging. Remote monitoring and control systems enable real-time detection of hydrogen sulfide leaks, enabling prompt response and reducing the risk of costly downtime. Training programs for industrial hygiene and respiratory protection are essential for ensuring the safety of workers handling H2S. In addition, H2S scavengers contribute to efficiency improvements by minimizing the need for costly spill containment measures and sulphur recovery processes.

They also play a role in emission control, wastewater treatment, and gas analyzers, ensuring compliance with environmental regulations and enhancing overall process optimization. The H2S scavenger market is expected to grow significantly due to the increasing demand for natural gas and the need to ensure process safety, environmental compliance, and cost reduction in the oil and gas industry. The market's evolution is driven by advancements in technology, including data analytics and risk management systems, which enable more effective and efficient H2S scavenging.

The Oil and gas segment was valued at USD 901.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

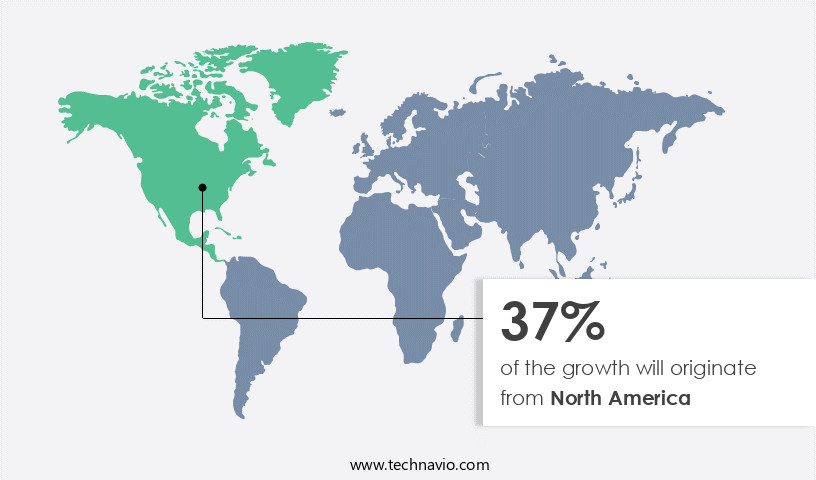

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The H2S scavenger market in North America is experiencing significant growth due to increasing investments in natural gas processing facilities and petrochemical complexes in the US, Canada, and Mexico. The natural gas industry's expansion is driving the demand for H2S scavengers in natural gas processing, as these chemicals are essential for removing hydrogen sulfide (H2S) from natural gas streams to meet pipeline specifications and ensure safe transportation. Additionally, the production of fertilizers and biofuels in the region is increasing the demand for H2S scavengers in these industries. The US petrochemical sector's growth is a significant factor fueling the market's expansion.

The country's abundant natural gas resources make it an inexpensive feedstock for petrochemical production, leading to a surge in petrochemical production capacity. Furthermore, the relative decline in natural gas availability in the Middle East is prompting some petrochemical manufacturers to establish production bases in the US. H2S scavengers play a crucial role in various industrial applications, including odor control, safety procedures, and environmental regulations. In natural gas processing, they prevent the corrosive effects of H2S on pipelines and equipment, ensuring pipeline integrity and reducing the risk of costly leaks. In refining processes, they help improve efficiency and reduce emissions, while in the petrochemical industry, they are used in sulfur recovery and corrosion inhibition processes.

