Hyperscale Data Center Market Size 2025-2029

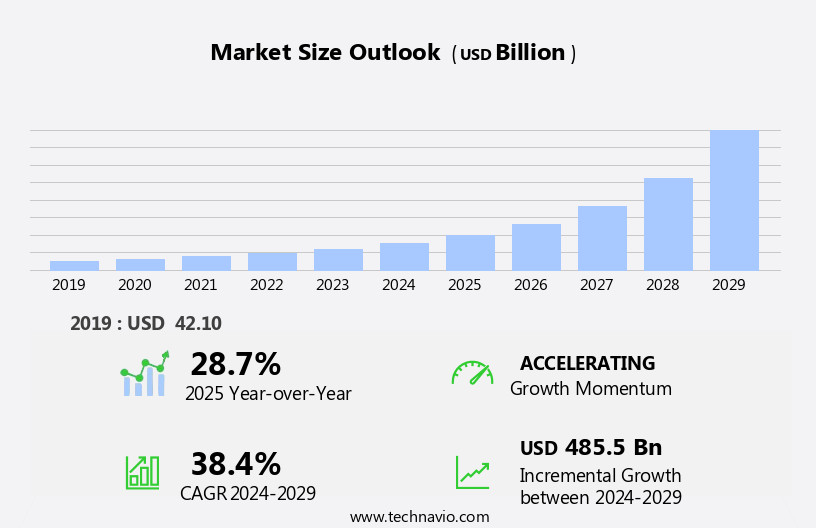

The hyperscale data center market size is forecast to increase by USD 485.5 billion, at a CAGR of 38.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the escalating demand for data center colocation facilities. Businesses are increasingly seeking to outsource their IT infrastructure to hyperscale data centers, which offer cost savings, improved scalability, and enhanced security. Additionally, advancements in infrastructure technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT), are fueling the need for more robust and efficient data center solutions. However, the market also faces challenges. The consolidation of data centers is intensifying competition, as major players continue to expand their offerings and acquire smaller competitors. Furthermore, the increasing complexity of managing large-scale data centers presents operational challenges, including energy efficiency, cooling systems, and network connectivity.

- Companies must navigate these obstacles to effectively capitalize on the market's potential and maintain a competitive edge. To succeed, they must focus on delivering innovative solutions that address the evolving needs of their customers while ensuring operational efficiency and cost-effectiveness.

What will be the Size of the Hyperscale Data Center Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Cloud storage solutions are increasingly being adopted, leading to data center consolidation and the rise of modular data centers. Power management and data center efficiency are key areas of focus, with an emphasis on renewable energy and green data centers. Cloud service providers are expanding their offerings, incorporating block storage, database services, and data analytics platforms. Data center construction and simulation tools are streamlining the design process, while data center interconnection and network security solutions are enhancing connectivity and protecting against cyber threats. High-performance computing and managed services are driving innovation in various sectors, including finance, healthcare, and research.

Data sovereignty and data governance are becoming crucial considerations, with DNS management and IP addressing playing important roles in ensuring data privacy and compliance. Micro data centers and edge computing are gaining traction, extending data processing capabilities closer to the source. Hyperscale computing and load balancers are enabling scalable infrastructure, while hybrid cloud models and business continuity solutions are ensuring uptime and disaster recovery. Data center optimization, capacity planning, and virtualization technologies are optimizing network bandwidth and server utilization. Power usage effectiveness and water usage effectiveness are essential metrics, with building management systems and environmental monitoring solutions helping to reduce carbon footprint.

Data center certifications and standards are ensuring best practices and driving industry growth. Cloud cost optimization and cloud migration are ongoing priorities, with infrastructure as code and machine learning solutions streamlining operations and reducing costs. Artificial intelligence and network switches are enhancing network performance and enabling new applications. Fiber optic cables and data center automation are improving network connectivity and efficiency. Overall, the market is characterized by continuous innovation and evolution, with a diverse range of applications and technologies shaping its future.

How is this Hyperscale Data Center Industry segmented?

