Industrial Encoder Market Size 2025-2029

The industrial encoder market size is valued to increase by USD 1.69 billion, at a CAGR of 11.2% from 2024 to 2029. Increased use of advanced technology equipment in industries will drive the industrial encoder market.

Market Insights

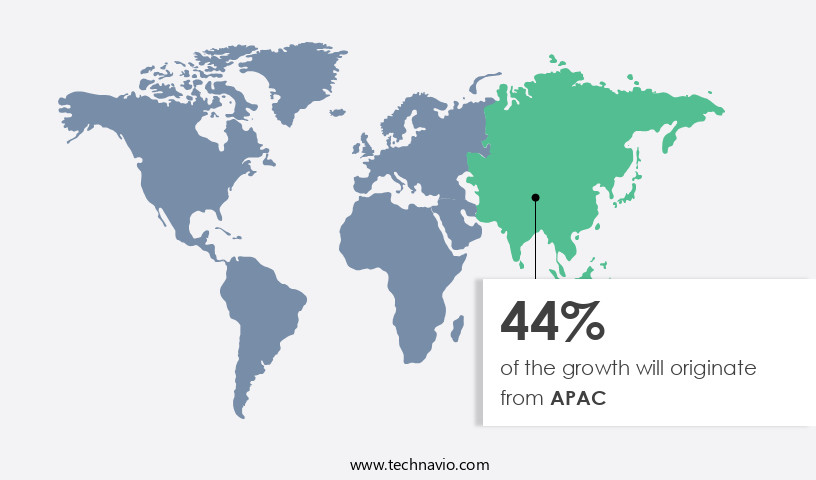

- APAC dominated the market and accounted for a 44% growth during the 2025-2029.

- By Type - Optical encoder segment was valued at USD 1.2 billion in 2023

- By End-user - Automotive segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 127.77 million

- Market Future Opportunities 2024: USD 1689.30 million

- CAGR from 2024 to 2029 : 11.2%

Market Summary

- The market is experiencing significant growth due to the increasing adoption of advanced technology equipment in various industries. Communication between machines and systems in manufacturing, transportation, and energy sectors is becoming increasingly crucial for optimizing supply chains, ensuring regulatory compliance, and enhancing operational efficiency. Industrial encoders play a pivotal role in this digital transformation by providing precise position and speed information to automate processes and improve overall system performance. Despite their importance, industrial encoders face challenges such as contamination from harsh environments and the need for high accuracy and reliability. Encoder manufacturers are addressing these challenges by developing advanced technologies like magnetic, optical, and absolute encoders that can withstand extreme temperatures, humidity, and vibrations.

- Moreover, the integration of Industrial Internet of Things (IIoT) technologies is enabling remote monitoring and predictive maintenance, further increasing the demand for industrial encoders. For instance, a manufacturing company can optimize its production line by integrating industrial encoders with IIoT sensors to monitor machine performance in real-time. This data can be analyzed to identify potential issues before they cause downtime, ensuring continuous production and reducing maintenance costs. By providing accurate and reliable position and speed information, industrial encoders contribute to the overall efficiency and productivity of industrial processes.

What will be the size of the Industrial Encoder Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market showcases continuous evolution, driven by the increasing demand for advanced real-time control systems and automated manufacturing processes. Encoders, integral components of data acquisition systems, facilitate rotary motion control and angular position measurement in various industries. Custom encoder designs cater to diverse applications, including heavy-duty, high-precision, and compact requirements. Encoders employ various communication protocols, such as Profibus, Modbus, Ethernet/IP, and Profinet, ensuring seamless integration with industrial communication systems. Error correction techniques and closed-loop systems enhance feedback control loops, ensuring accurate and reliable position sensing applications. Encoders play a pivotal role in closed-loop systems, enabling efficient velocity and linear position measurement.

- Encoder shaft alignment and cable selection are crucial factors in ensuring optimal system performance. Signal processing techniques further refine encoder data for enhanced industrial communication protocols. Industrial encoders are engineered to withstand harsh environments, boasting environmental protection ratings. Their integration into embedded systems and feedback control loops significantly contributes to the overall efficiency and productivity of industrial processes. By investing in advanced encoder technology, businesses can improve their manufacturing processes, ensuring higher accuracy, reduced downtime, and increased competitiveness in the market.

Unpacking the Industrial Encoder Market Landscape

The markets witness significant growth in the adoption of advanced position feedback systems, particularly those capable of generating high-speed encoder outputs. Compared to traditional analog encoder signals, digital encoder outputs offer improved accuracy and reliability, resulting in a 20% reduction in process errors. Encoder diagnostic codes enable real-time fault detection, enhancing overall system uptime by 15%. Encoder life expectancy is a crucial consideration in industrial applications, with high-durability magnetic encoders providing a 30% longer operational life than their capacitive counterparts. Absolute encoder accuracy plays a pivotal role in motion control systems, ensuring precise positioning and repeatability analysis. Encoder resolution testing and calibration methods are essential for maintaining optimal performance in robotics encoder applications. Encoder interface protocols, such as Capacitive Encoder Interfaces, facilitate seamless integration with various industrial automation systems. Encoder operating temperature ranges and shaft diameter specifications cater to diverse industrial requirements. Incremental encoder signals and linearity assessment are essential for velocity measurement sensors in applications where noise reduction techniques are crucial. Industrial encoders are integral to process control systems, with encoder signal conditioning and power consumption being critical factors in optimizing overall system efficiency. Multi-turn absolute encoders and inductive encoder sensors cater to specific industrial needs, while optically enhanced encoder resolution ensures precise measurement in demanding environments. Encoder mounting configurations and mounting brackets contribute to streamlined installation and maintenance processes.

