Industrial Coating Equipment Market Size 2025-2029

The industrial coating equipment market size is forecast to increase by USD 3.94 billion, at a CAGR of 5.3% between 2024 and 2029.

- The market is experiencing significant growth due to increasing demand from various end-user industries, particularly in sectors such as automotive, construction, and consumer goods. This trend is driven by the need for high-performance coatings that offer superior protection against corrosion, wear and tear, and environmental factors. Additionally, the introduction of new and innovative coating technologies is fueling market growth. However, the high initial investment costs associated with purchasing and installing industrial coating equipment can be a challenge for small and medium-sized enterprises. Despite this, the long-term benefits of using advanced coating technologies, such as increased productivity, improved product quality, and reduced maintenance costs, make it a worthwhile investment for businesses in the manufacturing sector. Overall, the market is expected to continue its growth trajectory, driven by technological advancements and the increasing demand for high-performance coatings.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a wide range of solutions designed to enhance the aesthetic characteristics of various industries' products and infrastructure. Two significant sectors driving the demand for coating equipment are power generation and building & construction. In the power generation industry, coating equipment is essential for protecting critical components from degradation caused by harsh operating conditions. Incentives, such as subsidies and tax breaks, are encouraging the adoption of coating technologies in manufacturing facilities. Coating processes are increasingly being utilized in the production of electric mobility components, including charging stations, batteries, and electric vehicles. Liquid coating equipment, including rollers and brushes, is commonly used in the manufacturing of coated electronic devices.

- However, the choice of coating materials and processes depends on the specific customer requirement and industrial needs. For instance, powder coating equipment is preferred for its ability to produce uniform, thick coatings on metal components, reducing air drag and rusting. The coating process is not only essential for improving the appearance of products but also for enhancing their functionality and longevity. Specialty coating equipment is increasingly being adopted to cater to the unique requirements of various industries. For example, the building & construction sector relies on coating equipment to protect structures from weathering and other environmental factors. Despite the numerous benefits of coating technologies, the assembly cost remains a concern for many manufacturers.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Specialty coating

- Liquid coating

- Powder coating

- End-user

- Industrial

- Automotive and transportation

- Construction and agriculture

- Aerospace

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

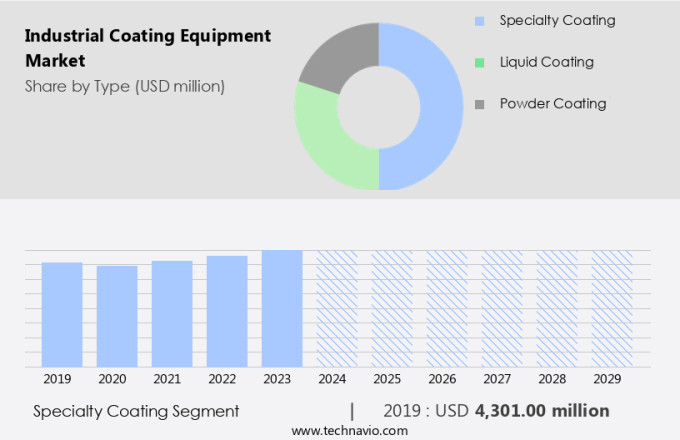

- The specialty coating segment is estimated to witness significant growth during the forecast period.

Specialty coating equipment is a significant sector within the industrial coating market, catering to specialized applications requiring unique formulations. Thermal spray coatings, anti-corrosion coatings, and industrial protective coatings are integral to industries such as aerospace, marine, energy, and electronics. The primary advantage of specialty coatings lies in their ability to provide specialized protection against extreme conditions, including high temperatures, chemicals, and mechanical wear. For instance, in the aerospace industry, thermal spray coatings are utilized to shield aircraft components from intense heat and wear, ensuring their durability and dependability. Coating technologies, including PVD (Physical Vapor Deposition) and electrocoating, are employed to create these specialized coatings.