The hyperscale data center industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Critical infrastructure

- Support infrastructure

- End-user

- BFSI

- Energy

- IT

- Others

- Component

- Solutions

- Service

- Deployment Type

- Greenfield

- Brownfield

- Greenfield

- Brownfield

- Energy Source

- Renewable Energy

- UPS Systems

- Hybrid Power

- Energy Storage

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

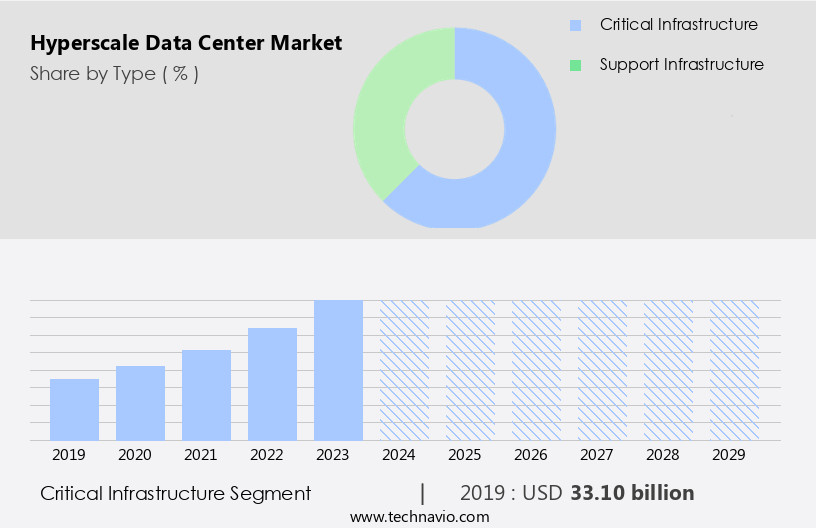

By Type Insights

The critical infrastructure segment is estimated to witness significant growth during the forecast period.

In the dynamic data center market, design plays a crucial role in accommodating various technologies such as NoSQL databases, edge computing, DDoS protection, software-defined networking, content delivery networks, and more. Renewable energy and green data centers are increasingly prioritized to reduce carbon footprint, aligning with cloud native and serverless computing trends. Uptime Institute's performance monitoring and intrusion detection systems ensure data center optimization and security. Database services, file storage, and disaster recovery solutions are essential components of the data center ecosystem. Circular economy principles are integrated into data center operations through efficient power management, cooling systems, water usage effectiveness, and building management systems.

Data compliance is ensured through rigorous data governance and certification processes. Cloud computing models, including private, public, and hybrid, offer flexibility in capacity planning and network virtualization. Bare metal servers, virtual machines, and containerization provide various deployment options for applications. Capacity planning and network bandwidth are critical considerations for cloud service providers offering block storage, data center security, and power usage effectiveness. Data analytics platforms enable businesses to gain insights from their data, while data center construction and simulation tools optimize infrastructure design. Data center interconnection and network security ensure seamless data transfer and protection. High-performance computing, managed services, and data sovereignty address specific industry requirements.

Micro data centers and edge data centers extend data processing capabilities closer to the source, enhancing network performance and reducing latency. Hyperscale computing, load balancers, and hybrid cloud solutions cater to the evolving needs of businesses. Data backup, network performance, and business continuity are essential elements of any robust data center strategy. IP addressing and infrastructure as code enable automation and streamlined management. Data center standards, cloud cost optimization, and cloud migration tools facilitate smooth transitions to modern data center architectures. Machine learning and artificial intelligence are transforming data center operations, improving efficiency and performance. Environmental monitoring, intrusion prevention systems, and object storage address emerging challenges in data center management.

Fiber optic cables and network switches ensure reliable and high-speed data transfer. Sustainable data centers, energy efficiency, and data visualization tools help businesses make informed decisions and optimize their data center investments.

The Critical infrastructure segment was valued at USD 33.10 billion in 2019 and showed a gradual increase during the forecast period.