The market's growth is also influenced by the increasing focus on process optimization, monitoring systems, and risk management. H2S scavengers help improve process safety by reducing the risk of explosions and other hazardous situations. They are also essential for regulatory compliance, as environmental regulations limit the amount of H2S that can be released into the environment. In conclusion, the H2S scavenger market in North America is experiencing robust growth due to the expansion of the natural gas and petrochemical industries. These chemicals are essential for various industrial applications, including natural gas processing, refining, and petrochemical production. The market's growth is driven by the need for process optimization, monitoring systems, and risk management, as well as regulatory compliance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market represents a significant segment in the industrial gas industry, focusing on the production and application of H2S scavengers to mitigate the risks and challenges associated with H2S emissions. H2S scavengers are essential in various industries, including oil and gas production, wastewater treatment, and chemical manufacturing, where H2S is generated or encountered. These scavengers effectively neutralize H2S, preventing its release into the environment and ensuring compliance with stringent regulatory standards. Key players in the market offer a range of H2S scavenger technologies, including activated carbon, iron sponge, and molecular sieves, each with unique advantages in terms of capacity, selectivity, and regeneration requirements. Additionally, ongoing research and development efforts aim to improve the efficiency and sustainability of H2S scavenger systems, further driving market growth.

What are the key market drivers leading to the rise in the adoption of Hydrogen Sulfide (H2S) Scavenger Industry?

- The increase in global oil and gas refinery capacity serves as the primary driver for market growth in this sector.

- The H2S scavenger market is driven by the increasing demand for leak detection and odor control in natural gas processing. With the rise in crude oil production, the need for production chemicals, including H2S scavengers, has surged. Hydrogen sulfide is a byproduct of crude oil and is formed during the refining process. Its presence in hydrocarbon streams can be detrimental, as it poses risks to occupational safety and environmental impact. To mitigate these risks, refineries employ H2S scavengers, which react with hydrogen sulfide to form a stable and water-soluble product. This allows for effective removal of hydrogen sulfide from the system, ensuring the safety of workers and reducing environmental emissions.

- Moreover, remote monitoring and control systems have become essential in the natural gas industry, enabling real-time detection of H2S leaks and minimizing the risk of accidents. Chemical injection technology is also a critical component of H2S scavenger systems, as it ensures precise dosing and optimal performance. Effective risk management is a top priority for companies in the oil and gas sector. H2S scavengers play a crucial role in this regard, helping to minimize the risks associated with hydrogen sulfide and maintain the integrity of processing systems. By investing in advanced H2S scavenger technologies, companies can improve their operational efficiency, enhance safety, and reduce their environmental footprint.

What are the market trends shaping the Hydrogen Sulfide (H2S) Scavenger Industry?

- The adoption of IoT technology in industrial emission control systems is a current market trend, gaining increasing popularity. This technological advancement enhances the efficiency and effectiveness of emission monitoring and reduction processes.

- The market is gaining significant attention due to the increasing demand for improving air quality and ensuring industrial hygiene. In refining processes, H2S is a common byproduct that requires effective removal to prevent potential health hazards and environmental concerns. H2S can cause respiratory issues, making respiratory protection a priority in industrial settings. Advancements in technology, such as data analytics, have enabled the optimization of gas treating processes, leading to cost reduction and improved pipeline integrity. The application of H2S scavengers in amine treating processes is essential for the removal of H2S from natural gas streams, particularly in sour gas production.

- Life cycle assessment studies have shown that the use of H2S scavengers can lead to significant cost savings and environmental benefits. The integration of Big Data capabilities, including analytics and machine learning, can provide valuable insights into H2S levels, causes, and fluctuations, enabling more effective and efficient interventions. In conclusion, the H2S scavenger market is driven by the need to ensure industrial hygiene, improve pipeline integrity, and reduce costs in refining processes. The application of advanced technologies, such as data analytics and real-time sensors, can provide valuable insights and enable more effective H2S removal, ultimately contributing to improved air quality and a safer working environment.

What challenges does the Hydrogen Sulfide (H2S) Scavenger Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The H2S scavenger market is driven by various industrial sectors, with market growth contingent upon the global economy's strength. As economic conditions improve, the demand for manufactured goods and services increases, leading to an uptick in H2S scavenger market demand. However, market expansion can be hindered by volatile raw material prices, which negatively impact supplier profitability and market supply. Crude oil price fluctuations pose significant challenges to the H2S scavenger market, as these elements influence the cost of production and the overall market dynamics.