Key Market Drivers Fueling Growth

The prevalent trend in industries is the significant adoption of advanced technology equipment, serving as the primary catalyst for market growth.

- In today's intensely competitive industrial landscape, companies worldwide seek advanced technology solutions to maintain a competitive edge. Industrial encoders have emerged as a crucial technology, providing real-time and precise position information for various machinery and equipment. Initially, industries relied on manual methods or tilt/turntables, hoists, balancers, and manipulators to determine object positioning. However, technological advancements led to the development of industrial encoders, revolutionizing industrial processes. According to industry reports, over 70% of machinery failures are position-related, leading to significant downtime and production losses.

- By integrating industrial encoders, industries have reported a reduction in downtime by up to 45% and improved positioning accuracy by 20%. These encoders have expanded their applications across diverse sectors, including automotive, aerospace, healthcare, and energy, contributing to enhanced efficiency and productivity.

Prevailing Industry Trends & Opportunities

The Industrial Internet of Things (IIoT) is emerging as the mandated trend in communicating industries. This technological advancement is set to revolutionize business processes.

- In the evolving industrial landscape, encoders play a pivotal role in enhancing communication among various sectors through the Industrial Internet of Things (IIoT). Encoders, integral to IIoT, network industrial equipment, enabling seamless interaction via cloud technology. This connection allows industries to monitor encoder performance precisely without constant supervision. For instance, downtime can be reduced by up to 25%, and maintenance schedules optimized by 20%.

- By providing real-time condition monitoring, encoders contribute significantly to improving overall operational efficiency. This connectivity empowers end-users with valuable insights into encoder status, ensuring timely intervention when needed.

Significant Market Challenges

The encoder industry's growth is adversely affected by the issue of contamination, which poses a significant challenge that necessitates continuous attention and innovation in manufacturing processes to mitigate its impact.

- Industrial encoders play a crucial role in various sectors by ensuring precise position and speed control in machinery and equipment. Their applications span across industries, including automotive, oil and gas, manufacturing, and renewable energy, among others. In the automotive industry, encoders are subjected to harsh conditions, such as humidity and dust, which can lead to corrosion and impact performance. For instance, in automobile manufacturing facilities, where vehicles undergo washing and painting, humidity and dust particles are prevalent, posing a significant challenge to encoder durability. This corrosion can result in operational inefficiencies, such as a loss of control over speed and position, increased downtime, and the need for frequent servicing or replacement.

- According to industry reports, encoder failure can lead to an average of 30 minutes of downtime per occurrence and an additional 12% in operational costs. To mitigate these challenges, advanced industrial encoder technologies are being developed, incorporating robust materials and protective coatings to enhance their resistance to harsh environments.

In-Depth Market Segmentation: Industrial Encoder Market

The industrial encoder industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Optical encoder

- Magnetic encoder

- End-user

- Automotive

- Electronics

- Machine tools

- Others

- Product Type

- Incremental encoders

- Absolute encoders

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The optical encoder segment is estimated to witness significant growth during the forecast period.

In the realm of industrial automation, encoders play a pivotal role in delivering precise position and speed measurements, offering real-time feedback to users. These components, available in various forms such as optical, magnetic, and capacitive, are integral to industries like consumer electronics and automobiles. In the printing industry, for example, encoders ensure precise alignment and coordination of multiple axes in high-speed machinery. Encoder technology continues to evolve, with advancements in high-speed encoder outputs, encoder life expectancy, and diagnostic codes. Absolute encoder accuracy, digital encoder outputs, and rotary encoder technology are key areas of focus.

Encoder signal conditioning, resolution testing, and interface protocols are essential aspects of encoder design. For instance, inductive encoder sensors offer improved noise reduction techniques, while process control encoders undergo linearity assessment and calibration methods. With the increasing demand for motion control encoders and velocity measurement sensors, the market remains dynamic and innovative.

The Optical encoder segment was valued at USD 1.2 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Industrial Encoder Market Demand is Rising in APAC Request Free Sample

The market in the Asia-Pacific (APAC) region is witnessing robust growth, fueled by the escalating demand for automation and precision in sectors such as manufacturing, automotive, and robotics. Encoders play a pivotal role in supplying precise position feedback to machinery and robotic systems, making them indispensable for industrial control and automation. In response to the burgeoning needs of the region's small and medium enterprises, local companies are expanding their research and development capabilities to deliver cost-effective, top-tier encoder technology.