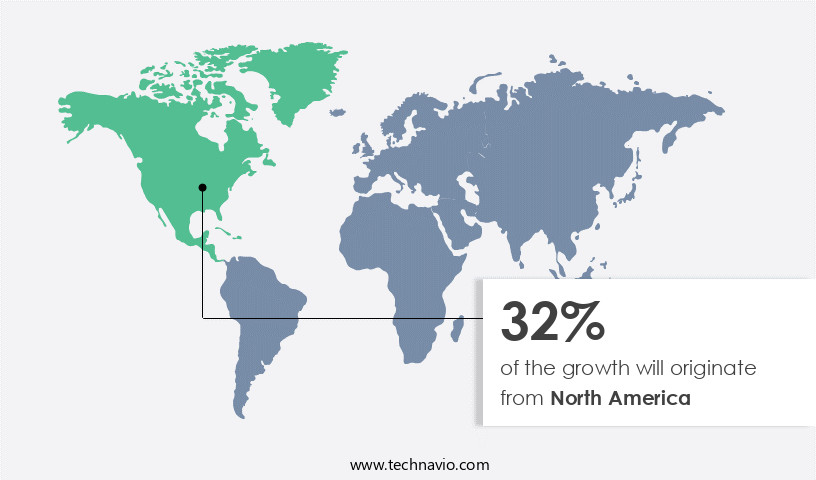

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic North American market, the US dominates data center spending, with significant investments in sustainable power sources and data center construction. Hyperscale data centers, controlled by Content Delivery Networks (CDNs), colocation providers, and media transmission associations, are prevalent in the region. Major corporations, including Alphabet Inc. (Google), Microsoft Corp., Facebook Inc., Apple Inc., and Amazon.Com Inc. (Amazon Web Services), headquartered in the US, contribute to the market's growth. Local server farm framework companies, such as Dell Technologies Inc., further strengthen the market's ecosystem. Data center design continues to evolve with the adoption of cloud-native technologies, renewable energy, and green data centers.

Edge computing, DDoS protection, software-defined networking, and content delivery networks are integral components of modern data center infrastructure. Database services, file storage, and disaster recovery solutions are essential for businesses seeking data center optimization and business continuity. Cloud security, data center automation, network bandwidth, cooling systems, and water usage effectiveness are critical factors for data center efficiency and performance monitoring. Building management systems, data compliance, and data center certifications ensure data governance and data privacy. Big data analytics, machine learning, and artificial intelligence are transforming data center operations and management. Network security, high-performance computing, managed services, and hybrid cloud solutions are essential for businesses seeking to optimize their cloud infrastructure and reduce costs.

Power management, data center simulation, and data center interconnection are key areas of focus for data center efficiency and sustainability. Data visualization, energy efficiency, and network switches are essential for effective data center management and performance optimization. The circular economy, intrusion detection systems, and object storage are gaining traction as businesses adopt more sustainable and cost-effective data storage solutions. In conclusion, the North American data center market is experiencing significant growth, driven by investments in sustainable power sources, cloud infrastructure, and advanced technologies. The market's evolution is shaped by the integration of various components, including data center design, edge computing, DDoS protection, software-defined networking, content delivery networks, renewable energy, green data centers, data center optimization, remote monitoring, serverless computing, uptime institute, performance monitoring, intrusion detection systems, database services, file storage, circular economy, disaster recovery, SQL databases, cloud security, data center automation, network bandwidth, cooling systems, water usage effectiveness, building management systems, data compliance, data center ecosystem, data backup, network performance, cloud computing models, bare metal servers, data privacy, data center certifications, big data analytics, data storage, virtual machines, capacity planning, network virtualization, server virtualization, tiered data centers, cloud storage, data center consolidation, modular data centers, power management, data center efficiency, cloud service providers, block storage, data center security, power usage effectiveness, data analytics platforms, data center construction, data center simulation, data center interconnection, network security, high-performance computing, managed services, data sovereignty, DNS management, micro data centers, hyperscale computing, load balancers, hybrid cloud, business continuity, data center footprint, data governance, and cloud infrastructure.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hyperscale Data Center Industry?

- The increasing demand for colocation facilities in data centers serves as the primary market driver.

- Colocation data centers offer enterprises significant cost savings and improved connectivity by renting out computing servers, storage, and network equipment. These facilities, which house private racks for IT infrastructure, enable Small and Medium Enterprises (SMEs) to operate using modern infrastructure at reduced subscription costs. The number of colocation data centers is expanding rapidly, as more enterprises opt for this model instead of building their own data centers. Cloud platforms are increasingly popular, with some enterprises choosing to build and manage them in-house while others opt for managed services. Colocation data centers provide an ideal solution for these cloud platforms, offering advanced features such as NoSQL databases, software-defined networking, DDoS protection, intrusion detection systems, and performance monitoring.

- Moreover, data center optimization is a crucial concern for enterprises, and colocation facilities provide access to the latest technologies, including edge computing, serverless computing, and content delivery networks. Additionally, the adoption of green data centers, powered by renewable energy, is a growing trend, reducing the carbon footprint and promoting the circular economy. Database services, file storage, and disaster recovery are other essential services offered by colocation data centers, ensuring business continuity and data security. Overall, the benefits of colocation data centers are driving their adoption, making them an essential component of modern IT infrastructure.