Get a glance at the market report of share of various segments Request Free Sample

The specialty coating segment was valued at USD 4.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

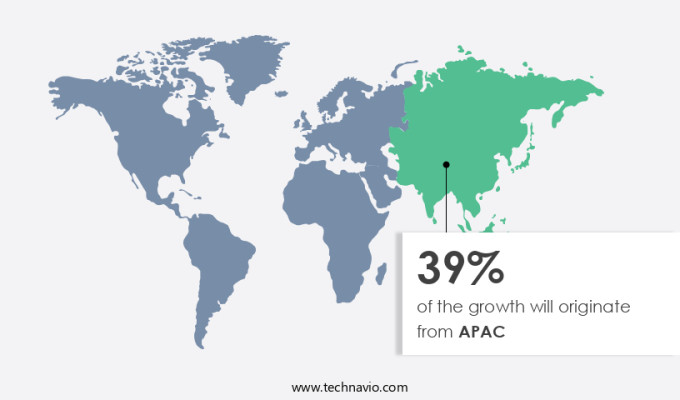

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region leads the market due to rapid industrialization, economic growth, and technological advancements. China and India, two major economies in the region, significantly contribute to this market expansion. The Chinese manufacturing sector, as the world's largest manufacturing hub, is embracing Industry 4.0, modernizing production and promoting high-tech industries. This initiative aims to enhance product quality and efficiency, increasing the demand for advanced coating equipment. In APAC, coating manufacturers focus on developing innovative solutions for various industries, including infrastructure, electric vehicles, and electric vehicle components. The coating market continues to grow, driven by the increasing demand for high-performance coatings and the need for sustainable manufacturing processes. Coating equipment suppliers are investing in research and development to meet this demand, offering solutions for diverse applications such as coating for furniture and other industrial uses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Industrial Coating Equipment Market?

Increasing demand from end-user industries is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand from various industries for advanced coating solutions. The automotive sector is a major contributor to this trend, as the production of electric vehicles (EVs) and their components necessitates protective coatings that ensure resistance to corrosion, weathering, and wear. Coating equipment is essential for achieving high-performance finishes that enhance the aesthetic appeal of EVs while adhering to environmental regulations through the use of eco-friendly, low-VOC and waterborne coatings. Additionally, the infrastructure sector is also driving market growth as there is a rising need for durable, corrosion-resistant coatings for EV charging stations and other infrastructure components.

- Renewable energy, aerospace, food processing, construction, and consumer products industries are also investing in innovative coating technologies for rust protection, degradation prevention, and sustainable coating solutions. The coating industry is continually evolving, with high-performance coatings, PVD coatings, and coating application technologies leading the way in providing cost-effective and efficient solutions for various industries. The electric vehicle industry's adoption is further fueling the market, with the need for innovative coatings to meet the specific requirements of EV manufacturing. Coating equipment suppliers are focusing on developing innovative solutions to meet the growing demand for sustainable and high-performance coatings, while also addressing the production cost concerns of their clients.

What are the market trends shaping the Industrial Coating Equipment Market?

The introduction of new products is the upcoming trend in the market.

- The market is experiencing notable growth due to the development of advanced technologies designed to increase efficiency, accuracy, and user-friendliness. This innovation caters to the evolving requirements of numerous industries, resulting in superior performance and cost savings. For instance, on November 28, 2023, Nordson Electronics Solutions introduced the ASYMTEK Select Coat SL-1040, a conformal coating system specifically engineered for high-volume printed circuit assembly. This system showcases enhanced automation, control, and precision, incorporating the SC-450 PreciseCoat Jet, EasyCoat software, and an ultrasonic cleaning station for increased uptime and cost efficiency. The SL-1040 is outfitted with dual and triple applicators to boost throughput, enabling selective coating for optimal yield while avoiding keep-out zones.

- Moreover, the industrial coating market expansion is influenced by the electric vehicle industry's rise. Electric vehicle manufacturing necessitates advanced coating solutions for components such as batteries, charging stations, and metal components to ensure corrosion protection and rust resistance. Coating innovation has led to the development of eco-friendly, high-performance coatings that cater to the electric vehicle industry's sustainability focus.

- Furthermore, the aerospace, automotive, food processing, construction, and medical device industries are among those that benefit from industrial coating equipment advancements. These industries require durable, high-performance coatings for various applications, including infrastructure, consumer products, renewable energy, and transportation. Coating technology has evolved to provide degradation protection, PVD coatings, and sustainable coating solutions for various industries, ensuring improved production cost and coating consumption.

What challenges does the Industrial Coating Equipment Market face during the growth?

High initial investment costs is a key challenge affecting the market growth.