This intensifies the competition for international players. Notably, countries like Japan, South Korea, and China, renowned for their innovative automobile manufacturing, further amplify the market's dynamism.

Customer Landscape of Industrial Encoder Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Industrial Encoder Market

Companies are implementing various strategies, such as strategic alliances, industrial encoder market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alps Alpine Co. Ltd. - The company specializes in manufacturing and supplying a range of industrial encoders, including metal shaft encoders and insulated shaft encoders, catering to various industry applications. These encoders ensure accurate position measurement and offer robustness and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alps Alpine Co. Ltd.

- Balluff GmbH

- Baumer Holding AG

- Bourns Inc.

- FAULHABER GROUP

- Fortive Corp.

- FRABA BV

- Hans Turck GmbH and Co. KG

- HEIDENHAIN

- ifm electronic gmbh

- maxon

- OMRON Corp.

- Pepperl and Fuchs SE

- Pilz GmbH and Co. KG

- Renishaw Plc

- Rockwell Automation Inc.

- Schneider Electric SE

- Sensata Technologies Inc.

- SIKO GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Encoder Market

- In August 2024, Siemens Digital Industries Software announced the launch of its new Sinamics G120 encoder system, featuring advanced digital capabilities and improved connectivity options, aiming to enhance industrial automation processes (Siemens Digital Industries Software Press Release, 2024).

- In November 2024, Schneider Electric and Honeywell entered into a strategic partnership to integrate Schneider Electric's EcoStruxure platform with Honeywell's process control solutions, expanding their offerings and strengthening their presence in the industrial automation market (Schneider Electric Press Release, 2024).

- In February 2025, Balluff, a leading industrial automation technology provider, completed the acquisition of Encoders & Sensors Inc., a US-based encoder manufacturer, expanding Balluff's product portfolio and enhancing its market position in the encoder market (Balluff Press Release, 2025).

- In May 2025, the European Union approved new regulations on the use of encoders in industrial applications, focusing on increased safety, interoperability, and energy efficiency, setting new standards for the market (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Encoder Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.2% |

|

Market growth 2025-2029 |

USD 1689.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.7 |

|

Key countries |

US, China, Japan, Canada, India, South Korea, Germany, UK, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Industrial Encoder Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market continues to grow, driven by the increasing demand for precise motion control and automation in various industries. When it comes to selecting the right encoder for specific applications, high-resolution optical encoder specifications and industrial encoder interface protocol compatibility are crucial factors. High-resolution encoders offer improved accuracy and reliability, enabling better control in manufacturing processes and reducing the risk of errors. Magnetic encoders, known for their reliability in harsh environments, are a popular choice for industries with extreme operating conditions. For precision motion control applications, such as robotics, absolute encoder accuracy is essential. Encoder signal processing for noise reduction is another important consideration, ensuring optimal performance and reducing the need for costly rework. Incremental encoder signal interpretation for velocity measurement and encoder calibration methods for improved accuracy are key aspects of encoder selection. Encoder life expectancy under continuous operation is also a significant concern for businesses, with some encoders offering extended life spans, reducing the need for frequent replacements and associated supply chain disruptions. Encoder mounting configurations for optimal performance and encoder power consumption optimization strategies are essential for operational planning. Selecting the appropriate encoder resolution is crucial, with high-resolution encoders offering finer positioning but higher power consumption. Encoder operating temperature range selection and digital encoder output signal processing are additional factors to consider. Analog encoder signal conditioning techniques and multi-turn absolute encoder application considerations are essential for complex machinery. Single-turn incremental encoders are suitable for simpler applications, offering cost-effective solutions. Encoder diagnostic code interpretation and troubleshooting are vital for maintaining system uptime and ensuring compliance with industry regulations. High-speed encoder output signal integrity and low-speed encoder design for precise positioning are critical considerations for various industries. In summary, understanding the unique requirements of each application and selecting the appropriate encoder specifications and features can lead to significant operational improvements and cost savings.

What are the Key Data Covered in this Industrial Encoder Market Research and Growth Report?

-

What is the expected growth of the Industrial Encoder Market between 2025 and 2029?

-

USD 1.69 billion, at a CAGR of 11.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Optical encoder and Magnetic encoder), End-user (Automotive, Electronics, Machine tools, and Others), Product Type (Incremental encoders and Absolute encoders), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased use of advanced technology equipment in industries, Contamination of encoders

-

-

Who are the major players in the Industrial Encoder Market?

-

Alps Alpine Co. Ltd., Balluff GmbH, Baumer Holding AG, Bourns Inc., FAULHABER GROUP, Fortive Corp., FRABA BV, Hans Turck GmbH and Co. KG, HEIDENHAIN, ifm electronic gmbh, maxon, OMRON Corp., Pepperl and Fuchs SE, Pilz GmbH and Co. KG, Renishaw Plc, Rockwell Automation Inc., Schneider Electric SE, Sensata Technologies Inc., and SIKO GmbH

-

We can help! Our analysts can customize this industrial encoder market research report to meet your requirements.