What are the market trends shaping the Hyperscale Data Center Industry?

- The trend in the market is toward the expansion of infrastructure innovations. It is essential for professionals to stay informed about the latest advancements in this area.

- The market has witnessed significant advancements over the past decade, driven by the adoption of innovative technologies to enhance infrastructure efficiency. In the realm of IT equipment, microservers are poised to replace blade servers, while flash storage and the installation of 100 Gb Ethernet for networking purposes are expected to replace traditional storage. Cooling systems have evolved with techniques such as free cooling, aisle containment, and liquid immersion cooling, which help reduce the heat generated by IT equipment. Racks are being redesigned for improved flexibility and in-rack cooling installations, enabling better cable management. companies continue to innovate, offering rack-embedded PDUs and multi-mode UPS systems to deliver higher performance.

- Data center automation plays a crucial role in optimizing operations, ensuring data compliance, and improving network performance. Cloud security remains a top priority, with certifications such as SOC 2 and ISO 27001 becoming essential for data center ecosystems. Big data analytics and virtualization technologies like server and network virtualization, as well as capacity planning, are integral to managing the complexities of hyperscale data centers. Tiered data centers and cloud computing models, including public, private, and hybrid, cater to varying business needs. Data backup and disaster recovery solutions ensure business continuity, while data privacy remains a critical concern for organizations.

What challenges does the Hyperscale Data Center Industry face during its growth?

- The consolidation of data centers poses a significant challenge to the industry's growth trajectory. This trend, driven by the need for cost savings, improved efficiency, and enhanced security, necessitates strategic planning and execution for organizations seeking to optimize their IT infrastructure.

- Data center consolidation is a strategic initiative undertaken by enterprises to optimize costs, improve security, and enhance overall efficiency. By consolidating servers onto single computing hardware through virtualization, businesses can reduce costs by up to 30 percent and power consumption by 55 percent. Additionally, data center security is bolstered by up to 35 percent, and efficiency is increased by 50 percent. The U.S. Federal government is also embracing data center consolidation to streamline operations and invest in advanced computing platforms. Virtualization, a common technology in IT infrastructure, enables the consolidation of servers, storage, and network equipment, thereby boosting operational efficiency.

- Cloud storage and cloud service providers are key drivers of hyperscale computing, which requires high-performance computing, load balancers, and power management for optimal data center efficiency. Power usage effectiveness (PUE) is a critical metric for measuring data center efficiency, with industry leaders aiming for PUE ratings as low as 1.2. Data analytics platforms, DNS management, and network security are essential components of modern data centers, requiring advanced solutions for managing and securing vast amounts of data. Modular data centers and micro data centers are gaining popularity due to their scalability, flexibility, and ease of deployment.

- Data center simulation and interconnection are essential for optimizing data center performance and reducing latency, while managed services and block storage offerings from cloud service providers enable businesses to focus on their core competencies. Data sovereignty and high-performance computing are also crucial considerations for businesses operating in regulated industries or requiring complex computational workloads.