- The market encompasses a range of advanced technologies and solutions used for applying coatings to various consumer products, infrastructure, electric vehicle components, and industrial applications. Coating manufacturers continue to innovate and develop high-performance coatings for sectors such as automotive, aerospace, construction, and renewable energy. Electric vehicle manufacturing, charging stations, and related components require corrosion protection and eco-friendly coatings to ensure durability and sustainability. Coating equipment suppliers offer alternatives to traditional solvent-based coatings, including powder coatings, PVD coatings, and liquid coatings, to cater to the evolving market demands. High initial investment costs pose a significant challenge in the market, particularly for small and medium-sized enterprises (SMEs) and businesses in developing regions.

- The substantial upfront expenditure required for advanced coating equipment, especially automated and robotic systems, can deter potential buyers. These high costs are attributed to the sophisticated technology and features that modern equipment offers, such as precision, automation, and integration with other industrial processes. For example, the Wagner ColorSelect X powder coating system is priced at approximately USD 32,852.51, reflecting the advanced capabilities and efficiency it provides. Similarly, a Powder Coating Package 1 from Eptex Coatings, which includes a 4x4x6 curing oven and a hobby gun, is priced at USD 10,000. Coating equipment development focuses on improving performance, reducing production costs, and enhancing coating consumption efficiency.

- Key applications include coating for furniture, food processing, construction, marine, and industrial services. The coating industry continues to evolve, with a growing emphasis on sustainable coating solutions for consumer products, transportation, and infrastructure. Electric vehicle industry adoption and the rise of renewable energy are driving the demand for advanced coating technologies, including high-performance coatings for degradation protection, corrosion resistance, and energy efficiency. Coating innovation is a critical factor in maintaining a competitive edge in this dynamic market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ANEST IWATA Corp. - The company offers industrial coating equipment such as Siphon Spray Guns, Pressure Spray Guns, Pressure Pots, Diaphram Pump and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Sunac Corp.

- Axalta Coating Systems Ltd.

- Gema Switzerland Gmbh

- Graco Inc.

- IHI Corp.

- Intevac Inc.

- IPCO AB

- J Wagner GMBH

- Linde Plc

- Midvale Industries Inc.

- Nipponpaint Industrial Coatings Co. LTD.

- Nordson Corp.

- OC Oerlikon Corp. AG

- PPG Industries Inc.

- Reliant Finishing Systems

- Rockett Inc.

- SATA GmbH and Co. KG

- Sprimag

- Sumitomo Heavy Industries Ltd.

- True Max Industries

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of technologies and applications, serving various industries such as infrastructure, electric vehicles, consumer products, aerospace, and construction, among others. This market is driven by the increasing demand for high-performance coatings that offer protection against corrosion, rust, and degradation. Electric vehicles (EVs) and renewable energy are emerging sectors that are significantly contributing to the growth of the industrial coating market. The electric vehicle industry's expansion is leading to an increased demand for coating equipment that can produce electric vehicle components and batteries with efficient, eco-friendly coatings. These coatings are essential for ensuring the longevity and performance of EVs, particularly in terms of corrosion protection and energy efficiency. The infrastructure sector is another major consumer of industrial coating equipment. Coatings play a crucial role in the protection and preservation of various infrastructure assets, including bridges, buildings, and pipelines.

Further, coating equipment is used to apply protective coatings to these structures, ensuring their durability and resistance to weather and environmental conditions. In the aerospace industry, high-performance coatings are used extensively to protect aircraft from the harsh conditions of flight. Coating equipment is essential for applying these coatings evenly and consistently, ensuring the safety and reliability of aircraft. The food processing industry also relies on industrial coating equipment for various applications, such as applying coatings to food packaging materials to enhance their shelf life and protect against contamination. In the construction industry, coatings are used for various applications, including rust protection, waterproofing, and decorative finishes. Coating innovation is a key driver of growth in the market. Advancements in coating technology have led to the development of high-performance coatings that offer superior protection against corrosion, rust, and degradation.

PVD coatings, for instance, offer excellent hardness, wear resistance, and decorative properties, making them ideal for various applications in industries such as aerospace, automotive, and electronics. The cost of coating equipment is a significant factor influencing market dynamics. While high-performance coatings offer superior protection, they can be more expensive to produce than traditional coatings. As a result, coating equipment manufacturers are focusing on developing cost-effective solutions that can help reduce production costs while maintaining coating quality. In conclusion, the market is driven by various factors, including the increasing demand for high-performance coatings, emerging sectors such as electric vehicles and renewable energy, and coating innovation. The market is expected to continue growing as industries seek to enhance the durability and performance of their products and assets through the use of advanced coating solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market Growth 2025-2029 |

USD 3.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, Germany, India, Japan, UK, Brazil, South Korea, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.