- To mitigate risks and ensure process safety, it is essential for businesses to invest in gas detection technologies, training programs, and efficient material selection. Additionally, adherence to environmental regulations and regulatory compliance is crucial for market players. Implementing spill containment measures, sulphur recovery processes, and corrosion inhibition techniques can further enhance market competitiveness and sustainability.

Exclusive Customer Landscape

The hydrogen sulfide (h2s) scavenger market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hydrogen sulfide (h2s) scavenger market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hydrogen sulfide (h2s) scavenger market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arkema - The company provides a hydrogen sulfide scavenging solution, branded as Norust, for the removal of H2S in oil, gas, and water applications. This technology ensures adherence to the most stringent health, safety, and environmental regulations. The Norust solution effectively mitigates hydrogen sulfide risks, safeguarding personnel and the environment. It is a reliable and efficient choice for industries seeking to maintain operational excellence and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema

- Baker Hughes Co.

- BASF SE

- Cestoil Chemical Inc.

- Chemical Products Industries Inc.

- Dorf Ketal Chemicals India Pvt. Ltd.

- Ecolab Inc.

- General Electric Co.

- Halliburton Co.

- Hexion Inc.

- Innospec Inc.

- Merichem Co.

- Newpoint Gas LLC

- Schlumberger Ltd.

- Sofina SA

- Solvay SA

- The Dow Chemical Co.

- Vink Chemicals GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hydrogen Sulfide (H2S) Scavenger Market

- In January 2024, Air Products and Chemicals, a leading industrial gases company, announced the launch of its new HydroSolve H2S scavenger product line, designed to remove hydrogen sulfide (H2S) from natural gas streams more efficiently than previous technologies (Air Products and Chemicals Press Release, 2024).

- In March 2024, Linde plc and Praxair, Inc. Completed their merger to form Linde plc, creating a global leader in industrial gases, including H2S scavenging solutions (Linde plc Press Release, 2024). This merger allowed the combined company to expand its product offerings and geographic reach in the H2S scavenger market.

- In May 2024, the U.S. Environmental Protection Agency (EPA) issued new regulations requiring stricter H2S emission limits for oil and gas facilities, driving demand for advanced H2S scavenging technologies (EPA Press Release, 2024).

- In April 2025, Amtex Systems, a leading provider of H2S scavenging systems, secured a USD10 million contract from a major oil and gas producer to supply its H2SGuard technology for a new natural gas processing facility in the Permian Basin (Amtex Systems Press Release, 2025). This significant contract win underscores the growing demand for effective H2S scavenging solutions in the oil and gas industry.

Research Analyst Overview

- The H2S scavenger market experiences dynamic activity, driven by the need for effective H2S removal in various industries. Performance evaluation and product testing are crucial in ensuring the efficiency and reliability of H2S scavengers. Strategic alliances and technology licensing foster innovation, while technical support and data logging enable continuous improvement. Waste management and gas purification are key applications, requiring robust solutions for risk assessment and environmental remediation. Best practices in sulfur removal involve sensor technology for real-time monitoring and quality control.

- Hazard analysis and joint ventures help mitigate risks and ensure compliance with industry standards. Regulatory reporting and compliance audits are essential for maintaining transparency and safety training for workforce. Product stewardship and contract manufacturing require strong partnerships and intellectual property protection. Application engineering and H2S removal solutions contribute to supply chain management and enhance overall process control.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hydrogen Sulfide (H2S) Scavenger Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 271 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, Canada, China, Japan, India, UK, Germany, South Korea, France, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydrogen Sulfide (H2S) Scavenger Market Research and Growth Report?

- CAGR of the Hydrogen Sulfide (H2S) Scavenger industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydrogen sulfide (h2s) scavenger market growth of industry companies

We can help! Our analysts can customize this hydrogen sulfide (h2s) scavenger market research report to meet your requirements.