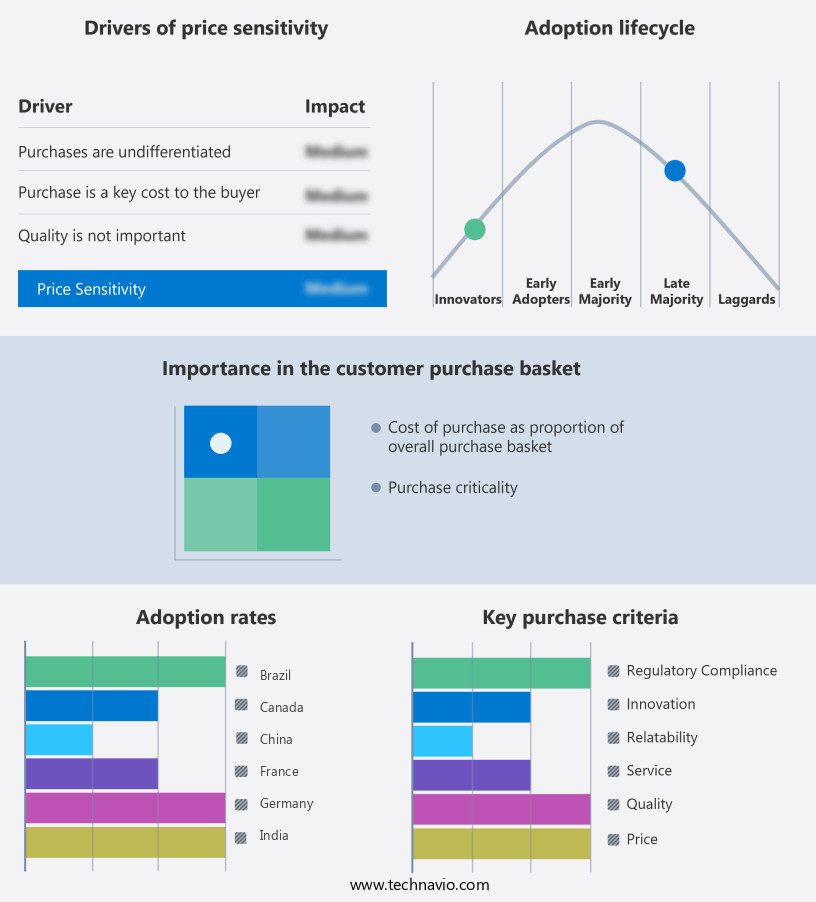

Exclusive Customer Landscape

The hyperscale data center market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hyperscale data center market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hyperscale data center market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon Web Services Inc. - The company delivers hyperscale data center solutions, incorporating a carbon-intelligent computing platform. This innovative approach optimizes energy efficiency and reduces carbon emissions, enhancing the sustainability of IT infrastructure. By leveraging advanced technologies, the platform intelligently allocates computing resources and dynamically adjusts power usage, ensuring optimal performance while minimizing environmental impact. This forward-thinking strategy not only supports business growth but also contributes to a greener technology ecosystem.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- Equinix Inc.

- Digital Realty Trust Inc.

- Rackspace Technology Inc.

- CoreSite Realty Corporation

- CyrusOne Inc.

- Alibaba Cloud

- Tencent Cloud

- Baidu Inc.

- HCL Technologies Ltd.

- Tata Communications Ltd.

- SAP SE

- OVHcloud

- Scaleway

- NTT Communications Corporation

- KDDI Corporation

- Canopy Data Centers

- V.tal

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hyperscale Data Center Market

- In February 2023, Microsoft announced the expansion of its Azure Hyperscale data center region in Sweden, marking its third region in the country. This expansion is expected to cater to the growing demand for cloud services in the European market (Microsoft Press Release, 2023).

- In March 2024, Amazon Web Services (AWS) and Alibaba Cloud, two leading hyperscale data center providers, entered into a strategic partnership to expand their collaborative efforts in the global market. The partnership aims to provide joint solutions and services to customers, enabling them to leverage the strengths of both companies (AWS Press Release, 2024).

- In May 2024, Google announced a significant investment of USD10 billion in its data centers and offices worldwide over the next few years. This investment is focused on expanding its data center capacity, enhancing its infrastructure, and accelerating its digital transformation initiatives (Google Press Release, 2024).

- In October 2025, IBM and NVIDIA unveiled a new AI supercomputer, "Odyssey," designed specifically for hyperscale data centers. This supercomputer is expected to deliver industry-leading performance and efficiency, catering to the growing demand for AI and machine learning applications in various industries (IBM Press Release, 2025).

Research Analyst Overview

- The market is characterized by the adoption of advanced technologies to enhance efficiency, security, and reliability. Google Cloud Functions and Azure Functions are driving the serverless functions trend, allowing businesses to run applications without managing infrastructure. Free cooling and air conditioning systems, utilizing humidity control and heat exchangers, optimize energy usage. Power Distribution Units (PDUs) and Uninterruptible Power Supplies (UPS) ensure business continuity, while battery backup and diesel generators provide backup power. Data encryption, vulnerability management, and threat intelligence safeguard against cyber threats.

- Power over Ethernet, container orchestration, and infrastructure as code streamline operations. Direct liquid cooling and immersion cooling offer high-density cooling solutions. Chiller systems and data archiving facilitate effective data management. Data loss prevention tools protect against accidental or intentional data breaches. Overall, these innovations contribute to the dynamic and evolving hyperscale data center landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hyperscale Data Center Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 38.4% |

|

Market growth 2025-2029 |

USD 485.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

28.7 |

|

Key countries |

US, India, Germany, China, Canada, Japan, UK, France, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hyperscale Data Center Market Research and Growth Report?

- CAGR of the Hyperscale Data Center industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hyperscale data center market growth of industry companies

We can help! Our analysts can customize this hyperscale data center market research report to meet your requirements.